Buy Now

Chemical Market Size, Share, Growth & Industry Analysis, By Type (Commodity, Specialty, Agriculture, Others), By End Use (Pharmaceutical, Personal Care, Construction, Manufacturing, Electronics, Automotive, Others), and Regional Analysis, 2024-2031

Pages: 140 | Base Year: 2023 | Release: February 2025 | Author: Versha V.

The market plays a crucial role in global economic development. It encompasses a wide range of products, including raw materials like petrochemicals, which are derived from oil & natural gas, polymers used in plastic manufacturing, and specialty chemicals that serve niche applications in electronics, textiles, and coatings.

Finished goods derived from chemicals are integral to various industries, including agriculture and pharmaceuticals.

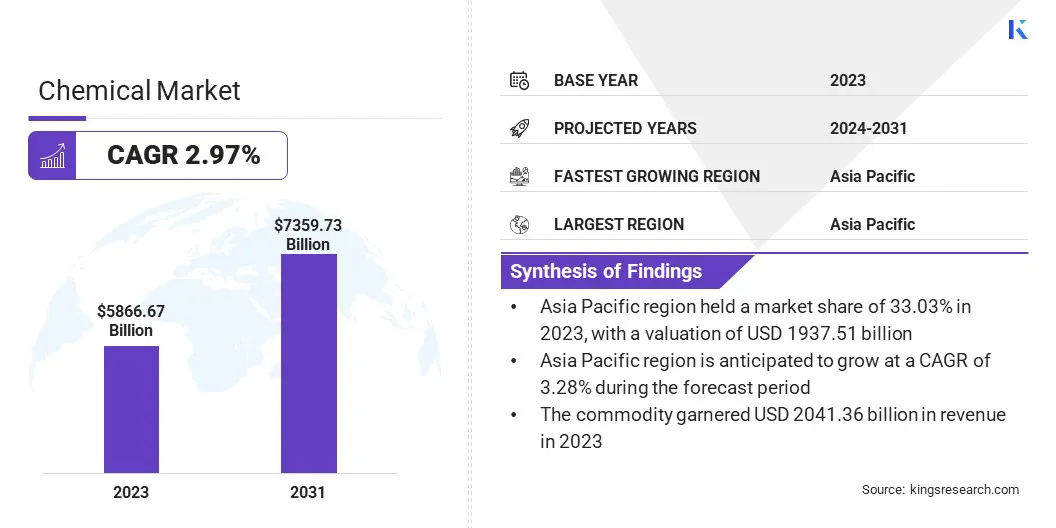

The global chemical market size was valued at USD 5866.67 billion in 2023 and is projected to grow from USD 5995.43 billion in 2024 to USD 7359.73 billion by 2031, exhibiting a CAGR of 2.97% during the forecast period.

The market is driven by an increasing demand for chemicals across key industries such as agriculture, automotive, construction, pharmaceuticals, and food & beverages. Advancements in chemical processing technologies, coupled with rising urbanization and industrialization, are contributing to the market growth, especially in emerging economies.

Major companies operating in the chemical industry are BASF, DuPont, CNPC, LG Chem, Sumitomo Chemical Co., Ltd., LyondellBasell Industries Holdings B.V., Formosa Plastics Corporation, INEOS, The Sherwin-Williams Company, SABIC, Mitsubishi Chemical Group Corporation, Air Liquide, Exxon Mobil Corporation, Henkel AG & Co. KGaA, and Evonik Industries AG.

The market is also registering increased investment in R&D to innovate safer, more efficient products while complying with stringent environmental regulations globally. The increasing focus on circular economy principles and recycling is poised to further drive growth, creating opportunities for industry players.

Market Driver

"Increasing Industrialization and Automation"

The chemical market is primarily driven by increasing demand across a broad range of end-use industries, supported by rapid industrialization and urbanization, especially in emerging economies such as China, India, and Brazil.

These economies have registered significant expansion in infrastructure, manufacturing, and consumer product production, which are heavily reliant on chemical products. The demand for chemicals used in manufacturing, processing, and various other applications is growing amid continous industrialization in these countries, driving the market.

The rise of technological advancements, digitalization, and automation in manufacturing processes further fuels this demand, as industries look for more efficient and sustainable solutions.

Market Challenge

"Volatility of Raw Material Prices"

A significant challenge in the chemical market is the volatility of raw material prices, which are influenced by external factors like fluctuating global demand and geopolitical tensions. This price instability can create uncertainty for manufacturers and lead to unpredictable costs for consumers.

Companies can diversify their supplier base, reducing dependence on a single raw material source. Investing in advanced inventory management systems and predictive analytics can help companies better forecast demand and manage stock more effectively.

Another strategy is exploring alternative, more stable raw material sources, such as bio-based or recycled materials, which not only offer cost advantages over the long term but also meet the growing consumer preference for sustainable products.

Market Trend

"Shift Toward Bio-based Chemicals"

The shift toward bio-based chemicals is one of the most significant trends currently reshaping the chemical market. Amid rising environmental concerns and increasing demand for sustainability, bio-based chemicals derived from renewable resources such as plants, algae, and waste products are gaining traction as alternatives to traditional petrochemical-derived chemicals.

These bio-based chemicals are considered environmentally friendly, as they are biodegradable, less toxic, and produce fewer Greenhouse Gas (GHG) emissions during production. The trend of bio-based chemicals not only supports sustainability goals but also creates business opportunities for chemical companies committed to innovation and environmental responsibility.

|

Segmentation |

Details |

|

By Type |

Commodity, Specialty, Agriculture, Others |

|

By End Use |

Pharmaceutical, Personal Care, Construction, Manufacturing, Electronics, Automotive, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 33.03% chemical market share in 2023, with a valuation of USD 1937.51 billion. This dominance is attributed to the rapid industrialization, urbanization, and robust manufacturing activities in countries such as China, India, and Japan.

The increasing demand for both commodity and specialty chemicals in the region, coupled with the growing adoption of sustainable and bio-based solutions, further drives its market share. Additionally, the expansion of infrastructure and the rise of emerging economies in the region continue to fuel growth, positioning Asia Pacific as a key player in the global market.

The chemical industry in North America is poised to grow at a CAGR of 3.06% over the forecast period. This growth is driven by the increasing demand for advanced chemicals in industries such as pharmaceuticals, personal care, and agriculture. The region is also registering substantial investments in sustainable chemical solutions, particularly bio-based products.

Additionally, the presence of major chemical manufacturing companies and continuous innovation in R&D are expected to support North America's growth trajectory in the coming years.

The global chemical market is characterized by a large number of participants, including established corporations and rising organizations. Key players in the market are actively driving innovation and advancing technology to strengthen their position in an expanding industry.

With applications across various sectors such as manufacturing, agriculture, pharmaceuticals, and consumer goods, companies are consistently improving their product portfolios to meet specific industry needs. Businesses are focusing on regional expansion as the market registers robust growth, tailoring their solutions to address local demands while scaling operations to capitalize on opportunities in global markets.

Additionally, there is a growing emphasis on sustainability, with many players investing in eco-friendly and bio-based alternatives to meet the increasing demand for greener chemical solutions. Strategic partnerships, mergers, and acquisitions are also being pursued to enhance product offerings, expand market reach, and leverage synergies across regions.

The competitive landscape is becoming more dynamic, with businesses innovating to stay ahead of regulatory changes and emerging market trends.

Recent Developments (M&A/Partnerships/New Product Launch)

Frequently Asked Questions