Automotive and Transportation

Automotive Chip Market

Automotive Chip Market Size, Share, Growth & Industry Analysis, By Product (Processor & Microcontroller, Analog IC, Discrete Power Device, Logic IC, Sensor, Others), By Vehicle (Passenger Cars, Commercial Vehicles), By Propulsion (IC Engine, Electric), By Application, and Regional Analysis, 2021-2031 2024-2031

Pages : 120

Base Year : 2023

Release : November 2024

Report ID: KR1132

Automotive Chip Market Size

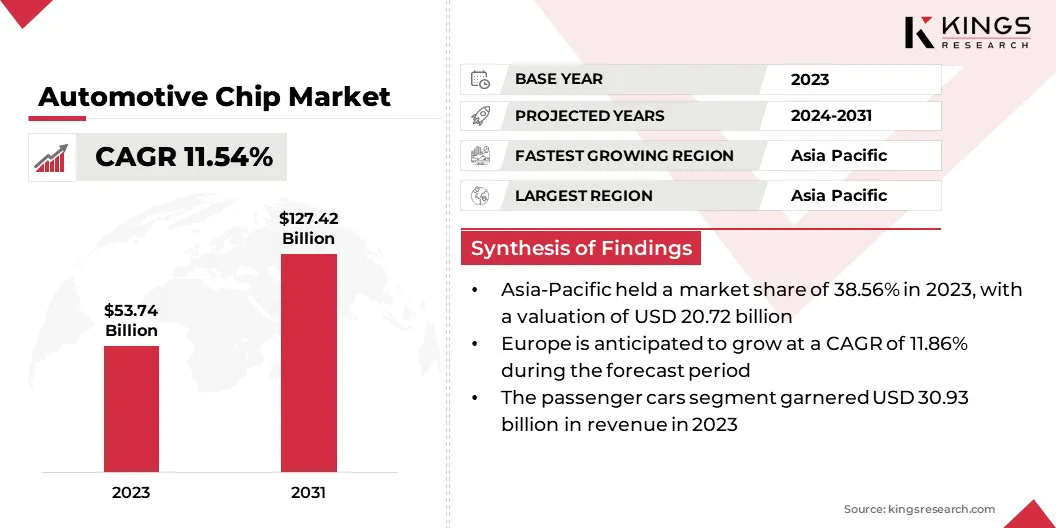

The global automotive chip market size was recorded at USD 53.74 billion in 2023, which is estimated to be valued at USD 59.31 billion in 2024 and projected to reach USD 127.42 billion by 2031, growing at a CAGR of 11.54% from 2024 to 2031. Advancements in autonomous driving technology and expansion of the electric vehicle (EV) infrastructure are fueling the demand for high-performance chips.

In the scope of work, the report includes products offered by companies such as Qualcomm Technologies, Inc., NVIDIA Corporation, Infineon Technologies AG, Intel Corporation, Renesas Electronics Corporation, Arm Limited, NXP Semiconductors, Semiconductor Components Industries, LLC, Analog Devices, Inc., Micron Technology, Inc., and others.

Rapid advancements in autonomous driving technology have significantly increased the demand for high-performance chips, which are pivotal for enabling real-time decision-making and processing vast amounts of sensor data. These chips power the computational backbone of autonomous vehicles (AVs), supporting functionalities such as object detection, route optimization, and vehicle-to-everything (V2X) communication.

Rising investments in this technology by automakers and tech companies have accelerated the development of specialized chips, such as AI-enabled processors and advanced GPUs, that can handle the intricate requirements of autonomous systems.

- For instance, in November 2024, Renesas Electronics unveiled its next-generation automotive fusion system-on-chips (SoCs), targeting ADAS, in-vehicle infotainment (IVI), and gateway applications. The R-Car X5H offers secure, integrated processing across domains using hardware-based isolation technology. Its innovative chiplet design allows for the expansion of AI and graphics capabilities, positioning it as a cutting-edge solution for modern, multi-functional automotive systems.

Governments and private sector players are channeling funds into AV testing and development, creating opportunities for chip manufacturers to innovate further. This trend is particularly pronounced in regions like North America and Asia Pacific, where significant pilot programs and partnerships are underway.

As the autonomous vehicle market matures, the high-performance chip segment is expected to witness exponential growth, driven by the need for more sophisticated computational capabilities to ensure safety, efficiency, and scalability.

Automotive chips, also known as semiconductor devices for vehicles, are specialized electronic components designed to manage and enhance various functionalities within automobiles. These chips act as the central control units for a wide array of systems, including engine management, infotainment, ADAS, and connectivity solutions. Products in this domain include microcontrollers, processors, and sensors, each tailored for specific automotive requirements.

Automotive chips are used in conventional internal combustion engine (ICE) vehicles as well as electric and hybrid vehicles, with the latter seeing an increasing need for chips that support battery management and charging infrastructure. Applications range from safety-critical functions, such as braking and airbag deployment, to luxury features like smart displays and autonomous navigation.

The versatility of automotive chips is driving their adoption across all vehicle categories, enabling automakers to integrate innovative features that enhance driving experiences, improve safety, and comply with stringent environmental regulations. Their critical role underscores their growing significance in the global automotive industry.

Analyst Review

The automotive chip market is witnessing unprecedented growth, driven by the confluence of technological advancements and evolving consumer preferences. Key players in the market are strategically investing in R&D to develop next-generation chips that cater to the increasing demand for electrification, automation, and connectivity.

Partnerships with automakers are emerging as a critical strategy, allowing chip manufacturers to co-develop customized solutions that meet specific performance requirements.

- For instance, in October 2024, Qualcomm partnered with Alphabet's Google to deliver an integrated solution combining chips and software, empowering automakers to develop bespoke AI voice assistants. Leveraging Qualcomm’s technology and Google’s AI capabilities, automakers can create unique voice assistants tailored to their brand that operate independently of a driver’s smartphone, enhancing in-vehicle connectivity and user experience.

The adoption of AI and machine learning is becoming a focal point, enabling companies to create chips with superior processing power and energy efficiency. The market is propelled by heightened EV adoption, the proliferation of ADAS features, and the integration of 5G connectivity in vehicles.

Winning imperatives for companies include scaling production capabilities to address semiconductor shortages, maintaining supply chain resilience, and exploring emerging markets with untapped potential. As the market continues to evolve, innovation and strategic collaborations will remain essential for sustaining competitive advantages and meeting the industry's dynamic demands.

Automotive Chip Market Growth Factors

AVs promise enhanced safety, reduced traffic congestion, and optimized fuel efficiency, fueling consumer and government interest alike.The growing demand for AVs) is reshaping the global automotive landscape, driven by advancements in artificial intelligence (AI), machine learning, and sensor technologies.

This demand has significantly increased the need for cutting-edge chips capable of processing vast amounts of data from cameras, radar, lidar, and ultrasonic sensors in real-time. High-performance processors and AI-enabled chips are critical for enabling precise decision-making and seamless vehicle control in complex environments.

- In May 2023, Porsche partnered with Mobileye to integrate its "SuperVision" technology platform into future models. This collaboration follows Mobileye’s agreement with Geely and aims to implement Level 4 autonomous driving. The platform enables advanced automated assistance and navigation functions, reflecting Porsche’s focus on leveraging cutting-edge technology for enhanced vehicle autonomy and safety.

Automakers and tech companies are accelerating investments in the R&D of AV, with pilot projects and regulatory initiatives emerging globally. This surge is attributed to the growing focus on enhancing road safety and providing an improved driving experience.

As countries move toward adopting smart transportation systems, the AV market creates a substantial growth opportunity for chip manufacturers, particularly in regions with supportive infrastructure and policies for autonomous mobility solutions.

The ongoing semiconductor shortages have emerged as a significant challenge for the global automotive industry, disrupting production schedules and delaying vehicle deliveries. A surge in demand for consumer electronics during the COVID-19 pandemic, coupled with supply chain bottlenecks, created an unprecedented strain on semiconductor manufacturing capacity.

Automotive chips, which are essential for controlling functions such as braking, infotainment, and ADAS, have been particularly affected, causing automakers to scale back production. This challenge has underscored the need for diversification in supply chains and enhanced collaboration with semiconductor manufacturers.

Companies are adopting multi-pronged approaches, including vertical integration, long-term supplier contracts, and investments in domestic semiconductor fabs, to alleviate shortages. Collaboration with governments to incentivize chip production and adopting just-in-case inventory models are further aiding resilience.

Key industry players are fostering partnerships for innovation in chip design to optimize material usage and boost production efficiency, ensuring supply stability and sustained growth in a volatile market.

Automotive Chip Market Trends

The increased focus on ADAS is revolutionizing the automotive industry by enhancing vehicle safety and driving comfort. Features such as adaptive cruise control, automatic emergency braking, lane departure warnings, and blind-spot detection are becoming standard across various vehicle segments. This trend is driven by the growing consumer awareness about vehicle safety and stringent regulations mandating the inclusion of ADAS functionalities in new models.

- For instance, in October 2024, the Partnership for Analytics Research in Traffic Safety (PARTS) released an updated report on ADAS deployment in passenger vehicles. PARTS, a collaboration between automakers and USDOT's NHTSA, revealed that by the 2023 model year, 10 of 14 ADAS features achieved over 50% market penetration, with five exceeding 90%, signaling significant adoption of safety-enhancing technologies.

Automotive chips play a pivotal role in enabling these systems, processing data from multiple sensors and cameras to provide real-time insights and control. The trend is further amplified by the push for semi-autonomous and autonomous driving capabilities, which rely heavily on ADAS as foundational technologies.

Chip manufacturers are increasingly developing specialized processors and AI-powered solutions to cater to the growing demand for high-precision data processing. As automakers compete to offer differentiated ADAS features, this focus creates lucrative opportunities for semiconductor companies, ensuring sustained innovation and market growth.

Segmentation Analysis

The global market has been segmented based on product, vehicle, propulsion, application, and geography.

By Product

Based on product, the market has been segmented into processor & microcontroller, analog IC, discrete power device, logic IC, sensor, and others. The processor and microcontroller segment's dominance, capturing a 26.12% market share in 2023, is largely attributed to their critical role in modern automotive systems.

Microcontrollers and processors are the brains behind essential vehicle functions, ranging from engine control and transmission management to advanced safety features and infotainment systems. Their ability to handle complex computations and manage real-time data processing makes them indispensable for vehicles with ADAS and EV powertrains.

The growing adoption of EVs and hybrid vehicles has further fueled the demand for microcontrollers designed for battery management systems, energy optimization, and precise motor control. Additionally, advancements in semiconductor technologies, including the development of energy-efficient and high-performance processors, have enabled automakers to incorporate more sophisticated functionalities into vehicles.

The demand for powerful, multi-core processors and microcontrollers continues to rise as automotive manufacturers increasingly integrate connected and autonomous features, cementing their position as a cornerstone of automotive innovation.

By Vehicle

Based on vehicle, the market has been classified into passenger cars and commercial vehicles. The anticipated CAGR of 11.81% of the commercial vehicles segment during the forecast period underscores its growing role in driving the automotive chip market. This growth is propelled by the rising adoption of advanced technologies in trucks, buses, and delivery vehicles to enhance safety, efficiency, and connectivity.

Governments across the globe are enforcing stringent emission regulations, compelling fleet operators to adopt electric and hybrid commercial vehicles that require sophisticated chipsets for energy management, telematics, and autonomous driving functionalities.

The increasing demand for logistics and e-commerce services has further emphasized the need for smart commercial vehicles equipped with GPS tracking, route optimization, and load management systems, all of which depend on high-performance chips. Moreover, technological advancements in ADAS for commercial vehicles, such as collision avoidance and adaptive cruise control, are driving significant chip adoption.

The integration of AI and IoT in fleet management solutions further supports the segment's robust growth trajectory, making it a vital contributor to the overall market.

By Application

Based on application, the market has been divided into powertrain, safety, body electronics, chassis, and telematics & infotainment. The body electronics segment led the automotive chip market in 2023, reaching a valuation of USD 20.18 billion is primarily driven by the increasing integration of electronic components in vehicle systems to enhance convenience, safety, and personalization.

This segment includes key systems such as power windows, climate control, lighting, keyless entry, and seat adjustment mechanisms, which are now standard features in most modern vehicles. The rising consumer demand for comfort-oriented and smart features, particularly in mid-range and luxury vehicles, has significantly boosted the adoption of body electronics.

Additionally, the shift toward electric and hybrid vehicles has amplified the need for efficient electronic systems to optimize energy consumption while providing advanced functionality. Automakers are leveraging advancements in semiconductor technologies to create compact, energy-efficient body control modules that support connectivity and remote operation.

The growing trend of vehicle customization, combined with stringent regulatory requirements for safety and emissions, has further accelerated investments in body electronics, solidifying its position as a key revenue driver in the automotive chip market.

Automotive Chip Market Regional Analysis

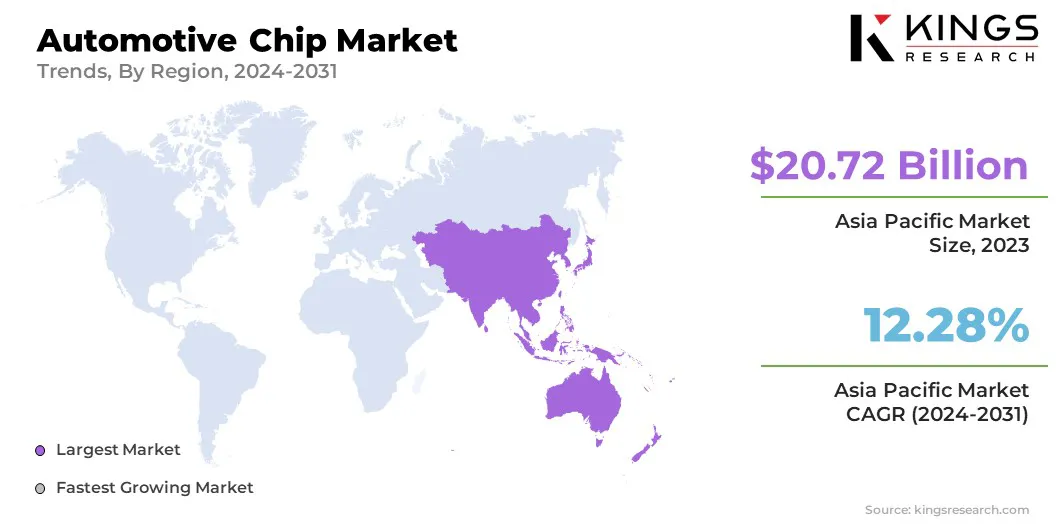

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East, and Africa, and Latin America.

Asia Pacific dominated the global automotive chip market in 2023, accounting for 38.56% of the market share and achieving a valuation of USD 20.72 billion. This robust market position is attributed to the region's thriving automotive manufacturing hubs, particularly in China, Japan, and South Korea. These countries house major automakers and semiconductor manufacturers, enabling seamless integration of automotive chips into vehicle production.

The growing adoption of electric and hybrid vehicles in the region, spurred by government incentives and stringent emission norms, has significantly increased the demand for advanced chips tailored to EV powertrains, battery management systems, and infotainment technologies.

- In September 2024, SiliconAuto, an automotive technology company backed by Foxconn, inaugurated its R&D center in Bengaluru. This facility will specialize in semiconductor product design and system-on-chip (SoC) development for the automotive industry. The center, which is part of the joint venture between Stellantis NV and Hon Hai Technology Group, reflects SiliconAuto's dedication to advancing innovation and shaping a smarter, safer future for transportation.

Furthermore, the increasing focus on smart vehicles equipped with connectivity features and ADAS is driving innovation in automotive semiconductors. Countries like India are emerging as key players, with rising vehicle production and increasing investment in automotive technology. This dynamic ecosystem, coupled with a high concentration of R&D activities, ensures that Asia Pacific remains a critical growth engine for the global market.

The automotive chip market in Europe is poised to expand at a robust CAGR of 11.86% in the coming years, fueled by the region's strong emphasis on technological advancements and sustainability. As a leader in EV adoption, Europe has witnessed significant growth in the demand for chips tailored to EV-specific functionalities, such as battery management, charging infrastructure, and energy optimization.

The region is also at the forefront of integrating ADAS and AV technologies, further boosting the need for high-performance automotive semiconductors. Stringent regulatory requirements for safety and emissions are driving automakers to incorporate cutting-edge electronic systems, enhancing the appeal of chips that enable these features. Additionally, Europe is home to key players in the semiconductor industry, fostering innovation and local supply chain resilience.

Initiatives such as the European Union’s push for semiconductor self-sufficiency and the development of chip manufacturing facilities underscore the region’s commitment to ensuring sustained growth in the automotive chip market.

Competitive Landscape

The global automotive chip market report will provide valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Automotive Chip Market

- Qualcomm Technologies, Inc.

- NVIDIA Corporation

- Infineon Technologies AG

- Intel Corporation

- Renesas Electronics Corporation

- Arm Limited

- NXP Semiconductors

- Semiconductor Components Industries, LLC

- Analog Devices, Inc.

- Micron Technology, Inc.

Key Industry Developments

- January 2024 (Launch): Intel announced plans to advance its "AI Everywhere" strategy in the automotive sector, including acquiring Silicon Mobility, a fabless company specializing in . Intel also launched AI-enhanced, software-defined vehicle SoCs, with Zeekr as the first OEM partner to deliver generative AI-powered in-vehicle experiences.

- January 2024 (Launch): Texas Instruments launched groundbreaking automotive semiconductors, including the AWR2544 millimeter-wave radar sensor chip for improved ADAS decision-making and software-programmable driver chips, for supporting functional safety in battery systems. These innovations, showcased at CES 2024, aim to enhance autonomy and safety in modern vehicles.

- January 2023 (Partnership): NVIDIA and Foxconn announced a strategic partnership to develop automated and AV platforms. Foxconn will produce ECUs featuring NVIDIA DRIVE Orin and Hyperion sensors for high-autonomy capabilities. This collaboration strengthens Foxconn’s intelligent driving solutions, advancing energy-efficient, AV technologies globally.

The global automotive chip market has been segmented as:

By Product

- Processor & Microcontroller

- Analog IC

- Discrete Power Device

- Logic IC

- Sensor

- Others

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Propulsion

- IC Engine

- Electric

By Application

- Powertrain

- Safety

- Body Electronics

- Chassis

- Telematics & Infotainment

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)