buyNow

Pneumatic Conveying Systems Market

Pneumatic Conveying Systems Market Size, Share, Growth & Industry Analysis, By System Type (Dilute Phase Systems, Dense Phase Systems), By Technology (Positive Pressure Systems, Vacuum Systems, Combination Systems), By Industry (Manufacturing, Power Generation), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Sunanda G.

Market Definition

Pneumatic conveying systems transport bulk solids like powders, granules, and pellets through pipelines using pressurized air or vacuum. These systems offer clean, enclosed handling solutions that reduce contamination and material degradation. The market scope covers industries such as food processing, pharmaceuticals, chemicals, and cement where controlled and efficient material flow is essential.

Engineers use pneumatic conveying systems for ingredient dosing, dust-free transfer, batch blending, and recycling operations to enhance process hygiene, optimize production throughput, and ensure workplace safety.

Pneumatic Conveying Systems Market Overview

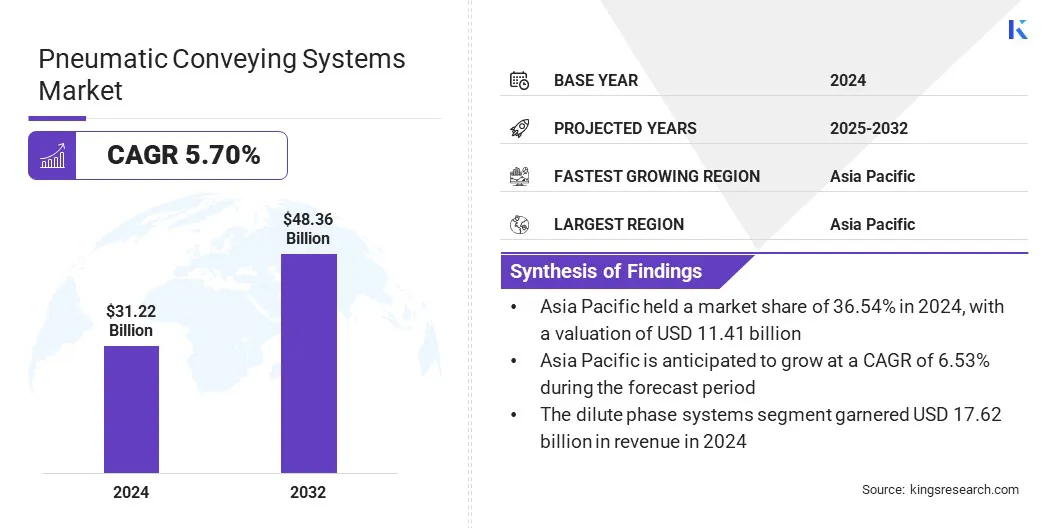

The global pneumatic conveying systems market size was valued at USD 31.22 billion in 2024 and is projected to grow from USD 32.81 billion in 2025 to USD 48.36 billion by 2032, exhibiting a CAGR of 5.70% during the forecast period. This market is registering steady growth, driven by the surging demand for energy-efficient dilute and dense phase systems, which offer lower power consumption and reduced material degradation.

Additionally, the adoption of IoT-enabled smart systems with predictive maintenance capabilities is enhancing operational efficiency, reducing downtime, and supporting long-term cost optimization across industries.

Key Highlights

- The pneumatic conveying systems industry size was valued at USD 31.22 billion in 2024.

- The market is projected to grow at a CAGR of 5.70% from 2025 to 2032.

- Asia Pacific held a market share of 36.54% in 2024, with a valuation of USD 11.41 billion.

- The dilute phase systems segment garnered USD 17.62 billion in revenue in 2024.

- The positive pressure systems segment is expected to reach USD 22.05 billion by 2032.

- The manufacturing segment secured the largest revenue share of 36.54% in 2024.

- The market in Europe is anticipated to grow at a CAGR of 6.10% during the forecast period.

Major companies operating in the pneumatic conveying systems market are Atlas Copco AB, Coperion GmbH, Cyclonaire Corporation, Palamatic Process, Dynamic Air, Flexicon Corporation, Gericke AG, DongYang P&F, Nilfisk Group, Schenck Process LLC, Milacron, LLC, Macawber Engineering Systems India Pvt. Ltd., Nol-Tec Systems Inc., VAC-U-MAX, and WAMGROUP S.p.A.

The widespread adoption of automation and Industry 4.0 practices is driving the demand for pneumatic conveying systems across multiple manufacturing sectors. Companies in the chemicals, food & beverage, and pharmaceutical industries are deploying automated conveyors to enhance material handling efficiency and reduce manual intervention.

Integration of IoT sensors enables the real-time monitoring of system performance, material flow, and operating conditions. Predictive maintenance capabilities minimize unplanned downtime and extend equipment lifespan by identifying issues before failures occur. These smart systems are improving throughput, consistency, and quality in bulk material processing environments.

Market Driver

Surging Demand for Energy-efficient Dilute and Dense Phase Systems

Technological advancements in pneumatic conveying drive the demand for energy-efficient dilute and dense phase systems across material handling industries. Manufacturers are adopting optimized blower and compressor technologies that reduce power consumption without compromising performance. Improved airflow design and system controls enhance operational efficiency while allowing the flexible handling of powders, granules, and fragile materials.

Dense phase systems offer lower velocity transport with minimal product degradation, making them suitable for sensitive applications. Dilute phase systems are being enhanced to support the faster conveying of lighter materials with reduced energy losses.

- In March 2024, Carmeuse Systems launched the CV Series Rotary Airlock Valve, built for pneumatic conveying systems with pressures up to 15 psi. The valve features precision-machined tight rotor clearances to minimize air leakage and improve fill efficiency. It handles dry and granulated materials such as powder, grain, and chemical products, supporting dilute and dense phase systems.

Market Challenge

Complex Material Handling Needs Increasing Design Challenges

A key challenge in the pneumatic conveying systems market is to manage the diverse flow characteristics of bulk materials such as dry powders, pellets, and flakes. These variations affect system performance, making it difficult to ensure consistent flow or material degradation. Design complexity increases when handling materials with abrasive, sticky, or fragile properties, raising maintenance requirements and operational risks.

To address this challenge, market players focus on customizing system components based on material profiles, optimizing airflow control, and using advanced simulation tools during design. Companies are also incorporating real-time monitoring technologies to detect flow disruptions early and improve system reliability.

Market Trend

Adoption of IoT-enabled Smart Systems & Predictive Maintenance

A key trend in the pneumatic conveying systems market is the adoption of IoT-enabled smart systems for improved monitoring and maintenance. Conveyor systems equipped with sensors are being integrated with Industry 4.0 platforms to collect and transmit real-time performance data. This connectivity allows operators to remotely track system efficiency, detect faults, and receive automated maintenance alerts.

Predictive maintenance capabilities help reduce downtime by identifying potential issues before they cause failures. Data-driven insights also support process optimization and extend equipment lifespan. The market is moving toward more connected and proactive solutions that enhance reliability and operational efficiency.

- In May 2025, MACTEX, an industrial automation provider, launched a cloud-integrated pneumatic conveying system featuring embedded sensors and AI analytics. Sensors monitor air pressure, flow rate, and vibration, and transmit data to a cloud dashboard. An AI-driven module analyzes trends to predict impending faults, triggering automated maintenance alerts and reducing unplanned downtime.

Pneumatic Conveying Systems Market Report Snapshot

|

Segmentation |

Details |

|

By System Type |

Dilute Phase Systems, Dense Phase Systems |

|

By Technology |

Positive Pressure Systems, Vacuum Systems, Combination Systems |

|

By Industry |

Manufacturing, Power Generation, Pharmaceuticals, Chemicals, Plastic and rubber, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By System Type (Dilute Phase Systems and Dense Phase Systems): The dilute phase systems segment earned USD 17.62 billion in 2024, due to its cost-effectiveness, simpler system design, and widespread suitability for transporting low-density and non-abrasive materials across diverse industries such as food, plastics, and chemicals.

- By Technology (Positive Pressure Systems, Vacuum Systems, and Combination Systems): The positive pressure systems segment held 45.66% share of the market in 2024, due to its ability to transport bulk materials over longer distances at higher capacities and lower operational costs.

- By Industry (Manufacturing, Power Generation, Pharmaceuticals, and Chemicals, Plastic, rubber, and Others): The manufacturing segment is projected to reach USD 18.15 billion by 2032, owing to the high demand for automated and dust-free bulk material handling solutions that enhance process efficiency, reduce contamination, and support continuous production in sectors like food, chemicals, and plastics.

Pneumatic Conveying Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific pneumatic conveying systems market share stood at around 36.54% in 2024, with a valuation of USD 11.41 billion. This dominance is attributed to the position of Asia Pacific as a key production hub for specialty chemicals, lithium compounds, and battery materials used in electronics and electric vehicle (EV) manufacturing.

- According to a March 2025 report by the International Energy Agency (IEA), China was responsible for producing over 75% of all batteries sold globally. In 2025, average battery prices in China declined by nearly 30%, the fastest drop globally. Additionally, more than 70% of all EV batteries ever manufactured originated in China, contributing to a deep base of manufacturing expertise in China.

These industries require the handling of fine, hazardous, or highly reactive powders, making pneumatic conveying systems ideal due to their enclosed and precisely controlled transport capabilities. As a result, the demand for dense phase conveying systems, particularly in chemical clusters and battery gigafactories, is growing.

The pneumatic conveying systems industry in Europe is poised for growth at a CAGR of 6.10% over the forecast period. This growth is attributed to the well-established and expanding pharmaceutical and biotechnology sector in Europe, supported by substantial R&D investments and robust export demand.

- In November 2024, the European Federation of Pharmaceutical Industries and Associations (EFPIA) reported that the EU's pharmaceutical R&D spending reached USD 49.9 billion in 2022, growing at an average rate of 4.4% annually since 2010.

These industries demand ultra-clean, contamination-free handling of powders and granules used in drug formulation and production. Pneumatic conveying systems, particularly those engineered for cleanroom environments, are increasingly adopted to comply with stringent hygiene standards and Good Manufacturing Practice (GMP) guidelines, thereby fueling their demand in this region.

Regulatory Frameworks

- In the U.S., pneumatic conveying systems are regulated under the Occupational Safety and Health Administration (OSHA) standards 29 CFR 1910 Subpart O and 29 CFR 1926.555, which require the guarding of moving parts, emergency stop controls, and safety signage. Electrical components must comply with National Fire Protection Association (NFPA) 70E, UL 508A, and National Electrical Code (NEC) standards. Dust handling is governed by NFPA 66, NFPA 68, and NFPA 91, especially in grain or chemical facilities.

- Europe enforces the EU Machinery Directive (2006/42/EC) and Low Voltage Directive (2014/35/EU) for the safe design and operation of conveying systems. EN 60204-1 governs electrical safety, while explosion-prone installations follow the ATEX Directive 2014/34/EU and 99/92/EC. Dust and powder handling must comply with EN 1127-1, EN 15089, and EN 16447, ensuring protection against fire and explosion risks in dense & dilute phase systems.

- In China, regulations governing pneumatic conveying fall under the National Safety Production Law and standards set by the Standardization Administration of China (SAC). The country enforces adaptations of International Electrotechnical Commission (IEC) standards like IEC 60204-1 for electrical safety and IEC 60079 series for explosion protection. Equipment used in hazardous dust environments must be certified by China Compulsory Certification (CCC), and dust control falls under AQ/T safety standards for industrial machinery.

- Japan adheres to IEC-aligned safety norms through the Japanese Industrial Standards (JIS), particularly JIS B 9960-1 (equivalent to IEC 60204-1) for machinery and electrical safety. Explosion-proof design is governed by the Industrial Safety and Health Law (ISHL) and High Pressure Gas Safety Act, requiring risk assessments and flameproof certifications. The Japan Explosives Control Act regulates material transport in combustible dust environments, ensuring full containment and ignition prevention.

- South Korea implements machinery safety through the Korean Occupational Safety and Health Act (KOSHA) and aligns with IEC standards such as IEC 60204-1 for electrical systems and IEC 60079 for explosion protection. The Korea Gas Safety Corporation (KGS) and Korean Agency for Technology and Standards (KATS) oversee safety certifications for powder transport equipment used in high-risk zones, including battery, chemical, and food processing plants.

Competitive Landscape

Players in the pneumatic conveying systems industry are adopting strategies such as product innovation, technological advancements, and strategic partnerships, contributing to the market’s growth.

Companies are focusing on developing efficient systems to handle sensitive or abrasive materials while reducing energy consumption and maintenance needs. Collaborations between equipment manufacturers and material processing firms are also helping deliver integrated solutions tailored for the food, chemicals, and plastics industries.

Key Companies in Pneumatic Conveying Systems Market:

- Atlas Copco AB

- Coperion GmbH

- Cyclonaire Corporation

- Palamatic Process

- Dynamic Air

- Flexicon Corporation

- Gericke AG

- DongYang P&F

- Nilfisk Group

- Schenck Process LLC

- Milacron, LLC

- Macawber Engineering Systems India Pvt. Ltd.

- Nol-Tec Systems. Inc.

- VAC-U-MAX

- WAMGROUP S.p.A

Recent Developments (Partnerships)

- In March 2024, Coperion and Schenck Process FPM jointly showcased their integrated pneumatic conveying solutions at NPE 2024 in Orlando, Florida. The exhibit included virtual plant demonstrations incorporating feeders, dust collection, and conveying components tailored for plastic processing.

freqAskQues