Buy Now

Car as a Connected Living Ecosystem Market Size, Share, Growth & Industry Analysis, By Connectivity Solution (Embedded, Tethered, Integrated), By Technology (3G/4G/LTE, 5G, Satellite), By Application (Industrial Use, Power Generation, Transportation, Petrochemical Industry, Other), By End User, and Regional Analysis, 2024-2031

Pages: 210 | Base Year: 2023 | Release: March 2025 | Author: Sunanda G.

The market encompasses the integration of advanced digital technologies, IoT connectivity, and AI-driven systems into vehicles, transforming them into intelligent, interactive environments.

This market focuses on embedding in-vehicle infotainment, telematics, V2X communication, and smart cabin solutions that enhance user experience, safety, and automation. Vehicles function as personalized digital hubs, utilizing cloud-based services, real-time navigation, and predictive analytics to optimize performance and convenience.

Applications span autonomous driving, remote diagnostics, over-the-air (OTA) software updates, and seamless device synchronization, catering to evolving consumer expectations for connected mobility and redefining transportation through enhanced digital interactions.

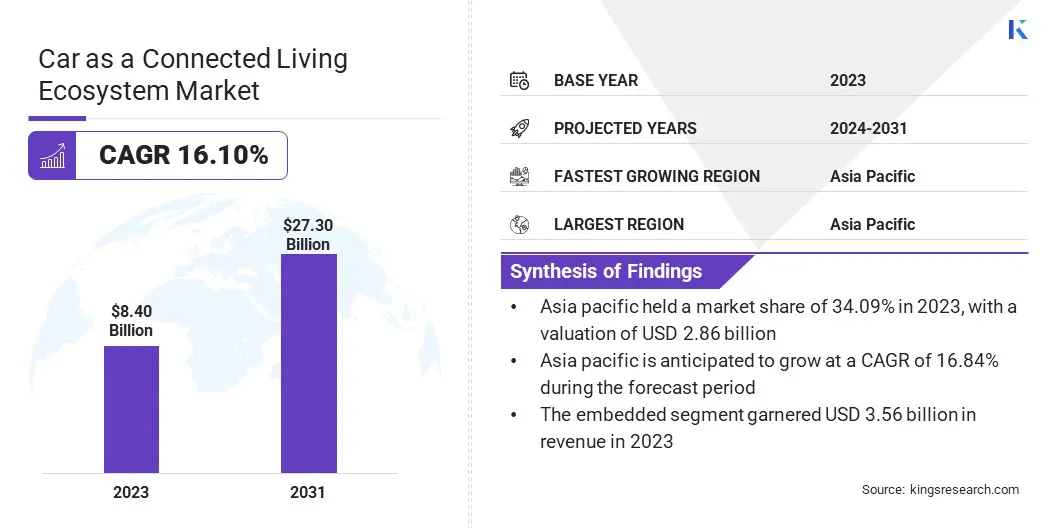

The global car as a connected living ecosystem market size was valued at USD 8.40 billion in 2023 and is projected to grow from USD 9.60 billion in 2024 to USD 27.30 billion by 2031, exhibiting a CAGR of 16.10% during the forecast period.

The market is driven by advancements in vehicle-to-everything (V2X) communication and AI-powered infotainment systems. Automakers are integrating real-time data exchange, enhancing safety, traffic efficiency, and seamless connectivity.

Additionally, the rising consumer demand for personalized in-vehicle experiences is accelerating the adoption of smart cabins, enabling voice assistants, IoT integration, and immersive entertainment, further strengthening market expansion.

Major companies operating in the car as a connected living ecosystem industry are General Motors Company (GM), Tesla, Inc., Toyota Motor Corporation, Volkswagen Group, Robert Bosch GmbH, Continental AG, DENSO CORPORATION, Samsung Electronics Co., Ltd. (HARMAN International), Qualcomm Technologies, Inc., AT&T Intellectual Property., Visteon Corporation, Mobileye, Xiaomi, Ford Motor Company, and BMW AG.

Consumers increasingly prefer immersive and interactive driving experiences, driving automakers to enhance infotainment systems with AI-powered voice assistants, real-time navigation, and cloud-based entertainment.

Integration with platforms such as Apple CarPlay, Android Auto, and Amazon Alexa is improving user engagement while enabling personalized content recommendations. Automakers are expanding subscription-based services, providing continuous software enhancements and exclusive digital offerings.

The shift toward connected infotainment solutions is increasing collaborations between automotive and technology companies, strengthening the market by elevating user expectations and promoting digital integration in vehicles.

Market Driver

"Advancements in IoT and 5G Connectivity"

The integration of IoT and 5G technology is transforming the automotive industry by enabling seamless real-time communication between vehicles, infrastructure, and cloud-based platforms. Faster data transmission enhances vehicle-to-everything (V2X) communication, remote diagnostics, and predictive maintenance, leading to improved efficiency and safety.

Automakers are leveraging high-speed connectivity to introduce AI-driven infotainment, personalized user experiences, and over-the-air (OTA) software updates. The rising adoption of smart transportation solutions and government initiatives promoting intelligent mobility are further accelerating the demand for connected vehicles, contributing to the growth of the car as a connected living ecosystem market.

Market Challenge

"Data Security and Privacy Concerns"

The expansion of the car as a connected living ecosystem market faces a significant challenge in ensuring data security and privacy. The risk of cyber threats and unauthorized access is rising with vehicles constantly exchanging data through V2X communication, cloud platforms, and IoT networks.

Companies are implementing robust cybersecurity frameworks, including end-to-end encryption, blockchain-based security, and AI-driven anomaly detection systems.

Automakers are also collaborating with cybersecurity firms to enhance threat response mechanisms and comply with stringent data protection regulations. These proactive measures are strengthening consumer confidence and driving the secure adoption of connected vehicle technologies.

Market Trend

"Expansion of Vehicle-to-Everything (V2X) Communication"

The growing adoption of V2X technology is enhancing vehicle interaction with surrounding environments, including other vehicles, pedestrians, and infrastructure. Real-time data sharing enables predictive safety measures, collision avoidance, and dynamic traffic routing.

Automakers are integrating V2X solutions to improve road safety and enhance autonomous vehicle decision-making. Government initiatives promoting intelligent transportation systems are accelerating the deployment of V2X technology.

The expansion of this communication framework is playing a crucial role in the development of the car as a connected living ecosystem market by strengthening real-time connectivity and improving mobility efficiency.

|

Segmentation |

Details |

|

By Connectivity Solution |

Embedded, Tethered, Integrated |

|

By Technology |

3G/4G/LTE, 5G, Satellite |

|

By Application |

Industrial Use, Power Generation, Residential & Commercial, Transportation, Petrochemical Industry |

|

By End User |

Original Equipment Manufacturers (OEMs), Aftermarket |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific region accounted for 34.09% share of the car as a connected living ecosystem market in 2023, with a valuation of USD 2.86 billion. Asia Pacific is registering extensive deployment of 5G networks, enabling seamless connectivity for smart mobility solutions.

Countries like China, Japan, and South Korea are leading in 5G adoption, creating a robust digital infrastructure for vehicle-to-everything (V2X) communication. Automakers and telecom providers are collaborating to enhance real-time data exchange, autonomous driving capabilities, and in-vehicle infotainment experiences.

The integration of low-latency, high-speed connectivity is accelerating the adoption of connected vehicle technologies, fueling the market across the region.

Additionally, governments across Asia Pacific are heavily investing in smart city development, integrating connected mobility solutions to improve urban transportation. Countries like Singapore, China, and India are implementing AI-powered traffic management systems, vehicle-to-infrastructure (V2I) communication, and real-time navigation solutions.

Policies promoting intelligent transportation networks, automated toll collection, and connected public transit are fostering the adoption of smart vehicles. These initiatives are positioning Asia Pacific as a key hub for connected automotive technologies, strengthening the market.

The car as a connected living ecosystem industry in North America is poised for significant growth at a robust CAGR of 16.26% over the forecast period. Governments and private sector players in North America are heavily investing in smart transportation initiatives and autonomous vehicle (AV) testing programs.

States like California, Texas, and Michigan are leading in AV policy development, enabling real-world trials of connected and self-driving vehicles. Companies such as Tesla, General Motors, and Ford are integrating AI-driven automation, V2I connectivity, and edge computing to enhance vehicle intelligence.

The growing focus on intelligent transportation systems is driving the adoption of connected car technologies, strengthening the market in North America.

Leading automotive manufacturers in North America are forming strategic alliances with technology firms to accelerate innovation in connected mobility. Companies such as Ford, General Motors, and Stellantis are collaborating with Microsoft, Qualcomm, and NVIDIA to develop AI-powered driving systems, advanced telematics, and edge computing solutions.

These partnerships are enabling real-time data processing, predictive analytics, and cybersecurity enhancements, strengthening the region’s connected automotive ecosystem. The continuous integration of cutting-edge technologies is driving the market.

The car as a connected living ecosystem industry is characterized by several participants, that are adopting strategies focused on technological advancements in personal vehicles to realign their autonomous driving strategies, enhancing vehicle intelligence, safety, and connectivity.

These efforts include integrating AI-driven driver assistance systems, sensor fusion technologies, and over-the-air (OTA) software updates to improve autonomous functionalities. Automakers and tech companies are also investing in advanced LiDAR, radar, and high-definition mapping to refine self-driving capabilities.

These innovations are streamlining autonomous vehicle deployment while improving user experience and safety, strengthening the adoption of connected and self-driving vehicles. Such strategic advancements are accelerating the growth of the market.

Recent Developments (Product Launch)

Frequently Asked Questions