buyNow

Directional Drilling Services Market

Directional Drilling Services Market Size, Share, Growth & Industry Analysis, By Type (Conventional, Rotary Steerable System), By Location (Onshore, Offshore), By Service (Logging While Drilling (LWD), Measurement While Drilling (MWD), Mud Motors, Others), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Directional drilling services enable the controlled deviation of wellbores from a vertical path to reach targeted underground zones. Widely adopted in the oil & gas, geothermal, and utility sectors, these services enhance drilling efficiency, reduce surface impact, and optimize resource recovery from multiple reservoirs.

Directional Drilling Services Market Overview

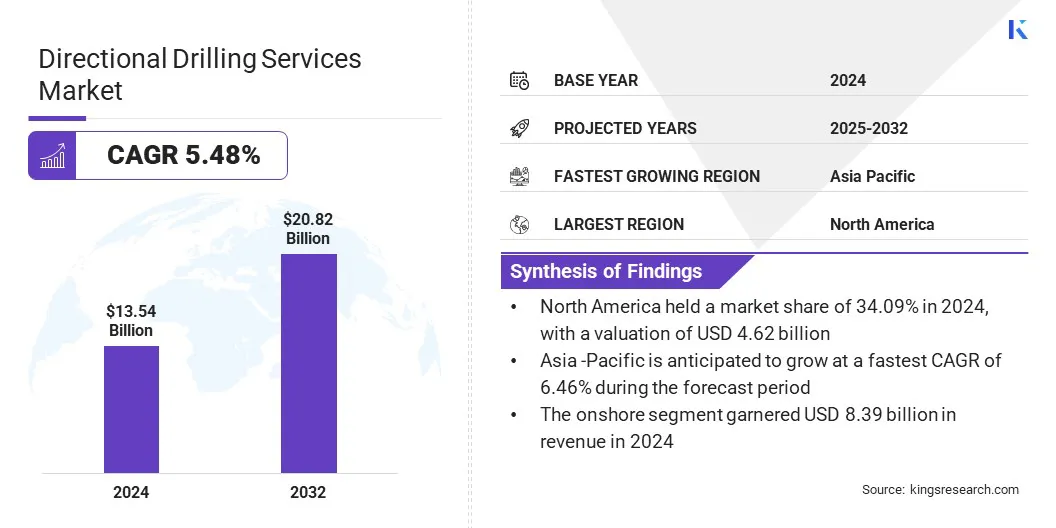

The global directional drilling services market size was valued at USD 13.54 billion in 2024 and is projected to grow from USD 14.25 billion in 2025 to USD 20.82 billion by 2032, exhibiting a CAGR of 5.48% over the forecast period.

Market growth is attributed to the rising demand for liquid fuels, which is supporting the increased exploration and production activities to meet global energy needs. This growth is further supported by the integration of automation and AI in drilling operations that enable real-time optimization and improved efficiency across complex drilling environments.

Key Highlights:

- The directional drilling services industry size was valued at USD 13.54 billion in 2024.

- The market is projected to grow at a CAGR of 5.48% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 4.62 billion.

- The conventional segment garnered USD 7.81 billion in revenue in 2024.

- The onshore segment is expected to reach USD 12.61 billion by 2032.

- The measurement while drilling (MWD) segment is anticipated to witness the fastest CAGR of 5.78% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.46% through the projection period.

Major companies operating in the directional drilling services market are Baker Hughes Company, SLB, Halliburton Energy Services, Inc, Weatherford, China Oilfield Services Limited, Phoenix Technology Services, NOV, Nabors Industries Ltd, Scientific Drilling International, Gyrodata, KLX ENERGY, The Crossing Group, Jindal Drilling & Industries Limited, Noble Corporation, and Parker Wellbore.

Advanced rotary steerable systems (RSS) are fueling market growth due to their ability to provide accurate and real-time control of drilling direction in difficult underground formations.

These systems offer improved drilling efficiency, faster penetration rates, and reduced non-productive time, which makes them essential for deep and extended-reach wells. The increasing adoption of RSS continues to propel market growth by enhancing drilling performance and reducing operational risks.

- In October 2024, Halliburton launched iCruise Force, a high-performance motorized rotary steerable system designed to extend drilling depth and enhance directional control in complex formations. Integrated with the LOGIX automation platform, the system improves wellbore precision, penetration rates, and remote operational efficiency, supporting the industry's shift toward intelligent, cost-effective directional drilling solutions.

Market Driver

Rising Demand for Liquid Fuels

Rising demand for liquid fuels is boosting the growth of the directional drilling services market. The growing energy needs of developing economies are prompting oil and gas producers to intensify exploration and production activities to meet long-term supply requirements.

Directional drilling offers an efficient solution for accessing complex reservoirs while minimizing surface disruption. Moreover, rising efforts to maximize output from both conventional and unconventional fields are supporting the adoption of advanced drilling technologies.

- According to the U.S. Energy Information Administration (EIA), global liquid fuels consumption is projected to increase by 0.8 million barrels per day (mb/d) in 2025 and 1.1 mb/d in 2026 year-over-year.

Market Challenge

High Initial Capital and Operational Costs

A major challenge limiting the expansion of the directional drilling services market is the high initial capital and operational costs associated with advanced equipment and technology. Procuring and maintaining horizontal directional drilling rigs, downhole tools, and digital control systems requires substantial upfront investment.

Additionally, skilled labor, ongoing maintenance, and the use of high-performance drilling fluids increase operational expenses. These high costs create entry barriers for smaller contractors and can impact profitability in price-sensitive markets or during periods of reduced infrastructure or energy investment.

To address this challenge, market players are adopting several cost-optimization strategies. They are investing in modular and multi-functional drilling equipment that enhances efficiency and reduces downtime.

Additionally, companies are forming strategic partnerships or entering leasing and rental agreements to reduce capital expenditure. Additionally, the integration of automation, remote monitoring, and predictive maintenance systems is helping lower labor and repair costs.

Market Trend

Integration of Automation and AI in Drilling Operations

A key trend influencing the directional drilling services market is the increasing integration of automation and AI-driven technologies to enhance drilling accuracy and operational efficiency. Service providers are adopting real-time geosteering platforms, predictive analytics, and intelligent monitoring systems to optimize well placement and reduce non-productive time.

This trend is prompting companies to invest in digital drilling software, sensor-enabled tools, and AI-powered decision-support systems that improve data interpretation and streamline complex drilling operations. These innovations are reshaping the market by enabling more precise, efficient, and data-driven services.

- In January 2024, Scientific Drilling International acquired the DynaView data platform from Tally Energy Services to enhance its directional drilling capabilities. The platform includes tools such as Geosteer Pro and Pressure Pro, enabling real-time well path optimization, advanced geological modeling, and predictive analytics for more efficient and reliable wellbore placement.

Directional Drilling Services Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Conventional, Rotary Steerable System |

|

By Location |

Onshore, Offshore |

|

By Service |

Logging While Drilling (LWD), Measurement While Drilling (MWD), Mud Motors, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Conventional and Rotary Steerable System): The conventional segment earned USD 7.81 billion in 2024, mainly due to its widespread use, cost-effectiveness, and suitability for standard drilling operations.

- By Location (Onshore and Offshore): The onshore segment held a share of 61.95% in 2024, fueled by lower operational costs, easier accessibility, and the abundance of land-based drilling projects.

- By Service (Logging While Drilling (LWD), Measurement While Drilling (MWD), Mud Motors, and Others): The logging while drilling (LWD) segment is projected to reach USD 6.85 billion by 2032, owing to growing demand for real-time formation evaluation and reservoir characterization.

Directional Drilling Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America directional drilling services market accounted for a share of 34.09% in 2024, valued at USD 4.62 billion. This dominance is reinforced by the strong presence of established service providers and advanced infrastructure capabilities. The regional market is further fostered by increased investment in trenchless technologies to address the increasing need for efficient underground utility upgrades and energy pipeline installations.

Moreover, the regional market is benefiting from rising investment in modernizing aging utility networks, particularly for electricity and natural gas. The presence of skilled labor and strategic acquisitions aimed at enhancing regional service portfolios is further supporting regional market expansion.

- In June 2025, MPE Partners and its portfolio company, Delphi Infrastructure Group, acquired JMF Underground, a provider of underground utility services specializing in horizontal directional drilling, trenching, and excavation. The acquisition enhances DIG’s presence in the Mid-Atlantic and Eastern U.S., strengthening its capabilities in underground electrical and natural gas infrastructure services.

The Asia Pacific directional drilling services industry is set to grow at a robust CAGR of 6.46% over the forecast period. This growth is attributed to the increasing demand for energy infrastructure and the growing focus on resource exploration. Regional market growth is further boosted by expanded offshore and onshore drilling operations, supported by advanced technologies that enable efficient well placement and complex trajectory control.

Moreover, the domestic market is benefiting from rising investment in natural gas development and unconventional energy projects in countries such as China, India, and Australia. The presence of international service providers and strategic collaborations is further bolstering regional market expansion.

- In October 2024, Nabors Industries acquired the Parker Wellbore in a USD 472 million stock and debt deal to expand its global drilling solutions business. The acquisition enhances Nabors’ directional drilling capabilities through Parker’s fleet, downhole tool rentals, and international presence across the U.S., Middle East, Latin America, and Asia.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates directional drilling services by enforcing environmental standards related to air emissions, water usage, hazardous waste disposal, and site restoration. It oversees compliance with the Clean Water Act and Clean Air Act, ensuring that drilling operations minimize ecological impact, groundwater contamination, and surface disruption during resource extraction.

- In the UK, the North Sea Transition Authority (NSTA) regulates directional drilling by issuing licenses, monitoring drilling plans, and ensuring safe, efficient, and low-carbon operations in offshore and onshore energy exploration. It enforces regulations that guide resource recovery, environmental stewardship, and decommissioning responsibilities in alignment with the UK’s net zero goals.

- In China, the Ministry of Natural Resources (MNR) governs directional drilling activities by regulating land use rights, mineral resource allocation, and environmental impact assessments. It ensures alignment with national land planning policies, ecological protection mandates, and licensing requirements.

- In India, the Ministry of Petroleum and Natural Gas (MoPNG) regulates directional drilling by overseeing exploration licensing, well safety, and operational standards in the upstream oil and gas sector. It ensures compliance with national hydrocarbon policies, resource management strategies, and health, safety, and environmental (HSE) frameworks.

Competitive Landscape

Major players in the directional drilling services industry are expanding their capabilities by acquiring specialized underground utility providers to strengthen regional presence and service diversity. Market players are enhancing their expertise in horizontal directional drilling, auger boring, and tunneling to meet growing demand across water, wastewater, and energy infrastructure segments.

Additionally, players are investing in advanced drilling technologies and workforce development to ensure the safety, precision, and efficiency of underground utility installations across water, wastewater, energy, and telecommunication infrastructure projects.

- In September 2024, HardRock Infrastructure Services, in partnership with Tower Arch Capital, acquired HDW Construction & Drilling to expand its presence in the water and wastewater utility industry. The acquisition strengthens HardRock’s position in Texas as a provider of horizontal directional drilling, auger boring, and tunneling services across critical infrastructure sectors.

List of Key Companies in Directional Drilling Services Market:

- Baker Hughes Company

- SLB

- Halliburton Energy Services, Inc

- Weatherford

- China Oilfield Services Limited

- Phoenix Technology Services

- NOV

- Nabors Industries Ltd

- Scientific Drilling International

- Gyrodata

- KLX ENERGY

- The Crossing Group

- Jindal Drilling & Industries Limited

- Noble Corporation

- Parker Wellbore.

Recent Developments (M&A/ New Product Launch)

- In January 2025, Ditch Witch launched the JT21, a next-generation horizontal directional drill offering 40% more downhole horsepower than its predecessor. Designed for fiber and underground utility jobs, the JT21 features advanced hydraulics, VAM technology, and enhanced operator controls, enabling faster, more efficient installations and higher ROI for HDD contractors.

- In November 2024, Major Drilling Group International acquired Explomin Perforaciones, a specialty driller in South America, for up to USD 85 million. The acquisition strengthens its presence in the copper-rich Andes and expands its directional, deep hole, and underground drilling capabilities across Peru, Colombia, the Dominican Republic, and Spain.

freqAskQues