buyNow

Brewing Enzymes Market

Brewing Enzymes Market Size, Share, Growth & Industry Analysis, By Type (Amylase, Beta-glucanase, Protease, Xylanase, Others), By Source (Plant, Microbial), By Application (Beer, Wine)), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Sunanda G.

Brewing Enzymes Market Snapshot

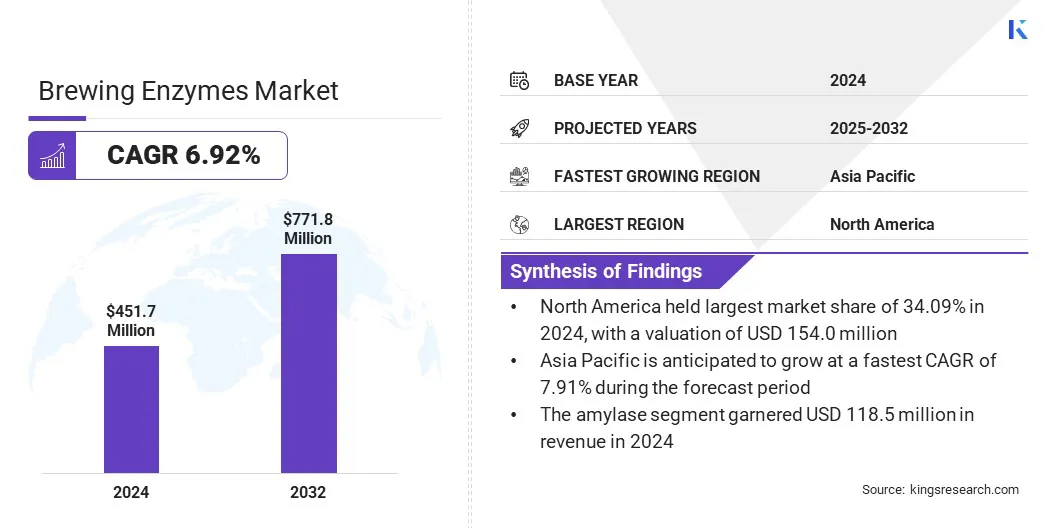

The global brewing enzymes market size was valued at USD 451.7 million in 2024 and is projected to grow from USD 482.8 million in 2025 to USD 771.8 million by 2032, exhibiting a CAGR of 6.92% during the forecast period. The market is expanding due to the rising demand for specialty and craft beer, which requires tailored enzyme solutions for consistent flavor and efficiency.

Additionally, the increasing popularity of premium and functional no and low-alcohol beverages is driving the need for enzymes that improve mouthfeel, stability, and fermentation control.

Key Market Highlights:

- The global market size was valued at USD 451.7 million in 2024.

- The market is projected to grow at a CAGR of 6.92% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 154.0 million.

- The amylase segment garnered USD 118.5 million in revenue in 2024.

- The plant segment is expected to reach USD 475.0 million by 2032.

- The beer segment secured the largest revenue share of 57.23% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.91% during the forecast period.

Major companies operating in the brewing enzymes industry are Novozymes A/S, DuPont, AB Enzymes, dsm-firmenich, Amano Enzyme Inc., CBS BREW, Kerry Group plc., Megazyme Ltd., Nagase America LLC, SternEnzym GmbH, IFF, Aumgene Biosciences, Enzyme Development Corporation, WeissBioTech, and Creative Enzymes.

Brewing Enzymes Market Overview

Increasing focus on process optimization is driving the demand for brewing enzymes in large-scale beer production. Brewing enzymes improve raw material conversion, resulting in higher yield and more efficient extraction of fermentable sugars.

Reducing mash viscosity and enhancing fermentation performance are enabling breweries to streamline operations and reduce energy and water usage. Enzymes also support the use of adjuncts like unmalted grains, which lowers input costs without compromising quality. Large breweries are adopting enzyme solutions to increase throughput, maintain consistency, and meet production targets more efficiently.

- In June 2025, Shrijiexbiz Pvt Ltd introduced a high‑purity Gluco Amylase Enzyme for large‑scale breweries. This enzyme completes starch breakdown by converting residual dextrins into fermentable glucose, enhancing fermentable sugar availability for yeast.

Market Driver

Rising Demand for Specialty and Craft Beer

Rising demand for specialty and craft beer is driving increased use of brewing enzymes among small and independent brewers. Craft breweries rely on enzymes to improve filtration, accelerate production cycles, and enhance overall process control.

Maintaining flavor consistency across small batches is becoming essential as consumers expect high-quality and distinctive beer profiles. Brewing enzymes enable better utilization of diverse raw materials, allowing for creative recipes and efficient fermentation. Small-scale producers are also using enzymes to reduce haze and improve clarity without compromising taste.

- In January 2023, WeissBioTech introduced Lautermax and Attenumax, two enzyme blends tailored for small-scale breweries. These products assist brewers in achieving precise results while differentiating their products, allowing for creative recipes and efficient fermentation.

Market Challenge

High Product Sensitivity to Temperature and pH

A key challenge in the brewing enzymes market is managing the sensitivity of enzyme activity to changes in temperature and pH levels during production.

Even minor deviations in processing conditions can significantly reduce enzyme effectiveness, impacting product consistency and quality. This sensitivity demands precise control systems and skilled personnel, increasing operational complexity for brewers.

To address this challenge, market players are developing more robust enzyme formulations that perform reliably across wider temperature and pH ranges. Companies are also integrating advanced monitoring technologies and automation to ensure consistent processing conditions and maintain enzyme performance.

Market Trend

Growing Demand for Premium and Functional NOLO Products

A key trend in the market is the rising focus on premium and functional NOLO (no- and low-alcohol) beverages. Health-conscious consumers, particularly from Gen Z and younger millennial groups, are increasingly selecting alcohol-free options that feature wellness-oriented ingredients such as adaptogens, L-theanine, and ginseng.

Flavor development is evolving to match the complexity and balance of traditional alcoholic drinks. Brands are also investing in premium packaging to elevate product appeal and compete directly with upscale alcoholic offerings.

- In September 2024, IFF introduced DIAZYME NOLO, a specialized enzyme blend tailored for the rapidly expanding no- and low-alcohol beer segment. This blend aims to enhance taste and operational efficiency for brewers by optimizing fermentation and flavor profiles.

Brewing Enzymes Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Amylase, Beta-glucanase, Protease, Xylanase, Others |

|

By Source |

Plant, Microbial |

|

By Application |

Beer, Wine |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Amylase, Beta-glucanase, Protease, Xylanase, Others): The amylase segment earned USD 118.5 million in 2024 due to its essential role in breaking down starches into fermentable sugars, which improves extraction efficiency and enhances fermentation.

- By Source (Plant, Microbial): The plant segment held 62.15% of the market in 2024, due to its cost-effective production, abundant availability, and growing preference for natural and non-GMO enzyme sources in beer manufacturing.

- By Application (Beer, Wine): The beer segment is projected to reach USD 421.9 million by 2032, owing to the high global consumption of beer and the widespread adoption of enzymes to enhance brewing efficiency, improve yield, and support the production of diverse beer styles.

Brewing Enzymes Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America brewing enzymes market share stood at 34.09% in 2024 in the global market, with a valuation of USD 154.0 million. This dominance is attributable to the rising consumer demand for light, gluten-free, and low-carb beers across North America.

Brewing enzymes enable the production of such beers by breaking down gluten and reducing residual sugars, which is driving enzyme use in new product formulations. Moreover, breweries in the region are early adopters of process optimization technologies, including enzyme-based brewing.

This helps reduce energy and water usage, shorten production time, and improve yields, making enzymes a key component in modern brewery operations.

The brewing enzymes industry in Asia Pacific is poised for a significant CAGR of 7.91% over the forecast period. This growth is driven by the increasing use of locally available grains such as rice, sorghum, and cassava by large brewers in the region.

Brewing enzymes are critical for processing these grains by enabling efficient starch conversion and ensuring consistent product quality, supporting both innovation and cost efficiency. Additionally, international and domestic brewing companies are expanding production capacities across Asia Pacific.

New facilities are adopting enzyme-based brewing processes to improve yield, reduce brewing time, and ensure quality consistency, contributing to sustained market growth.

- In January 2025, Australia's Bundaberg Brewed Drinks is accelerating its international expansion with a new product designed specifically for the South Korean market. The company unveiled the new drink at a trade show in Singapore in April, marking its first time launching a flavor exclusively for an international audience.

Regulatory Frameworks

- In the U.S., brewing enzymes are regulated by the Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act. Enzymes are classified as either food additives or Generally Recognized as Safe (GRAS), with listings under 21 CFR Parts 173 and 184. Additionally, the Alcohol and Tobacco Tax and Trade Bureau (TTB) governs enzyme use in alcohol production under 27 CFR, ensuring compliance with safety and labeling standards.

- The European Union regulates brewing enzymes under Regulation (EC) No. 1332/2008 on food enzymes. The European Food Safety Authority (EFSA) evaluates their safety, while the European Commission maintains an approved Union list. Enzymes must also comply with Regulation (EC) No. 1331/2008 on common authorization procedures and Regulation (EU) No. 1169/2011 on food information.

- China regulates brewing enzymes through the National Food Safety Standards (GB Standards), managed by the National Health Commission (NHC). Enzymes are treated as food additives and must pass strict toxicological and quality reviews. Approved enzymes are listed in official catalogues and are subject to continuous monitoring. Domestic and imported enzymes must comply with labelling and purity standards set by the State Administration for Market Regulation (SAMR), ensuring consistency and safety in food processing.

- In Japan, brewing enzymes fall under the Food Sanitation Act, administered by the Ministry of Health, Labour and Welfare (MHLW). Only enzymes on the government-approved list can be used in food and beverage manufacturing. Safety evaluation includes allergenicity and purity testing, with periodic updates reflecting advances in enzyme production.

Competitive Landscape

Major players in the brewing enzymes market are adopting strategies such as product innovation, focused R&D, and strategic collaborations to improve brewing efficiency and support cost-effective production.

By developing advanced enzyme formulations tailored for diverse raw materials, companies are helping brewers increase flexibility in ingredient sourcing and reduce reliance on traditional processes. These efforts are aligning with industry needs for sustainability, improved yield, and operational efficiency.

Key Companies in Brewing Enzymes Market:

- Novozymes A/S

- DuPont

- AB Enzymes

- dsm-firmenich

- Amano Enzyme Inc.

- CBS BREW

- Kerry Group plc.

- Megazyme Ltd.

- Nagase America LLC

- SternEnzym GmbH

- IFF

- Aumgene Biosciences

- Enzyme Development Corporation

- WeissBioTech

- Creative Enzymes

Recent Developments (Product Launch)

- In May 2023, Creative Enzymes introduced a high-performance brewing enzyme blend that allows brewers to increase the use of adjuncts like unmalted grains and locally sourced raw materials without the need for cereal cooking. This innovation enhances brewhouse capacity, cuts production costs, and supports sustainability initiatives.

freqAskQues