Machinery Equipment-Construction

3D Printing Metal Market

3D Printing Metal Market Size, Share, Growth & Industry Analysis, By Form (Powder, Filament), By Product (Titanium, Nickel, Stainless Steel, Others), By End-User Industry (Aerospace & Defense, Healthcare, Automotive, Industrial), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : February 2025

Report ID: KR1331

Market Definition

3D printing metal, also known as metal additive manufacturing, is a process where metal materials are used to create three-dimensional objects layer by layer. Unlike traditional manufacturing methods that involve subtracting material, 3D printing builds up objects from the ground up, adding material only where it's needed.

3D Printing Metal Market Overview

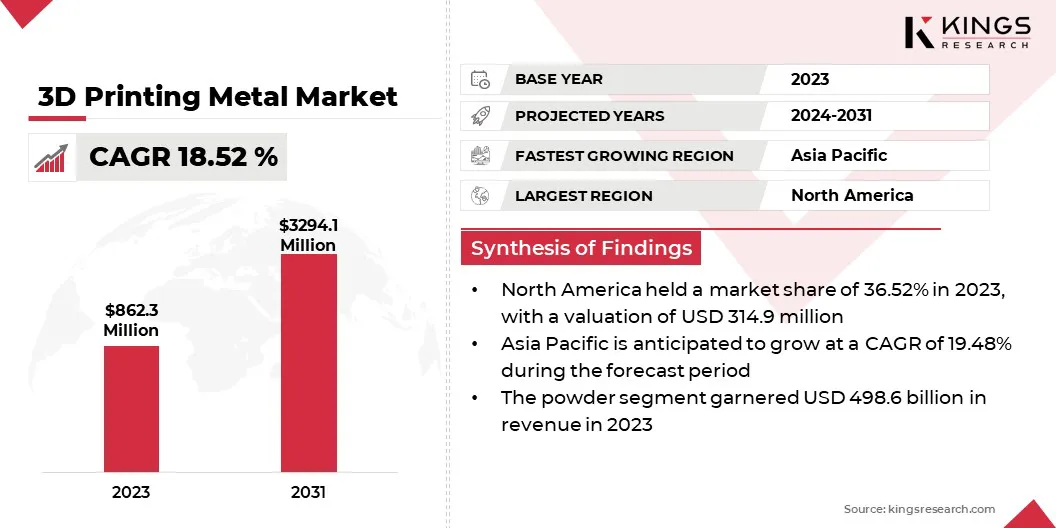

The global 3D printing metal market size was valued at USD 862.3 million in 2023 and is projected to grow from USD 1,002.9 million in 2024 to USD 3,294.1 million by 2031, exhibiting a CAGR of 18.52% during the forecast period.

This expansion is largely driven by technological advancements, a wider variety of applications, and increasing demand for custom and complex parts across industries. The capabilities of 3D printing metal continue to increase as more advanced metal alloys are developed and more precise printing methods emerge.

These innovations make it possible to produce high-performance parts that meet the stringent requirements of industries like aerospace, automotive, and healthcare.

Major companies operating in the 3D printing metal market are EOS GmbH, BLT, Nikon Corporation, 3D Systems, Inc., General Electric Company, DMG MORI., Farsoon Technologies, Desktop Metal, Inc., Eplus3D, HP Development Company, L.P., Markforged, Inc., Raise 3D Technologies, Inc., Rapidia Tech Inc., ONE CLICK METAL, and Kurtz Holding GmbH & Co. Beteiligungs KG.

The ability of 3D printing metal to create highly customized and intricate geometries cannot be achieved by traditional manufacturing methods. This is especially valuable in sectors like aerospace, where lightweight, complex components are often required.

- For instance, in September 2024, the European Space Agency (ESA) and Airbus announced a successful 3D printing of the first metal part on the International Space Station. This milestone marks the first instance of 3D metal printing in space and is seen as a crucial step toward enhancing crew autonomy for future long-duration space missions, including those to the Moon and Mars.

Key Highlights:

- The 3D printing metal market size was valued at USD 862.3 million in 2023.

- The market is projected to grow at a CAGR of 18.52% from 2024 to 2031.

- North America held a market share of 36.52% in 2023, with a valuation of USD 314.9 million.

- The powder segment garnered USD 498.6 million in revenue in 2023.

- The titanium segment is expected to reach USD 1,460.7 million by 2031.

- The aerospace & defense segment is expected to reach USD 1,430.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 19.48% during the forecast period.

Market Driver

"Rising Demand for Custom Metal Parts and Technological Advancements in 3D Printing"

Increasing demand for custom and complex metal parts in industries like aerospace, automotive, and healthcare is driving the 3D printing metal market , as traditional manufacturing methods struggle to meet the precision and complexity requirements.

Technological advancements in metal printing, which have improved material properties, production speed, and cost efficiency, are also contributing to the market’s expansion by making the process more accessible and viable for a wider range of applications.

- For instance in August 2024, Markforged introduced the FX10 Metal Kit, making the FX10 the world’s first industrial 3D printer capable of printing both metal filaments and composites with continuous fiber reinforcement. The new metal printing capability includes a 316L stainless steel filament and a faster print engine, aimed at increasing productivity on factory floors.

Additionally, the growing adoption of additive manufacturing for rapid prototyping and on-demand production helps reduce lead times, minimize material waste, and offers greater flexibility for manufacturers.

Market Challenge

"Limited Range of Metals Compatible and Consistency Concerns"

High costs associated with equipment and materials are one of the significant challenges in this market, particularly for small and medium-sized businesses. Advancements in affordable printer designs and the development of cost-effective metal powders are helping lower the overall expenses.

Another challenge is the limited range of metal materials compatible with 3D printing, which restricts its use in some sectors. This issue is being tackled through ongoing material innovations, leading to the creation of new alloys and composites that offer broader applications.

Additionally, ensuring the strength and consistency of 3D printed metal parts, especially in industries like aerospace and healthcare, remains a challenge. This is being resolved with improved post-processing techniques and enhanced quality control methods that help meet stringent industry standards.

Market Trend

"Automation and Minimal Material Waste"

Material innovation is driving the 3D printing metal market, with advancements in specialized alloys and composites offering enhanced strength, heat resistance, and durability, particularly benefiting industries like aerospace and automotive.

Automation and AI integration are transforming production by increasing precision, reducing manual labour, and optimizing workflows.

Sustainability is also gaining traction, as 3D printing minimizes material waste, promotes the use of recycled materials, and enables more localized production, all of which reduce the environmental footprint compared to traditional manufacturing methods.

- For instance in May 2024, the BMW Group expanded its use of 3D-printed robot grippers, including bionic grippers for chassis construction at its Munich plant. The new grippers are made using 3D printing to create sand casting molds, resulting in a 30% weight reduction. This advancement allows for the use of smaller, energy-efficient lifting robots, cutting costs and reducing CO2 emissions.

3D Printing Metal Market Report Snapshot

|

Segmentation |

Details |

|

By Form |

Powder, Filament |

|

By Product |

Titanium, Nickel, Stainless Steel, Others |

|

By End User Industry |

Aerospace & Defense, Healthcare, Automotive, Industrial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Form (Powder, Filament): The powder segment earned USD 498.6 million in 2023, due to its widespread use in advanced 3D printing processes which allow for the production of complex and high-performance parts across various industries.

- By Product (Titanium, Nickel, Stainless Steel, and Others): The titanium segment held 42.33% share of the market in 2023, due to its superior strength-to-weight ratio and corrosion resistance.

- By End User Industry (Aerospace & Defense, Healthcare, Automotive, and Industrial): The aerospace & defence segment is projected to reach USD 1,430.6 million by 2031, owing to the increasing demand for lightweight, durable, and complex components, as well as the need for rapid prototyping and cost-effective production of critical parts.

3D Printing Metal Market Regional Analysis

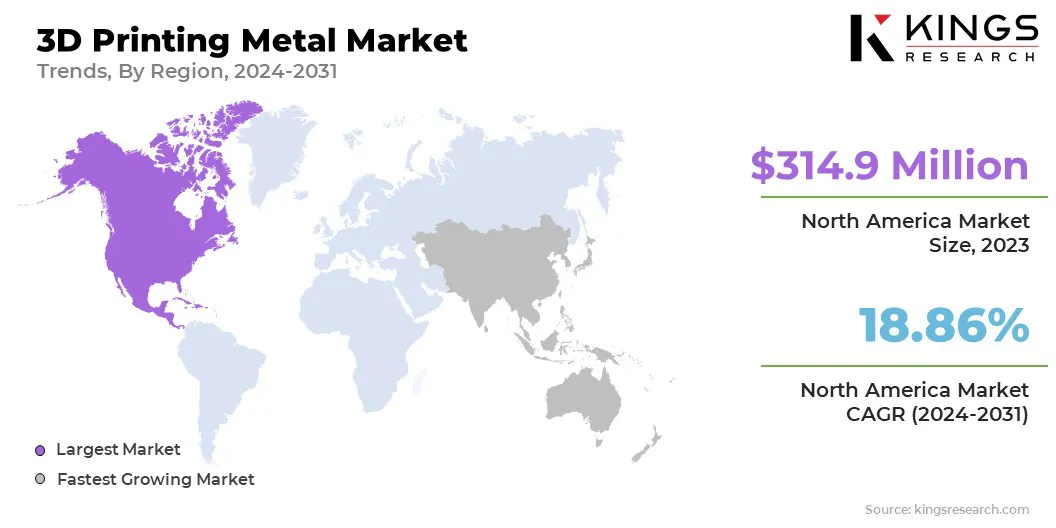

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 36.52% share of the 3D printing metal market in 2023, with a valuation of USD 314.9 million. This dominance can be attributed to North America's strong presence in key industries such as aerospace, defence, automotive, and healthcare, where 3D metal printing is increasingly adopted for its ability to produce complex, lightweight, and high-performance components.

The region benefits from a concentration of major manufacturers, extensive research and development capabilities, and a well-established supply chain for 3D printing materials. Moreover, significant investments in additive manufacturing technology, coupled with the rising demand for customized solutions and rapid prototyping, are expected to further fuel the market growth.

- For instance in May 2024, EOS North America announced the launch of its 14,600 square-foot Additive Minds Academy Center in Michigan. The training facility, part of a $500,000 investment in workforce development, aims to provide hands-on and classroom training for engineers and operators in both metal and polymer additive manufacturing.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 19.48% over the forecast period. This growth is driven by increasing industrialization and technological advancements in countries like China, Japan, and South Korea, which are heavily investing in 3D printing technologies across various sectors, including automotive, aerospace, and healthcare.

The region is experiencing a shift toward advanced manufacturing practices, where metal 3D printing is gaining traction due to its ability to reduce production costs, enhance product design, and improve manufacturing efficiency.

The expanding adoption of Industry 4.0 technologies and supportive government initiatives are expected to further accelerate the growth of this market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) regulates medical devices made using 3D printing. The FDA's Center for Devices and Radiological Health (CDRH) is responsible for regulating these devices

- In China, the National Medical Products Administration (NMPA) is the regulatory authority that governs 3D printers, particularly when used to produce medical devices.

- In India, the primary regulatory authority overseeing 3D printers is the Ministry of Electronics and Information Technology (MeitY), which focuses on the development and advancement of additive manufacturing (3D printing) technology through initiatives like the Centre of Excellence for Additive Manufacturing (CoE AM).

Competitive Landscape:

The 3D printing metal industry is characterized by a large number of participants, including both established corporations and rising organizations, each contributing to growth and innovation in the industry.

The competitive landscape is marked by a mix of global leaders with significant resources and advanced technologies, as well as smaller, more agile companies that focus on niche applications and specialized materials.

These companies are actively competing to offer cutting-edge solutions in metal 3D printing, focusing on improving the quality, efficiency, and versatility of their products.

Collaborations between manufacturers of 3D printing systems and metal powder suppliers have increased to optimize production workflows and reduce material costs.

Competition is expected to intensify with the rising demand for complex, lightweight, and customized metal parts across industries like aerospace, automotive, and healthcare, driving further innovation and pushing companies to continuously improve their offerings.

- For instance in June 2024, Materialise and ArcelorMittal Powders announced a partnership to optimize laser powder bed fusion (LPBF) equipment and 3D metal printing. The collaboration combines Materialise’s next-gen build processor with ArcelorMittal’s AdamIQ steel powders to improve speed, quality, and cost-efficiency in metal additive manufacturing.

List of Key Companies in 3D Printing Metal Market:

- EOS GmbH

- BLT

- Nikon Corporation

- 3D Systems, Inc.

- General Electric Company

- DMG MORI.

- Farsoon Technologies

- Desktop Metal, Inc.

- Eplus3D

- HP Development Company, L.P.

- Markforged, Inc.

- Raise 3D Technologies, Inc.

- Rapidia Tech Inc.

- ONE CLICK METAL

- Kurtz Holding GmbH & Co. Beteiligungs KG

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, SPEE3D demonstrated its XSPEE3D system's ability to print metal parts in sub-zero environments for the US Department of Defence’s Point of Need Manufacturing Challenge. The project highlighted the system’s capability to produce parts with similar material properties to those made in lab conditions, aiding the DOD’s efforts to enhance expeditionary manufacturing in extreme environments.

- In November 2024, HP Inc. introduced innovations at Formnext 2024, including a halogen-free flame-retardant material, the HP 3D Build Optimizer, and expanded metal 3D printing capabilities, alongside key collaborations with Autodesk, ArcelorMittal, and Eaton to drive 3D printing adoption.

- In November 2024, Hexagon’s Manufacturing Intelligence division introduced Advanced Compensation technology, combining process simulation and 3D scan compensation to eliminate costly trial-and-error in precision metal part production.

- In June 2024, Desktop Metal and BEGA announced their partnership to showcase binder jet 3D printed aluminum lighting components at RAPID + TCT. The collaboration focuses on optimizing Al6061 powder for printing complex lighting components, with parts produced on Desktop Metal’s X25Pro printer.

- In May 2024, Desktop Metal announced the release of an upgraded Production System P-1 with a Reactive Safety Kit, enabling high-speed binder jet 3D printing of titanium and aluminum. This upgrade unlocks the safe production of these materials and is already being used by manufacturers like TriTech Titanium Parts for complex part production.

- In February 2024, Wilson Sporting Goods Co. announced the release of the Wilson Airless Gen1, the first-ever 3D-printed basketball that never needs inflation. Building on the success of its prototype, the limited-edition Airless Gen1 features improved performance, a streamlined manufacturing process, and enhanced customization options.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)