Aerospace and Defense

Aerospace Materials Market

Aerospace Materials Market Size, Share, Growth & Industry Analysis, By Type (Structural (Alloys, Plastics, and Composites) and Non-structural (General and Commercial, Military and Defense, and Space Vehicles)), By Aircraft (General and Commercial, Military and Defense, and Space Vehicles), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR216

Aerospace Materials Market Size

Global Aerospace Materials Market size was valued at USD 40.27 billion in 2023 and is projected to grow from USD 43.33 billion in 2024 to USD 78.29 billion by 2031, exhibiting a CAGR of 8.82% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Hexcel Corporation, thyssenkrupp Materials NA, Inc., Röchling, DuPont, Huntsman International LLC, Toray Advanced Composites, Alcoa Corporation, Novelis, SGL Carbon, ATI, Syensqo, and others.

The rising adoption of 3D printing technologies and growing demand for lightweight materials are driving market expansion. The increasing production of commercial and military aircraft is a key driver in the aerospace materials market, backed by the burgeoning global travel demand and the evolving defense needs of nations. With air travel becoming more accessible and affordable, passenger numbers are rising, necessitating the expansion of airline fleets. Commercial airlines are investing heavily in new, more fuel-efficient aircraft to meet this growing demand and reduce operating costs.

Simultaneously, geopolitical tensions and the modernization of defense forces are prompting governments to bolster their military capabilities with advanced aircraft, including fighter jets, surveillance planes, and drones. This surge in aircraft production directly impacts the demand for aerospace materials, such as lightweight composites, advanced alloys, and high-performance polymers, which are essential for manufacturing aircraft components that meet stringent safety and performance standards. The aerospace industry’s push toward sustainability and efficiency thereby amplifies this demand, as newer materials are developed to enhance fuel efficiency, reduce emissions, and improve overall aircraft performance.

Aerospace materials refer to the specialized materials used in the construction of aircraft, spacecraft, and related systems and components, designed to withstand the unique demands of flight and space environments. These materials must possess properties such as high strength-to-weight ratios, resistance to extreme temperatures, and durability against various stress factors encountered during operation.

Common types of aerospace materials include composites, which are lightweight and strong, used extensively in fuselage and wing structures; titanium alloys, known for their high strength and resistance to corrosion, employed in engine components and airframes; and aluminum alloys, favored for their lightweight and cost-effectiveness, used in various structural parts of the aircraft. Advanced polymers and ceramics are also used in components that require high thermal resistance and minimal weight. These materials are critical to ensuring the safety, efficiency, and longevity of both commercial and military aircraft, as they directly impact fuel efficiency, performance, and maintenance requirements.

Analyst’s Review

The aerospace materials market is witnessing significant growth, driven by strategic initiatives and innovations from key industry players. Companies are focusing on developing advanced materials that offer superior performance, such as high-strength composites and lightweight alloys, to meet the evolving demands of the aerospace sector. These strategies are crucial in enhancing fuel efficiency, reducing emissions, and improving overall aircraft performance, aligning with the industry's push toward sustainability.

Additionally, leading companies are investing heavily in research and development to pioneer new material technologies that withstand extreme conditions and extend the lifespan of aerospace components. Collaborations and partnerships between material manufacturers and aerospace firms are also becoming more prevalent, facilitating the co-development of innovative solutions and accelerating market expansion.

- For instance, in February 2024, Honeywell announced an USD 84 million investment to expand its Olathe manufacturing facility in Kansas. This expansion supports the future of aviation by strengthening the domestic supply chain for next-generation avionics, protective coating, and printed circuit board assemblies.

Moreover, the current growth trajectory is supported by the rising production of both commercial and military aircraft, driven by increasing global travel and defense modernization programs.

Aerospace Materials Market Growth Factors

The rising adoption of 3D printing technologies is significantly transforming the aerospace materials market, serving as a powerful driver for innovation and efficiency. 3D printing, also known as additive manufacturing, allows for the precise fabrication of complex aerospace components with reduced material wastage and shorter production times compared to traditional manufacturing methods. This technology enables the creation of lightweight yet strong parts, which are essential for improving fuel efficiency and performance in both commercial and military aircraft.

Additionally, 3D printing facilitates rapid prototyping, allowing aerospace engineers to quickly iterate and test new designs, accelerating the development process. The customization capabilities of 3D printing also support the production of bespoke parts tailored to specific requirements, which is particularly valuable in the maintenance, repair, and overhaul (MRO) sector.

Furthermore, as technology continues to advance, the range of materials compatible with 3D printing, including advanced polymers, metals, and composites, is expanding, creating new possibilities for innovative aerospace applications. The growing adoption of 3D printing in the aerospace industry underscores its potential to enhance manufacturing efficiency, reduce costs, and drive the development of next-generation aircraft components.

The high cost associated with advanced aerospace materials presents a significant restraint in the market, impacting the widespread adoption of these materials. Advanced materials like carbon fiber composites, titanium alloys, and high-performance polymers are integral to the development of modern aircraft due to their superior strength-to-weight ratios, corrosion resistance, and thermal stability.

However, the production processes for these materials are often complex and resource-intensive, leading to elevated manufacturing costs. For instance, the fabrication of carbon fiber composites involves multiple stages, including fiber production, resin impregnation, and curing, each requiring specialized equipment and skilled labor. These high costs are prohibitive for smaller aerospace manufacturers and suppliers, limiting their ability to compete with larger, more established companies.

Moreover, the initial investment required for research and development, as well as for setting up manufacturing facilities for these advanced materials, adds to the financial burden. Addressing this cost challenge is crucial for fostering broader market growth and enabling the benefits of advanced materials to be more widely realized.

Aerospace Materials Market Trends

The growing demand for lightweight materials is a prominent trend in the aerospace industry, driven by the need to enhance fuel efficiency and reduce operational costs. Lightweight materials, such as carbon fiber composites, aluminum-lithium alloys, and advanced polymers, are increasingly being used in aircraft construction to achieve significant weight reductions without compromising strength and durability. This trend is particularly pronounced in the design and manufacturing of new-generation aircraft, which prioritize efficiency and environmental sustainability. The use of these materials enables aircraft to carry more payload, extend their range, and reduce fuel consumption, leading to lower greenhouse gas emissions.

Additionally, the aerospace industry's push toward electric and hybrid-electric aircraft is amplifying the demand for lightweight materials, as reducing the weight of the aircraft is critical to maximizing the performance and range of these emerging technologies. The benefits of lightweight materials extend beyond performance and environmental impact, also contributing to lower maintenance costs and improved lifecycle performance of aircraft.

Segmentation Analysis

The global market is segmented based on type, aircraft, and geography.

By Type

Based on type, the market is segmented into structural and non-structural. The structural segment captured the largest aerospace materials market share of 78.55% in 2023, driven by the critical importance of structural components in aircraft design and manufacturing. The structural segment is further classified as alloys, plastics, and composites.

Structural materials, such as high-strength composites, aluminum alloys, and titanium alloys, are essential for the primary construction of aircraft, including the fuselage, wings, and landing gear. These components must withstand extreme stress and environmental conditions while maintaining the integrity and safety of the aircraft. The increasing production of both commercial and military aircraft significantly fuels the demand for these materials, as manufacturers strive to enhance performance, fuel efficiency, and durability.

Additionally, advancements in material technology, such as the development of new composite materials that offer superior strength-to-weight ratios, thereby boost the dominance of the structural segment. The aerospace industry's shift toward lighter and more fuel-efficient aircraft designs also contributes to the growth of this segment, as structural components are a key area where weight savings are realized.

By Aircraft

Based on aircraft, the aerospace materials market is classified into general and commercial, military and defense, and space vehicles. The general and commercial segment is anticipated to witness the highest growth at a CAGR of 9.89% over the forecast period, reflecting the robust expansion and modernization of the commercial aviation sector. The global increase in air travel demand, driven by economic growth, rising disposable incomes, and the expansion of low-cost carriers, is prompting airlines to invest heavily in new aircraft to expand their fleets.

The advancements in aircraft technology are leading to the development of more fuel-efficient and environmentally friendly planes, which are incentivizing airlines to update their fleets. Additionally, the growing emphasis on enhancing passenger experience and operational efficiency is driving the adoption of advanced materials and technologies in commercial aircraft. The general aviation sector, which includes private and business jets, is also experiencing growth due to the rising demand for personal and corporate air travel, especially in emerging markets.

Aerospace Materials Market Regional Analysis

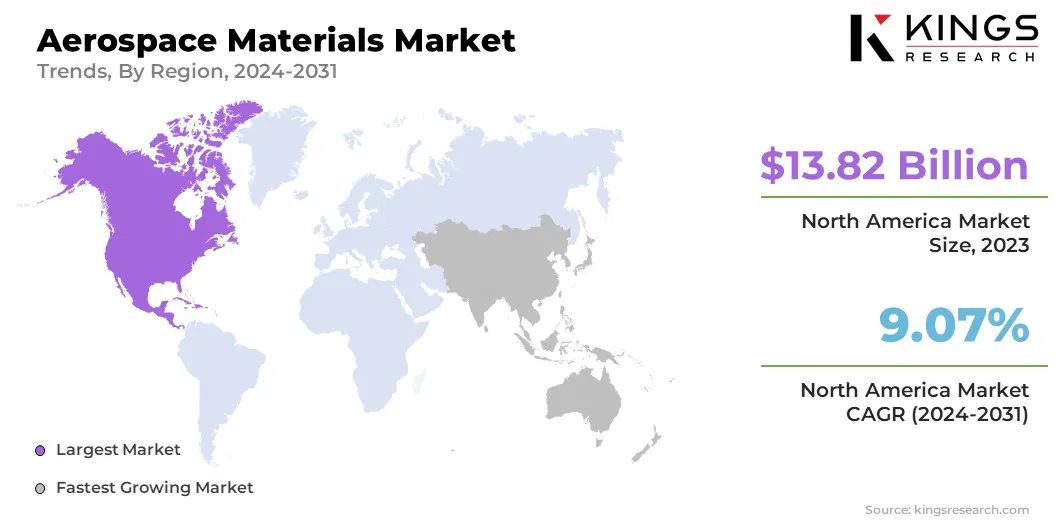

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America aerospace materials market share accounted for 34.32% and was valued at USD 13.82 billion in 2023. The robust industrial base drives substantial demand for high-performance materials required for aircraft production. Additionally, North America's strong focus on technological innovation and research and development contributes to the advancement and adoption of new materials, such as carbon fiber composites and titanium alloys, which are critical for modern aircraft design. The presence of leading aerospace research institutions and a well-established supply chain is supporting the growth of the market.

- For instance, in March 2023, NASA awarded USD 50 million to 14 organizations to advance manufacturing processes and composite materials for aircraft structures. These green technologies aim to reduce aviation carbon emissions. Part of the HiCAM project, the awards focused on lowering costs and boosting U.S. composite structure production rates.

Moreover, significant government and private sector investments in aerospace projects, particularly in defense and space exploration, are stimulating continuous demand for advanced materials. The region's emphasis on sustainability and the development of fuel-efficient aircraft is propelling the adoption of lightweight and durable materials, solidifying North America's dominant position in the global market.

The Europe aerospace materials market is poised to experience the highest growth at a projected CAGR of 10.12% over 2024-2031. The region is witnessing increased investment in the aerospace sector, driven by both government initiatives and private enterprises aimed at advancing aerospace technology and manufacturing capabilities. Europe's focus on innovation is fostering the development and adoption of cutting-edge materials that enhance aircraft performance and sustainability.

Additionally, the growing demand for new commercial aircraft to support the expanding air travel market in Europe is boosting the need for advanced aerospace materials. The region's strong emphasis on environmental regulations and sustainability is driving the adoption of lightweight, fuel-efficient materials that reduce emissions and operational costs.

Furthermore, Europe's strategic collaborations and partnerships within the aerospace industry, coupled with significant research and development efforts, are accelerating the introduction of new materials and technologies. This dynamic environment positions Europe for robust growth in the aerospace materials market, as it continues to advance its capabilities and meet the evolving demands of the aerospace sector.

Competitive Landscape

The aerospace materials market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Aerospace Materials Market

- Hexcel Corporation

- thyssenkrupp Materials NA, Inc.

- Röchling

- DuPont

- Huntsman International LLC

- Toray Advanced Composites

- Alcoa Corporation

- Novelis

- SGL Carbon

- ATI

- Syensqo

Key Industry Developments

- March 2024 (Launch): Toray Advanced Composites expanded its product portfolio with the launch of Toray Cetex TC915 PA+. Ideal for sporting goods, high-performance industrial, automotive, energy, UAM, and UAS applications, TC915 PA+ features enhanced technical specifications, including increased strength, higher stiffness, improved temperature stability, and reduced moisture absorption, meeting diverse industry demands

- October 2023 (Partnership): Thyssenkrupp Aerospace extended its partnership with Boeing's supply chain through its global network, operating dedicated facilities across North America. These sites provide raw materials and value-added services to Boeing and its subcontractors in North America, Europe, and Asia, managing aluminum flat & extrusion products and titanium supply.

The global aerospace materials market is segmented as:

By Type

- Structural

- Alloys

- Plastics

- Composites

- Non-structural

- Coatings

- Adhesives and Sealants

- Foams

- Seals

By Aircraft

- General and Commercial

- Military and Defense

- Space Vehicles

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership