buyNow

Cold Chain Monitoring Market

Cold Chain Monitoring Market Size, Share, Growth & Industry Analysis, By Temperature Range (Frozen, Chilled, Deep-frozen), By Offering (Hardware, Software), By Logistics (Transportation, Storage), By Application (Food & Beverages, Pharmaceuticals & Healthcare) and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Cold chain monitoring refers to the use of technologies and systems to track and control temperature-sensitive products throughout storage and transportation, ensuring they remain within required temperature ranges to maintain quality and safety. The market encompasses hardware devices such as sensors, data loggers, and RFID tags, along with software platforms for real-time analytics, alert management, and regulatory compliance.

It serves industries including pharmaceuticals, food and beverage, and chemicals, where temperature integrity is critical across distribution channels. The market scope includes monitoring solutions deployed across air, sea, and land logistics, as well as cold storage facilities and last-mile delivery points.

Cold Chain Monitoring Market Overview

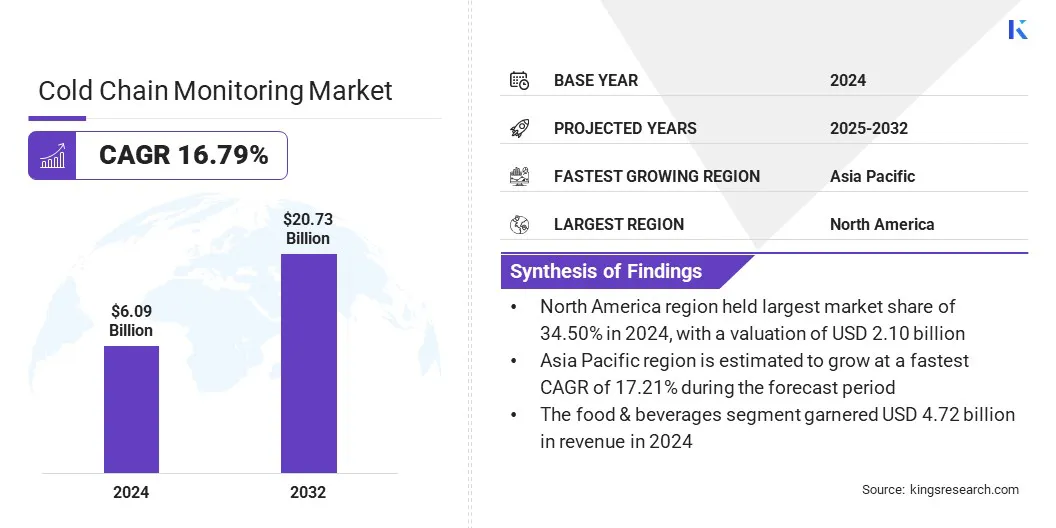

The global cold chain monitoring market size was valued at USD 6.09 billion in 2024 and is projected to grow from USD 6.99 billion in 2025 to USD 20.73 billion by 2032, exhibiting a CAGR of 16.79% during the forecast period. The growth is attributed to expanding e-commerce in perishable grocery deliveries, supported by rising integration of IoT technologies that enable precise tracking, automated alerts, and enhanced cold chain visibility.

Key Highlights:

- The cold chain monitoring industry size was recorded at USD 6.09 billion in 2024.

- The market is projected to grow at a CAGR of 16.79% from 2025 to 2032.

- North America held a market share of 34.50% in 2024, with a valuation of USD 2.10 billion.

- The frozen segment garnered USD 3.78 billion in revenue in 2024.

- The hardware segment is expected to reach USD 15.73 billion by 2032.

- The transportation segment secured the largest revenue share of 65.70% in 2024.

- The Chemicals segment is poised for a robust CAGR of 19.08% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 17.21% during the forecast period.

Major companies operating in the cold chain monitoring market are ORBCOMM, Carrier, ELPRO-BUCHS AG, Berlinger & Co. AG, Monnit Corporation, Emerson Electric Co., Testo SE & Co. KGaA, ROTRONIC AG, Frigga Technology, NXP Semiconductors, Dickson, Zebra Technologies Corp., Sensolus, Daksh Technology, and DeltaTrak Inc.

Rising demand for temperature-sensitive pharmaceuticals and biologics is driving the growth of the market, as these products require strict temperature control to maintain their efficacy and compliance with safety standards. This includes vaccines, insulin, monoclonal antibodies, and cell or gene therapies, which are highly susceptible to temperature excursions during storage and transit.

The growing reliance on biologics and advanced therapies globally is increasing the need for reliable, real-time monitoring solutions across the pharmaceutical supply chain.

Moreover, market players are developing advanced monitoring devices with IoT capabilities, cloud integration, and predictive analytics to meet the complex requirements of pharmaceutical logistics, thereby increasing the adoption. Major pharmaceutical companies and distributors are increasingly adopting these technologies to reduce spoilage risk and meet regulatory compliance, in turn, driving market growth.

Market Driver

E-commerce Growth Driving Cold Chain Monitoring in Perishable Deliveries

The rapid expansion of e-commerce in fresh food and grocery delivery is a key driver for the cold chain monitoring market. This rapid expansion is increasing the volume and frequency of temperature-sensitive shipments, requiring stringent temperature control throughout storage, handling, and last-mile delivery.

Moreover, online platforms manage a broad range of perishable products including dairy, meat, seafood, and fresh produce. Therefore, to maintain product quality and extend shelf life across these critical stages, businesses are increasingly relying on precise, real-time monitoring systems.

Moreover, market players are offering advanced monitoring technologies that enable continuous temperature tracking, data analytics, and automated alerts. E-commerce retailers and logistics operators are adopting these systems to prevent spoilage and maintain compliance with food safety regulations.

- In February 2025, the United States Department of Agriculture Foreign Agricultural Service (USDA FAS) reported that JD.com and Tmall launched self-operated cross-border e-commerce cold-chain warehouses to handle fresh fruit imports. This initiative significantly contributes to the growth of e-commerce in fresh food and grocery delivery by enhancing the efficiency and reliability of temperature-controlled supply chains.

Market Challenge

High Implementation Costs

A key challenge in the cold chain monitoring market is the high cost associated with deploying advanced monitoring technologies, which restricts adoption among small and mid-sized logistics operators. These solutions often require substantial investment in devices, software platforms, and connectivity infrastructure, limiting scalability across less capital-intensive operations.

To mitigate this challenge, manufacturers are developing cost-efficient solutions with modular features and flexible deployment models. Several providers are introducing cloud-based platforms and subscription pricing structures that reduce upfront capital requirements. These initiatives are enhancing market accessibility and steadily lowering financial barriers for smaller stakeholders.

Market Trend

Rising Integration of IoT Technologies in Cold Chain Monitoring

The growing implementation of Internet of Things (IoT) enabled monitoring solutions is a key trend influencing the cold chain monitoring market. These systems use connected sensors and cloud infrastructure to deliver real-time data on temperature, humidity, and location across the supply chain. Their deployment is increasing within logistics and storage operations to improve data accuracy, support timely responses, and ensure compliance with regulatory standards.

- In February 2024, Sensitech launched TempTale GEO X, an IoT temperature monitoring solution tailored for life sciences and logistics. This GxP-compliant solution monitors temperature-sensitive medicines and vaccines globally across multiple transport modes.

Cold Chain Monitoring Market Report Snapshot

|

Segmentation |

Details |

|

By Temperature Range |

Frozen, Chilled, Deep-frozen |

|

By Offering |

Hardware, Software |

|

By Logistics |

Transportation, Storage |

|

By Application |

Food & Beverages, Pharmaceuticals & Healthcare, Chemicals |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Temperature Range (Frozen, Chilled, and Deep-frozen): The frozen segment earned USD 3.78 billion in 2024 due to the high demand for temperature-critical products such as frozen foods, pharmaceuticals, and biologics that require strict low-temperature control throughout the supply chain.

- By Offering (Hardware and Software): The hardware segment held 78.10% of the market in 2024, due to the essential role of sensors, data loggers, and tracking devices in enabling real-time visibility and accurate temperature control across the supply chain.

- By Logistics (Transportation and Storage): The transportation segment is projected to reach USD 13.00 billion by 2032, owing to the critical need for continuous temperature tracking during transit to prevent spoilage and ensure product integrity across long-distance supply routes.

- By Application (Food & Beverages, Pharmaceuticals & Healthcare, and Chemicals): The food & beverages segment earned USD 4.72 billion in 2024 due to the high volume of perishable products requiring strict temperature control to maintain safety, quality, and regulatory compliance throughout the distribution process.

Cold Chain Monitoring Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America cold chain monitoring market share stood at 34.50% in 2024 in the global market, with a valuation of USD 2.10 billion. This dominance is attributed to the growth in pharmaceutical and biotech manufacturing hubs across North America, which has increased the demand for reliable cold chain monitoring systems.

The region hosts a high concentration of facilities producing vaccines, biologics, and temperature-sensitive drugs that require strict temperature control throughout the supply chain. These operations depend on continuous monitoring to maintain product stability and meet regulatory standards. These factors are driving sustained investment by manufacturers, logistics providers, and technology firms, reinforcing the region’s leading position in the market.

- In December 2024, Amgen announced a USD 1 billion investment to build a second drug substance manufacturing facility in Holly Springs, North Carolina, bringing its total planned investment in the area to over USD 1.5 billion.

Asia Pacific cold chain monitoring industry is poised for a significant CAGR of 17.21% over the forecast period. This growth is driven by sustained government investments in cold storage infrastructure across key Asia Pacific countries, particularly India, China, and Southeast Asia. These initiatives are expanding temperature-controlled facilities to support agricultural supply chains, pharmaceutical logistics, and food safety compliance.

Governments are implementing national programs to develop integrated logistics systems equipped with advanced monitoring technologies. As a result, increasing government funding and growing private sector involvement is accelerating the development of advanced cold storage solutions in Asia Pacific, thereby driving market growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) enforces 21 CFR Part 11, Good Distribution Practices (GDP), and the Food Safety Modernization Act (FSMA) to ensure temperature control and traceability, thereby regulating the market by setting mandatory compliance standards for pharmaceutical, biologic, and food supply chains.

- In China, the National Medical Products Administration (NMPA) enforces Good Supply Practice (GSP) guidelines, mandating continuous temperature monitoring, real-time data logging, and compliance reporting for pharmaceutical and biologic cold chain logistics.

Competitive Landscape

The cold chain monitoring industry is characterized by ongoing product innovation, with companies launching advanced solutions emphasizing real-time tracking, cloud connectivity, and compliance with regulatory standards. Key players are introducing sensor-based platforms with improved accuracy and automated alerts to support pharmaceutical, food and logistics applications.

These product developments address evolving supply chain requirements and reinforce market competition through innovation, differentiation and the delivery of end-to-end visibility across temperature-sensitive distribution networks.

- In February 2025, Mediterranean Shipping Company (MSC) S.A. launched iReefer, an advanced container monitoring system for refrigerated cargo. The solution enables customers to track temperature-controlled shipments in real time from any location. Moreover, iReefer is able to provide live data on location, temperature and humidityof the cargo.

Key Companies in Cold Chain Monitoring Market:

- ORBCOMM

- Carrier

- ELPRO-BUCHS AG

- Berlinger & Co. AG

- Monnit Corporation

- Emerson Electric Co.

- Testo SE & Co. KGaA

- ROTRONIC AG

- Frigga Technology

- NXP Semiconductors

- Dickson

- Zebra Technologies Corp.

- Sensolus

- Daksh Technology

- DeltaTrak Inc.

Recent Developments (M&A/Launch)

- In January 2025, UPS acquired Frigo-Trans and its sister company BPL, both recognized for advanced healthcare logistics services across Europe. These acquisitions strengthen UPS Healthcare’s global offering in temperature-controlled and time-critical logistics.

- In April 2024, Tower Cold Chain launched a live tracking feature with ELPRO, enabling near real-time monitoring of temperature, location, shock, tilt and altitude for KTEvolution pharmaceutical shipments.

- In November 2023, Sensitech introduced a new solution for monitoring outbound shipments via the SensiWatch platform. This advancement enhances cold chain monitoring by extending real-time cargo protection to last-mile delivery, ensuring the quality of perishable goods.

freqAskQues