Automotive and Transportation

Acoustic Vehicle Alerting System Market

Acoustic Vehicle Alerting System Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV)), By Vehicle Type (Two Wheelers, Passenger Vehicles, Commercial Vehicles), By Mounting, By Sales Channel, and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : March 2025

Report ID: KR1405

Market Definition

The acoustic vehicle alerting system (AVAS) market involves the development, production, and deployment of artificial sound systems designed for electric and hybrid vehicles to enhance pedestrian safety. AVAS solutions integrate external speakers, controllers, and sound modules to generate audible warnings, improving road safety.

Acoustic Vehicle Alerting System Market Overview

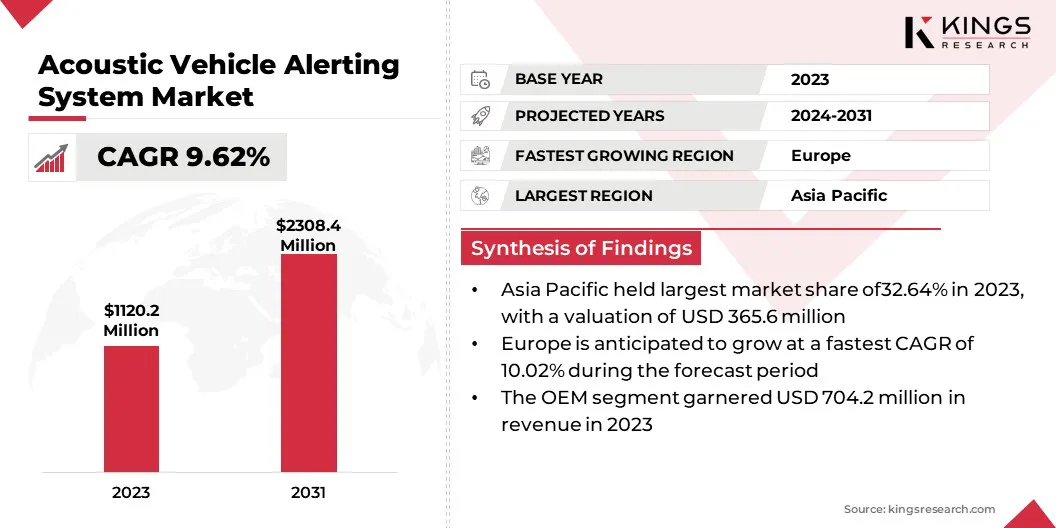

The global acoustic vehicle alerting system market size was valued at USD 1120.2 million in 2023 and is projected to grow from USD 1213.9 million in 2024 to USD 2308.4 million by 2031, exhibiting a CAGR of 9.62% during the forecast period.

This is attributed to the rising adoption of electric and hybrid vehicles and stringent regulatory mandates globally. AVAS solutions are essential for ensuring pedestrian safety by generating artificial sounds that compensate for the near-silent operation of EVs, particularly in urban areas and low-speed driving conditions.

Major companies operating in the acoustic vehicle alerting system industry are Continental Engineering Services, DENSO ELECTRONICS CORPORATION, Maruti Suzuki India Ltd., HELLA GmbH & Co. KGaA, SoundRacer AB, Volkswagen, Mercedes-Benz AG, HARMAN International, General Motors, Brigade Electronics Group Plc, and STMicroelectronics.

The market is growing, due to the rapid adoption of electric and hybrid vehicles, addressing pedestrian safety concerns from near-silent EV operation. AI-powered sound modulation and adaptive acoustics enable real-time adjustments based on speed, traffic density, and ambient noise, enhancing safety while reducing urban noise pollution.

Key Highlights:

- The acoustic vehicle alerting system industry size was valued at USD 1120.2 million in 2023.

- The market is projected to grow at a CAGR of 9.62% from 2024 to 2031.

- Asia Pacific held a market share of 32.64% in 2023, with a valuation of USD 365.6 million.

- The battery electric vehicle (BEV) segment garnered USD 636.9 million in revenue in 2023.

- The passenger vehicles segment is expected to reach USD 915.7 million by 2031.

- The integrated segment is expected to reach USD 1330.8 million by 2031.

- The OEM segment is expected to reach USD 1445.3 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 10.02% during the forecast period.

Market Driver

"Rapid Global Adoption of Electric and Hybrid Vehicles"

The acoustic vehicle alerting system market is primarily driven by the rapid global adoption of electric and hybrid vehicles, fueled by increasing environmental concerns and stringent emission regulations. Governments worldwide are implementing policies to reduce carbon footprints, encouraging automakers to shift to electrification.

However, the near-silent operation of EVs at low speeds poses safety risks, particularly for pedestrians, cyclists, and visually impaired individuals. The rise in EV production, coupled with ongoing innovations in automotive acoustics and digital sound engineering, is expected to sustain the growth trajectory of the AVAS market.

The market will continue to expand significantly as more governments push for mandatory AVAS installations and vehicle manufacturers prioritize safety features.

- According to the International Energy Agency (IEA), nearly one in five cars sold was electric in 2023, with global EV sales totaling 14 million, an increase of 3.5 million units from 2022, reflecting a 35% annual growth rate. This rapid expansion, fueled by advancing technology and shifting consumer preferences, is accelerating the demand for acoustic vehicle alerting systems (AVAS) to enhance pedestrian safety.

Market Challenge

"Balance Between Pedestrian Safety and Urban Noise Pollution Concerns"

A major challenge in the acoustic vehicle alerting system market is balancing pedestrian safety with urban noise pollution concerns. AVAS is essential for mitigating the risks posed by silent electric and hybrid vehicles; however, excessive or poorly designed artificial sounds can contribute to environmental noise pollution, contradicting one of the key benefits of EVs that lead to quieter urban spaces.

Advancements in AI-driven sound modulation and adaptive acoustic technology can help optimize AVAS performance. Intelligent AVAS solutions can dynamically adjust sound levels based on vehicle speed, pedestrian density, and surrounding noise conditions, ensuring adequate warning signals while minimizing unnecessary noise pollution.

Market Trend

"AI-powered Sound Modulation and Adaptive Acoustics"

The acoustic vehicle alerting system market is actively integrating advanced AI-powered sound modulation and adaptive acoustics to effectively balance safety with noise pollution. These advanced technologies enable AVAS solutions to optimize their performance in real time.

AI helps these intelligent systems to dynamically adjust the emitted sound volume and characteristics based on a variety of factors. These factors include the vehicle's speed, pedestrian traffic density in the surrounding area, and ambient environmental noise levels.

This dynamic adaptation ensures that the AVAS effectively provides necessary warning signals to pedestrians and other vulnerable road users, thereby enhancing safety, while simultaneously mitigating the potential for excessive noise pollution in urban environments.

This targeted approach represents a significant advancement in AVAS technology, promoting both road safety and a more acoustically comfortable urban landscape.

Acoustic Vehicle Alerting System Market Report Snapshot

|

Segmentation |

Details |

|

By Propulsion Type |

Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV) |

|

By Vehicle Type |

Two Wheelers, Passenger Vehicles, Commercial Vehicles |

|

By Mounting |

Integrated, Separated |

|

By Sales Channel |

OEM, Aftermarket |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Propulsion Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV)): The battery electric vehicle (BEV) segment earned USD 636.9 million in 2023, due to the rapid adoption of fully electric vehicles (EVs) globally, due to stringent emissions regulations, government incentives, and advancements in battery technology.

- By Vehicle Type (Two Wheelers, Passenger Vehicles, Commercial Vehicles): The passenger vehicles segment held 38.19% share of the market in 2023, due to the rising sales of electric passenger cars, growing consumer awareness regarding road safety, and regulatory enforcement of AVAS in electric cars across key markets.

- By Mounting (Integrated, Separated): The integrated segment is projected to reach USD 1330.8 million by 2031, owing to the increasing demand for compact, factory-fitted AVAS solutions that seamlessly integrate with vehicle architecture.

- By Sales Channel (OEM, Aftermarket): The OEM segment is projected to reach USD 1445.3 million by 2031, as automakers are increasingly prioritizing AVAS installation during vehicle production to meet mandatory regulatory requirements.

Acoustic Vehicle Alerting System Market Regional Analysis

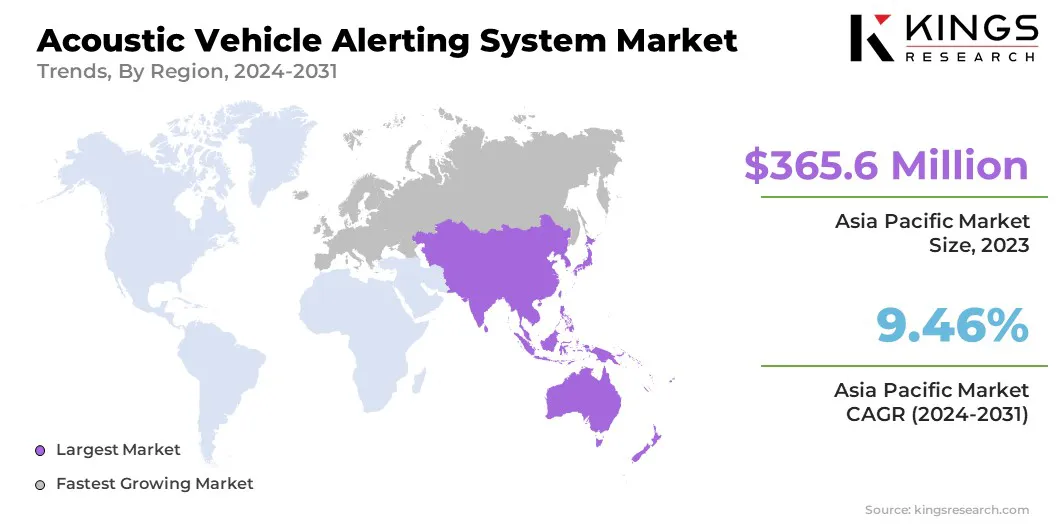

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific region accounted for 32.64% share of the acoustic vehicle alerting system market in 2023, with a valuation of USD 365.6 million. This growth is driven by the rapid expansion of the EV industry in leading markets such as China, Japan, and South Korea, where government policies and subsidies encourage EV adoption.

China, the largest EV market, has implemented strict AVAS regulations to enhance pedestrian safety, further boosting market demand. Additionally, increasing urbanization and infrastructure development are driving the need for advanced vehicle safety systems in the region.

- According to the IEA, China dominated the EV market in 2023, accounting for 60% of global EV sales. This signifies China’s pivotal role in driving the market, as the surge in EV adoption increases the demand for enhanced pedestrian safety solutions.

- In May 2024, Transport for NSW (Transport) launched the AVAS Sound Design project, a research-driven initiative to develop a standardized AVAS sound for its expanding Zero Emission Bus (ZEB) fleet. This project, initiated by Transport, is executed in collaboration with iMOVE Cooperative Research Centres (CRC) and the University of Technology Sydney (UTS).

The acoustic vehicle alerting system industry in Europe is poised to grow at a CAGR of 10.02% over the forecast period, driven by the increasing adoption of electric & hybrid vehicles and the growing focus on enhancing road safety technologies.

Leading automotive manufacturers are expanding their EV portfolios, thus, the demand for advanced vehicle sound systems to improve pedestrian awareness is rising. Countries such as Germany, France, and the UK are at the forefront of this transition, supported by strong investments in R&D and innovation in automotive acoustics.

- In July 2024, Hutchinson developed an advanced multi-material solution to mitigate sound vibrations from E-compressors and E-motors. Engineered for optimal vibration attenuation and absorption, it effectively targets high-frequency noise (>1000 Hz) in E-modules. This innovation enhances acoustic performance, ensuring quieter and more efficient operation in electric powertrain systems.

Regulatory Frameworks:

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) regulates the market under FMVSS No. 141, requiring electric and hybrid vehicles to emit minimum sound levels at low speeds to enhance pedestrian safety, ensuring compliance with federal safety standards.

- In Europe, the European Commission (EC) regulates the market, under UNECE Regulation No. 138 (R138), which mandates AVAS installation in electric and hybrid vehicles to enhance pedestrian safety by generating artificial sound at low speeds, ensuring compliance with standardized noise requirements.

Competitive Landscape:

The acoustic vehicle alerting system industry is characterized by a highly competitive environment, with numerous established corporations and emerging players striving for a large market share.

Leading automotive manufacturers, technology providers, and specialized acoustic system developers are actively investing in innovation, product differentiation, and strategic collaborations to gain a competitive edge.

Key players in the market focus on advancing AVAS technology through AI-driven sound modulation, adaptive noise control, and customizable sound profiles to enhance pedestrian safety while maintaining brand identity. Companies are also leveraging strategic partnerships, mergers, and acquisitions to expand their global presence and strengthen their product portfolios.

List of Key Companies in Acoustic Vehicle Alerting System Market:

- Continental Engineering Services

- DENSO ELECTRONICS CORPORATION

- Maruti Suzuki India Ltd.

- HELLA GmbH & Co. KGaA

- SoundRacer AB

- Volkswagen

- Mercedes-Benz AG

- HARMAN International

- General Motors

- Brigade Electronics Group Plc

- STMicroelectronics

Recent Developments

- In July 2024, Brose Fahrzeugteile SE & Co. KG developed an AVAS that enhances pedestrian safety in electric and hybrid vehicles through customizable sound profiles. This advancement underscores the industry's commitment to innovative AVAS solutions, ensuring both compliance and brand differentiation as the EV market continues to expand.

- In March 2023, Clientron secured the ISO 26262:2018 ASIL-D Automotive Functional Safety Certification, reinforcing its position in the global smart automotive supply chain. This achievement enhances integration across autonomous driving systems, smart cockpits, BCM, VCU, AVAS, and vision assistance solutions. It also strengthens partnerships with European and American automakers and tier-1 suppliers, advancing Clientron’s expansion into the global EV market.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)