Aerospace and Defense

Autonomous Aircraft Market

Autonomous Aircraft Market Size, Share, Growth & Industry Analysis, By Type (Unmanned Aerial Vehicles (UAVs), Urban Air Mobility (UAM), Commercial Aircraft), By Use Case (Surveillance and Monitoring, Cargo Delivery, Passenger Transportation), By Application (Military and Defense, Civil and Commercial) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR475

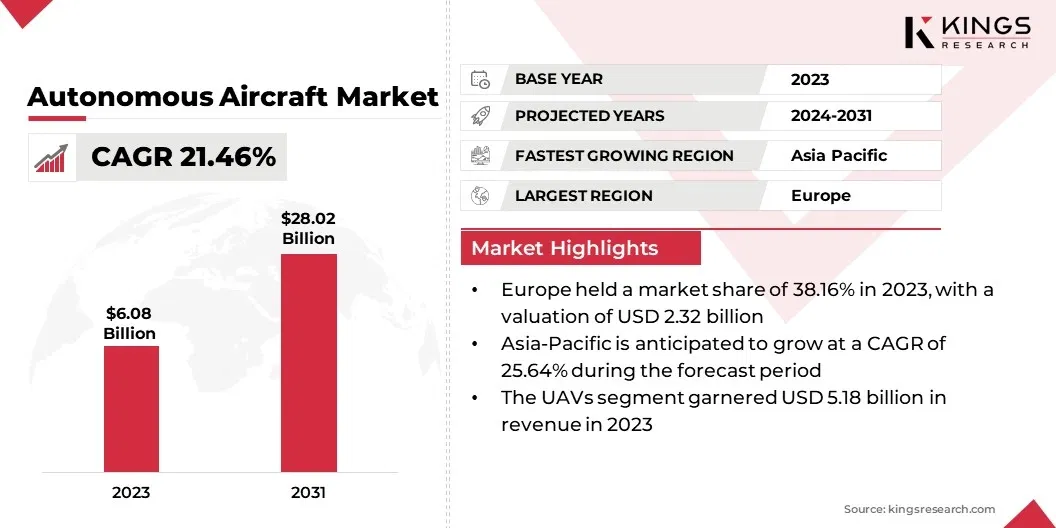

Autonomous Aircraft Market Size

The global Autonomous Aircraft Market size was valued at USD 6.08 billion in 2023 and is projected to reach USD 28.02 billion by 2031, growing at a CAGR of 21.46% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Boeing Company, Airbus SE, Northrop Grumman Corporation, Lockheed Martin Corporation, General Atomics Aeronautical Systems, Inc., Textron Inc., Thales Group, Raytheon Technologies Corporation, BAE Systems plc, DJI Technology Co., Ltd. and Others.

In 2023, the global market perspective for autonomous aircraft is shaped prominently by ongoing technological advancements, notably in artificial intelligence (AI), sensor technologies, and communication systems. These innovations are pivotal in propelling the capabilities and efficiency of autonomous aircraft to new heights. The integration of advanced AI algorithms enables these aircraft to make real-time decisions, adapt to dynamic environments, and enhance overall performance.

Breakthroughs in sensor technologies, including radar, lidar, and high-resolution cameras, contribute to improved navigation, obstacle detection, and surveillance capabilities. Furthermore, advancements in communication systems facilitate seamless data transfer and connectivity, enabling autonomous aircraft to operate efficiently in diverse scenarios.

This technological momentum not only fosters the development of cutting-edge military applications but also drives the expansion of commercial applications, including urban air mobility and cargo delivery, shaping the autonomous aircraft market landscape in 2023.

Analyst’s Review

The autonomous aircraft market is expected to experience significant growth between 2024 and 2031. The predominant trend driving market progress is the integration of advanced artificial intelligence (AI) algorithms, which will enable autonomous aircraft to make real-time decisions, learn from their surroundings, and adapt to dynamic environments. This is anticipated to enhance the autonomy of these aircraft and improve their operational efficiency and safety.

The surge in energy storage innovations will revolutionize the endurance and range of autonomous aircraft. This will address one of the critical limitations in the industry, offering extended flight durations and increased operational flexibility.

The emergence of sophisticated air traffic management systems that are tailored specifically for autonomous vehicles will ensure the safe and efficient integration of autonomous aircraft into existing airspace. These trends foreshadow a dynamic and groundbreaking period for the autonomous aircraft market, with a shift toward more sustainable and high-performance energy storage solutions, as well as robust air traffic management solutions to facilitate the seamless coexistence of autonomous aircraft.

Market Definition

Autonomous aircraft, also known as unmanned aerial vehicles (UAVs) or drones, refer to aircraft that operate without direct human control on board. These vehicles can be piloted remotely or operated autonomously through pre-programmed flight plans or artificial intelligence algorithms. They find applications in various sectors, including military, commercial, and recreational purposes, offering capabilities ranging from surveillance and monitoring to cargo delivery and passenger transportation.

The regulatory landscape for autonomous aircraft is a critical aspect that shapes their deployment and operation. Various countries and international bodies have established regulations to ensure the safe and responsible use of these unmanned systems. For instance, in the United States, the Federal Aviation Administration (FAA) plays a central role in regulating drone operations through Part 107 of the Federal Aviation Regulations, outlining rules for commercial drone use.

In Europe, the European Union Aviation Safety Agency (EASA) has implemented regulations such as the Specific Operations Risk Assessment (SORA) framework for assessing the safety of specific drone operations. Additionally, the International Civil Aviation Organization (ICAO) provides global standards and guidelines to harmonize regulations for autonomous aircraft on an international scale.

As the industry evolves, collaboration between regulatory bodies, industry stakeholders, and advancements in regulatory frameworks is likely to be crucial to ensuring the safe and widespread integration of autonomous aircraft into airspace.

Autonomous Aircraft Market Dynamics

The growing interest in urban air mobility (UAM) is a significant factor driving the growth of the aerospace market. This interest is fueled by the growing need to alleviate urban traffic congestion and improve transportation efficiency. The development of autonomous passenger drones for short-distance, point-to-point flights within urban and suburban areas is a key focus of the market. Additionally, the indispensable role of autonomous aircraft in military applications is another influential driver.

These aircraft play a vital role in military operations, providing strategic advantages in reconnaissance, surveillance, and tactical capabilities, while also enhancing operational effectiveness and reducing risks to human lives. The burgeoning interest in UAM and the deployment of autonomous aircraft in military contexts are driving transformative advancements in the aerospace sector.

The market for autonomous aircraft faces significant regulatory challenges that may hinder its widespread adoption across diverse applications, ranging from commercial drones to urban air mobility. The challenge arises from the need to integrate these innovative vehicles into existing airspace frameworks, which were primarily crafted with human-piloted aircraft in mind. The unique characteristics of autonomous aircraft demand a nuanced approach to safety, navigation, and airspace management. The lack of clear and universally accepted regulations may impede the growing utilization of autonomous aircraft.

Collaborative efforts between industry stakeholders, governmental bodies, and international aviation organizations become imperative to surmount these regulatory challenges and pave the way for the seamless integration of autonomous aircraft into global airspace systems.

The autonomous aircraft market is poised to observe massive growth opportunities, driven by a rapid surge in commercial drone applications, where the commercial sector is witnessing expansive growth across diverse domains such as agriculture, infrastructure inspection, and filmmaking. Simultaneously, the development of hybrid-electric aircraft introduces an avenue to bolster sustainability and extend the operational range of autonomous platforms, in keeping with the global push toward greener aviation solutions.

Another noteworthy opportunity lies in collaborations and partnerships between technology firms, aerospace manufacturers, and regulatory bodies. Such strategic alliances foster innovation and create avenues for the development of comprehensive and standardized solutions, thereby ensuring a harmonized approach to addressing challenges and promoting the widespread integration of autonomous aircraft across various sectors.

The autonomous aircraft market faces significant challenges related to security and cyber threats, as these innovative vehicles become more interconnected. With heightened connectivity comes an increased vulnerability to potential cyberattacks, necessitating robust security measures to safeguard these systems.

The integration of sophisticated communication technologies and the reliance on data links for real-time decision-making create entry points for malicious actors seeking unauthorized access or control. Ensuring the resilience of autonomous aircraft systems against cyber threats is imperative to prevent unauthorized interference, protect sensitive data, and maintain the safety and integrity of operations.

Segmentation Analysis

The global autonomous aircraft market is segmented based on type, use case, application, and geography.

By Type

Based on type, the autonomous aircraft market is segmented into unmanned aerial vehicles (UAVs), urban air mobility (UAM), and commercial aircraft. The UAVs segment demonstrated robust growth, generating an impressive revenue of USD 5.18 billion in 2023. This growth can be attributed to the versatile applications of UAVs across military, commercial, and recreational sectors. Their pivotal role in surveillance, reconnaissance, and the growing demand for commercial drone services, including agriculture and infrastructure inspection, contributed significantly to the segment expansion. As UAV technology continued to evolve, the market witnessed increased adoption, which drove substantial revenue growth in 2023.

By Use Case

Based on use case, the autonomous aircraft market is classified into surveillance and monitoring, cargo delivery, and passenger transportation. The surveillance and monitoring segment secured a substantial market share of 65.12% in 2023 due to its critical role in various applications. UAVs have become indispensable in providing real-time data for security, law enforcement, and environmental monitoring. The prevalent need for advanced surveillance capabilities across military and civilian domains has supported the segment's dominance. This widespread adoption underscores the pivotal role of autonomous aircraft in addressing evolving security challenges and monitoring requirements, contributing significantly to their market share.

By Application

Based on application, the autonomous aircraft market is classified into military and defense, and civil and commercial. The military and defense segment is poised to dominate the market between 2024 and 2031, projecting an impressive CAGR of 25.11%. This robust growth is mainly fueled by the escalating demand for autonomous aircraft in military operations, where UAVs play a pivotal role in reconnaissance, surveillance, and tactical applications. The segment's dominance is further backed by ongoing advancements in technology, enhancing the strategic advantages these autonomous systems offer in modern warfare scenarios.

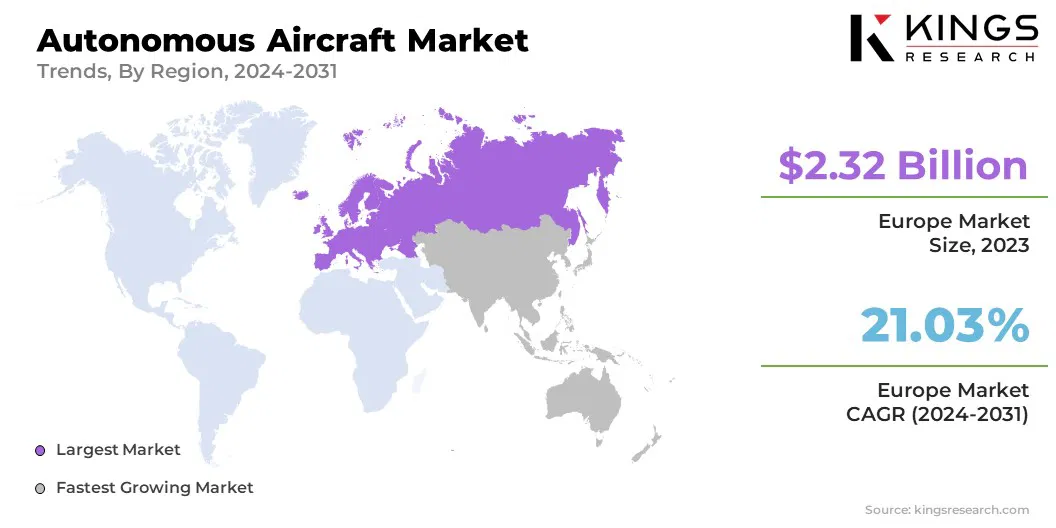

Autonomous Aircraft Market Regional Analysis

Based on region, the global autonomous aircraft market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Autonomous Aircraft Market share stood around 38.16% in 2023 in the global market, with a valuation of USD 2.32 billion. This dominance can be attributed to a combination of factors, including a strong focus on technological innovation, supportive regulatory frameworks, and significant investments in research and development.

The European region has seen robust adoption of autonomous aircraft across military, commercial, and urban air mobility applications, positioning it as a key region in shaping the growth trajectory of the autonomous aircraft market. The region's commitment to advancing aerospace technologies and fostering a conducive environment for autonomous systems contributed significantly to its remarkable revenue generation in 2023.

The Asia-Pacific region is positioned for remarkable growth in the autonomous aircraft market between 2024 and 2031, showcasing an impressive CAGR of 25.64%. This surge is fueled by various factors, including increasing investments in cutting-edge aerospace technologies, a rising demand for unmanned systems in military applications, and a growing focus on urban air mobility solutions. As countries in the region actively embrace the potential of autonomous aircraft across diverse sectors, this robust CAGR underscores its pivotal role in shaping the future landscape of autonomous aviation

Competitive Landscape

The global autonomous aircraft market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments involve a range of strategic initiatives including, investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Autonomous Aircraft Market

- Boeing Company

- Airbus SE

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- General Atomics Aeronautical Systems, Inc.

- Textron Inc.

- Thales Group

- Raytheon Technologies Corporation

- BAE Systems plc

- DJI Technology Co., Ltd.

Key Industry Developments

- December 2023 (Partnership): Autonomous aviation leaders Daedalean and Xwing announced a strategic partnership to advance AI capabilities in the industry. This collaboration aimed to enhance autonomous flight systems, integrating Daedalean's expertise in AI for safety-critical applications with Xwing's cutting-edge autonomous flight technology. Together, they accelerated the development and deployment of safe and efficient autonomous aviation solutions, marking a significant milestone in the evolution of AI-driven technologies in the aviation sector.

- November 2023 (Launch): Airbus launched an Autonomous Aircraft Division in the USA, concentrating on military unmanned aerial vehicles (UAVs). The division aimed to advance autonomous technologies for defense applications, encompassing intelligence, surveillance, reconnaissance, and other military operations. Airbus' strategic move aligned with the growing demand for innovative military UAV solutions and strengthened the company's position in the autonomous aircraft market, particularly in the United States.

The global Autonomous Aircraft Market is segmented as:

By Type

- Unmanned Aerial Vehicles (UAVs)

- Urban Air Mobility (UAM)

- Commercial Aircraft

By Use Case

- Surveillance and Monitoring

- Cargo Delivery

- Passenger Transportation

By Application

- Military and Defense

- Civil and Commercial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)