Buy Now

Anti-Microbial Coatings Market Size, Share, Growth & Industry Analysis, By Type (Silver, Copper, Titanium, Zinc, Polymer, Others), By End Use (Building & Construction, Food Processing, Textiles, Home Appliances, Medical & Healthcare, Others), and Regional Analysis 2024-2031

Pages: 120 | Base Year: 2023 | Release: December 2024 | Author: Sunanda G.

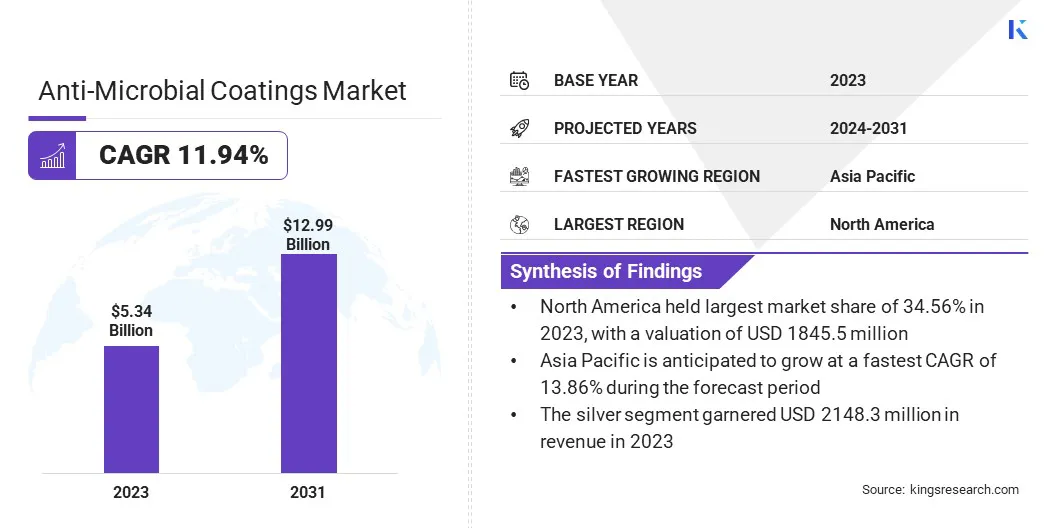

The global antimicrobial coatings market size was recorded at USD 5.34 billion in 2023, which is estimated to be USD 5.90 billion in 2024 and projected to reach USD 12.99 billion by 2031, growing at a CAGR of 11.94% from 2024 to 2031.

The growing emphasis on hygiene and safety across various sectors has significantly accelerated the growth of the antimicrobial coatings market. Additionally, the need to prevent microbial growth on surfaces in healthcare, food processing, and public spaces is increasing.

In the scope of work, the report includes products offered by companies such as PPG Industries, Inc., Axalta Coating Systems, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., RPM International Inc., DuPont, Burke Industrial Coatings, BASF, Sono-Tek Corporation, Arxada Services AG, and others.

Moreover, these coatings offer a reliable solution to minimize the risk of infections and contamination, ensuring safer environments. The heightened awareness around cleanliness, especially in the wake of global health concerns, continues to drive the demand for antimicrobial coatings, making them an essential component in maintaining high hygiene standards.

Antimicrobial coatings are advanced surface treatments designed to prevent the growth and spread of harmful microorganisms, such as bacteria, viruses, fungi, and mold. These coatings are formulated with active agents, including silver, copper, or organic compounds, which disrupt microbial cells and inhibit their reproduction.

Widely applied in healthcare, construction, food processing, and consumer electronics, antimicrobial coatings ensure enhanced hygiene, reduce contamination risks, and improve product durability. By providing a long-lasting protective barrier, these coatings address regulatory requirements and growing consumer demands for safety and infection control. Their versatility and effectiveness make them essential in creating cleaner, safer environments across industries.

The antimicrobial coatings market is experiencing a transformative shift due to advancements in nanotechnology, which are redefining product performance and expanding their application scope. The incorporation of nanoparticles, including silver, copper, and zinc, has significantly enhanced the antimicrobial properties of coatings, enabling prolonged protection and improved efficacy.

These innovations have resulted in thinner, more efficient coatings that cater to industries demanding high-performance infection control solutions. Scientists and industry leaders are collaborating to design and test highly efficient, eco-friendly, and durable coatings with antibacterial, antiviral, and antifungal properties, aiming to mitigate the risk of future microbial infections.

Nanotechnology-driven coatings are becoming a preferred choice, with healthcare, electronics, and construction sectors prioritizing effective pathogen resistance, fostering robust market growth. The integration of nanotechnology positions this market for sustained expansion in the coming years.

The rapid expansion of the healthcare sector is a major driver of the antimicrobial coatings market. With the rising number of healthcare facilities globally, there is an urgent need to control the spread of infections in hospitals, clinics, and medical equipment. Antimicrobial coatings are being increasingly applied to medical devices, hospital surfaces, and protective clothing to reduce the transmission of harmful pathogens.

Moreover, the rising awareness of infections and diseases, particularly healthcare-associated infections (HAIs), is significantly contributing to the growth of the market. These coatings are applied to hospital surfaces, medical devices, and other high-touch areas to reduce the spread of infections.

The growing concern over the impact of microbial resistance and the effectiveness of antimicrobial coatings further encourages their adoption in diverse sectors focused on maintaining public health.

However, high production costs and complexities associated with the formulation of antimicrobial coatings restrain market growth, particularly for small-scale manufacturers. These challenges stem from the use of advanced materials like nanoparticles and stringent regulatory compliance requirements. Companies are investing in research and development (R&D) to optimize production processes and reduce costs to overcome these hurdles.

Strategic partnerships and collaborations with raw material suppliers help streamline supply chains and ensure cost efficiency. Additionally, organizations are focusing on developing eco-friendly formulations to comply with evolving regulations while appealing to environmentally conscious consumers. These approaches are enabling market players to address challenges and drive sustained growth.

The aviation and transportation sectors are increasingly utilizing antimicrobial coatings to ensure passenger safety and comfort. Airlines are applying these coatings to seats, tray tables, and cabin surfaces, while public transport systems are incorporating them in buses, trains, and subways.

The growing usage of antimicrobial coatings is attributed to the rising awareness of hygiene standards among travelers and transportation operators. The application of antimicrobial coatings helps mitigate concerns about the spread of infections in high-traffic environments, supporting market expansion in these sectors.

Additionally, the development and integration of smart antimicrobial coatings are contributing to market growth. These coatings can respond to environmental changes, releasing active agents when needed to combat microbial growth.

The healthcare, textiles, and packaging industries are adopting smart coatings for their advanced capabilities, which include self-healing and prolonged efficacy. The unique functionality of smart coatings makes them highly desirable for applications where long-lasting and adaptive solutions are required, further driving their adoption.

The global market is segmented based on type, end use, and geography.

Based on type, the market is segmented into silver, copper, titanium, zinc, polymer, and others. The silver segment led the antimicrobial coatings market in 2023, reaching the valuation of USD 2.15 billion. Silver ions are highly effective in neutralizing a broad spectrum of pathogens, including bacteria, viruses, and fungi, making them a preferred choice for infection control. Their long-lasting antimicrobial activity ensures prolonged protection, reducing the need for frequent reapplication.

Moreover, silver-based coatings are compatible with diverse substrates, including metals, plastics, and textiles, increasing their usability across the healthcare, electronics, and food processing industries. The rising demand for premium, high-performance antimicrobial solutions, coupled with growing awareness of infection prevention, further strengthens the dominance of the silver segment in the market.

Based on end use, the market is classified into building & construction, food processing, textiles, home appliances, medical & healthcare, and others. The medical & healthcare segment is poised for significant growth at a robust CAGR of 13.39% through the forecast period, due to its critical need for infection prevention and stringent regulatory requirements.

Hospitals, clinics, and diagnostic centers are increasingly relying on antimicrobial coatings to reduce the risk of HAIs, which are a significant concern for patient safety.

These coatings are widely applied on high-touch surfaces, surgical instruments, and medical devices, ensuring a sterile environment and minimizing contamination risks. Rising healthcare expenditures and the growing focus on advanced infection control measures further amplify the demand for antimicrobial coatings.

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America accounted for 34.56% share of the global antimicrobial coatings market in 2023, with a valuation of USD 1.85 billion. The robust growth of the healthcare sector is a significant driver of the market in North America. Increasing investments in hospital infrastructure, the establishment of advanced healthcare facilities, and the rising demand for infection prevention solutions are propelling market growth.

Moreover, the implementation of strict infection control regulations in healthcare settings is a key driver in North America. Regulatory bodies, including the Centers for Disease Control and Prevention (CDC) and the U.S. Food and Drug Administration (FDA), are mandating the use of materials and coatings that minimize HAIs.

Hospitals and clinics are increasingly adopting antimicrobial coatings on medical devices, high-touch surfaces, and protective equipment to comply with these standards and reduce infection risks, fueling market demand.

The antimicrobial coatings market in Asia Pacific is poised for significant growth at a robust CAGR of 13.86% over the forecast period. Asia Pacific is witnessing rapid urbanization and large-scale infrastructure development, creating substantial demand for antimicrobial coatings in construction materials. These coatings are applied to HVAC systems, walls, and flooring in residential, commercial, and public buildings to improve indoor air quality and inhibit microbial growth.

The growing focus on creating hygienic spaces, particularly in urban areas, is driving adoption across the region. Government investments in smart cities and sustainable building projects further amplify market growth.

Additionally, the region is a global hub for the production of smartphones, laptops, and other consumer electronics, where these coatings are used to enhance hygiene and durability. Rising awareness about the importance of antimicrobial protection in daily-use gadgets, coupled with the growing consumer demand for high-performance products, is boosting market growth.

The global antimicrobial coatings market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

Key Industry Developments

By Type

By End Use

By Region

Frequently Asked Questions