buyNow

Intelligent Virtual Assistant Market

Intelligent Virtual Assistant Market Size, Share, Growth & Industry Analysis, By Product Type (Smart Speakers, Chatbots, Mobile Virtual Assistants, Smart Display Assistants), By Technology (Speech Recognition, Text-to-Speech (TTS), Natural Language Processing (NLP)), By Deployment Mode (On-Premise, Cloud-Based), By Application, and Regional Analysis, 2024-2031

pages: 140 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

Intelligent virtual assistants (IVA) are AI-driven software applications that engage in human-like interactions using natural language processing, machine learning, and contextual awareness. These systems interpret user intent, manage multi-turn conversations, and adapt responses based on past interactions to deliver personalized assistance.

They are commonly used in customer service, banking, e-commerce, and healthcare, intelligent virtual assistants automate routine tasks and enhance user engagement across digital channels. The IVA market also includes applications that enhance enterprise productivity, enable voice-driven interfaces, and support connected devices requiring intelligent decision-making and responsive conversational capabilities.

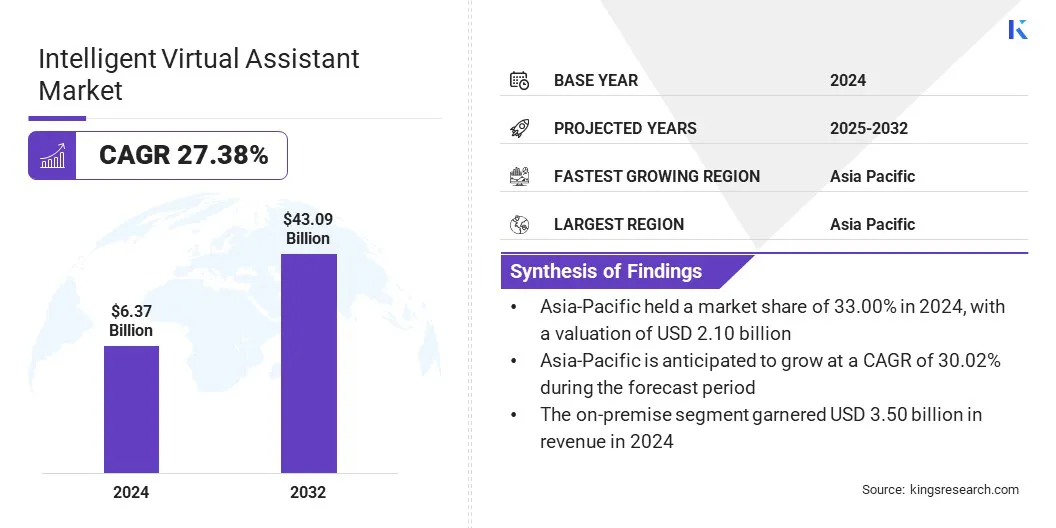

The global intelligent virtual assistant market size was valued at USD 6.37 billion in 2024 and is projected to grow from USD 7.92 billion in 2025 to USD 43.09 billion by 2032, exhibiting a CAGR of 27.38% during the forecast period. Personalized customer experience, driven by AI-powered interactions tailored to individual contexts, enhances satisfaction by providing more relevant, timely, and accurate solutions, boosting customer loyalty and engagement.

Key Highlights

- The intelligent virtual assistant industry size was valued at USD 6.37 billion in 2024.

- The market is projected to grow at a CAGR of 27.38% from 2025 to 2032.

- Asia-Pacific held a market share of 33.00% in 2024, with a valuation of USD 2.10 billion.

- The smart speakers segment garnered USD 2.87 billion in revenue in 2024.

- The natural language processing (NLP) segment is expected to reach USD 12.55 billion by 2032.

- The cloud-based segment is anticipated to witness the fastest CAGR of 32.59% over the forecast period.

- The customer service & support segment garnered USD 1.27 billion in revenue in 2024.

- North America is anticipated to grow at a CAGR of 26.41% during the forecast period.

Major companies operating in the intelligent virtual assistant market are [24]7.ai, Inc., Amazon Web Services, Inc., Apple Inc., HCL Technologies Limited, Google LLC, Creative Virtual, CodeBaby, LLC, eGain Corporation, Alphabet Inc., IBM, Microsoft, Ivalua Inc., Pegasystems Inc., Verint Systems Inc., and Oracle.

Intelligent Virtual Assistant Market Report Scope

Intelligent Virtual Assistant Market Report Scope

|

Segmentation |

Details |

|

By Product Type |

Smart Speakers, Chatbots, Mobile Virtual Assistants, and Smart Display Assistants |

|

By Technology |

Speech Recognition, Text-to-Speech (TTS), Natural Language Processing (NLP), Machine Learning & Deep Learning, and Voice Recognition & Authentication |

|

By Deployment Mode |

On-Premise and Cloud-Based |

|

By Application |

Customer Service & Support, Healthcare Assistance, E-commerce & Retail, Education & E-learning, Banking, Financial Services & Insurance (BFSI), Travel & Hospitality, Smart Home Automation, and IT Helpdesk & Internal Enterprise Support |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Intelligent Virtual Assistant Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific intelligent virtual assistant market share stood at around 33.00% in 2024, valued at USD 2.10 billion. This leading position is fueled by rapid advancements in artificial intelligence, which enable the development of more sophisticated, multilingual, and context-aware virtual assistants tailored to regional user needs.

Strong government support for digital initiatives such as national AI roadmaps, investments in cloud and 5G infrastructure, and smart city programs further accelerates deployment across public and private sectors. These initiatives are aimed at promoting digital transformation, enhancing service delivery, and encouraging AI adoption at scale.

Additionally, the region’s mobile-first and linguistically diverse population creates strong demand for localized, conversational AI experiences across industries such as banking, e-commerce, and healthcare.

Rising integration of voice-enabled technologies in smart devices, expansion of cloud infrastructure, and increasing enterprise focus on customer experience optimization further accelerate adoption. Ongoing advancements in natural language processing and real-time analytics, along with partnerships between technology firms and telecom providers, is driving the market growth across Asia Pacific.

- In August 2024, Taiwan-based ASUS ROG unveiled an upgraded version of its AI Virtual Assistant, previously known as “Virtual Pet,” featuring Llama 3–powered document summarization, Whisper-based voice transcription, and intelligent offline chat support. Developed to enhance user engagement and system efficiency, the assistant also enables real-time device monitoring and performance optimization, offering a smarter and more interactive experience for ROG users.

The North America intelligent virtual assistant industry is set to grow at a CAGR of 26.41% over the forecast period. This growth is propelled by the rising enterprise demand for intelligent automation, growing reliance on AI-driven customer interaction platforms, and the expanding application of virtual assistants in industries such as banking, healthcare, and retail. The region’s strong digital infrastructure and early adoption of advanced technologies are creating a favorable environment for intelligent virtual assistant deployment.

The North America intelligent virtual assistant industry is set to grow at a CAGR of 26.41% over the forecast period. This growth is propelled by the rising enterprise demand for intelligent automation, growing reliance on AI-driven customer interaction platforms, and the expanding application of virtual assistants in industries such as banking, healthcare, and retail. The region’s strong digital infrastructure and early adoption of advanced technologies are creating a favorable environment for intelligent virtual assistant deployment.

Government-backed initiatives promoting AI research, coupled with rising investments from leading technology firms, are further fueling domestic market expansion. Moreover, the growing emphasis by enterprise on enhancing customer experience, improving operational efficiency, and integrating intelligent systems into enterprise workflows is accelerating the adoption of intelligent virtual assistants throughout North America.

- In November 2024, Verint announced that a major U.S. travel services company deployed its AI-powered IVA, replacing a legacy IVR system. This resulted in a significant increase in self-service call containment from 10% to 50% within a month, driving USD 10 million in annual savings, highlighting the transformative impact of Verint's IVA in optimizing customer service operations and improving overall efficiency.

Intelligent Virtual Assistant Market Overview

The market is registering strong growth, driven by the rising adoption of AI technologies across customer service and enterprise operations. Increasing demand for automation, improved customer engagement, and operational cost reduction are fueling the market.

The integration of generative AI and voice-enabled interfaces is enhancing IVA capabilities, enabling real-time support and smarter task handling. With organizations across sectors prioritizing digital transformation, the market is projected to register sustained investment and innovation, particularly in high-volume customer interaction environments.

- In July 2024, DBS announced the rollout of “CSO Assistant,” a Gen AI-powered virtual assistant developed in-house to support 500 Customer Service Officers in Singapore. It enhances customer experience, reduces call handling time by 20%, and exemplifies DBS’s innovation in the market.

Market Driver

Personalized Customer Experience

Personalized customer experiences are driving the intelligent virtual assistant market. AI-powered interactions that adapt to each customer’s unique context, such as preferences, past interactions, and behavior, result in more relevant, timely, and effective solutions.

This personalization improves customer satisfaction by delivering tailored responses and recommendations, making interactions more efficient and engaging. Businesses are increasingly turning to IVAs to provide individualized, seamless experiences across various touchpoints as consumer expectations evolve, boosting both loyalty and retention.

- In April 2023, Verint announced enhanced capabilities for its IVA, powered by Verint Da Vinci AI. The solution enables faster design, deployment, and scaling of AI-driven customer experiences, boosting ROI and efficiency. It supports hybrid workforces, omnichannel services, and personalized automation for industries like banking and healthcare.

Market Challenge

User Trust and Acceptance

User trust and acceptance pose significant challenges in the intelligent virtual assistant market, as many customers remain hesitant to rely on AI for critical tasks, preferring human interaction instead of automated responses. Companies can focus on building transparent, reliable, and secure AI systems that demonstrate clear value in resolving issues efficiently.

Offering hybrid solutions where AI handles routine tasks while human agents manage more complex issues can also help bridge this gap, fostering trust and increasing overall user satisfaction with AI-powered services.

Market Trend

Increased Adoption in Various Industries

The adoption of IVA across various industries, including banking, healthcare, retail, and automotive, is driving the market. These sectors are increasingly integrating IVAs to enhance customer engagement, streamline operations, and provide more efficient services.

IVAs are helping businesses meet the growing demand for seamless digital interactions by automating routine tasks, improving response times, and offering personalized experiences, ultimately driving operational efficiency and boosting customer satisfaction.

- In January 2024, Mercedes-Benz unveiled cutting-edge digital advancements at the Consumer Technology Association (CES), highlighting the new MBUX Virtual Assistant powered by generative AI. This assistant transforms customer interactions with personalized, natural conversations, offering an intuitive user experience. The technology aims to redefine in-car digital interactions, making them more human-like and proactive, all integrated seamlessly with Mercedes-Benz’s new MB.OS system, setting a new standard in AI-powered, personalized customer service.

Market Segmentation

- By Product Type (Smart Speakers, Chatbots, Mobile Virtual Assistants, and Smart Display Assistants): The smart speakers segment earned USD 2.87 billion in 2024 due to rising consumer adoption of voice-activated devices for hands-free assistance and smart home integration.

- By Technology (Speech Recognition, Text-to-Speech (TTS), Natural Language Processing (NLP), Machine Learning & Deep Learning, and Voice Recognition & Authentication): The natural language processing (NLP)segment held 28.00% of the market in 2024, attributed to its critical role in enabling context-aware, human-like interactions across virtual assistant applications.

- By Deployment Mode (On-Premise, and Cloud-Based): The cloud-based segment is projected to reach USD 27.31 billion by 2032, owing to its scalability, lower infrastructure costs, and seamless integration with AI and data analytics platforms.

- By Application (Customer Service & Support, Healthcare Assistance, E-commerce & Retail, Education & E-learning, Banking, Financial Services & Insurance (BFSI), Travel & Hospitality, Smart Home Automation, and IT Helpdesk & Internal Enterprise Support): The healthcare assistance segment is anticipated to grow at a CAGR of 32.42% through the projection period, mainly due to increasing demand for virtual health consultations, patient engagement tools, and AI-driven medical support services.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) prevents fraudulent practices, offering guidance to consumers on avoiding scams, while focusing on transparency, privacy, and data security in AI deployments.

- The EU General Data Protection Regulation (GDPR) governs how the personal data of individuals in the EU may be processed and transferred. It also includes guidelines on consent and data usage for AI models.

- In India, the Digital Personal Data Protection Bill, 2023 ensures lawful data processing, individuals' rights, data fiduciary obligations, and penalties for breaches. It emphasizes transparency, consent, security, and safeguards for children's data.

Competitive Landscape

Companies in the intelligent virtual assistant industry are increasingly focusing on integrating generative AI to enhance automation and improve customer experiences. They are developing AI-powered virtual assistants that can handle complex tasks such as onboarding, query resolution, and transaction management.

Additionally, businesses are incorporating advanced analytics, ML, and NLP capabilities to deliver personalized interactions, reduce operational costs, and improve overall efficiency across various industries, including banking, healthcare, and retail.

- In May 2024, Wipro announced a collaboration with Microsoft to launch generative AI-powered virtual assistants for the financial services sector. The suite includes solutions for investor intelligence, onboarding, and loan origination, aiming to enhance productivity, reduce document validation time, and provide personalized, data-driven client interactions for financial professionals.

Key Companies in Intelligent Virtual Assistant Market:

- [24]7.ai, Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- HCL Technologies Limited

- Google LLC

- Creative Virtual

- CodeBaby, LLC

- eGain Corporation

- Alphabet Inc.

- IBM

- Microsoft

- Ivalua Inc.

- Pegasystems Inc.

- Verint Systems Inc.

- Oracle

Recent Developments (Launch)

- In June 2025, NWN Corporation unveiled AiVA, an intelligent virtual assistant, and Managed DEX, a cloud-based digital experience platform, aimed at transforming digital employee experiences through AI-driven automation. These solutions optimize IT helpdesk operations, automate repetitive tasks, and improve response times across enterprise workflows.

- In April 2025, 8x8 launched the AI Orchestrator, enabling seamless decision flows across multiple AI bots and vendor solutions. This innovation enhances customer experiences by ensuring frictionless interactions, faster query resolution, and better operational flexibility, ultimately supporting businesses in their digital transformation and AI-powered customer engagement strategies.

- In June 2024, Apple introduced Apple Intelligence, a personal AI system integrated into iOS 18, iPadOS 18, and macOS Sequoia. It combines generative AI with personal context to simplify tasks while ensuring privacy through on-device processing and private cloud computing. Siri, ChatGPT, and enhanced writing tools elevate user experience.

- In March 2024, Openstream.ai launched its patented Enterprise Virtual Assistant (EVA) platform, using a neuro-symbolic AI approach. This technology enables businesses to create human-like voice agents and virtual assistants, enhancing empathy in conversations and reducing errors like hallucinations, setting it apart from competitors in the conversational AI space.

freqAskQues