Advanced Materials and Chemicals

Carbon Fiber Market

Carbon Fiber Market Size, Share, Growth & Industry Analysis, By End-use Industry (Aerospace and Defense, Automotive, Wind Turbines, Others), By Type (High-strength Carbon Fiber, High-modulus Carbon Fiber, Intermediate Modulus Carbon Fiber), By Raw Material and Regional Analysis, 2024-2031

Pages : 148

Base Year : 2023

Release : December 2024

Report ID: KR1147

Carbon Fiber Market Size

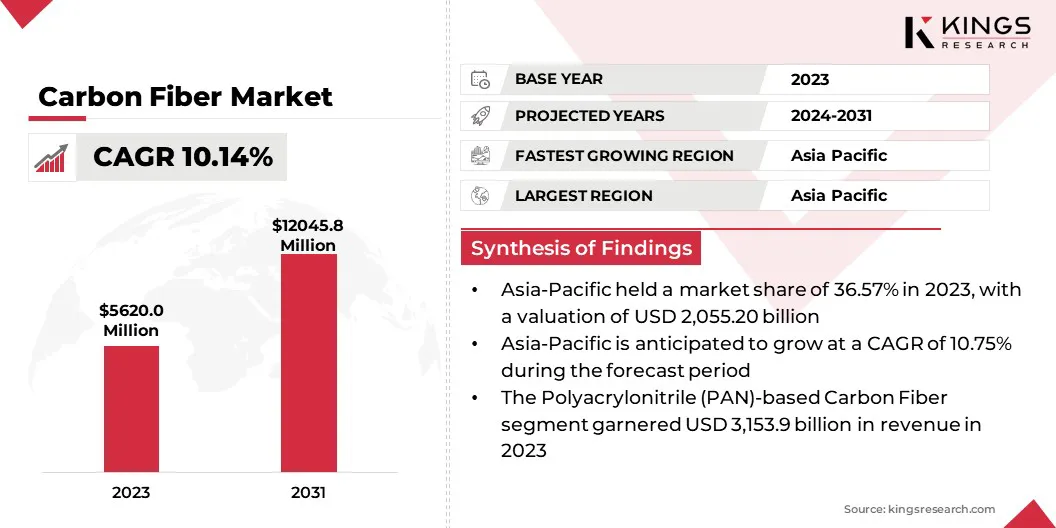

The global carbon fiber market size was valued at USD 5,620.0 in 2023 and is projected to grow from USD 6,128.2 million in 2024 to USD 12,045.8 million by 2031, exhibiting a CAGR of 10.14% during the forecast period.

The market is expected to grow significantly, due to its versatile nature and wide range of applications across industries like aerospace, automotive, sports equipment, medical devices, civil engineering, and industrial sectors.

In the scope of work, the report includes products offered by companies such as TEIJIN LIMITED, SGL Carbon, TORAY INDUSTRIES, INC., Hexcel Corporation, Mitsubishi Chemical Corporation, DowAksa, KUREHA CORPORATION, Formosa Plastics Corporation, Jiangsu Hengshen Co. Ltd, NIPPON STEEL Chemical & Material Co., Ltd, and others

The carbon fiber market is growing, due to the strong, stiff, and lightweight properties of carbon fiber, making it ideal for use in aerospace, automotive, military, and recreational applications. Carbon fiber is produced by twisting carbon filaments, which are woven into cloth or molded with resin.

Surface treatments, like oxidation, enhance bonding properties. Despite its benefits, carbon fiber is susceptible to breaking under compression, impact, or machining, which creates weak points. However, surface treatments like oxidation and plasma treatments can improve the bonding properties of carbon fibers.

Ongoing research aims to reduce production costs, improve recycling methods, and explore new applications. As these advancements continue, the demand for carbon fiber is expected to rise, expanding its market potential.

The market involves the production and supply of carbon fiber, a material known for its strength, stiffness, and lightweight properties. This material is widely used in various end-use industries, such as automotive, where it helps improve fuel efficiency by reducing vehicle weight.

In the aerospace sector, carbon fiber is used to create durable aircraft components, enhancing performance and reducing weight. In the renewable energy industry, carbon fiber plays a crucial role in improving the performance of wind turbines. Additionally, it is used in construction to strengthen materials like concrete and steel, as well as in sports equipment and consumer electronics.

The market is driven by the increasing demand for lightweight, durable, and high-performance materials. The market is further segmented by types of carbon fiber and raw materials, catering to the diverse needs of these industries.

Analyst’s Review

The carbon fiber market is growing rapidly, due to the material's unique properties, including strength, lightweight nature, corrosion resistance, low thermal expansion, and flexibility. As a result, the demand for carbon fiber is increasing across the automotive, aerospace, renewable energy and construction sectors.

This, in turn, is driving innovation and advancements in product development and manufacturing processes. These attributes make it highly suitable for use in automotive, aerospace, renewable energy, and construction sectors, where performance and durability are key factors playing crucial role for the market growth.

Manufacturers are leveraging these characteristics to design lighter, more efficient products, from vehicles to wind turbines and aircraft parts. Additionally, the ability of carbon fiber to block radio frequencies and dampen vibrations is driving its use in consumer electronics and military applications.

To stay competitive, manufacturers are focusing on strategies like cost-effective production methods, improving recycling technologies, and enhancing product innovation to meet growing demand and expand market reach.

- A study published in October 2024 by the Journal of the American Chemical Society indicates that researchers from the University of Southern California have developed a process to recycle carbon fiber into reusable materials. This innovation addresses the recycling of carbon fiber, a significant challenge.

Carbon Fiber Market Growth Factors

The carbon fiber market is set for significant growth, due to several key factors. The high-performance, lightweight properties of carbon fiber make it ideal for use in aerospace, automotive, and sports equipment industries, where reduced weight and enhanced durability are crucial.

Technological advancements in manufacturing have lowered production costs, while improved recycling techniques make carbon fiber more accessible and sustainable. Government regulations promoting eco-friendly solutions are also accelerating its adoption.

Additionally, the growing demand for commercial aviation and aerospace, fueled by globalization and increased financial resources, is further driving the use of carbon fiber in aircraft construction.

- In April 2023, Solvay and GKN Aerospace renewed their partnership highlighting the growing demand for carbon fiber-based thermoplastic composites in aerospace. This collaboration drives innovation in lightweight, cost-effective materials, boosting themarket, especially in high-rate production for commercial aviation.

The carbon fiber market faces several challenges, including high costs, limited raw material availability, and recycling difficulties. The expensive nature of carbon fiber restricts its use to high-end applications like luxury cars, especially in the automotive industry.

Additionally, the volatile supply of raw materials disrupts production and increases costs. Recycling remains a significant challenge, with few facilities to process composite waste effectively.

Solutions to these issues include developing cost-efficient manufacturing technologies, diversifying raw material sources, and investing in advanced recycling techniques to make carbon fiber more affordable, accessible, and sustainable for broader applications.

Carbon Fiber Industry Trends

The demand for lightweight materials, particularly carbon fiber, has surged in industries where performance, fuel efficiency, and reduced weight are critical. Aerospace and automotive sectors are key drivers of this demand, as lightweight materials like carbon fiber help improve fuel efficiency, reduce emissions, and enhance overall performance.

In the aerospace industry, carbon fiber is used in aircraft components, offering strength without the added weight of traditional metals. Similarly, in the automotive industry, lightweight carbon fiber components are increasingly being used in high-performance and some luxury vehicles to optimize fuel economy and handling.

As sustainability and energy efficiency become more pressing, industries are looking for materials that can deliver superior performance while also meeting environmental goals, making carbon fiber a prime solution.

- Lamborghini, through a collaboration with Boeing and the Advanced Composite Structures Laboratory, has developed carbon fiber technology, reinforcing its leadership in using lightweight composites for luxury vehicles, while enhancing performance and innovation.

Advancements in manufacturing technologies are playing a critical role in the growth of the carbon fiber market. Over the years, innovations in carbon fiber production have enabled more efficient and cost-effective manufacturing.

These advancements allow for the creation of carbon fiber components with improved precision, quality, and scalability, making them more accessible for mass production. As manufacturing processes become more streamlined, carbon fiber is increasingly being incorporated in different industries.

The use of technology also supports high-rate manufacturing, meeting the growing demand for carbon fiber. Ultimately, these improvements make carbon fiber more viable for widespread use and help reduce production costs, driving the market's expansion.

Segmentation Analysis

The global market is segmented based on end-use industry, type, raw materials, and geography.

By End-use Industry

Based on end-use industry, the market is segmented into aerospace and defense, automotive, wind turbines, sports equipment and others. The aerospace and defense segment led the carbon fiber market in 2023, reaching the valuation of USD 2,037.8 million.

Carbon fiber is widely used in the aerospace and defense industries, due to its unique combination of lightweight, high-strength properties, which are essential for high-performance applications in aircraft, missile components, and satellites.

The continuous innovation in aircraft design and materials has led to an increasing demand for fuel-efficient, high-performance aircraft, where carbon fiber plays a crucial role in reducing weight while maintaining strength and durability.

Additionally, military applications require materials that are both lightweight and tough, making carbon fiber an ideal choice for creating durable, reliable components. Technological advancements and stringent requirements for advanced materials ensure carbon fiber's growing prominence in these sectors.

- In May 2024, India announced plans to begin manufacturing T100 carbon fiber, crucial for the defense, aerospace, and civil engineering sectors. This initiative is a collaboration between Bhabha Atomic Research Centre (BARC), Hindustan Aeronautics Limited (HAL), and MIDHANI.

By Type

Based on type, the market is segmented into high-strength carbon fiber, high-modulus carbon fiber and intermediate modulus carbon fiber. The high-strength carbon fiber segment secured the largest revenue share of 42.41% in 2023. High-strength carbon fiber is commonly used across various industries, due to its superior tensile strength, which provides high impact resistance and durability.

Its versatility makes it suitable for applications in automotive, aerospace, sports equipment, and construction, where lightweight yet strong materials are essential. Additionally, it offers a cost-effective alternative to high-modulus fibers, making it more accessible for a broader range of industries.

As the demand for durable and lightweight materials increases, particularly in emerging markets like Asia Pacific, the affordability and performance of high-strength carbon fiber continue to drive its widespread adoption in numerous sectors.

By Raw Material

Based on raw material, the market is bifurcated into polyacrylonitrile (PAN)-based carbon fiber and pitch-based carbon fiber. The polyacrylonitrile (PAN)-based carbon fiber segment is poised for significant growth, expanding at a CAGR of 10.48% through the forecast period.

PAN-based carbon fiber is widely used as a raw material, due to its superior mechanical properties, including high strength, tensile strength, modulus, and excellent thermal stability. These attributes make it ideal for a wide range of applications, from aerospace and automotive to sports equipment and leisure products, where performance and durability are essential.

The material’s versatility allows it to be tailored for different uses, while well-established manufacturing processes contribute to cost-effectiveness. These mature, efficient processes, combined with economies of scale, make PAN-based carbon fiber a preferred choice in industries seeking high-performance, reliable materials at a competitive cost.

Carbon Fiber Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The carbon fiber market in Asia Pacific accounted for 36.57% share of the global market in 2023, with a valuation of USD 2,055.2 million. Asia Pacific is a dominant region in the market, due to rapid industrialization and urbanization, particularly in countries like China, India, and South Korea.

These countries witnessed increasing demand for lightweight, high-strength materials in key sectors like automotive, aerospace, and wind energy, where carbon fiber plays a critical role. Additionally, government support for research and development (R&D), renewable energy, and infrastructure development is fueling the adoption of advanced materials.

The carbon fiber market in North America is poised for significant growth over the forecast period, expanding at a CAGR of 10.28%. This is attributed to its robust aerospace and defense sectors, where the U.S. plays a leading role, in driving substantial demand for high-performance materials. The region is also a hub for automotive innovation, with a strong focus on lightweight, fuel-efficient vehicles, further boosting carbon fiber usage.

Significant investments in R&D are advancing carbon fiber technologies, while government initiatives supporting advanced materials and manufacturing technologies are fostering market expansion. The growing demand for fuel-efficient and lightweight vehicles, alongside these key factors, positions North America for continued growth in the market.

Competitive Landscape

The global carbon fiber market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Carbon Fiber Market

- TEIJIN LIMITED

- SGL Carbon

- TORAY INDUSTRIES, INC.

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- DowAksa

- KUREHA CORPORATION

- Formosa Plastics Corporation

- Jiangsu Hengshen Co.,Ltd

- NIPPON STEEL Chemical & Material Co., Ltd

Key Industry Developments

- June 2024 (Funding): Carbon Revolution plc secured an agreement with Orion Infrastructure Capital (OIC) for a funding of USD USD 25 million in five tranches. This funding will support the company’s capacity expansion to meet the growing demand from OEM customers as it scales the production of carbon fiber wheels.

- March 2024 (Expansion): Jindal Advanced Materials (JAM) partnered with Italy's MAE S.p.A to establish a carbon fiber plant with an annual capacity of 3,500 metric tons, expanding production capabilities.

The global carbon fiber market is segmented as:

By End-use Industry

- Aerospace and Defense

- Automotive

- Wind Turbines

- Sports equipment

- Others

By Type

- High-strength Carbon Fiber

- High-modulus Carbon Fiber

- Intermediate Modulus Carbon Fiber

By Raw Material

- Polyacrylonitrile (PAN)-based Carbon Fiber

- Pitch-based Carbon Fiber

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years