Buy Now

Anti-Migrating Agent Market Size, Share, Growth & Industry Analysis, By Type (Non-Ionic, Anionic, Cationic, Amphoteric), By Grade (Technical, Food, Pharmaceutical), By Chemistry (Organic, Inorganic), By Source (Natural, Synthetic), By Application, By End Use Industry, and Regional Analysis, 2024-2031

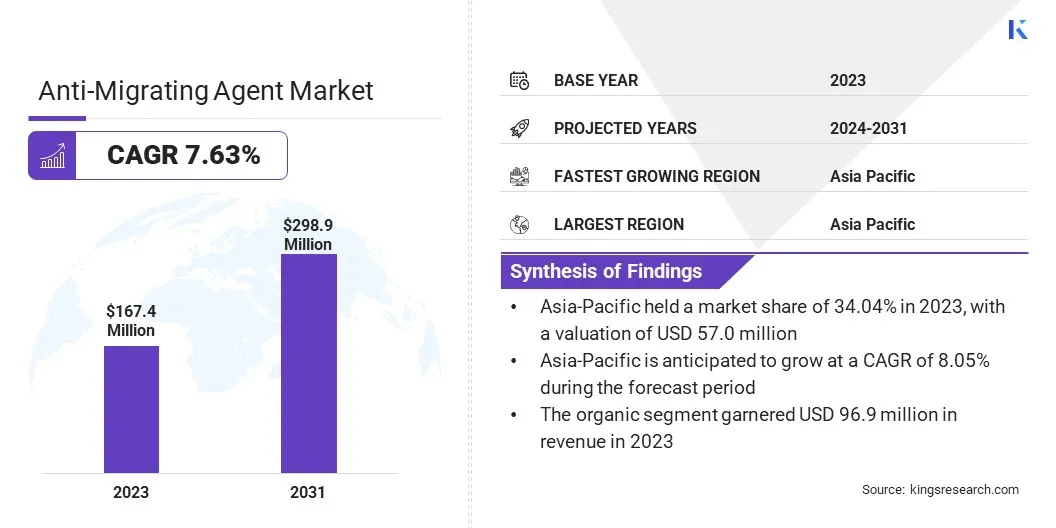

Pages: 260 | Base Year: 2023 | Release: March 2025 | Author: Versha V.

The market involves the production and supply of chemical additives designed to prevent the migration of various substances, such as plasticizers, stabilizers, or other additives, from one part of a material to another.

These agents are primarily used in polymers and plastic products to improve their durability, stability, and performance over time.

The global anti-migrating agent market size was valued at USD 167.4 million in 2023 and is projected to grow from USD 178.6 million in 2024 to USD 298.9 million by 2031, exhibiting a CAGR of 7.63% during the forecast period.

This growth is primarily driven by the increasing demand for high-quality, durable materials across various industries such as packaging, automotive, electronics, and healthcare. Anti-migrating agents are crucial in ensuring the stability and longevity of polymers and plastic products by preventing the migration of additives which can compromise product performance and safety.

Major companies operating in the anti-migrating agent industry are SNF, artience Co., Ltd., Tanatex Chemicals B.V., Shree BS Chemicals, Hangzhou Chungyo Chemicals Co., Ltd., RUDOLF Holding SE & Co. KG, Weifang Ruiguang Chemical Co. Ltd., BEN TECH CHEMICAL, Dymatic Chemicals, Inc., N S CHEMICALS & CONSULTANTS PVT. LTD., BASF, Evonik Industries AG, Asutex, Arkema, and Sarex.

Rising consumer awareness of product quality and safety, along with the expanding need for sustainable and long-lasting materials, is further contributing to the market's growth.

Innovations in material science and stricter regulatory standards for product safety & quality are expected to fuel the demand for anti-migrating agents, positioning them as essential components in the manufacturing of advanced high-performance materials.

Market Driver

Growing Demand for High-performance Materials

Industries such as packaging, automotive, electronics, healthcare, and construction require materials that offer enhanced durability, safety, and functionality. This increases the need for high-performance materials that withstand harsh conditions and have longer lifespans while maintaining their integrity and safety.

Anti-migrating agents prevent the migration of additives, ensuring material stability and product safety. In packaging, these agents prevent harmful chemicals from leaching into food, while in electronics and healthcare, they maintain the performance and safety of components and devices.

The shift toward sustainable practices are driving the demand for eco-friendly anti-migrating agents that meet both performance and environmental goals, further fueling the market.

Market Challenge

Regulatory Compliance and Standards

Regulatory compliance is a major challenge for the anti-migrating agent market, as different regions have varying and strict regulations on chemical use in products. In sectors like food packaging, healthcare, and pharmaceuticals, anti-migrating agents must meet safety standards set by regulatory bodies like the FDA and the EU's REACH.

These regulations ensure that harmful chemicals do not migrate into consumables or medical products. Manufacturers must invest significant resources to ensure compliance, and frequent updates to safety standards add complexity and cost. Navigating these diverse regulations can create barriers for companies expanding into new markets.

Collaborating with regulatory experts and third-party testing organizations can help ensure that products meet the necessary safety and quality requirements. Investing in research and development to create versatile, compliant formulations that can be used across multiple markets can streamline the process.

Manufacturers can also maintain a robust documentation and reporting system to quickly address regulatory inquiries and provide transparency. By prioritizing compliance from the early stages of product development and fostering strong relationships with regulatory bodies, companies can reduce the risk of non-compliance, minimize delays, and navigate diverse regulatory landscapes more effectively.

Market Trend

Shift Toward Sustainable, Bio-based, and Eco-friendly Solutions

Focus on sustainable, bio-based, and eco-friendly solutions is growing in the anti-migrating agent market. Manufacturers are developing anti-migrating agents derived from renewable, non-toxic sources as industries face increasing environmental regulations and consumer demand for greener products.

This trend is particularly significant in sectors like food packaging and healthcare with heightened concerns about chemical safety and environmental impact. Companies are investing in research to create sustainable alternatives that maintain high performance while addressing both safety and sustainability concerns, aligning with global environmental goals and regulatory requirements.

|

Segmentation |

Details |

|

By Type |

Non-ionic , Anionic, Cationic, Amphoteric |

|

By Grade |

Technical, Food, Pharmaceutical |

|

By Chemistry |

Organic, Inorganic |

|

By Source |

Natural, Synthetic |

|

By Application |

Dyeing, Textile Printing, Coatings, Others |

|

By End Use Industry |

Construction, Automotive, Consumer Goods, Electronics, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 34.04% in 2023, with a valuation of USD 57.0 million. The anti-migrating agent market in Asia Pacific is expected to maintain its dominant position, driven by rapid industrialization, a growing manufacturing base, and increasing demand for high-performance materials across diverse sectors such as automotive, packaging, and healthcare.

The region's expanding consumer goods sector in China, India, and Japan, is also contributing to the growth, as consumers become more concerned about product safety and sustainability. Additionally, the rise in government regulations regarding chemical safety, particularly in food packaging and medical applications, is encouraging the adoption of anti-migrating agents.

The anti-migrating agent industry in Europe is poised for significant growth at a robust CAGR of 7.65% over the forecast period, driven by stringent regulatory frameworks and growing consumer demand for safe, sustainable, and high-quality materials.

The European Union's strict regulations on chemical migration, particularly in food packaging and medical products, are pushing manufacturers to adopt anti-migrating agents to ensure compliance with safety standards.

Industries such as automotive, electronics, and healthcare are increasingly relying on advanced polymers and coatings, where anti-migrating agents play a crucial role in maintaining material integrity. The region's focus on sustainability and eco-friendly solutions further boosts the demand for bio-based and non-toxic anti-migrating agents, supporting the overall market growth in Europe.

Major companies focus on expanding their portfolios, improving product performance, and ensuring regulatory compliance, while newer entrants offer sustainable and cost-effective solutions.

Strategic partnerships, mergers, and technological innovations are key to gaining market share and staying ahead of competition. This dynamic environment drives continuous innovation and improvement in anti-migrating agent offerings.

Recent Developments (New Product Launch)

Frequently Asked Questions