Buy Now

AI Code Tools Market Size, Share, Growth & Industry Analysis, By Component (Tools, Services), By Deployment (Cloud-based, On-premises,), By Technology (Machine Learning, Natural Language Processing, Generative AI), By Application, By Vertical and Regional Analysis, 2024-2031

Pages: 210 | Base Year: 2023 | Release: March 2025 | Author: Sunanda G.

The market encompasses software solutions designed to enhance code development, debugging, optimization, and deployment through artificial intelligence. These tools streamline processes such as automated code generation, error detection, syntax correction, and predictive coding by leveraging machine learning and natural language processing.

Developers utilize AI-powered coding assistants, automated testing frameworks, and intelligent code completion tools to improve efficiency and reduce manual effort. Applications span software development, enterprise IT, cybersecurity, and DevOps, enabling faster iteration cycles and enhanced software reliability.

AI-driven refactoring and performance optimization contribute to improved scalability, while integration with cloud platforms supports seamless collaboration and version control.

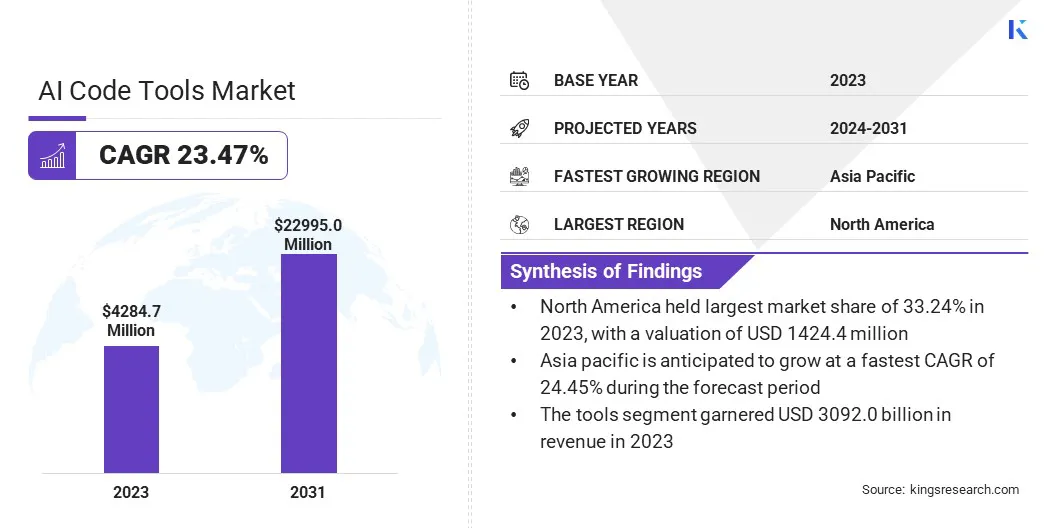

The global AI code tools market size was valued at USD 4284.7 million in 2023 and is projected to grow from USD 5257.9 million in 2024 to USD 22995.0 million by 2031, exhibiting a CAGR of 23.47% during the forecast period. This expansion is fueled by continuous advancements in large language models (LLMs), enhancing code generation, debugging, and automation capabilities.

Additionally, increasing integration of AI-powered assistants within popular development environments is streamlining workflows and improving efficiency. Growing demand for faster software development, coupled with AI-driven personalization features, is leading to widespread adoption across enterprises.

Major companies operating in the AI code tools industry are Microsoft, OpenAI, Amazon Web Services, Tabnine Ltd., Replit, Inc., Sourcegraph, Inc., Google, IBM Corporation, Salesforce, Inc., Meta, Qodo, Tabnine, JetBrains, Datadog, Lightning AI, and others.

Enterprises and developers are leveraging AI-driven tools to automate critical coding tasks, enhancing efficiency in software development. AI-powered coding assistants streamline code generation, error detection, and debugging, reducing manual intervention.

Advanced machine learning models improve contextual understanding, enabling precise code suggestions and refactoring. Businesses integrate AI-driven solutions to accelerate product releases and maintain software quality.

The demand for AI-powered IDE extensions and cloud-based coding environments is rising, contributing to the expansion of the market. Growing reliance on AI-based automation across industries is further fostering the adoption of intelligent coding solutions.

Market Driver

"Increasing Focus on Code Security and Compliance"

AI-driven security tools are transforming software development by identifying vulnerabilities, ensuring adherence to coding standards, and automating security checks. Businesses implement AI-powered solutions to detect threats and enforce compliance.

Organizations with stringent regulations integrate AI-driven security within development environments. Automated audits reduce risks from human errors in manual reviews.

These tools assist developers in implementing secure coding techniques, mitigating cyber threats. Rising concerns over software security are driving demand for AI-assisted code analysis, reinforcing market growth.

Market Challenge

"Ensuring Code Accuracy and Security"

A significant challenge hampering the progress of the AI code tools market is maintaining code accuracy and security, as AI-generated code may introduce vulnerabilities or errors. Inaccurate code suggestions and potential security risks can lead to compliance issues and software inefficiencies.

To address this challenge, companies are refining AI models with advanced training on high-quality datasets, real-time security checks, and AI-assisted debugging.

Additionally, they are incorporating AI-powered code review agents to detect vulnerabilities and suggest secure coding practices. Through rigorous testing and continuous model improvement, companies are ensuring reliable and secure AI-driven coding solutions.

Market Trend

"Advancements in Natural Language Processing (NLP) and Machine Learning (ML)"

The AI code tools market is expanding due to advancements in natural language processing (NLP) and machine learning (ML), enabling AI-driven coding assistants to understand developer intent, generate context-aware suggestions, and execute coding tasks autonomously.

Sophisticated AI models analyze vast code repositories, recognize patterns, and refine code quality with minimal human input. As NLP and ML models become more efficient, AI-powered development tools enhance productivity, streamline workflows, and accelerate software deployment.

|

Segmentation |

Details |

|

By Component |

Tools, Services |

|

By Deployment |

Cloud-based, On-premises |

|

By Technology |

Machine Learning, Natural Language Processing, Generative AI |

|

By Application |

Data Science & Machine Learning, Cloud Services & DevOps, Web Development, Mobile App Development, Gaming Development, Embedded Systems, Others |

|

By Vertical |

BFSI, Healthcare, IT & Telecommunications, Government & Defense, Manufacturing, Energy & Utility, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America AI code tools market share stood at around 33.24% in 2023, valued at USD 1424.4 million. North America, a hub for major technology firms such as Microsoft, Google, and Meta, is witnessing widespread adoption of AI-driven coding tools.

These companies leverage AI coding assistants to automate code generation, enhance debugging, and accelerate software deployment. The region’s focus on AI-driven software engineering is fostering innovation in AI-powered IDEs, code review platforms, and autonomous programming agents.

Additionally, the regional market is benefiting from significant venture capital funding and corporate investments in AI-driven code automation startups. Companies such as Sourcegraph, Tabnine, and Replit have secured funding to develop advanced AI coding assistants, accelerating product commercialization.

This financial backing supports innovation in autonomous code generation, real-time collaboration, and AI-driven software optimization.

Asia Pacific AI code tools industry is estimated to grow at a robust CAGR of 24.45% over the forecast period. Asia-Pacific’s major technology hubs, including India, China, and Singapore, are experiencing rapid adoption of AI-driven software development.

IT service providers and tech firms are integrating AI-powered coding tools to automate software creation, optimize debugging, and enhance deployment efficiency. The growing software outsourcing industry and rising investment in AI-based solutions are boosting the demand for AI-enhanced IDEs and intelligent code assistants.

Furthermore, Asia-Pacific’s dominance in 5G and telecom infrastructure is creating the demand for AI-assisted coding solutions. Telecom leaders such as Huawei, NTT Docomo, and Reliance Jio integrate AI code tools to automate network software development, edge computing optimizations, and IoT connectivity. These tools reduce latency, improve security, and accelerate telecom software innovation, fostering regional market expansion.

The AI code tools industry is characterized by a number of market players continously advancing AI-powered coding tools through upgrades and new developments, strengthening their competitive position.

By enhancing AI models for improved code generation, debugging, and review capabilities, companies are optimizing developer workflows and increasing adoption across various industries.

The seamless integration of advanced AI-driven assistants into coding environments highlights the growing emphasis on intelligent automation in software development. These advancements improve efficiency and accuracy , positioning AI code tools as essential for modern programming needs.

Recent Developments (Product Launch)

Frequently Asked Questions