buyNow

Thermoplastic Elastomers Market

Thermoplastic Elastomers Market Size, Share, Growth & Industry Analysis, By Types (Styrenic Block Copolymers, Thermoplastic Polyurethanes, Thermoplastic Copolyesters & Others), By End-Use Industry (Automotive, Building & Construction, Footwear, Medical, Others), and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: August 2024 | author: Swati J.

Thermoplastic Elastomers Market Size

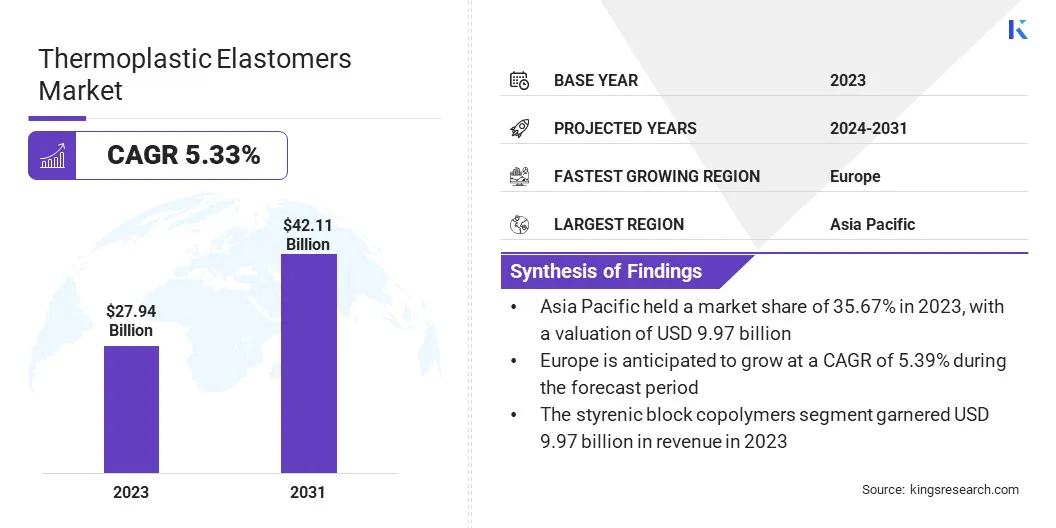

The global Thermoplastic Elastomers Market size was valued at USD 27.94 billion in 2023 and is projected to grow from USD 29.27 billion in 2024 to USD 42.11 billion by 2031, exhibiting a CAGR of 5.33% during the forecast period. The market is expanding due to increasing industrial automation and advancements in manufacturing technologies.

Factors such as the rise of smart materials and the pressing need for high-performance, customizable solutions are boosting market growth. Additionally, the market is influenced by the development of TPEs with enhanced thermal and chemical resistance, which addresses diverse application requirements.

In the scope of work, the report includes solutions offered by companies such as APAR Industries Ltd, Arkoma, Asahi Kasei Corporation, Avient Corporation, BASF Corporation, Celanese Corporation, Covestro AG, DuPont, Evonik Industries AG, Exxon Mobil Corporation, and others.

The thermoplastic elastomers market is experiencing robust growth, fueled by increasing applications across diverse industries such as the automotive and medical sectors. TPEs are valued for their versatility, biocompatibility, flexibility, and durability, making them ideal for demanding applications such as automotive sealing systems and medical devices.

They enhance vehicle performance and sustainability in the automotive sector, while in the medical field, they meet stringent regulatory standards and withstand sterilization. The growing demand for eco-friendly materials and advancements in TPE technology are fostering market expansion.

- On October 9, 2023, Avient Corporation made significant progress in the market by unveiling its Stat-Tech TPE Static Dissipative & Electrically Conductive Elastomers at the Fakuma International Trade Fair. These new TPEs, with resistivity from 100Ω to 10^10Ω, are designed to prevent electromagnetic and radio frequency interference in critical electrical components.

A thermoplastic elastomer (TPE) is a type of polymer that combines the properties of both elastomers (rubber-like materials) and thermoplastics. TPEs are characterized by their ability to be repeatedly melted and re-molded when heated, similar to thermoplastics, while retaining the flexibility and elasticity of traditional rubber.

They offer a wide range of properties, including flexibility, durability, and processability, making them suitable for various applications. TPEs are used in diverse industries such as automotive, medical, consumer goods, and electronics due to their versatility and ability to meet specific performance and regulatory requirements.

Analyst’s Review

Analyst’s Review

A key factor propelling the expansion of the thermoplastic elastomers market is the increasing demand for advanced materials with superior performance in automotive applications. The development of TPE compounds with enhanced EPDM adhesion for automotive sealing systems and exteriors highlights the industry's rising need for materials that offer excellent adhesion, durability, and processability. This demand is fueled by the automotive sector's focus on improving vehicle reliability, performance, and overall quality.

- In May 2024, KRAIBURG TPE introduced new Thermoplastic Elastomers (TPEs) featuring EPDM adhesion for automotive sealing systems and exteriors. These advanced compounds set a new standard in material technology by providing exceptional adhesion, durability, and processability. The TPEs were made available globally with extensive technical support for parts and processing. This launch reaffirmed KRAIBURG TPE’s commitment to excellence in automotive solutions, with the aim of empowering manufacturers with reliable supply and consistent quality.

As manufacturers seek to enhance their products and ensure supply security, the adoption of innovative TPE solutions is stimulating market growth by meeting the stringent requirements of modern automotive applications.

Thermoplastic Elastomers Market Growth Factors

The automotive industry's adoption of thermoplastic elastomers (TPEs) significantly fosters market growth due to their lightweight, versatile properties. TPEs replace traditional rubber and thermoset plastics in components such as seals, gaskets, and interiors, thereby improving fuel efficiency and reducing emissions. Their flexibility and durability meet the industry's performance demands while offering cost-effective production.

Additionally, TPEs' environmental benefits align with growing consumer and regulatory pressures for sustainability. This shift toward eco-friendly, high-performance materials propels the growth of the market, with continued innovations ensuring sustained growth in the automotive sector.

The development of the thermoplastic elastomers market is hindered by fluctuations in raw material prices, which affect both production costs and pricing stability. Fluctuations in the prices of key raw materials, such as petrochemicals and additives, create uncertainties that can lead to higher costs for end-users and reduced profit margins for manufacturers.

Key players are mitigating this challenge by diversifying their supply chains and securing long-term supplier contracts to stabilize costs. They are further investing heavily in research and development to find alternative materials and optimize TPE formulations, thus reducing reliance on volatile raw materials and aiding in managing cost fluctuations effectively.

Thermoplastic Elastomers Market Trends

The growing trend toward developing bio-based thermoplastic elastomers (TPEs) is supporting market growth as manufacturers and consumers are increasingly prioritizing environmental sustainability. Companies are investing heavily in the research and development of bio-based TPEs, which are derived from renewable resources, thereby reducing reliance on fossil fuels and minimizing environmental impact. This shift is aligning with global sustainability initiatives and meeting the rising demand for eco-friendly materials.

As awareness of environmental issues is growing, consumers are preferring products with lower environmental footprints, thereby prompting manufacturers to engage in continuous innovation. Regulatory pressures and incentives are further promoting the use of renewable resources, thereby propelling the thermoplastic elastomers market expansion.

- For instance, in June 2023, Avient Corporation launched new halogen-free flame-retardant (HFFR) grades in its reSound BIO and resound REC TPE portfolios. These grades, which are made with recycled and bio-based resin, meet the rising demand for sustainable materials in consumer electronics, such as USB-C connector cable jackets.

The increasing use of thermoplastic elastomers (TPEs) in the medical sector is aiding market growth. TPEs are being adopted more widely due to their biocompatibility, flexibility, and ability to withstand sterilization processes, making them ideal for medical tubing, catheters, and other critical devices.

Their superior performance in meeting stringent regulatory standards and durability under sterilization conditions is addressing the healthcare industry's growing demand for safer, more reliable products. As medical device manufacturers prioritize these qualities, the market for TPEs is growing rapidly. This trend is further fueled by the continuous need for advanced materials that enhance patient safety and product performance, thereby fostering market growth.

Segmentation Analysis

The global market is segmented based on types, end-use industry, and geography.

By Types

Based on types, the market is categorized into styrenic block copolymers, thermoplastic polyurethanes, thermoplastic copolyesters, thermoplastic polyolefins, thermoplastic vulcanizates, and others. The styrenic block copolymers segment led the thermoplastic elastomers market in 2023, reaching a valuation of USD 9.97 billion.

SBCs, including polystyrene-butadiene-styrene (SBS) and styrene-ethylene-butylene-styrene (SEBS), are renowned for their excellent elasticity, durability, and ease of processing. They are widely used in automotive components, consumer goods, and construction applications, where their ability to balance flexibility with strength is highly valued.

Technological advancements are continually enhancing SBC properties, such as thermal stability and resistance to environmental factors, thereby broadening their application scope. Additionally, increasing consumer demand for high-quality, long-lasting products and the transition toward more sustainable materials are supporting segmental growth.

By End-Use Industry

Based on end-use industry, the market is categorized into automotive, building & construction, footwear, electrical & electronics, medical, and others. The automotive segment captured the largest thermoplastic elastomers market share of 41.87% in 2023. TPEs are increasingly used in automotive applications such as seals, gaskets, interior trims, and bumpers, where their flexibility, durability, and resistance to extreme temperatures and environmental conditions are highly valued.

The growing shift toward sustainable automotive solutions is further fueling this growth, as TPEs contribute to weight reduction and improved fuel efficiency. This advancement is supported by innovations such as recycled and bio-based materials. Technological advancements in TPEs are enhancing their performance and enabling the development of complex components. Additionally, rising consumer demand for high-quality, aesthetically pleasing vehicle interiors is facilitating the widespread adoption of TPEs, making them a key material in modern automotive manufacturing.

Thermoplastic Elastomers Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific thermoplastic elastomers market share stood around 35.67% in 2023 in the global market, with a valuation of USD 9.97 billion. This growth is largely attributed to rapid industrialization and the rising automotive production in the region. TPEs are increasingly utilized in automotive components, consumer goods, and electronics due to their durability, flexibility, and performance. The booming automotive sector in countries such as China and India, coupled with a growing middle-class population and infrastructure development, is fueling demand.

- For instance, in September 2023, Covestro commenced construction on a new Thermoplastic Polyurethanes (TPU) production facility in Zhuhai, China, following an investment announcement earlier that year. The facility, planned to be developed in three phases, aims to achieve a total annual production capacity of 120,000 tons of TPU upon full completion. The first phase, projected to be completed by 2025, is anticipated to have a production capacity of approximately 30,000 tons per year, with an initial investment in the mid double-digit million Euro range. The final phase is expected to be completed by 2033.

Additionally, advancements in TPE technology and a growing focus on eco-friendly solutions are contributing to market expansion.

Europe is anticipated to witness significant growth at a CAGR of 5.39% over the forecast period, largely due to stringent regulatory frameworks and a strong emphasis on innovation in material science. European standards for product safety, environmental impact, and performance are leading to increased adoption of TPEs across various applications.

Additionally, the promotion of circular economy practices and the integration of TPEs in high-tech applications, such as smart textiles and advanced consumer electronics, are contributing to the regional market expansion.

Furthermore, key players in Europe are significantly supporting this growth through strategic partnerships, which are expanding their reach and capabilities in the thermoplastic elastomers (TPE) sector.

- For instance, on January 1, 2023, Nexeo Plastics announced an expansion of its partnership with Teknor Apex, becoming a key distributor for Teknor Apex's thermoplastic elastomers (TPEs) in Europe. This expanded collaboration encompasses Teknor Apex’s Sarlink and Monprene TPE portfolios.

Competitive Landscape

The global thermoplastic elastomers market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Thermoplastic Elastomers Market

- APAR Industries Ltd

- Arkema

- Asahi Kasei Corporation

- Avient Corporation

- BASF Corporation

- Celanese Corporation

- Covestro AG

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

Key Industry Development

- October 2023 (Product Launch): Evonik launched its new INFINAM TPA 4006 P elastomer powder material for SLS 3D printing. The company expanded its portfolio of elastomeric materials for powder bed fusion 3D printing technologies with this new grade and optimized for compatibility with all types of open-source SLS 3D printing machines.

The global thermoplastic elastomers market is segmented as:

By Types

- Styrenic Block Copolymers (SBC)

- Thermoplastic Polyurethanes

- Thermoplastic Copolyesters

- Thermoplastic Polyolefins

- Thermoplastic Vulcanizates

- Others

By End-Use Industry

- Automotive

- Building & Construction

- Footwear

- Electrical & Electronics

- Medical

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

freqAskQues