buyNow

Electronic Shelf Label Market

Electronic Shelf Label Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Product Type (LCD ESL, E-Paper ESL), By Communication Tech (Radio-frequency (RF), Infrared, NFC/BLE), By Store Type, By Display Size and Regional Analysis, 2025-2032

pages: 120 | baseYear: 2024 | release: July 2025 | author: Antriksh P.

Market Definition

Electronic shelf label (ESL) are digital display devices used in retail settings to convey product pricing, promotional details, and other pertinent information. These labels are updated remotely via wireless communication networks. This market encompasses the design, production, and deployment of ESL systems across diverse retail formats, including supermarkets, hypermarkets, and specialty stores.

It includes hardware components such as electronic ink displays, wireless communication modules, and software infrastructure necessary for price management, inventory tracking, and integration with retail information systems.

Electronic Shelf Label Market Overview

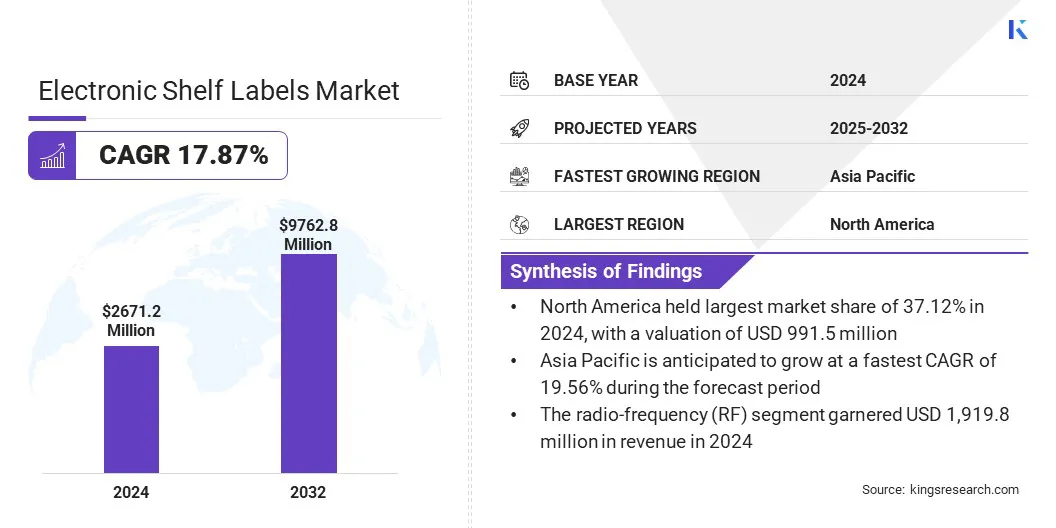

The global electronic shelf label market size was valued at USD 2,671.2 million in 2024 and is projected to grow from USD 3,088.3 million in 2025 to USD 9,762.8 million by 2032, exhibiting a significant CAGR of 17.87% over the forecast period.

The market is experiencing significant growth due to the increasing demand for automation and real-time pricing in the retail sector. Retailers are adopting ESL systems to enhance pricing accuracy, streamline store operations, and improve customer experience. The growing popularity of retail strategies and the need for dynamic pricing are further accelerating adoption.

Key Highlights

- The electronic shelf label industry size was valued at USD 2,671.2 million in 2024.

- The market is projected to grow at a CAGR of 17.87% from 2025 to 2032.

- North America held a market share of 37.12% in 2024, with a valuation of USD 991.5 million.

- The hardware segment garnered USD 1,766.2 million in revenue in 2024.

- The LCD ESL segment is expected to reach USD 5,637.7 million by 2032.

- The radio-frequency (RF) segment is expected to reach USD 7,363.6 million by 2032.

- The hypermarkets & supermarkets segment is expected to reach USD 4,986.9 million by 2032.

- The < 3″ segment is expected to reach USD 4,852.5 million by 2032.

- The market in Asia Pacific is anticipated to grow at the fastest CAGR of 19.56% over the forecast period.

Major companies operating in the electronic shelf label market are VusionGroup, Pricer, Displaydata Ltd., SOLUM, Teraoka (Pty) Ltd, M2COMM, SUNVAN(SHANGHAI) ELECTRONICS TECHNOLOGY CO., LTD., Opticon, PARTRON ESL, Hanshow Technology, Hangzhou Zkong Networks Co, Allsee Technologies Limited, MOKOSmart, Future Shelf, and Henderson Technology.

Technological advancements in the development of compact and integrated ESL architectures that reduce component size, simplify production, and lower energy consumption are contributing to their large-scale implementation.

Technological advancements in the development of compact and integrated ESL architectures that reduce component size, simplify production, and lower energy consumption are contributing to their large-scale implementation.

- In April 2025, E Ink collaborated with Realtek Semiconductor to launch the second-generation System-on-Panel (SoP) electronic shelf label. The new design features a 30% reduction in Thin-Film Transistor (TFT) size and 50% smaller flexible printed circuits, enabling slimmer and more efficient labels. It integrates Realtek’s Bluetooth chipset using the Chip-on-Glass technology, embedding a Radio Frequency Integrated Circuit (RFIC) directly onto the glass to streamline manufacturing, reduce material usage, and enhance energy efficiency.

These innovations offer cost-effective deployment and help retailers meet sustainability and efficiency goals.

Market Driver

Modern Retail Strategies Fueling ESL Market Expansion

The electronic shelf label market is experiencing substantial growth mainly due to the ongoing expansion of retail infrastructure across developed and emerging economies. As retail enterprises scale their operations and establish new outlets, there is a corresponding rise in the demand for advanced in-store technologies such as ESLs. These systems are critical for ensuring pricing accuracy, minimizing manual labor, and improving overall operational efficiency.

Furthermore, modernization efforts within existing retail chains, particularly those focused on the integration of automation and digital tools are accelerating the adoption of ESL solutions. The increasing inclination of retailers toward developing connected and intelligent store formats further fosters a favorable environment for the deployment of ESL technologies.

- In May 2025, the Co-operative Group (Co-op) partnered with VusionGroup to implement electronic shelf edge labels across approximately 2,400 stores. The partnership aims to replace traditional paper labels with smart digital alternatives to enhance product information transparency, reduce paper waste, and simplify in-store operations.

These factors are embedding digital shelf management as a core component of contemporary retail strategies, thereby reinforcing the market's upward growth trajectory.

Market Challenge

Battery and Sustainability Challenges

One of the major challenges in the electronic shelf label market is battery life and its environmental impact. ESLs, particularly e-paper models, are powered by internal batteries that last up to 3–10 years.

However, in high-frequency retail environments where price updates and flashes are frequent, batteries tend to drain faster, which increases maintenance costs, operational disruptions, and electronic waste as a result of mass battery disposal. This affects retailers' long-term return on investment and also poses a significant sustainability concern, especially as global retail chains move toward eco-friendly operations.

To address this, leading ESL manufacturers are introducing innovative solutions that focus on extending battery life, enhancing energy efficiency, and promoting sustainability. These advancements include the use of long-lasting battery technologies, energy-saving components, and eco-certified designs.

- In January 2025, Hanshow introduced its Nebular-583 electronic shelf label (ESL) model as part of its commitment to sustainability and energy efficiency in retail. The solution features a 5.83-inch high-resolution display, advanced functionalities like NFC support and LED indicators, and a 15-year battery life powered by lithium manganese dioxide (LiMnO₂).

These solutions significantly reduce electronic waste and the environmental impact of ESL systems while improving operational efficiency for retailers.

Market Trend

AI and IoT-Driven Advancements in Shelf Management Technology

The electronic shelf label market is making significant advancements, primarily driven by the integration of artificial intelligence (AI) and Internet of Things (IoT). ESLs are IoT-enabled devices that connect wirelessly to retail systems, allowing real-time updates of prices, promotions, and inventory.

The incorporation of AI further enhances these capabilities by enabling the analysis of shelf conditions, demand forecasting, and dynamic adjustments in pricing based on inventory levels and consumer behavior.

- In January 2025, Pricer collaborated with Focal Systems to accelerate the digitization and optimization of physical retail stores. The collaboration combines Pricer’s ESL technology and dynamic pricing solutions with Focal Systems’ AI-powered shelf vision and product availability detection to enable real-time shelf insights, task automation, and enhanced operational efficiency for retailers.

This convergence of technologies streamlines operational workflows, reduces the need for manual intervention, improves pricing accuracy, and enhances overall customer experience. As the retail sector transitions toward intelligent and connected store environments, the adoption of AI- and IoT-powered ESL solutions is becoming a foundational element for digital retail transformation.

Electronic Shelf Label Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Hardware, Software, Services |

|

By Product Type |

LCD ESL, E-Paper ESL |

|

By Communication Tech |

Radio-frequency (RF), Infrared, NFC/BLE |

|

By Store Type |

Hypermarkets & Supermarkets, Non-food Retail Stores, Convenience Stores, Others |

|

By Display Size |

< 3″, 3″–7″, 7″–10″, > 10″ |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 1,766.2 million in 2024, due to the rising adoption of digital shelf displays and increasing investments in retail automation infrastructure.

- By Product Type (LCD ESL and E-Paper ESL): The LCD ESL segment held 61.23% of the market in 2024, owing to its low cost, fast refresh rates, and suitability for high-turnover retail environments.

- By Communication Tech (Radio-frequency (RF), Infrared, and NFC/BLE): The radio-frequency (RF) segment is projected to reach USD 7,363.6 million by 2032, on account of its longer range, scalability, and compatibility with centralized pricing systems.

- By Store Type (Hypermarkets & Supermarkets, Non-food Retail Stores, Convenience Stores, and Others): The hypermarkets & supermarkets segment is estimated to reach USD 4,986.9 million by 2032, attributed to the need for frequent price updates, large product volumes, and enhanced in-store efficiency.

- By Display Size (< 3″, 3″–7″, 7″–10″, > 10″): The < 3″ segment is anticipated to reach USD 4,852.5 million by 2032, owing to its cost-effectiveness, space efficiency, and suitability for shelf-edge pricing in fast-moving consumer goods.

Electronic shelf label Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America electronic shelf label market share stood at around 37.12% in 2024, with a valuation of USD 991.5 million. This strong regional position can be attributed to the widespread digitalization of the retail sector in the U.S. and Canada.

North America electronic shelf label market share stood at around 37.12% in 2024, with a valuation of USD 991.5 million. This strong regional position can be attributed to the widespread digitalization of the retail sector in the U.S. and Canada.

Large-scale retail chains are rapidly adopting ESL systems to streamline pricing operations, minimize human errors, and enhance in-store customer engagement. Retailers manage thousands of outlets, which requires the scalability and flexibility offered by ESL systems for frequent price changes across diverse product categories.

- In December 2024, VusionGroup expanded its digital shelf solutions to all Walmart U.S. stores, after a successful deployment in nearly 500 locations. The rollout of EdgeSense and VusionCloud across 2,300 additional stores was designed to enhance associate productivity, optimize inventory management, and improve customer experience.

By enabling real-time pricing updates and integration with inventory and point-of-sale systems, ESLs lets retailers respond to market fluctuations, promotional strategies, and competitive pricing.

Moreover, high labor costs in the region have incentivized retailers to automate routine pricing tasks, which makes ESLs a cost-effective and operationally efficient alternative to manual labor. As a result, ESLs have emerged as a vital tool for driving retail efficiency and strengthening North America's market position.

Asia Pacific electronic shelf label industry is expected to register the fastest growth in the market, with a projected CAGR of 19.56% over the forecast period. Growth in this region is primarily driven by the rapid expansion of organized retail infrastructure across key economies. The increasing presence of large-format stores and global retail chains in Southeast Asia are accelerating the demand for digital store technologies.

- In March 2025, Frasers Group partnered with MAP Active to launch the Sports Direct brand in five new Southeast Asian markets, including Indonesia, the Philippines, Thailand, Vietnam, and Cambodia. The long-term plan involves opening over 350 stores across these countries.

This expansion highlights the region’s shift toward scalable and tech-enabled retail formats. As store networks grow in scale and complexity, the need for real-time pricing, inventory visibility, and operational efficiency is becoming critical for fueling the adoption of electronic shelf labels as a foundational retail technology across emerging markets in the region.

Competitive Landscape

The electronic shelf label industry is characterized by a strong focus on advanced product development and scalable deployment strategies. Market participants are continuously enhancing ESL functionality through the integration of e-paper displays, LED indicators, and wireless communication technologies designed for real-time updates.

In addition, partnerships between ESL providers and major retail chains are accelerating market expansion. These collaborations facilitate the seamless integration of ESL systems into existing retail infrastructures, enabling efficient large-scale implementations and improving in-store customer experiences.

- In June 2025, Tecsys Inc. launched ESL+, a next-generation electronic shelf labeling solution designed for hospital inventory management at the point of use. The solution features programmable buttons, LED indicators, and integration with Tecsys’ Elite Point of Use platform to enable real-time inventory interaction, improve restocking workflows, and reduce manual tracking. ESL+ is tailored for healthcare environments, offering on-shelf alerts for expiration, recall, and stockouts.

- In January 2025, Sexton Group Ltd partnered with JRTech Solutions to introduce advanced ESL technology to over 450 independent building materials dealers across North America. The collaboration enables the integration of ESL systems with existing POS and ERP platforms, enhancing pricing accuracy and operational efficiency.

These strategic initiatives are reinforcing the market’s growth trajectory, positioning electronic shelf labels as a core component of modern retail infrastructure and are driving the evolution of intelligent and responsive store environments.

Key Companies in Electronic Shelf Label Market:

- VusionGroup

- Pricer

- Displaydata Ltd.

- SOLUM

- Teraoka (Pty) Ltd

- M2COMM

- SUNVAN(SHANGHAI) ELECTRONICS TECHNOLOGY CO., LTD.

- Opticon

- PARTRON ESL

- Hanshow Technology

- Hangzhou Zkong Networks Co

- Allsee Technologies Limited

- MOKOSmart

- Future Shelf

- Henderson Technology

Recent Developments (Agreements/ Product Launch)

- In June 2025, Pricer agreed with Carrefour to grant it sole rights to supply electronic shelf label (ESL) solutions to the retailer for a three-year period. The agreement covers new installations and the replacement of existing systems across more than 1,700 stores, aimed at enhancing in-store automation and shelf-edge communication.

- In May 2025, Co-op partnered with VusionGroup to roll out electronic shelf edge labels across nearly 2,400 stores in the UK and Ireland, marking the region’s largest single-retailer ESL deployment. The technology will be deployed in approximately 1,500 stores by the end of 2025, with full rollout expected by the end of 2026.

freqAskQues