Buy Now

Casing Centralizer Market Size, Share, Growth & Industry Analysis, By Type (Spring, Rigid, Others), By Material (Aluminum, Steel, Others), By Application (Onshore, Offshore) and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

A casing centralizer is a mechanical device used to maintain casing alignment within the wellbore, ensuring effecting cementing by preserving clearance between the casing and the borehole wall. The market includes the production and deployment of various centralizer types used in oil and gas wells.

It covers bow-spring, rigid, and semi-rigid designs tailored to specific drilling requirements. It supports both onshore and offshore operations and involves equipment manufacturers, service providers, and suppliers across major oil-producing regions.

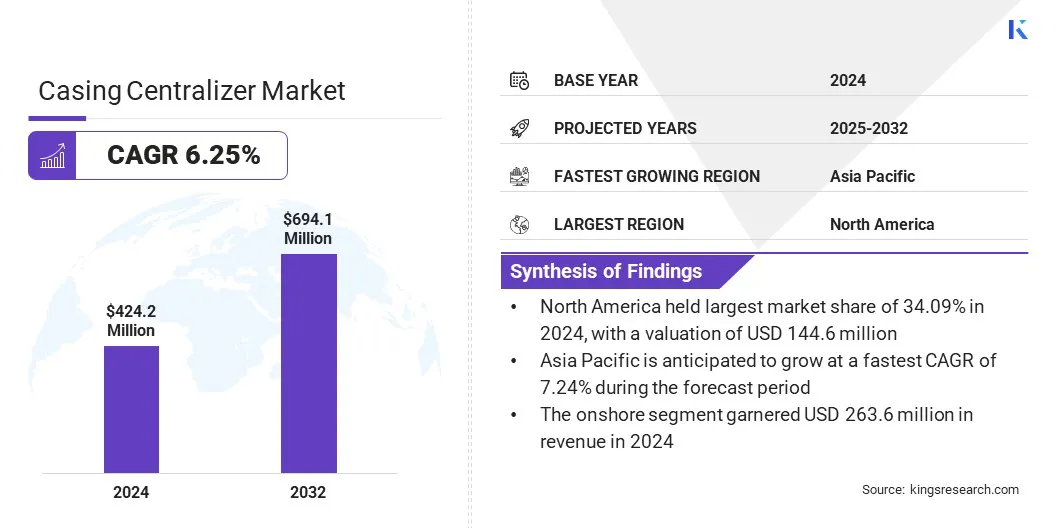

The global casing centralizer market size was valued at USD 424.2 million in 2024 and is projected to grow from USD 448.5 million in 2025 to USD 694.1 million by 2032, exhibiting a CAGR of 6.25% during the forecast period. This growth is fueled by increasing drilling activities across both onshore and offshore fields.

Rising adoption of horizontal and extended-reach drilling has created a consistent need for advanced centralization solutions to ensure proper casing alignment and effective cement placement.

Major companies operating in the casing centralizer market are Halliburton Energy Services, Inc., Weatherford, SLB, NOV, Baker Hughes Company, Centek, Innovex International, Inc., Summit Casing, NeOz Energy, RAY OIL TOOL COMPANY Inc., DRK OIL TOOLS PTE LTD, Dezhou Yuanda Petroleum Machinery Co., Ltd., Puyang Zhongshi Group Co.,Ltd, EP Group, and Drilling Tools International.

|

Segmentation |

Details |

|

By Type |

Spring (Hinged Welded Bow Spring Centralizer, Slip-On Welded Bow Spring Centralizer, Slip-On Welded Positive Casing Centralizer, Hinged Non-Welded Bow Spring Centralizer, Others), Rigid (Straight/Spiral Vane Solid Centralizer, Straight/Spiral Roller Solid Centralizer, Straight/Spiral Vane Aluminum Solid Centralizer, Others), Others |

|

By Material |

Aluminum, Steel, Others |

|

By Application |

Onshore, Offshore |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America casing centralizer market accounted for a substantial share of 34.09% in 2024, valued at USD 144.6 million. This dominance is reinforced by the sustained growth in drilling activities across major oil-producing regions.

Private oil and gas companies continue to expand shale oil and gas extraction, which supports the demand for casing centralizers. Manufacturers are strengthening regional distribution networks to improve access to high-performance centralization solutions.

These efforts aim to support efficient cementing operations and casing stability in complex wells. The focus on expanding product availability across key regions reflects the rising demand for advanced tools that enhance well integrity and field performance.

The Asia Pacific casing centralizer industry is expected to register the fastest CAGR of 7.24% over the forecast period. This growth is primarily bolstered by the increasing number of offshore drilling operations, which involve complex well conditions that require advanced centralization solutions to ensure proper casing alignment and effective cement placement.

Companies engaged in well design and field development are adopting rigid and bow-spring centralizers to address irregular borehole geometries and reducecementing failures.

Rising offshore activity, combined with growing efforts to improve wellbore integrity in technically challenging environments, fuels the demand for high-performance casing centralizers in the region.

Government support for oilfield development in major oil and gas-producing countries is driving market growth. These initiatives are accelerating drilling activity and expanding supporting infrastructure.

This is leading to rising demand for casing centralizers, supported by their essential role in maintaining zonal isolation and ensuring well integrity. Exploration progressing in both mature and frontier basins, aided by product innovation and the expansion of regional service capabilities, boosting market growth.

Rising Drilling Operations Supporting Centralizer Demand

The expansion of the market is propelled by increased global drilling activity across conventional and unconventional oil and gas fields. Continued investments in exploration and production are boosting the demand for well construction components that ensure long-term operational integrity.

Casing centralizers are essential for maintaining casing alignment and promoting uniform cement placement, which is essential for zonal isolation and preventing fluid migration. As drilling operations advance into deeper and more complex reservoirs, the need for reliable centralization becomes increasingly critical.

Additionally the expansion of onshore and offshore projects across regions such as North America, the Middle East, and Asia Pacific is propelling the adoption of high-performance casing centralizers.

Ensuring Reliable Performance in Complex Well Geometries

A major challenge limiting the expansion of the casing centralizer market is ensuring reliable performance in complex well geometries, such as highly deviated, horizontal, or extended-reach wells.

In these conditions, standard centralizers often fail to provide adequate standoff, leading to poor cement placement and compromised zonal isolation. This increases the risk of gas migration, casing failure, and costly remediation.

To address this issue, companies are adopting software-based centralizer placement simulation tools to optimize the number, type, and positioning of centralizers.

These tools enable accurate modeling of wellbore conditions, thereby improving standoff, cement coverage, and overall well integrity while reducing operational risks in complex drilling environments.

Growing Demand for Bow-Spring and Hybrid Centralizers in Directional Wells

The market is witnessing increased adoption of bow-spring and hybrid centralizers, particularly in horizontal and directional drilling. These designs offer the mechanical performance required to maintain casing position in curved and extended-reach wellbores.

Bow-spring centralizers deliver high restoring force to keep the casing centered, which enables uniform cement placement and effective zonal isolation. Hybrid centralizers combine the flexibility of bow-spring designs with the strength of rigid types, enhancing performance in complex well conditions.

The rising number of horizontal wells across major oil-producing regions is fueling demand, as operators focus on improving cementing reliability and well integrity.

Major companies operating in the casing centralizer market are focusing on delivering products that meet performance, durability, and operational reliability requirements across different well conditions.

Manufacturers in the oilfield equipment segment are prioritizing product innovation to address the technical demands of horizontal, high-angle, and extended-reach wells. These innovations focus on enhancing restoring force, minimizing starting force, and improving functionality in complex well trajectories.

Regional expansion is a key strategy, with companies establishing manufacturing units, service facilities, and distribution networks in high-growth areas. This enables timely product delivery, enhances customer support, and improves responsiveness to regional drilling needs.

Frequently Asked Questions