buyNow

Vacuum Contactor Market

Vacuum Contactor Market Size, Share, Growth & Industry Analysis, By Contacting Voltage (Low Voltage (< 1 kV), Medium Voltage (1 kV-5 kV), High Voltage (> 5 kV)), By Application (Motors, Transformers, Capacitors, Reactors, Others), By End-use Industry (Utilities, Industrial, Oil & Gas), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Sunanda G.

Market Definition

Vacuum contactor is an electromagnetic switching device that interrupts and establishes high-voltage power circuits within a vacuum environment. It offers rapid arc quenching, exceptional dielectric strength, and long operational life ideal for dynamic power control. The market scope spans utilities, rail transit, industrial automation, and renewable energy where reliable high-voltage switching is essential.

Engineers install vacuum contactors in several applications, including motor control, capacitor switching, traction systems, and grid protection to ensure minimal maintenance requirements and maximum operational safety.

Vacuum Contactor Market Overview

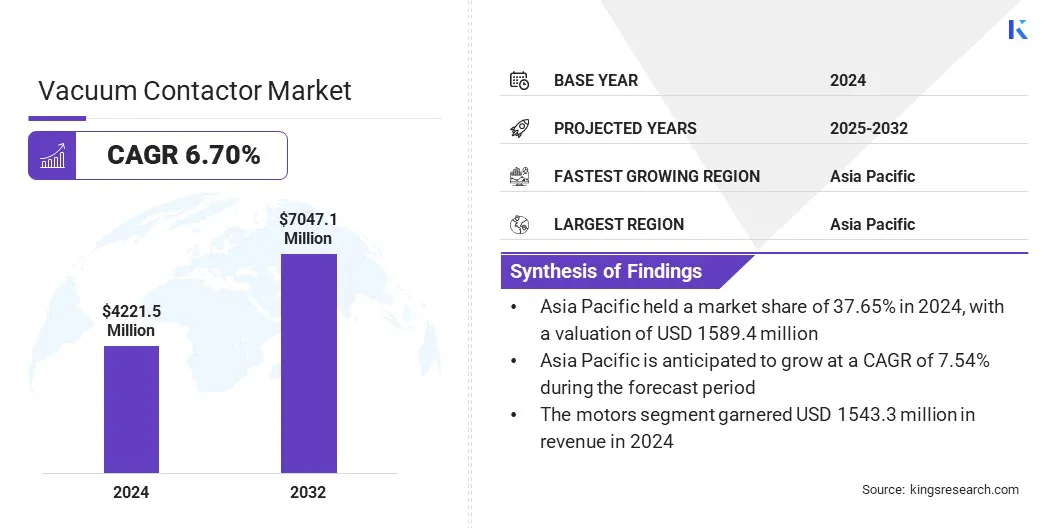

The global vacuum contactor market size was valued at USD 4,221.5 million in 2024 and is projected to grow from USD 4,475.2 million in 2025 to USD 7,047.1 million by 2032, exhibiting a CAGR of 6.70% during the forecast period.

The market is driven by the rising adoption of smart grids and Industrial Internet of Things (IIoT), which require reliable, remotely manageable switching solutions. Additionally, advancements in miniaturization and compact designs are making vacuum contactors suitable for space-constrained applications like EV infrastructure, data centers, and urban substations.

Key Highlights

- The vacuum contactor industry size was valued at USD 4,221.5 million in 2024.

- The market is projected to grow at a CAGR of 6.70% from 2025 to 2032.

- Asia Pacific held a market share of 37.65% in 2024, with a valuation of USD 1,589.4 million.

- The medium voltage (1 kV–5 kV) segment garnered USD 1,998.0 million in revenue in 2024.

- The motors segment is expected to reach USD 2,447.5 million by 2032.

- The utilities segment secured the largest revenue share of 37.56% in 2024.

- The market in North America is anticipated to grow at a CAGR of 6.93% during the forecast period.

Major companies operating in the vacuum contactor market are Schneider Electric, ABB, Eaton, Siemens, Rockwell Automation, Mitsubishi Electric Corporation, Toshiba, Fuji Electric Co., Ltd., CG Power & Industrial Solutions Ltd., Larsen & Toubro Ltd., LS ELECTRIC, Kunshan GuoLi Electronic Technology Co., Ltd., Liyond Electric Co., Ltd., TDK Electronics AG, and ElectronTubes.

Modernization of aging power infrastructure and rapid integration of large-scale renewable energy projects are driving the demand for vacuum contactors in high-voltage switching applications. Utilities are upgrading substations and distribution networks to handle increased load variability and ensure stable operation under new energy dynamics.

- In July 2025, Ofgem approved a USD 30.5 billion investment to upgrade the UK’s energy infrastructure as part of its green transition strategy. Around USD 19.1 billion is earmarked for modernizing gas systems, while USD 11.3 billion will go toward enhancing the high-voltage electricity grid. This funding marks the initial phase of a larger USD 101.7 billion program designed to reinforce the power network and protect UK households from global gas market volatility.

Vacuum contactors enable arc-free, efficient switching in wind farms, solar plants, and energy storage systems, where reliability and safety are critical. These devices offer long operational life, minimal maintenance, and superior performance in challenging environments. Renewable energy developers and grid operators are adopting vacuum contactors to support clean power transmission with enhanced control and protection.

Market Driver

Surging Adoption of Smart Grids and IIoT Integration

Rise of smart grids and integration of industrial internet of things (IIoT) technologies are driving the demand for vacuum contactors. These advanced devices are equipped with sensors and communication capabilities that enable real-time monitoring and diagnostics of switching operations. Utilities and industrial operators use smart vacuum contactors to detect anomalies, schedule maintenance, and enhance operational transparency.

Seamless integration into modern power distribution networks improves system efficiency, reducing downtime, and supporting data-driven decision-making. The need for intelligent, low-maintenance switching solutions increases as grids become more decentralized and digitally connected.

- In October 2024, Schneider Electric launched its Active Plus Medium Voltage switchgear equipped with EcoCare at Enlit Europe 2024. This solution features natively connected equipment designed for remote monitoring and advanced analytics, enabling condition-based maintenance and real-time grid oversight. Designed explicitly for smart grid environments, it integrates digital sensors and communication modules to enhance reliability and diagnostic capabilities in medium-voltage power distribution systems.

Market Challenge

High Initial CapEx and Complex Integration Limiting Adoption

A key challenge in the vacuum contactor market is the substantial upfront capital required for equipment procurement and deployment. These systems often demand specialized installation procedures and technical expertise, particularly when integrated into legacy electrical infrastructure. Such complexity and cost are discouraging adoption across sectors that rely on aging systems or operate under strict budget constraints.

To address this challenge, market players are developing compact, retrofit-friendly designs and offering technical support services to ease integration. Companies are also introducing flexible financing options and modular solutions to reduce entry barriers and support broader market uptake.

Market Trend

Miniaturization & Compact Design

A key trend in the vacuum contactor market is the development of miniaturized and compact designs to meet space constraints in modern electrical systems. Manufacturers are engineering smaller units that maintain performance while fitting into limited installation areas.

Applications such as urban substations, electric vehicle charging systems, data centers, and electric traction networks are driving the demand for space-efficient solutions. Compact vacuum contactors are supporting easier integration, reduced footprint, and simplified maintenance in dense environments.

Improved materials and thermal management are ensuring reliability despite size reductions. The market is adapting to changing infrastructure needs by delivering efficient solutions designed for confined spaces.

- In October 2023, ABB launched the ConVac medium-voltage vacuum contactor featuring a compact design with up to 20 % smaller footprint than conventional solutions. The device simplifies installation and maintenance with plug-and-play accessories and embedded terminal-box connections that reduce wiring time by up to 40 %. Designed for applications such as motors, transformers, and capacitor banks, the ConVac supports fault levels up to 50 kA and operates reliably between –30 °C and 55 °C.

Vacuum Contactor Market Report Snapshot

|

Segmentation |

Details |

|

By Contacting Voltage |

Low Voltage (< 1 kV), Medium Voltage (1 kV–5 kV), High Voltage (> 5 kV) |

|

By Application |

Motors, Transformers, Capacitors, Reactors, Others |

|

By End-use Industry |

Utilities, Industrial, Oil & Gas, Mining, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Contacting Voltage (Low Voltage (< 1 kV), Medium Voltage (1 kV–5 kV), and High Voltage (> 5 kV)): The medium voltage (1 kV–5 kV) segment earned USD 1,998.0 million in 2024, due to its widespread use in industrial motor control, power distribution, and infrastructure applications.

- By Application (Motors, Transformers, Capacitors, and Reactors): The motors segment held 36.56% share of the market in 2024, due to the high demand for reliable switching in motor control centers across industrial, commercial, and utility applications.

- By End-use Industry (Utilities, Industrial, Oil & Gas, Mining, and Others): The utilities segment is projected to reach USD 2,693.9 million by 2032, owing to ongoing grid modernization efforts and the need for reliable, arc-free switching solutions in high-voltage transmission and distribution infrastructure.

Vacuum Contactor Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific vacuum contactor market share of around 37.65% in 2024, with a valuation of USD 1,589.4 million. This dominance is largely driven by Asia Pacific’s strong position in global solar & wind capacity expansion. The region is actively integrating large-scale renewable energy projects into existing power grids, creating a need for dependable switching devices that can manage variable power flows.

- In June 2025, ACEN, in partnership with UPC Renewables, commenced work on two major renewable energy projects in India, a 420 MW solar power plant in Rajasthan and a 120 MW wind farm in Karnataka. Expected to be completed by early 2027, the two projects are anticipated to generate a combined annual output of 1,158 GWh of clean energy.

Vacuum contactors play a crucial role in such renewable energy infrastructure as they are specifically designed to efficiently switch inductive and capacitive loads, that are common in solar, wind, and energy storage systems. Their high endurance for frequent switching cycles and strong performance in outdoor environments make them essential components in solar farms, wind power substations, and battery storage facilities.

The vacuum contactor industry in North America is poised for significant CAGR of 6.93% over the forecast period. This growth is attributed to the rapid expansion of cloud computing, artificial intelligence, and digital services, which has significantly increased data center construction across North America. The U.S. Department of Energy (DOE) reports that electricity demand from data centers has tripled over the past decade and is expected to double or even triple again by 2028.

- In 2023, data centers accounted for roughly 4.4% of total U.S. electricity consumption, with projections indicating a rise to between 6.7% and 12% by 2028. Total energy utilization by data centers increased from 58 TWh in 2014 to 176 TWh in 2023, and could reach as high as 580 TWh by the end of the forecast period. This sharp rise in power demand reinforces the need for dependable switching solutions like vacuum contactors, which help maintain power stability and operational continuity in mission-critical data center environments.

Regulatory Frameworks

- Vacuum contactors in the U.S. must comply with the Underwriters Laboratories (UL) 60947-4-1 standard for motor controllers and the National Electrical Code (NEC), formally known as NFPA 70, issued by the National Fire Protection Association. Products are also governed by Occupational Safety and Health Administration (OSHA) requirements and American National Standards Institute (ANSI) standards such as ANSI B11. These ensure safe electrical system operation, arc-flash protection, and overall workplace safety.

- In the European Union (EU), vacuum contactors must meet the CE marking requirements under the Machinery Directive 2006/42/EC, confirming safety, health, and environmental compliance. Key standards include EN 60947-4-1 and IEC 62271-1 for low- and high-voltage applications. Compliance with the Restriction of Hazardous Substances (RoHS) Directive 2011/65/EU and the Electromagnetic Compatibility (EMC) Directive is mandatory. In hazardous areas, ATEX Directive 2014/34/EU certification is required for explosive atmospheres.

- China mandates China Compulsory Certification (CCC) for vacuum contactors, particularly those used in industrial or infrastructure settings. The key standard is GB 14048.4-2020, aligned with IEC 60947-4-1, but adapted for local grid requirements. Products must also comply with China RoHS II, which regulates hazardous substances, and SJ/T 11364 for Environmental-Friendly Use Period (EFUP) labeling. Testing is handled by accredited state laboratories before import or sale.

- Japan enforces conformity with Japanese Industrial Standards (JIS), harmonized with IEC norms such as IEC 60947-4-1. Vacuum contactors must be approved by the Ministry of Economy, Trade and Industry (METI) for energy efficiency and operational safety. Depending on application, additional cybersecurity protocols are required, especially for components integrated into smart grids or industrial IoT systems.

Competitive Landscape

Major players in the vacuum contactor industry are increasingly adopting strategies such as product innovation, targeted R&D, and compatibility-focused design enhancements to meet the evolving needs of end users and extend equipment lifespans.

Many manufacturers are developing direct-fit replacement components and investing in reverse-engineering capabilities to support aging systems still in operation. These efforts are often complemented by partnerships with OEMs and service providers to ensure seamless integration and long-term performance.

- In September 2024, Vacuum Interrupters launched the RVI‑VS7203 replacement vacuum interrupter. The unit is a direct fit for Siemens 3TL8, 97H35, and 97H37 vacuum contactors, offering 400 A RMS-rated current, 7.2 kV maximum voltage, and 5 kA short-circuit breaking capacity. The design features alumina ceramic sealing, high cumulative breaking capacity, and internal torsion control to match original OEM performance.

Key Companies in Vacuum Contactor Market:

- Schneider Electric

- ABB

- Eaton

- Siemens

- Rockwell Automation

- Mitsubishi Electric Corporation

- Toshiba

- Fuji Electric Co., Ltd.

- CG Power & Industrial Solutions Ltd.

- Larsen & Toubro Ltd.

- LS ELECTRIC

- Kunshan GuoLi Electronic Technology Co., Ltd.

- Liyond Electric Co., Ltd.

- TDK Electronics AG

- ElectronTubes

Recent Developments (Agreements/Product Launches)

- In January 2025, TDK introduced two high-voltage DC contactors: the HVC43MC with integrated mirror contact and the HVC45 capable of handling short-circuit currents up to 12 kA. These devices operate at up to 1000 V DC and are designed for applications such as EV battery systems, energy storage, DC charging stations, and UPS installations.

- In February 2024, Greegoo secured a new mining industry client in South Africa for its vacuum contactors. The order covers high-current vacuum contactors tailored for heavy-duty mining applications, reflecting client confidence in Greegoo’s performance.

freqAskQues