Buy Now

Body-Worn Camera Market Size, Share, Growth & Industry Analysis, By Resolution (HD (High Definition - 720p), Full HD (FHD - 1080p), 4K (Ultra HD)), By Mounting Type (Body Mount, Head Mount, Shoulder Mount), By End-User Industry (Law Enforcement, Military & Defense, Others), and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

A body-worn camera is a small video recording device typically attached to a person’s clothing, helmet or eyewear to capture audio and visual footage from the wearer’s point of view. These cameras are widely used by law enforcement, security personnel and emergency responders to enhance transparency, accountability, and evidence collection during interactions or operations.

The market encompasses a range of products with varying features, including high-definition video, GPS tracking, cloud connectivity, and real-time streaming capabilities.

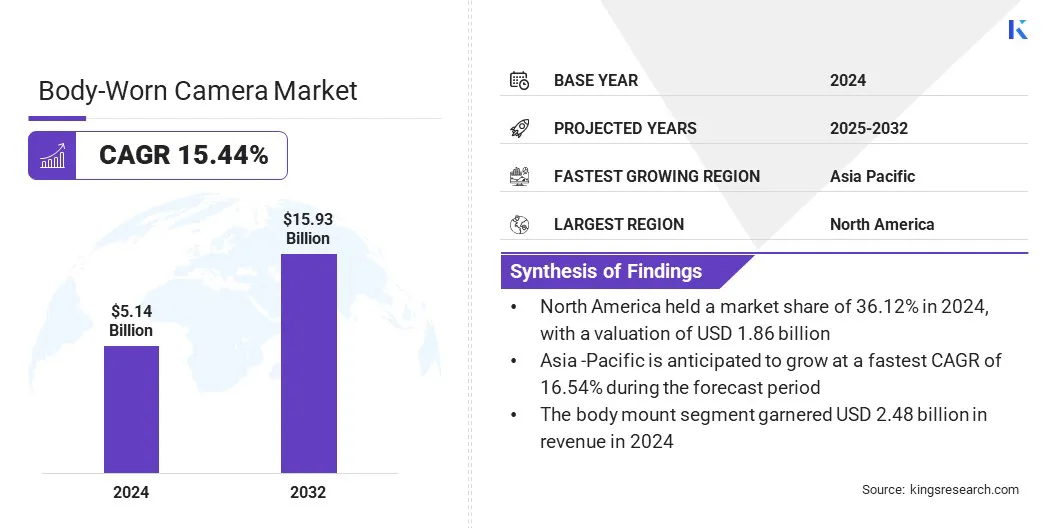

The global body-worn camera market size was valued at USD 5.14 billion in 2024 and is projected to grow from USD 5.83 billion in 2025 to USD 15.93 billion by 2032, exhibiting a CAGR of 15.44% during the forecast period.

The market growth is attributed to the rising concerns over frontline worker safety in high-interaction environments which are prompting increased adoption of body-worn cameras for real-time monitoring and evidence capture. The market is further progressing as organizations are strengthening their safety frameworks with wearable technologies that offer real-time visibility and reliable evidence which is driving broader adoption across commercial and institutional settings.

Major companies operating in the global body-worn camera market are Motorola Solutions, Inc., Digital Ally Inc., GETAC, Reveal Media Limited, Utility Associates, Inc, GoPro Inc., Transcend Information, Inc., Safe Fleet, Pinnacle Response Ltd, Pro-Vision, Wolfcom Enterprises, Shenzhen RECODA Technologies Limited, Hangzhou Hikvision Digital Technology Co., Ltd., Hytera Communications Corporation Limited and HALOS.

Technological advancements in wearable imaging are fueling the growth of the body-worn camera market by enabling high-resolution video capture with smarter functionality and compact durable designs. Features like modular lens systems auto-detection capabilities and extended battery life are making these devices more suitable for a wide range of operational environments.

These improvements are enhancing usability and supporting real-time awareness while improving the effectiveness of evidence collection. Sectors such as law enforcement, healthcare and retail are increasingly adopting body-worn cameras to strengthen safety improve accountability and support operational efficiency.

Increasing Government Funding for Law Enforcement Modernization

Increasing government funding for law enforcement modernization is accelerating the adoption of body-worn cameras across government agencies. Public safety departments are receiving targeted financial support to equip officers with advanced body-worn cameras that enhance transparency, accountability and operational efficiency. This shift toward digital policing solutions supports the growing public demand for responsible surveillance practices.

Authorities are actively allocating state-level grants to help agencies overcome budgetary constraints and meet evolving operational standards through the integration of wearable video technology. This financial backing is enabling widespread deployment of body-worn cameras across urban and rural jurisdictions, in turn driving body-worn camera market growth.

Privacy Concerns and Data Protection Regulations

Privacy concerns and data protection regulations are creating operational hurdles for agencies deploying body-worn cameras as they must navigate complex legal frameworks while maintaining transparency and accountability.

Agencies face challenges in ensuring that footage is recorded stored and accessed without violating individual privacy rights in public spaces. The lack of uniform standards increases the risk of misuse and noncompliance, which results in legal consequences and resistance from both officers and the public.

To address these challenges, companies are developing body-worn cameras with built-in encryption secure cloud storage and role-based access controls to prevent unauthorized viewing and sharing.

They are also integrating automated redaction tools to blur faces and sensitive information in footage before release to protect individual privacy and comply with data protection regulations during evidence sharing or public disclosure. These innovations help agencies meet legal requirements maintaining the public trust and ensuring the responsible use of surveillance technology.

Expansion Beyond Law Enforcement

The use of body-worn cameras is expanding beyond traditional law enforcement applications. The adoption of advanced body-worn cameras is increasing in sectors such as healthcare, logistics, private security, and retail to enhance employee safety, accountability, and incident documentation.

In high-risk customer-facing environments, body cameras are helping reduce workplace violence and improve transparency. Integration with real-time monitoring and evidence tools is enhancing oversight and extending their value across non-policing safety and accountability use cases.

|

Segmentation |

Details |

|

By Resolution |

HD (High Definition - 720p), Full HD (FHD - 1080p), 4K (Ultra HD) |

|

By Mounting Type |

Body Mount, Head Mount, Shoulder Mount |

|

By End-User Industry |

Law Enforcement, Military & Defense, Commercial & Industrial, Emergency Services (Fire & EMS), Sports & Leisure |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the global body-worn camera market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America body-worn camera market accounted for a share of 36.12% in 2024, with a valuation of USD 1.86 billion. The region's dominance is attributed to the strong presence of major public safety technology providers and a growing focus by law enforcement agencies and government bodies on real-time operational capabilities that enable agencies to monitor incidents more effectively.

Law enforcement agencies are expanding adoption to improve transparency, public trust, and surveillance capabilities. Additionally, the increasing deployment of real-time crime centers by regional law enforcement agencies aiming to centralize data streams enhance situational awareness and improve response coordination during active incidents, is further driving market growth.

Agencies are actively adopting technologies with live streaming and location tracking features, accelerating the integration of connected surveillance infrastructure across the region.

The Asia Pacific body-worn camera market is set to grow at a robust CAGR of 16.54% over the forecast period. This growth is attributed to the increasing adoption of surveillance technology across public safety agencies in the region. Law enforcement agencies in this region are actively deploying advanced body-worn cameras to enhance monitoring, ensure accountability and support transparent field operations.

Real-time data transmission becomes a priority for police forces to strengthen on-ground response and operational oversight. Additionally, national procurement initiatives that equip officers with connected cameras to enable real-time awareness and improve public safety are driving maket growth.

Governments are integrating these devices with centralized monitoring systems to enhance transparency and decision-making, thereby contributing to the region's market growth.

Major players in the body-worn camera market are focusing on advancing imaging technology by integrating AI capabilities to enhance video clarity and performance. They are investing in partnerships that improve lens quality and enable high-resolution capture for more accurate and detailed footage.

Manufacturers are embedding adaptive imaging systems that automatically adjust exposure, focus and stabilization based on the environment to ensure consistent video quality across varying light conditions and dynamic scenarios. Additionally, they are designing compact and lightweight devices that integrate easily into daily operations without hindering mobility while maintaining real-time communication.

Frequently Asked Questions