Buy Now

Card Market Size, Share, Growth & Industry Analysis, By Type (Financial Cards, Retail & Gas Cards, Transportation, Gift Cards, Government/Health Care Card, Others), By Material (Plastic, Metal) and Regional Analysis, 2024-2031

Pages: 120 | Base Year: 2023 | Release: March 2024 | Author: Antriksh P.

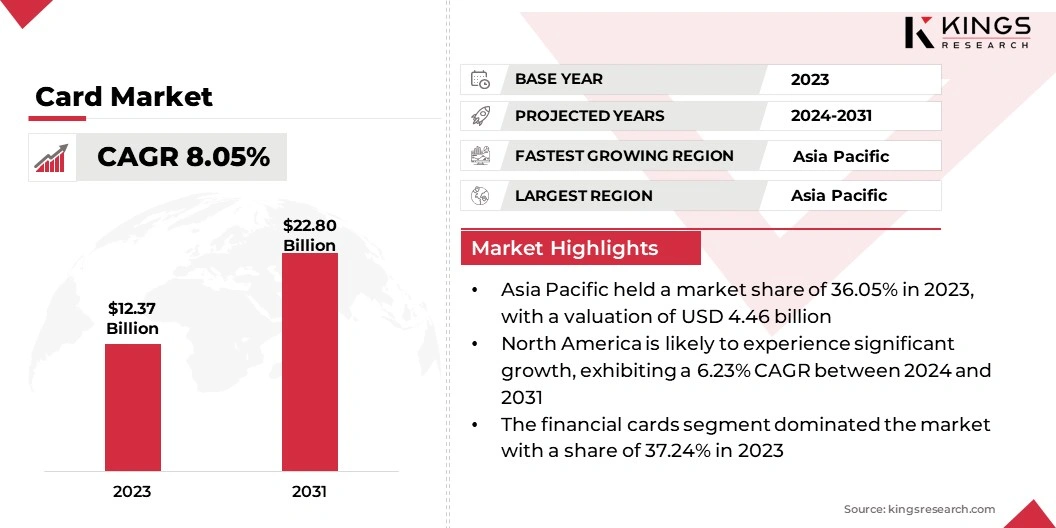

The global Card Market size was valued at USD 12.37 billion in 2023 and is projected to reach USD 22.80 billion by 2031, growing at a CAGR of 8.05% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Fiserv, Inc., Thales, CPI Card Group Inc., ABCorp Network, Giesecke+Devrient GmbH, Safran Group, CardLogix Corporation, Barnes International, FIS, N26 AG, IDEMIA and others.

The global card market is experiencing significant growth driven by various factors such as technological advancements, changing consumer preferences, and the increasing adoption of cashless transactions. With the rise of digital payments and the proliferation of e-commerce platforms, the demand for cards, including credit, debit, prepaid, and gift cards, is growing steadily.

Moreover, the COVID-19 pandemic has accelerated the shift toward contactless payments, thereby fueling the expansion of the card market. This growth trajectory is attributed to the increasing penetration of smartphones, rising disposable incomes, and the growing awareness regarding the convenience and security offered by card-based transactions.

The rising adoption of contactless payment technology is reshaping the dynamics of the global card market. Contactless payments, facilitated by Near Field Communication (NFC) technology, enable consumers to make secure transactions by simply tapping their cards or mobile devices on compatible terminals. This technology offers convenience, speed, and enhanced security, thereby driving its widespread adoption across various sectors such as retail, transportation, and hospitality.

The market outlook for contactless payment technology remains highly promising, with forecasts indicating exponential growth in the coming years. The development of the market is likely to be driven by factors such as the increasing deployment of contactless-enabled POS terminals, the proliferation of smartphones with NFC capabilities, and the growing preference for contactless transactions among consumers.

A card refers to a physical or virtual payment method used to facilitate transactions. Cards can be categorized into various types, including credit cards, debit cards, prepaid cards, and gift cards, each serving distinct payment purposes and functionalities. Credit cards allow users to borrow funds from a financial institution to make purchases, while debit cards enable direct withdrawals from the user's bank account.

Prepaid cards are loaded with a predetermined amount of funds and can be used until the balance is depleted, making them suitable for budgeting and gifting purposes. Additionally, gift cards are prepaid cards typically issued by retailers or businesses for use in their establishments. Cards can be made from different materials, including plastic, metal, and even biodegradable materials, depending on various factors such as durability, aesthetics, and environmental considerations.

The increasing emphasis on payment security and fraud prevention is a key factor shaping the global card market landscape. With the rise of digital transactions and online payments, ensuring the security of card-based transactions has become paramount for financial institutions, card issuers, and consumers. As a result, there is a growing demand for innovative payment security solutions and technologies to mitigate the risks of fraud, data breaches, and identity theft.

Industry players are investing heavily in advanced encryption techniques, biometric authentication, tokenization, and other security measures to safeguard cardholder data and enhance transaction security. Moreover, regulatory initiatives and industry standards such as the Payment Card Industry Data Security Standard (PCI DSS) play a crucial role in driving compliance and best practices in payment security across the card ecosystem.

Regulatory compliance challenges and evolving standards represent significant constraints for stakeholders in the global card market. As the card industry continues to evolve and innovate, regulatory bodies and policymakers enact and revise regulations to address emerging risks, protect consumer interests, and ensure the stability and integrity of the financial system.

Ensuring compliance with regulatory requirements such as Know Your Customer (KYC), Anti-Money Laundering (AML), data protection laws, and payment card industry standards imposes additional operational complexities and costs on card issuers and financial institutions.

Moreover, the evolving nature of regulatory frameworks and standards necessitates ongoing monitoring, adaptation, and investment in compliance measures, thereby posing significant challenges for market participants to maintain compliance while balancing business objectives and customer needs.

The global card market is segmented based on type, material, and geography.

Based on type, the market is classified into financial cards, retail & gas cards, transportation, gift cards, government/health care card, and others. The financial cards segment dominated the market with a share of 37.24% in 2023, mainly driven by the widespread adoption of credit, debit, and prepaid cards for various payment transactions.

Financial cards offer consumers convenient access to credit lines, banking services, and cashless payments, thereby driving their popularity and market dominance. Additionally, technological advancements such as contactless payment capabilities, biometric authentication, and embedded security features contribute to the growth and versatility of financial cards, thus solidifying their position as a preferred payment method in the global card market.

Based on material, the market is bifurcated into plastic and metal. The metal segment is estimated to witness substantial growth at a CAGR of 14.24% through the projection period, spurred by the increasing demand for premium and luxury card products. Metal cards, characterized by their durability, distinctive design, and premium feel, are gaining significant traction among affluent consumers, high-net-worth individuals, and premium cardholders seeking enhanced status and prestige.

The metal segment encompasses a range of metal-based cards, including stainless steel, titanium, and precious metal variants, which offer superior aesthetics and perceived value compared to traditional plastic cards.

Moreover, advancements in card manufacturing technologies and personalization capabilities enable issuers to create customized metal cards tailored to the preferences and lifestyles of discerning consumers, thereby driving the growth of the metal card segment in the global market.

Based on region, the global card market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Card Market share stood around 36.05% in 2023 in the global market, with a valuation of USD 4.46 billion, driven by the region's robust economic growth, expanding consumer base, and increasing adoption of digital payments.

The Asia-Pacific region encompasses diverse markets with varying levels of card penetration and payment preferences, ranging from mature markets such as Japan and South Korea to emerging economies such as China, India, and Southeast Asian countries.

Factors such as rising disposable incomes, rapid urbanization, smartphone penetration, and government initiatives promoting financial inclusion and digitalization contribute to the growth of the card market in Asia-Pacific. Moreover, strategic partnerships, technological advancements, and evolving consumer lifestyles drive innovation and expansion opportunities for card issuers and payment service providers in the region.

North America is likely to experience significant growth, exhibiting a 6.23% CAGR between 2024 and 2031, primarily fueled by the region's advanced payment infrastructure, high digital adoption rates, and ongoing technological innovations in the card market.

The North American card market benefits from various factors such as a large consumer base, a robust financial services industry, and a culture that encourages consumer spending and credit usage. Moreover, the shift toward contactless payments, mobile wallets, and digital banking solutions boosts the adoption of card-based transactions in North America.

Additionally, regulatory initiatives promoting payment security, data privacy, and interoperability drive market growth and innovation in the region. As North America continues to adopt digital transformation and witness evolving consumer preferences, the market provides ample growth opportunities for card issuers, fintech companies, and payment service providers.

The global card market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

By Type

By Material

By Region

Frequently Asked Questions