buyNow

Natural Gas Storage Market

Natural Gas Storage Market Size, Share, Growth & Industry Analysis, By Storage Type (Underground Storage, Above-Ground Storage), By End-Use Sector (Power Generation, Residential, Commercial, Transportation, Others), and Regional Analysis, 2025-2032

pages: 130 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

Natural gas storage involves the use of underground reservoirs, salt caverns, or LNG tanks to balance supply and demand, ensure energy reliability, and support pipeline operations. The market includes infrastructure, services, and trading activities. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Natural Gas Storage Market Overview

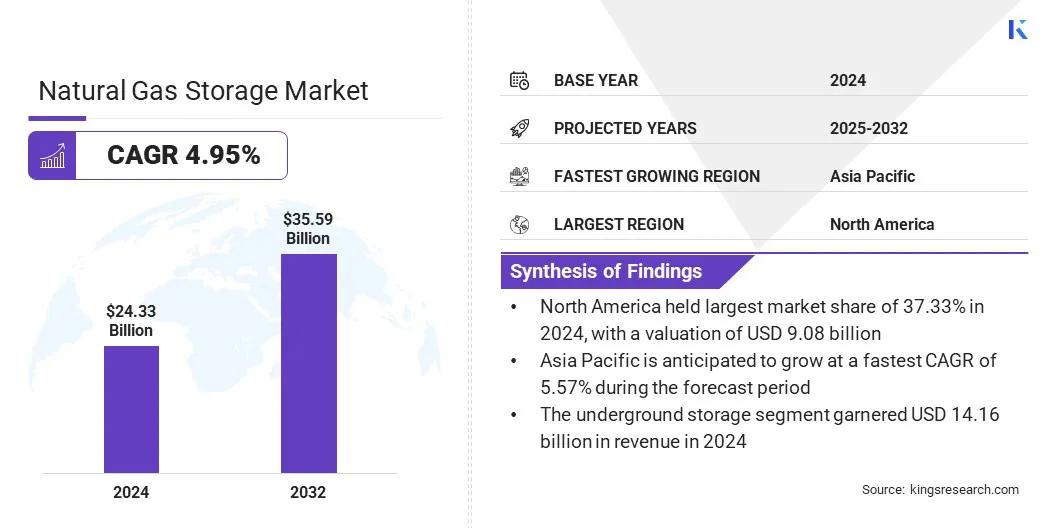

The global natural gas storage market size was valued at USD 24.33 billion in 2024, which is estimated to be USD 25.38 billion in 2025 and reach USD 35.59 billion by 2032, growing at a CAGR of 4.95% from 2025 to 2032.

Energy security and supply diversification are fueling the growth of market. Rising global demand and increasing supply risks are prompting countries to invest in storage infrastructure to ensure stable, uninterrupted access to natural gas throughout seasonal fluctuations and potential disruptions.

Key Highlights:

- The natural gas storage industry size was recorded at USD 24.33 billion in 2024.

- The market is projected to grow at a CAGR of 4.95% from 2025 to 2032.

- North America held a market share of 37.33% in 2024, with a valuation of USD 9.08 billion.

- The underground storage segment garnered USD 14.16 billion in revenue in 2024.

- The transportation segment is expected to reach USD 11.36 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 5.57% over the forecast period.

Major companies operating in the natural gas storage market are McDermott, NAFTA a. s., TC Energy Corporation, Enstor Gas, LLC., Uniper SE, Sempra Infrastructure, Enbridge Inc., Gazprom, Martin Midstream Partners L.P., Enstor Gas, LLC, Williams, Berkshire Hathaway Energy, Kinder Morgan, Southern Company, and Shell International B.V.

Natural gas storage is essential for ensuring energy reliability, balancing seasonal supply and demand, and stabilizing prices. This growth is further supported by the rising energy demand, clean fuel adoption, and energy security concerns. Additionally, technological advancements and regulatory efforts are enhancing storage capacity and efficiency.

- As of June 6, 2025, the U.S. Energy Information Administration (EIA) reported 2,707 billion cubic feet (Bcf) of working gas in storage, highlighting the importance of natural gas storage in meeting consumption needs.

Market Driver

Rising Need for Energy Security and Supply Diversification

The growth of the natural gas storage market is propelled by the need for energy security and supply diversification. With rising global energy demand and ongoing geopolitical uncertainties, nations are prioritizing reliable access to energy.

Storage facilities serve as a critical buffers, enabling stockpiling during low demand and withdrawal during peak usage or disruptions. This flexibility stabilizes markets and reduces dependence on single suppliers, making storage infrastructure essential to long-term energy planning and strategic resilience.

- In June 2024, Aramco and Sempra signed a non-binding Heads of Agreement for a 20-year LNG offtake deal of 5 Mtpa from the Port Arthur LNG Phase 2 project, with Aramco also considering a 25% equity stake. This initiative highlights growing investment in large-scale infrastructure that supports both liquefaction and storage. The project strengthens global supply chains, enhances energy security, and reflects rising demand for reliable, lower-carbon storage and export solutions in the LNG sector.

Market Challenge

High Capital Costs

High capital costs remain a significant challenge to the growth of the natural gas storage market, as developing and maintaining storage facilities demand substantial upfront investments. These costs can deter new entrants and hinder expansion. To overcome this, companies and governments are exploring public-private partnerships to share financial risks while leveraging innovative financing models and incentives.

Additionally, advances in technology that improve construction efficiency and reduce operational expenses can help lower overall costs. Strategic planning and regulatory support are also essential to promote investment and accelerate infrastructure development.

Market Trend

Rising Collaboration Between Energy Companies and Governments

Growing collaboration between energy companies and governments is a significant trend in the natural gas storage market. These partnerships are essential for pooling resources, sharing risks, and accelerating the development of critical storage infrastructure. They also facilitate regulatory support and innovation, helping projects align with evolving energy demands and sustainability goals.

Joint efforts address challenges in financing, technology deployment, and policy alignment, advancing more resilient and efficient storage solutions that enhance energy security and support the clean energy transition.

- In June 2024, Gasunie and Vopak, in partnership with the Ministry of Economic Affairs and Climate Policy of Netherlands, launched a market consultation to explore extending LNG storage and handling, as well as hydrogen and CO2 activities, at EemsEnergyTerminal in Eemshaven. This initiative aims to utilize the terminal beyond its initially planned timeline, enhancing natural gas storage capacity and energy security for the Netherlands and Europe while supporting the transition to a more sustainable energy system through expanded LNG use, hydrogen development, and carbon capture projects.

Natural Gas Storage Market Report Snapshot

|

Segmentation |

Details |

|

By Storage Type |

Underground Storage, Above-Ground Storage |

|

By End-Use Sector |

Power Generation, Residential, Commercial, Transportation, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Storage Type (Underground Storage and Above-Ground Storage): The underground storage segment earned USD 14.16 billion in 2024, mainly propelled by increased demand for seasonal gas balancing and strategic energy reserves in key regions.

- By End-Use Sector (Power Generation, Residential, Commercial, Transportation, and Others): The transportation segment held a share of 36.43% in 2024, supported by growing pipeline infrastructure and rising demand for efficient gas delivery.

Natural Gas Storage Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America natural gas storage market share stood at around 37.33% in 2024, valued at USD 9.08 billion. This dominance is reinforced by the region's well-developed infrastructure, abundant natural gas resources, and strong demand driven by industrial, residential, and power generation sectors.

The regional market further benefits from advanced technology, extensive pipeline networks, and supportive regulatory frameworks that facilitate efficient storage and distribution. Additionally, the growth of LNG exports and the shift toward cleaner energy sources reinforce North America’s leading position, making it a critical hub for natural gas storage and supply in the global energy landscape.

- In January 2024, Williams completed a USD 1.95 billion acquisition of six natural gas storage facilities in Louisiana and Mississippi, totaling 115 Bcf capacity, along with 230 miles of pipeline. This strategic move enhances its transportation network to meet rising LNG export and power generation demand in the Gulf Coast region.

The Asia-Pacific natural gas storage industry is estimated to grow at a CAGR of 5.57% over the forecast period. This growth is largely attributed to rapid economic growth, urbanization, and increasing energy demand in countries such as China, India, and Southeast Asian nations. Expanding infrastructure investments, including storage facilities and pipeline networks, are enhancing energy security and supply reliability.

According to India’s Ministry of Petroleum & Natural Gas, gas production increased from 34.45 BCM in FY 2022-23 to 36.44 BCM in FY 2023-24, supported by an operational natural gas pipeline network spanning 24,945 kilometers as of 2024. This growth supports the region’s efforts to reduce reliance on traditional fuels and accelerate the transition to cleaner, more sustainable energy sources, positioning Asia Pacific as a key region for natural gas storage.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) safeguards public health and the environment, conducts research, and enforces environmental regulations.

- The Federal Energy Regulatory Commission, or FERC, is an independent agency that regulates the interstate transmission of natural gas, oil, and electricity, as well as natural gas and hydropower projects.

- In Europe, the Agency for the Cooperation of Energy Regulators (ACER) promotes energy market integration to ensure affordable, secure and sustainable energy for businesses and citizens.

Competitive Landscape

In the natural gas storage industry, companies are expanding infrastructure to meet rising demand. Key initiatives include developing underground storage, increasing liquefied natural gas (LNG) storage capacities, and implementing advanced technologies for improved efficiency and safety.

Strategic partnerships and acquisitions are also prevalent, enabling firms to strengthen their market positions and diversify services. These initiatives support a reliable and flexible energy supply for both domestic use and exports.

- In April 2025, FERC approved Enstor’s Mississippi Hub Expansion Project, adding 33.5 Bcf of natural gas storage capacity and boosting injection capacity to 1.90 MMDth/day. Scheduled for completion by 2028, this expansion enhances energy security, supports economic growth, and meets rising demand driven by LNG exports and power generation in the Gulf Coast and Southeast markets.

List of Key Companies Natural Gas Storage Market:

- McDermott

- NAFTA a. s

- TC Energy Corporation

- Enstor Gas, LLC.

- Uniper SE

- Sempra Infrastructure

- Enbridge Inc.

- Gazprom

- Martin Midstream Partners L.P.

- Enstor Gas, LLC

- Williams

- Berkshire Hathaway Energy

- Kinder Morgan

- Southern Company

- Shell International B.V.

Recent Developments (New Project/Approval)

- In January 2025, Trinity Gas Storage commenced operations at its 24 Bcf natural gas storage facility in East Texas, boosting the state's energy security and reliability. Strategically positioned to support rising power demand, the facility addresses supply constraints, with expansion plans underway to meet growing market needs.

- In March 2025, Dominion Energy received approval to develop the Brunswick-Greensville LNG production, storage, and regasification facility in Virginia. The project aims to provide backup fuel for two gas-fired power stations, enhancing energy reliability. Operations are scheduled to begin in 2027.

freqAskQues