Energy and Power

Back Contact Solar Cells Market

Back Contact Solar Cells Market Size, Share, Growth & Industry Analysis, By Technology (PERC (Passivated Emitter and Rear Contact), IBC (Interdigitated Back Contact), HJT (Heterojunction Technology), Other Technologies), By End User (Residential, Commercial, Industrial, Utility-scale projects), By Application, and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : March 2025

Report ID: KR1456

Market Definition

Back contact solar cells are a type of photovoltaic (PV) cell with all electrical contacts placed on the rear side of the cell, eliminating front-side metal contacts that obstruct sunlight and reduce efficiency.

This design improves light absorption, enhances efficiency, and provides a cleaner aesthetic, making it ideal for applications requiring high-performance solar energy conversion. Notable examples include interdigitated back contact (IBC) and metal wrap-through (MWT) solar cells.

Back Contact Solar Cells Market Overview

The global back contact solar cells market size was valued at USD 456.8 million in 2023 and is projected to grow from USD 486.1 million in 2024 to USD 781.3 million by 2031, exhibiting a CAGR of 7.01% during the forecast period.

The growth of the market is driven by increasing demand for high-efficiency solar technologies and advancements in manufacturing processes. These cells offer superior energy conversion rates and enhanced aesthetics, making them ideal for residential, commercial, and industrial applications.

Additionally, supportive government policies, including tax incentives and renewable energy targets, are fostering investments and accelerating the adoption of back contact solar cells globally.

Major companies operating in the global back contact solar cells industry are SunPower Corporation, Panasonic Holdings Corporation, LG Electronics, Trina Solar Limited, LONGi, JinkoSolar, JA Solar Technology Co., Ltd., Hanwha Q CELLS, Motech Industries Inc., Solar Holdings AS, Mitsubishi Electric Corporation, KYOCERA Corporation, Wuxi Suntech Power Co., Ltd., Risen Energy Co., Ltd., KYOCERA Corporation, and others.

Government policies and incentives are fostering the growth of market. Tax credits, feed-in tariffs, and subsidies promote solar adoption, while regulations on carbon emissions and energy efficiency boost demand for advanced photovoltaic solutions.

Utility-scale solar projects benefit from performance-based incentives, favoring back contact solar cells for their higher energy yields. Compliance with renewable energy targets further bolsters market expansion.

- The 7th Session of the International Solar Alliance (ISA), held in New Delhi in November 2024, focused on accelearting solar energy deployment , particularly in regions with limited energy access. Key discussions covered initiatives, programs, and funding schemes aimed at supporting solar energy projects and strenghthening global collaboration.

Key Highlights:

- The global back contact solar cells market size was recorded at USD 456.8 million in 2023.

- The market is projected to grow at a CAGR of 7.01% from 2024 to 2031.

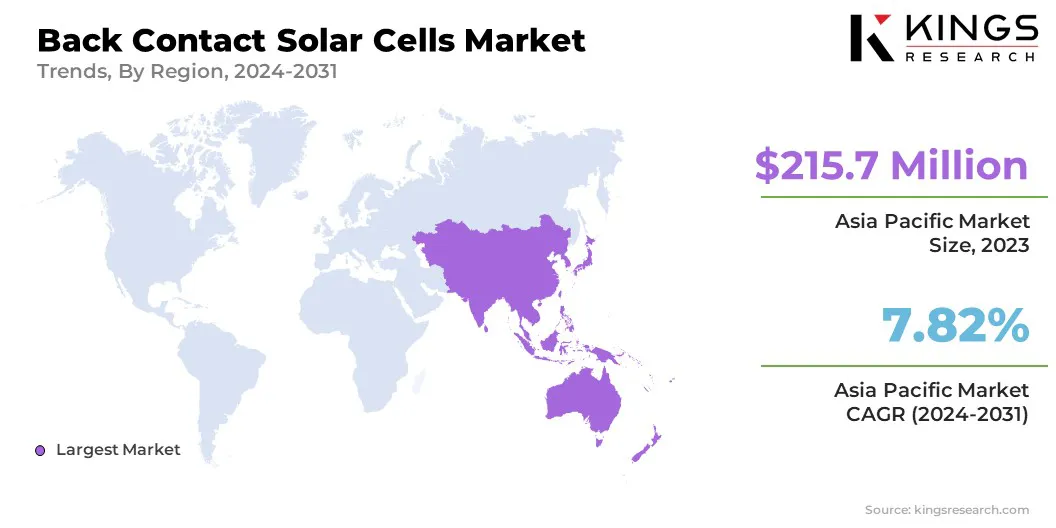

- Asia Pacific held a share of 47.21% in 2023, valued at USD 215.7 million.

- The PERC (Passivated Emitter and Rear Contact) segment garnered USD 183.3 million in revenue in 2023.

- The utility-scale projects segment is expected to reach USD 395.1 million by 2031.

- The solar power generation segment is set to grow a robust CAGR of 7.45% through the forecast period.

- North America is anticipated to grow at a CAGR of 6.98% over the forecast period.

Market Driver

"Growth in Distributed Solar Power Installations"

The adoption of distributed solar energy systems is rising, mainly due to increasing energy independence and grid decentralization. Residential and commercial rooftop installations require high-efficiency solar panels to maximize power generation in limited spaces.

The growth of back contact solar cells market benefits from this adoption, as these cells enable superior space utilization and higher energy output per unit area. The demand for back-contact solar technology is further strengthened by businesses and homeowners investing in solar energy storage and off-grid solutions.

- In July 2023, the International Energy Agency (IEA) reported in its latest Renewable Energy Market Update that distributed PV is expected to grow significantly, reaching 140 gigawatts in 2024, marking an increase of over 30% from 2022.

Market Challenge

"High Manufacturing Costs and Material Limitations"

A major challenge hindering the growth of the back contact solar cells market is the high manufacturing costs associated with complex production processes and the use of advanced materials. These solar cells require precision engineering and specialized equipment, increasing production expenses. Additionally, reliance on costly or limited raw materials introduces supply chain risks.

To address these challenges, companies are investing in laser-enhanced manufacturing, optimizing material usage, and developing cost-effective alternatives. Strategic partnerships and increased production capacity are leading to cost reductions, making back contact solar cells more commercially viable while maintaining high efficiency and performance standards.

Market Trend

"Technological Advancements in Photovoltaic Manufacturing"

Continuous advancements in photovoltaic manufacturing enhance the efficiency and affordability of back contact solar cells, emerging asd a key market trend. Research and development efforts focus on improving material quality, optimizing production processes, and reducing fabrication costs.

Innovations in interdigitated back contact (IBC) and metal wrap-through (MWT) technologies enhance electron transport, boosting energy output. The development of automation and precision engineering in solar cell production increases scalability.

Reduced production costs make high-performance back contact solar cells more accessible, boosting their adoption across residential, commercial, and industrial applications.

According to the latest World Economic Forum report, recent advancements in solar technology have emerged through perovskites, a class of crystalline compounds considered highly promising for solar panels.

Their ability to absorb different colors in the solar spectrum allows them to generate more power when paired with materials like silicon. In a recently published study in Nature, China-based solar module manufacturer LONGi detailed its progress in developing perovskite-silicon tandem solar cells, which enhance efficiency by layering an ultra-thin perovskite cell over a conventional silicon cell.

Back Contact Solar Cells Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

PERC (Passivated Emitter and Rear Contact), IBC (Interdigitated Back Contact), HJT (Heterojunction Technology), Other Technologies |

|

By End User |

Residential, Commercial, Industrial, Utility-scale projects |

|

By Application |

Solar Power Generation, Off-Grid Systems, BIPV (Building Integrated Photovoltaics) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Technology (PERC (Passivated Emitter and Rear Contact), IBC (Interdigitated Back Contact), HJT (Heterojunction Technology), and Other Technologies): The PERC (Passivated Emitter and Rear Contact) segment earned USD 183.3 million in 2023 due to its superior efficiency, cost-effectiveness, and widespread adoption in utility-scale and residential solar installations, making it a preferred choice for manufacturers and investors seeking high-performance and commercially viable solar solutions.

- By End User (Residential, Commercial, Industrial, and Utility-scale projects): The utility-scale projects segment held a share of 49.04% of the market in 2023, propelled by increasing investments in large-scale solar farms, higher energy yield per module, and growing government incentives supporting high-efficiency solar technologies for grid integration.

- By Application (Solar Power Generation, Off-Grid Systems, and BIPV (Building Integrated Photovoltaics)): The solar power generation segment is likely to grow at a CAGR of 7.45% through the forecast period, largely attributed to its high energy conversion efficiency, increasing adoption in utility-scale and rooftop solar projects, and growing investments supported by government incentives and renewable energy targets.

Back Contact Solar Cells Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific back contact solar cells market accounted for a substantial share of around 47.21% in 2023, valued at USD 215.7 million. Governments across Asia Pacific are promoting solar energy adoption through favorable policies, investments, and incentives.

Countries such as China, India, Japan, and Australia implement feed-in tariffs, tax benefits, and renewable energy targets. Initiatives such as China’s 14th Five-Year Plan and India’s PM-KUSUM scheme support advanced solar technologies, including back contact solar cells. Regulatory mandates for renewable energy further bolster regional market growth.

- According to the report published by the Ministry of New and Renewable Energy report in November 2024, Asia Pacific led global solar investments, allocating USD 223 billion to the sector in 2023.

Additionally, Asia Pacific is home to major solar manufacturers such as LONGi, JinkoSolar, Trina Solar, and JA Solar, which invest heavily in research and development to enhance solar cell efficiency and scalability. A well-established supply chain, coupled with advancements in photovoltaic manufacturing, fuether fuels the adoption of back contact solar cells in the region.

North America back contact solar cells industry is estimated to grow at a CAGR of 6.98% over the forecast period. Supportive policies at federal, state, and local levels are fostering this growth.

The U.S. Inflation Reduction Act (IRA) provides tax credits, production incentives, and funding for clean energy projects, promoting investment in high-efficiency solar technologies and dmestic production. Additionally, net metering policies, state-level Renewable Portfolio Standards (RPS), and Solar Investment Tax Credits (ITC) support market expansion across the U.S. and Canada.

- The U.S. has implemented tariffs on imported solar components to protect domestic industries. As of January 2025, tariffs on solar wafers and polysilicon imports from China have increased from 25% to 50%. State-level regulations also play a significant role; for instance, Texas has introduced legislative proposals to enhance consumer protection and industry standards in the residential solar sector.

Furthermore, large-scale solar farms are contributing significantly to regional market growth. Developers prioritize high-performance solar modules to maximize energy yields and improve project economics.

The efficiency advantages of back contact solar cells make them an attractive choice for utility-scale installations, particularly in regions with strong solar incentives, such as California, Texas, and Florida.

Regulatory Frameworks

- In the U.S., the Inflation Reduction Act (IRA) of 2022 offers substantial tax credits and incentives for clean energy projects, including advanced solar technologies such as back contact solar cells. This legislation aims to bolster domestic manufacturing and reduce reliance on imports. Additionally, .

- In Europe, the Net-Zero Industry Act, introduced as part of the Green Deal Industrial Plan, aims to scale up the manufacturing of clean technologies within the EU. This legislation seeks to simplify regulatory frameworks, accelerate project approvals, and set ambitious targets, such as achieving at least 40% of annual deployment needs for net-zero technologies by 2030.

- China provides significant subsidies to its solar industry, promoting domestic manufacturing and the export of solar components. This aggressive support has positioned China as a leading global supplier of solar technologies. However, these policies have also led to global trade tensions and protective measures from other countries aiming to shield their domestic industries from competitive pricing.

- Effective June 2026, India mandates that clean energy projects utilize solar photovoltaic modules made from domestically produced cells. This policy aims to reduce dependence on imports, particularly from China, and bolster local manufacturing. To support this initiative, India has imposed tariffs on imported solar components and offers incentives for domestic production. Major companies like Tata Power and Reliance Industries are investing in expanding India's solar cell manufacturing capacity in response to these regulations.

Competitive Landscape

The global back contact solar cells market is characterized by a number of participants, including both established corporations and emerging players. Market participants are focusing on innovation and the development of new products. Companies are investing in advanced research to enhance efficiency, durability, and cost-effectiveness.

Strategic collaborations, technology upgrades, and next-generation product launches are enabling businesses to differentiate themselves in the market. By integrating cutting-edge materials and optimizing manufacturing processes, key players are strengthening their market position while meeting the increasing demand for high-performance solar energy solutions.

- In November 2024, Longi introduced a heterojunction back-contact solar cell with 27.3% efficiency, leveraging laser-enhanced manufacturing to lower material costs and enhance performance. This innovation presents a scalable, high-efficiency solar technology while minimizing dependence on rare materials.

List of Key Companies in Back Contact Solar Cells Market:

- SunPower Corporation

- Panasonic Holdings Corporation

- LG Electronics

- Trina Solar Limited

- LONGi

- JinkoSolar

- JA Solar Technology Co., Ltd.

- Hanwha Q CELLS

- Motech Industries Inc.

- Solar Holdings AS

- Mitsubishi Electric Corporation

- KYOCERA Corporation

- Wuxi Suntech Power Co., Ltd.

- Risen Energy Co., Ltd.

- KYOCERA Corporation

Recent Developments (Expansion/Product Launch)

- In January 2025, Aiko Solar commenced production at its Jinan facility, its third manufacturing site for n-type all-back-contact solar modules. Designed with a total capacity of 30 GW for solar cells and panels, the plant's first 10 GW phase is expected to achieve full-scale output by late 2025.

- In December 2024, Trina Solar announced that its large-area n-type total passivation (TOPAS) solar cell, utilizing heterojunction (HJT or SHJ) technology, reached a 27.08% efficiency, setting a new benchmark for front and back contact solar cells. This marks the first instance of a crystalline silicon solar cell with a front and back contact structure surpassing 27% efficiency on the front side.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years