buyNow

Specialty Food Ingredients Market

Specialty Food Ingredients Market Size, Share, Growth & Industry Analysis, By Type (Enzymes, Emulsifiers, Flavors, Colorants, Others), By Application (Food & Beverages, Pharmaceutical, Personal Care) and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Specialty food ingredients are high-value additives used in small quantities to enhance the taste, texture, appearance, nutrition, and shelf life of food and beverage products. The market encompasses enzymes, emulsifiers, flavors, colorants, and preservatives. It serves multiple end-use industries, including food and beverages, pharmaceuticals, and personal care, supporting product formulation, innovation, and functional performance.

Specialty Food Ingredients Market Overview

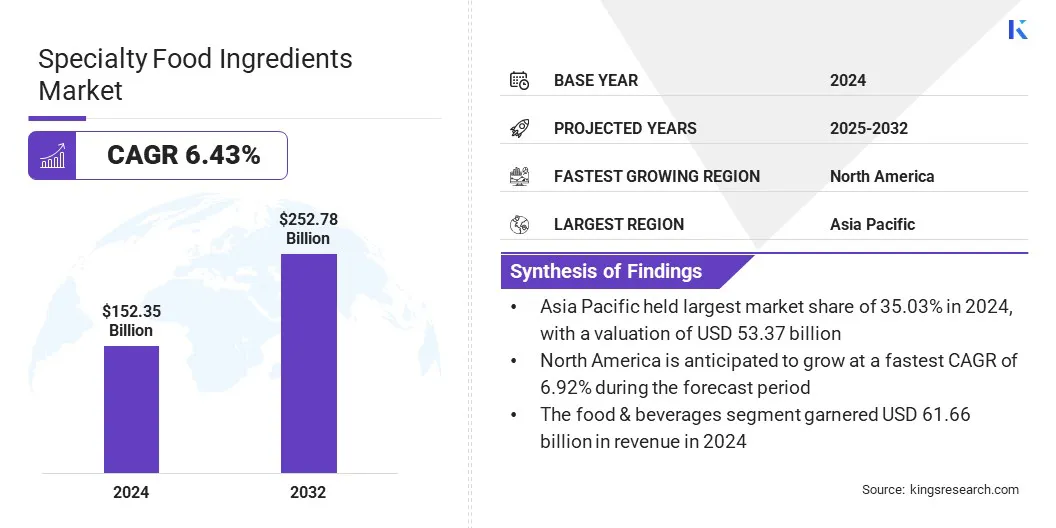

The global specialty food ingredients market size was valued at USD 152.35 billion in 2024 and is projected to grow from USD 161.29 billion in 2025 to USD 252.78 billion by 2032, exhibiting a CAGR of 6.43% during the forecast period.

This growth is driven by increasing consumer demand for clean-label, natural, and functional products. Manufacturers are incorporating bioactive components such as enzymes, emulsifiers, fibers, and botanical extracts to enhance taste, texture, nutritional value, and shelf life.

Key Highlights

- The specialty food ingredients industry size was valued at USD 152.35 billion in 2024.

- The market is projected to grow at a CAGR of 6.43% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 53.37 billion.

- The enzymes segment garnered USD 42.78 billion in revenue in 2024.

- The food & beverages segment is expected to reach USD 101.23 billion by 2032.

- North America is anticipated to grow at a CAGR of 6.92% over the forecast period.

Major companies operating in the specialty food ingredients market are ADM, Cargill, Incorporated, dsm-firmenich, International Flavors & Fragrances Inc., Kerry Group plc., Givaudan, Sensient Technologies Corporation, Ingredion, ASR GROUP, Novo Holdings A/S, DuPont, Symrise, Corbion N.V., Brenntag SE, and RAG-Stiftung.

The growing popularity of plant-based and alternative protein sources is prompting manufacturers to develop customized ingredient solutions that enhance texture, flavor, and nutritional value in meat and dairy alternatives. This trend reflects shifting consumer preferences toward sustainable diets and is supported by increased investments in plant-based product development across the food and beverage industry.

Market Driver

Rising Demand for Clean-Label and Natural Ingredients

The expansion of the specialty food ingredients market is propelled by the rising demand for clean-label and natural products. Consumers are increasingly prioritizing ingredient transparency and avoiding artificial additives, preservatives, and synthetic components.

This shift is compelling manufacturers to adopt natural, plant-based, and minimally processed ingredients across various product categories. The demand has led to increased use of specialty ingredients such as natural emulsifiers, fibers, stabilizers, and colors that align with clean-label requirements.

Furthermore, packaging claims such as organic and naturally sourced have become critical to product differentiation and brand positioning. This shift in consumer behavior is prompting strategic investments in product reformulation and innovation. Companies are expanding their clean-label portfolios to capture evolving preferences, which is contributing to the sustained market growth.

- In July 2024, Ingredion Incorporated launched FIBERTEX CF 500 and FIBERTEX CF 100, multi-benefit citrus fibers designed to enhance texture and support clean-label claims. These minimally processed upcycled ingredients offer viscosity, gelling, and emulsion stability while meeting consumer demand for natural, non-GMO, and fiber-rich products.

Market Challenge

Regulatory Complexity and Compliance Burden

Managing complex and evolving regulatory requirements across global markets presents a major challenge to the expansion of the food ingredients market. Regulatory bodies impose strict standards regarding ingredient approvals, health claims, food safety, allergen labeling, and clean-label declarations. These regulations vary widely across regions, creating difficulties for companies operating in multiple countries.

Non-compliance can lead to product recalls, delayed launches, reputational damage, and financial penalties. Maintaining up-to-date documentation and ensuring accurate labeling throughout the product lifecycle adds to operational burdens.

To address these challenges, companies are investing in regulatory affairs teams, digital traceability systems, and third-party compliance solutions. Strategic collaborations with technology providers are helping manufacturers automate documentation processes, monitor changes in global regulations, and ensure consistent adherence to labeling and safety standards across their ingredient portfolios.

- In April 2025, Ace Endico partnered with iFood DS to comply with the FDA’s Food Traceability Rule, which enhances the tracking of high-risk foods across the supply chain.

Market Trend

Rising Demand for Functional and Fortified Food Products

The specialty food ingredients market is experiencing sustained growth, largely due to increasing demand for functional and fortified food products. Consumers are showing a strong preference for food and beverage offerings that provide targeted health benefits such as immunity support, cognitive performance, and digestive wellness. This trend is driving the incorporation of bioactive components, including probiotics, vitamins, minerals, and botanical extracts, across a wide range of categories.

Manufacturers are responding by adopting ingredient technologies that enhance nutritional value without compromising product quality. Technologies such as microencapsulation are being increasingly used to improve ingredient stability and bioavailability. The rising focus on preventive health and performance nutrition is , expanding functional ingredient portfolios, and shaping industry strategies.

- In April 2025, Lubrizol partnered with Palmer Holland, Inc. to expand the availability of its microencapsulated nutraceutical ingredients across the Northeastern U.S. market. The agreement includes branded ingredients such as Lipofer, Magshape, and Curcushine, supporting improved taste, bioavailability, and functional performance in dietary supplements and fortified food and beverage applications.

Specialty Food Ingredients Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Enzymes, Emulsifiers, Flavors, Colorants, Others |

|

By Application |

Food & Beverages (Bakery, Confectionary, Convenience Foods, Dairy Products, Sauces, Dressings & Condiments, Alcoholic & Non-alcoholic, Others), Pharmaceutical, Personal Care |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Enzymes, Emulsifiers, Flavors, Colorants, and Others): The enzymes segment earned USD 42.78 billion in 2024, mainly due to its widespread use in food processing for improving texture, shelf life, and nutritional value.

- By Application (Food & Beverages, Pharmaceutical, and Personal Care): The food & beverages segment held a share of 40.47% in 2024, fueled by high global demand for functional, clean-label, and processed food products.

Specialty Food Ingredients Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific specialty food ingredients market accounted for a substantial share of 35.03% in 2024, valued at USD 53.37 billion. This dominance is reinfored by the rising demand for functional and fortified foods, as consumers increasingly prioritize health and nutrition in their daily diets. Urbanization and shifting lifestyles have led to higher consumption of processed and convenience food products.

Moreover, the region’s food and beverage sector is expanding due to favorable government policies and increasing foreign investments in countries such as China, India, and Southeast Asian nations. Companies are addressing the demand for clean-label and nutraceutical ingredients by enhancing their product offerings. Manufacturers are also focusing on innovation to meet evolving consumer preferences, supporting regional market expansion.

- In May 2025, Arla Foods Ingredients and Brenntag Group expanded their distribution partnership to include Vietnam, Thailand, and Indonesia. Brenntag will distribute Arla’s protein ingredients for health foods, infant nutrition, sports nutrition, and functionality in dairy and bakery. The expansion builds on their existing agreement in China and aims to meet Southeast Asia’s growing demand.

The North America specialty food ingredients industry is expected to register the fastest CAGR of 6.92% over the forecast period. This growth is supported by a well-established food processing sector and high consumer awareness.

Strong demand for clean-label and natural ingredients further boosts this progress. Consumers actively seek products with minimal artificial additives and transparent labeling. This preference compels manufacturers to adopt specialty ingredients that enhance nutritional value while maintaining taste and shelf life.

Rising health concerns, including obesity and diabetes, have increased interest in fortified, low-calorie, and functional food options. The region’s advanced research capabilities and strict regulatory standards further support innovation and product quality. Additionally, growing investments in food technology and ingredient development contribute to regional market expansion.

- In August 2024, Above Food Ingredients Inc. acquired The Redwood Group, LLC’s Specialty Crop Food Ingredients Division for USD 34 million. The acquisition marks Above Food’s first U.S.-based sourcing, manufacturing, and distribution facilities. The assets supply grains, pulses, and specialty crops to over 35 countries, strengthening Above Food’s vertically integrated ‘Seed-to-Fork’ operations across North America.

Regulatory Frameworks

- In the U.S., specialty food ingredients are regulated by the Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FD&C Act), which governs food additives, GRAS (Generally Recognized As Safe) substances, and labeling requirements.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates specialty food ingredients under the Food Safety and Standards (Food Products Standards and Food Additives) Regulations.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) governs food additives and ingredients under the Food Sanitation Act, supported by the Pharmaceuticals and Medical Devices Agency (PMDA) for safety evaluations.

Competitive Landscape

Companies operating in the specialty food ingredients industry are actively forming partnerships to expand their geographic reach and enhance product offerings. These alliances enable access to new distribution networks and facilitate faster adaptation to regional consumer preferences.

Additionally, companies are adopting mergers and acquisitions as a key growth strategy to gain technological capabilities, increase production capacity, and integrate supply chains. This approach helps improve operational efficiency and accelerates the launch of advanced ingredient solutions.

These factors collectively support the development of customized, functional, and clean-label products, shaping the market's competitive landscape amid rising demand for health-focused and value-added ingredients.

- In November 2024, Tate & Lyle acquired CP Kelco, including its operations in the U.S., China, and ApS operations, from J.M. Huber Corporation. The acquisition combines strengths in pectin, specialty gums, sweetening, mouthfeel, and fortification.

Key Companies in Specialty Food Ingredients Market:

- ADM

- Cargill, Incorporated

- dsm-firmenich

- International Flavors & Fragrances Inc.

- Kerry Group plc.

- Givaudan

- Sensient Technologies Corporation

- Ingredion

- ASR GROUP

- Novo Holdings A/S

- DuPont

- Symrise

- Corbion N.V.

- Brenntag SE

- RAG-Stiftung

Recent Developments (Acquisition/Partnership/Product Launch)

- In June 2025, Univar Solutions and Ingredion extended their partnership to the Benelux region for the distribution of plant-based proteins, stevia sweeteners, and native starches. The expansion addresses the growing demand for clean label, sustainable, and health-focused ingredients across Belgium, the Netherlands, and Luxembourg.

- In March 2025, Louis Dreyfus Company introduced its plant-based Vitamin E product line at Food Ingredients China 2025, enhancing its food ingredients portfolio with mixed tocopherols, lecithin, refined glycerin, pea protein, and specialty oils to meet he rising demand for sustainable, high-quality plant-based ingredients in China.

- In February 2025, Solina acquired Advanced Food Systems (AFS) and Sokol Custom Food Ingredients to strengthen its presence in North America. AFS specializes in custom dry seasonings, while Sokol produces sweet and savory sauces.

- In September 2024, ICL opened a new food specialty plant in China’s Zhangjiagang Free Trade Zone to produce specialty food solutions for the meat, poultry, and seafood segments, including texturants and marinades. The facility is designed to support ICL’s regional growth strategy and help customers develop innovative products suited to local consumer preferences.

freqAskQues