Chemical Logistics Market

Chemical Logistics Market Size, Share, Growth & Industry Analysis, By Mode of Transportation (Roadways, Railways, Airways, Waterways, Pipelines), By Service (Transportation and Distribution, Storage & warehousing, Customs & security & Others), By End-Use Industry, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1062

Chemical Logistics Market Size

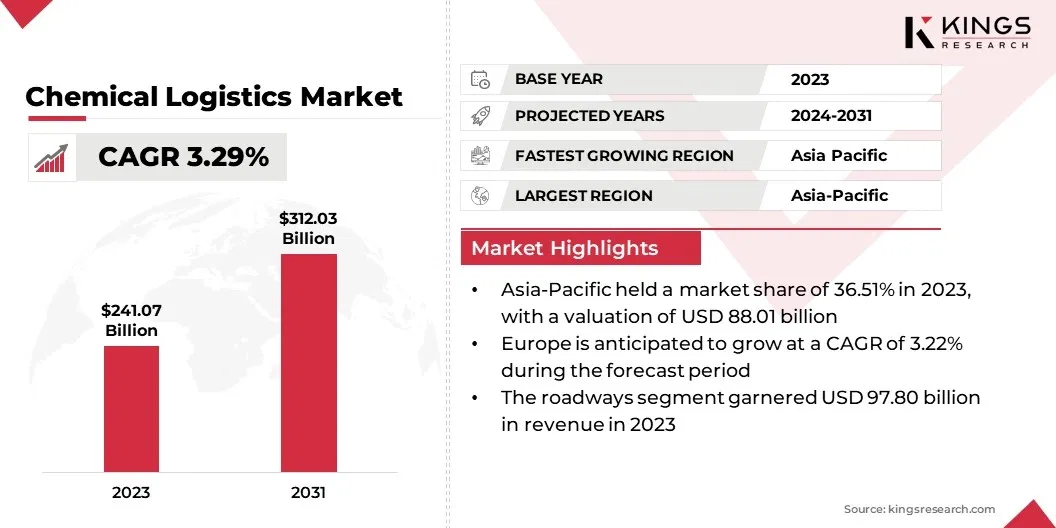

The global Chemical Logistics Market size was valued at USD 241.07 billion in 2023 and is projected to grow from USD 248.71 billion in 2024 to USD 312.03 billion by 2031, exhibiting a CAGR of 3.29% during the forecast period. The global market is experiencing steady growth due to the need for efficient transportation, storage, and handling of chemicals across various industries.

Advancements in supply chain technologies, such as automation and digital tracking, are enhancing operational efficiency. Additionally, the rise in international trade and expanding regulatory frameworks are further driving the market demand.

In the scope of work, the report includes service offered by companies such as C.H. Robinson Worldwide, Inc., Quantix SCS, LLC, BASF, Univar Solutions Inc., Al-Futtaim Logistics, DHL, Rhenus Logistics, Aegis Logistics Ltd, CEVA Logistics, PETROCHEM, and others.

The surge in chemical manufacturing is driving the growth of the chemical logistics market, as increased production across food, pharmaceuticals, automotive, and engineering industries is fueling the demand for specialized transportation and distribution services. Safe and efficient handling of chemicals, particularly for hazardous materials, is crucial and requires strict regulatory compliance.

- According to the American Chemistry Council, U.S. specialty chemical output is expected to grow by 0.4% in 2024. In addition, agricultural chemicals are anticipated to see a 2.6% rise, driven by demand for fertilizers and crop protection chemicals.

Additionally, global trade expansion and advancements in supply chain technologies are further enhancing the demand for robust logistics solutions in the chemical sector.

Chemical logistics encompasses the specialized handling, transportation, storage, and distribution of chemical products, including hazardous and non-hazardous materials. It requires strict adherence to safety protocols and regulatory compliance due to the sensitive nature of chemicals, which may pose environmental and health risks.

Chemical logistics offers temperature-controlled storage, secure packaging, and efficient transportation systems to ensure the safe movement of chemicals through the supply chain. Chemical logistics providers also leverage advanced technologies for real-time tracking and regulatory documentation to optimize operations while ensuring the safe and timely delivery of products across industries.

Analyst’s Review

Significant investments in infrastructure and strategic mergers and acquisitions (M&A) are fueling the expansion of the global logistics segment within the chemicals industry. Companies are improving their transportation networks, storage facilities, and safety protocols to handle the growing volume and complexity of chemical shipments. M&A activities are also resulting in consolidation, allowing key players to expand their global footprint and improve operational efficiency.

- For instance, energy giant Aramco is advancing two major projects in Saudi Arabia: a crude oil-to-chemicals (CTC) facility in Yanbu, expected to produce 9 million tons per year of chemicals and base oils by 2025, and the Amiral project, a joint venture with France’s Total, featuring a 1.5 million tons per year cracker set to launch in 2024 in Jubail.

Favorable government regulations in the region are also anticipated to further bolster market growth in the chemical sector, creating favorable conditions for expansion and development.

Chemical Logistics Market Growth Factors

The growing demand for specialty chemicals across pharmaceuticals, agriculture, and automotive industries is significantly driving the need for efficient chemical logistics services. These chemicals, often hazardous and sensitive, require specialized handling, storage, and transportation solutions to ensure safety and compliance with regulatory standards.

The complexity involved in managing hazardous materials, including temperature-controlled environments, customized packaging, and secure transportation, has led to an increased reliance on expert logistics providers. The increasing demand for specialty chemicals within the pharmaceutical, agricultural, and automotive industries is driving the need for advanced chemical logistics solutions, which is expected to drive the market demand.

However, the chemical logistics market faces challenges related to stringent environmental regulations, high operational costs, and complex safety requirements for handling hazardous materials. Additionally, fluctuating fuel prices and geopolitical uncertainties impact logistics efficiency and cost management.

Key players are mitigating these challenges by adopting sustainable practices and the latest technology. Companies are also investing in electric and alternative fuel-powered fleets to reduce carbon emissions and operational costs. Digitalization, to enable real-time tracking and automation, is improving supply chain transparency and efficiency.

Collaborations with regulatory bodies ensure compliance with evolving safety standards. These factors are expected to enhance the market growth during forecast period.

Chemical Logistics Market Trends

Globalization of the chemicals industry, driven by increasing exports and imports of raw materials and finished products, is fueling the demand for efficient and robust logistics networks. As chemical companies expand their global reach, the need for specialized logistics services to handle cross-border shipments and complex supply chains becomes critical.

Expanding trade agreements between countries are facilitating smoother international transactions, while advancements in supply chain technologies are enhancing operational efficiency and transparency.

- In October 2023, XPO Logistics, a leading provider of contract logistics services, announced the acquisition of Kuehne+Nagel's contract logistics business, including its chemical logistics operations. This acquisition would enhance XPO's network and deepen its expertise in managing hazardous materials.

These factors are driving the chemical logistics market growth, as chemical manufacturers increasingly rely on logistics providers to ensure the safe, timely, and cost-effective transportation of their products globally.

The adoption of IoT, blockchain, and big data analytics is driving market growth by improving operational efficiency in chemical logistics. Real-time tracking enhances supply chain transparency, reducing delays and errors. Blockchain ensures secure and accurate records, fostering trust in logistics processes.

Automation, combined with predictive analytics, optimizes routing and inventory management, reducing costs. These technologies also enhance safety compliance, minimizing risks in handling hazardous materials. Companies are prioritizing efficiency and safety, due to which the demand for tech-driven logistics solutions is rising. This trend is expected to drive the market over the forecast period.

Segmentation Analysis

The global market has been segmented on the basis of mode of transportation, service, end-use industry, and geography.

By Mode of Transportation

Based on mode of transportation, the chemical logistics market has been categorized into roadways, railways, airways, waterways, and pipelines. The roadways segment garnered the highest revenue of USD 97.80 billion in 2023.

Road transport remains a preferred mode for short and mid-distance chemical transportation due to its adaptability to different shipment sizes and types of chemicals. This segment benefits from the increasing demand for specialized vehicles, such as those equipped with temperature controls and hazardous material safety features.

The ongoing development of roadway infrastructure, particularly in emerging markets, is further supporting market growth. With manufacturers prioritizing reliable and timely delivery, the roadways segment is expected to see steady expansion in the coming years.

By Service

Based on service, the market has been categorized into transportation and distribution, storage & warehousing, customs & security, green logistics, consulting & management services, and others. The transportation and distribution segment captured the largest chemical logistics market share of 39.64% in 2023.

This segment encompasses the movement of chemicals from manufacturers to end users, requiring specialized solutions to ensure safety and compliance. The rise in international trade, coupled with stringent environmental and safety regulations, is propelling the need for advanced transportation systems, including tankers, rail, and intermodal solutions.

The adoption of technologies like GPS tracking, automation, and blockchain is further improving efficiency and transparency. Given the rise in global chemical production, the transportation and distribution segment are anticipated to experience continuous growth.

By End-Use Industry

Based on end-use industry, the market has been categorized into chemical, pharmaceutical, cosmetic, oil & gas, specialty chemicals, food & beverages, and others. The chemical segment is expected to account for the highest revenue of USD 88.22 billion by 2031. This segment is experiencing growth due to increased chemical production across industries such as pharmaceuticals, agriculture, and manufacturing.

Enhanced safety measures, regulatory compliance, and advancements in logistics technologies are crucial for managing the complexities of chemical transportation. Innovations in packaging and tracking, as well as the expansion of global supply chains, are further supporting the segment growth.

With the rising demand for chemicals and the expansion of global supply chains, the chemical segment in logistics is projected to see steady growth, reflecting broader industry trends and higher operational demands.

Chemical Logistics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific chemical logistics market share stood at the largest market share of 36.51% in 2023, with a valuation of USD 88.01 billion. The expansion of infrastructure, including advanced transportation networks and storage facilities, is enhancing logistics efficiency. Additionally, the region's growing focus on sustainability is prompting companies to adopt eco-friendly solutions, such as electric vehicles and optimizing supply chain processes.

- For instance, in February 2024, Rhenus India expanded its logistics capabilities by integrating electric trucks into its fleet by partnering with Brenntag. This initiative reflects a commitment to reducing carbon emissions and improving supply chain efficiency.

Regulatory developments and trade agreements are also contributing to market dynamics by facilitating smoother cross-border shipments. The region is also witnessing advancements in infrastructure and technology, further driving market growth.

Europe is anticipated to witness a significant growth at a CAGR of 3.22% over the forecast period. The region’s focus on regulatory compliance and environmental sustainability is leading to investments in advanced logistics infrastructure and eco-friendly technologies. The adoption of digital solutions, such as real-time tracking and automated systems, is improving operational efficiency and safety.

Additionally, Europe's well-established trade networks and strategic location facilitate efficient cross-border transportation of chemicals. As regulatory pressures intensify and technological innovations advance, the market in Europe is expected to expand, with increased emphasis on reducing environmental impact and enhancing supply chain effectiveness.

Competitive Landscape

The global chemical logistics market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Chemical Logistics Market

- C.H. Robinson Worldwide, Inc.

- Quantix SCS, LLC

- BASF

- Univar Solutions Inc.

- Al-Futtaim Logistics

- DHL

- Rhenus Logistics

- Aegis Logistics Ltd

- CEVA Logistics

- PETROCHEM

Key Industry Development

November 2023 (Partnership): Chemical giant, BASF, and railway operator, DB Cargo, partnered to develop and implement sustainable logistics solutions for the chemicals industry. This collaboration focuses on reducing the environmental impact of chemical transportation by leveraging innovative rail and intermodal transport options.

The global chemical logistics market has been segmented:

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

By Service

- Transportation and Distribution

- Storage & warehousing

- Customs & security

- Green Logistics

- Consulting & management services

- Others

By End-Use Industry

- Chemical

- Pharmaceutical

- Cosmetic

- Oil & Gas

- Specialty Chemicals

- Food & Beverages

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership