buyNow

Integrated Workplace Management System Market

Integrated Workplace Management System Market Size, Share, Growth & Industry Analysis, By Component (Solutions, Services), By Deployment Type (On-premise, Cloud-based), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), By End User Industry, and Regional Analysis, 2025-2032

pages: 200 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Integrated workplace management system (IWMS) is a software platform that helps organizations manage and optimize workplace resources, including real estate, infrastructure, and facilities. The market includes solutions and services for asset management, space planning, maintenance, and sustainability initiatives.

Integrated Workplace Management System Market Overview

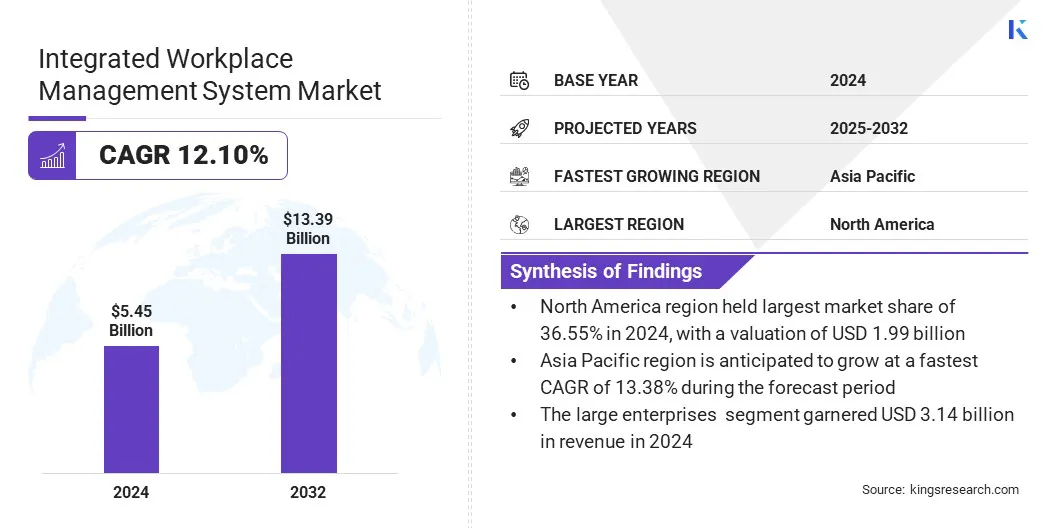

The global integrated workplace management system market size was valued at USD 5.45 billion in 2024 and is projected to grow from USD 6.02 billion in 2025 to USD 13.39 billion by 2032, exhibiting a CAGR of 12.10% during the forecast period.

The growth is fueled by the rising demand for workplace space optimization, as organizations aim to reduce real estate costs and improve space utilization. A key trend shaping the market is the use of technological advancements to enable enhanced asset maintenance through the integration of Internet of Things (IoT) and artificial intelligence (AI), which supports real-time monitoring and predictive maintenance of facility assets.

Key Highlights:

- The integrated workplace management system industry size was recorded at USD 5.45 billion in 2024.

- The market is projected to grow at a CAGR of 12.10% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 1.99 billion.

- The solutions segment garnered USD 3.08 billion in revenue in 2024.

- The on-premise segment is expected to reach USD 8.17 billion by 2032.

- The large enterprises segment is projected to reach USD 6.92 billion by 2032.

- The manufacturing segment is likely to generate a revenue of USD 4.78 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 13.38% over the forecast period.

Major companies operating in the integrated workplace management system market are Service Works Global Ltd., Accruent, OfficeRnD, Eptura, Planon, Archibus, IBM, Eden, Nakisa, MRI Software LLC, SAP SE, SPACEWELL INTERNATIONAL, Johnson Controls, Skedda, and OfficeSpace Software Inc.

Market expansion is propelled by the rising demand for platforms that offer seamless management of real estate portfolios, capital projects, facilities, and workplace operations.

Integrated workplace management system (IWMS) solutions are enabling organizations to centralize data, streamline workflows, and gain real-time visibility across property assets and operations. These platforms support better planning, cost control, and resource allocation, which are essential for managing large and complex infrastructure environments.

- In October 2024, Nakisa unveiled its next-generation integrated workplace management system (IWMS) product portfolio during Nakisa Week, the company’s annual event. The launch introduced a cloud-native platform designed for large enterprises, enabling seamless management of real estate portfolios, capital projects, facilities, and workplace operations. The portfolio integrates financial and operational data to deliver real-time insights, optimize performance, and support energy and sustainability initiatives.

Market Driver

Growing Demand for Workplace Space Optimization

The integrated workplace management system (IWMS) market is experiencing strong growth, mainly due to the increasing demand for workplace space optimization. Businesses are under pressure to reduce real estate costs and improve space efficiency across their facilities.

IWMS platforms enable precise space planning, monitor real-time occupancy, and support data-driven allocation. These solutions help organizations eliminate underutilized areas and align workspace usage with evolving operational needs. The focus on maximizing space efficiency is driving the adoption of IWMS across key industries.

- In July 2024, Accruent launched Accruent Space Intelligence, a space optimization and planning solution aimed at tackling rising office underutilization and vacancy rates. The platform centralizes fragmented data to deliver actionable insights, helping organizations and educational institutions make informed, data-driven decisions on space utilization.

Market Challenge

High Implementation Costs

A major challenge limiting the expansion of the integrated workplace management system (IWMS) market is the high cost of implementation. Many small and medium-sized enterprises find it difficult to manage expenses related to software deployment, customization, and training. This financial burden delays adoption despite the long-term benefits of workplace optimization.

To address this issue, vendors are offering cloud-based IWMS platforms with subscription-based pricing, reducing upfront capital requirements and enabling scalable adoption. This approach helps lower entry barriers and supports broader market penetration.

Market Trend

Technological Advancements

The integrated workplace management system (IWMS) market is witnessing significant growth, fueled by technological advancement, particularly in asset maintenance connectivity. Organizations are increasingly integrating Internet of Things (IoT) and artificial intelligence (AI) into IWMS platforms to enable real-time monitoring and predictive maintenance of assets.

This integration enhances equipment performance tracking, early fault detection, and efficient maintenance scheduling, thereby improving asset lifecycle management and reducing downtime and repair costs. This trend underscores the growing emphasis on data-driven facility management and intelligent infrastructure planning.

- In April 2024, Eptura introduced a series of worktech innovations to enhance connectivity, collaboration, and security within the built environment. Key updates include improved asset maintenance connectivity, allowing employees to submit service requests through familiar applications, and the addition of digital maps and floorplan views to help technicians efficiently locate assets.

Integrated Workplace Management System Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Solutions (Real Estate & Lease Management, Facilities & Space Management, Asset & Maintenance Management, Project Management, Environment Management), Services (Professional Services, Managed Services) |

|

By Deployment Type |

On-premise, Cloud-based |

|

By Enterprise Size |

Large Enterprises, Small and Medium-sized Enterprises |

|

By End User Industry |

Manufacturing, IT & Telecommunications, BFSI, Real Estate & Construction, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Solutions (Real Estate & Lease Management, Facilities & Space Management, Asset & Maintenance Management, Project Management, Environment Management), and Services (Professional Services, Managed Services)): The solutions segment earned USD 3.08 billion in 2024, mainly due to the growing demand for centralized platforms to manage real estate, assets, and facility operations.

- By Deployment Type (On-premise, Cloud-based): The on-premise segment held a share of 57.65% in 2024, propelled by higher data control and compliance needs among large organizations.

- By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises): The large enterprises segment is projected to reach USD 6.92 billion by 2032, owing to increasing investments in workplace automation and integrated facility management.

- By End User Industry (Manufacturing, IT & Telecommunications, BFSI, and Real Estate & Construction): The manufacturing segment is projected to reach USD 4.78 billion by 2032, fueled by the need for streamlined asset tracking and efficient space utilization in production environments.

Integrated Workplace Management System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America integrated workplace management system market share stood at 36.55% in 2024, valued at USD 1.99 billion. The dominance is reinforced by strong collaborations between key players, focused on advancing integrated workplace solutions.

Enterprises in North America are actively investing in cloud-based integrated workplace management system (IWMS) platforms integrated with Internet of Things (IoT) and artificial intelligence (AI) to enhance workplace efficiency and regulatory compliance.

These collaborations have accelerated solution development tailored to complex real estate and infrastructure needs. This sustained focus on innovation and strategic alignment has positioned North America as the leading market for integrated workplace management systems.

- In April 2025, JLL partnered with ServiceNow by joining ServiceNow’s global partner program to expand its IWMS offerings. This collaboration combines JLL’s commercial real estate and technology expertise with ServiceNow’s cloud-based Workplace Service Delivery product, enabling clients to extend HR and IT automation to real estate functions.

The Asia-Pacific integrated workplace management system industry is poised to grow at a significant CAGR of 13.38% over the forecast period. The growth is fueled by rising infrastructure development and increasing demand for efficient space utilization in commercial and industrial sectors.

Organizations in countries such as China and India are adopting integrated workplace management system (IWMS) platforms to enable digital facility management and enhance operational visibility across rapidly expanding urban areas.

Regulatory Frameworks

- In the U.S., integrated workplace management systems must comply with federal regulations such as the Occupational Safety and Health Administration (OSHA) standards for workplace safety and the Federal Energy Management Program (FEMP) guidelines for energy efficiency in federal buildings.

- In Europe, integrated workplace management systems platforms are subject to the General Data Protection Regulation (GDPR) for handling employee and facility data, and must align with the Energy Performance of Buildings Directive (EPBD) to support energy-efficient building management.

- In Japan, companies using integrated workplace management systems must adhere to the Act on the Rational Use of Energy for energy conservation and the Industrial Safety and Health Act for managing workplace safety.

Competitive Landscape

Key players in the integrated workplace management system industry are focusing on strategic collaborations to enhance their solution offerings and expand market reach. Many vendors are partnering with cloud infrastructure providers to strengthen deployment flexibility and improve system scalability for enterprise clients.

Several companies are forming alliances with facility management and real estate service firms to integrate integrated workplace management system platforms with industry-specific workflows.

Additionally, partnerships with technology providers are enabling the integration of IoT, artificial intelligence (AI), and advanced analytics, supporting real-time insights and predictive maintenance.

- In August 2024, Envoy partnered with Logitech to deliver a unified workplace solution to enhance workplace and meeting room management. The integration of Envoy Rooms with Logitech Tap Scheduler streamlines space management by simplifying room bookings, reallocating space based on live attendance, and improving visibility of meeting schedules.

Key Companies in Integrated Workplace Management System Market:

- Service Works Global Ltd.

- Accruent

- OfficeRnD

- Eptura

- Planon

- Archibus

- IBM

- Eden

- Nakisa

- MRI Software LLC

- SAP SE

- SPACEWELL INTERNATIONAL

- Johnson Controls

- Skedda

- OfficeSpace Software Inc.

Recent Developments (Product Launch)

- In January 2025, VelocityEHS introduced major enhancements to its Accelerate Platform aimed at improving workplace safety and risk management. The platform unifies industrial ergonomics, safety, chemical management, and operational risk to streamline operations, reduce risk, and enhance worker protection.

freqAskQues