Consumer Goods

Cosmetic Preservatives Market

Cosmetic Preservatives Market Size, Share, Growth & Industry Analysis, By Product (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Quaternary Compounds, Organic Acids, Others), By Application (Hair Care, Skincare, Toiletries, Fragrances & Perfumes, Others) and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1424

Market Definition

The cosmetic preservatives market involves the production, distribution, and application of preservatives used in personal care and cosmetic products to prevent microbial contamination, extend shelf life, and maintain product integrity. Key preservatives, including parabens, organic acids, and natural alternatives, are essential for ensuring consumer safety and regulatory compliance.

Cosmetic Preservatives Market Overview

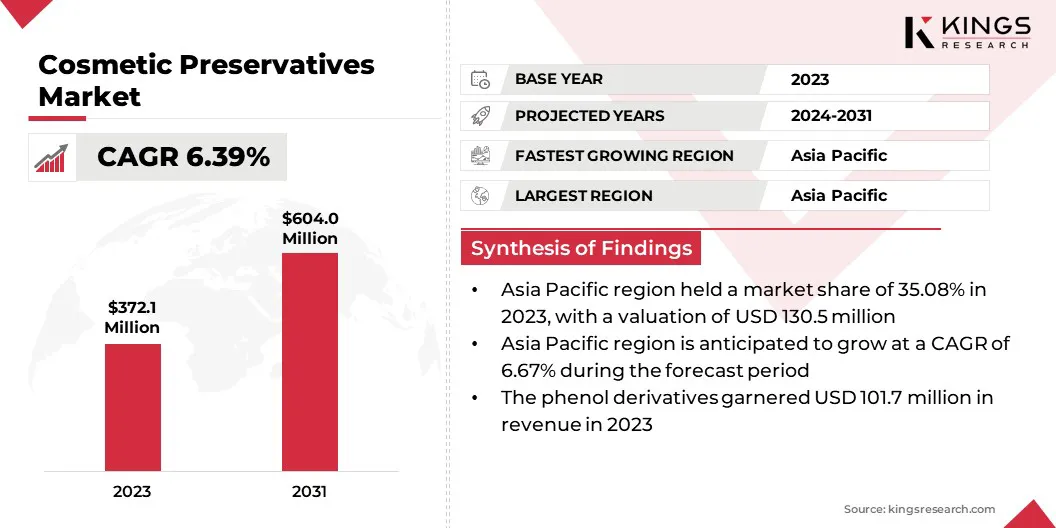

The global cosmetic preservatives market size was valued at USD 372.1 million in 2023 and is projected to grow from USD 391.6 million in 2024 to USD 604.0 million by 2031, exhibiting a CAGR of 6.39% during the forecast period.

Market growth is propelled by increasing consumer demand for safe, long-lasting cosmetic and personal care products, alongside rising awareness of hygiene and product stability. The expanding beauty and personal care industry, coupled with advancements in preservative technologies, has further fueled the demand for effective antimicrobial solutions.

Major companies operating in the global cosmetic preservatives Industry are Ashland, CHEMIPOL, S.A., Sharon group, Salicylates & Chemicals Pvt. Ltd., Symrise, NIPPON SHOKUBAI CO., LTD., BASF SE, Brenntag Austria GmbH, Lonza, Thor, The Lubrizol Corporation, Clariant, Dow, AE Chemie, Inc., Akema S.r.l, and others.

Growing investments in sustainable and bio-based preservatives, along with the expansion of the cosmetics sector in emerging markets, are expected to stimulate further market growth.

As brands seek innovative, high-performance, and consumer-friendly preservation systems, the market is set to witness steady expansion in the coming years.

Key applications span skincare, haircare, makeup, and toiletries, with major industry players investing in research and development to enhance product efficacy and compliance with global safety standards.

- In February 2025, Cécred, Beyoncé Knowles-Carter’s award-winning hair care brand, announced its expansion into Ulta Beauty, the largest U.S. beauty retailer, effective April 6, 2025. This strategic move aligns with the rising demand for high-performance beauty products, including cosmetics preservatives that ensure product efficacy and longevity, reinforcing Cécred’s commitment to premium, salon-quality formulations in an evolving beauty market.

Key Highlights:

- The global cosmetic preservatives market size was recorded at USD 372.1 million in 2023.

- The market is projected to grow at a CAGR of 6.39% from 2024 to 2031.

- Asia Pacific held a share of 35.08% in 2023, valued at USD 130.5 million.

- The phenol derivatives segment garnered USD 101.7 million in revenue in 2023.

- The skincare segment is expected to reach USD 135.6 million by 2031.

- Europe is anticipated to grow at a CAGR of 6.50% over the forecast period.

Market Driver

"Rising Demand for Natural and Clean-Label Preservatives"

The cosmetic preservatives market is experiencing significant growth due to the surging consumer preference for natural and clean-label beauty products. Concerns over the health risks associated with synthetic preservatives, such as parabens and formaldehyde-releasing agents, are driving regulatory scrutiny and a shift toward safer, eco-friendly alternatives.

This shift is compelling manufacturers to invest in plant-based, organic, and multifunctional preservatives that provide both antimicrobial efficacy and sustainability.

Additionally, advancements in green chemistry and biotechnology are enabling the development of novel natural preservatives that maintain product stability without compromising efficacy. The increasing consumer focus on clean beauty and ethical sourcing is expected to propel the adoption of natural preservatives , reshaping market landscape.

- In September 2024, Barclays' latest research highlighted strong growth of the health and beauty sector, fueled by shifting consumer preferences and social media influence. Despite broader retail challenges since August 2023, Barclays' data from July–August 2024 confirmed a 7.3% year-on-year increase in consumer spending in August 2024, underscoring the industry's resilience and rising demand.

Market Challenge

"Cost and Supply Chain Volatility"

A significant challenge hindering the expansion of the cosmetic preservatives market is the rising cost of raw materials and supply chain disruptions. The increasing demand for natural and sustainable preservatives has led to higher production costs, as plant-based and bioengineered alternatives require specialized extraction and processing methods.

To mitigate this challenge, companies are diversifying their supplier base, investing in local sourcing, and developing synthetic biology approaches to create lab-grown preservatives with consistent quality and availability.

Additionally, brands are adopting preservation-boosting formulation techniques, such as reducing water activity and optimizing packaging, to lower reliance on high-cost preservatives.

Market Trend

"Growing Adoption of Multifunctional Preservatives"

A key trend influencing the cosmetic preservatives market is the rising adoption of multifunctional preservatives, which offer both preservation and additional benefits such as moisturizing, antioxidant protection, or skin conditioning.

As demand for minimalistic and multifunctional formulations rises, cosmetic brands are integrating preservative systems that enhance product efficacy while ensuring microbial stability.

Multifunctional preservatives, such as glycols, organic acids, and certain botanical extracts, inhibit microbial growth while also improving sensory appeal and skin benefits. This trend is particularly prominent in the clean beauty segment, where formulators seek to minimize ingredient lists while maintaining product integrity.

- For instance, in May 2024, the American Chemical Society reported a pivotal shift toward sustainability in the cosmetics industry, supported by rising consumer awareness and regulatory pressures. This leads to increasing demand for eco-friendly, natural preservatives and advanced preservation techniques. Companies must innovate with sustainable formulations that ensure product safety, longevity, and compliance while meeting evolving consumer expectations and environmental standards.

Cosmetic Preservatives Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Quaternary Compounds, Organic Acids, Others |

|

By Application |

Hair Care, Skincare, Toiletries, Fragrances & Perfumes, Makeup & Color, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Quaternary Compounds, Organic Acids, and Others): The phenol derivatives segment earned USD 101.7 million in 2023 due to their broad-spectrum antimicrobial properties, cost-effectiveness, and compatibility with various cosmetic formulations.

- By Application (Hair Care, Skincare, Toiletries, Fragrances & Perfumes, and Others): The skincare held a share of 22.41% in 2023, largely attributed to the rising consumer preference for high-quality, long-lasting skincare products with effective preservation systems.

Cosmetic Preservatives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific cosmetic preservatives market captured a share of around 35.08% in 2023, valued at USD 130.5 million. This dominance is reinforced by the rapid expansion of the beauty and personal care industry in countries such as China, Japan, South Korea, and India.

The increasing demand for skincare, haircare, and organic cosmetic products, coupled with rising disposable incomes and changing consumer lifestyles, has fueled regional market growth.

Additionally, the strong presence of local and international cosmetic brands, advancements in preservative formulations, and regulatory shifts towards safe and sustainable ingredients contribute to regional market expansion.

Europe cosmetic preservatives industry is poised to grow at a CAGR of 6.50% over the forecast period, propelled by the increasing demand for premium skincare, haircare, and personal care products. Consumers in countries such as Germany, France, and the UK are transioning to clean-label, long-lasting, and high-performance formulations, highlighting the need for effective preservative solutions.

The domestic market is further benefiting from advancements in preservative technologies, including the development of multifunctional and plant-based preservatives that enhance product stability while offering additional skincare benefits.

- In March 2023, LANXESS presented its advanced portfolio of preservatives, multifunctionals, and fragrances for cosmetics at In-Cosmetics Barcelona, showcasing its Consumer Protection segment. Featuring the Flavors & Fragrances (F&F) and CARE business lines, the company emphasized high-quality, sustainable solutions. By leveraging green energy to reduce CO2 emissions, it supports cosmetic manufacturers in meeting sustainability goals while ensuring product protection and innovation.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the cosmetic preservatives market under the Federal Food, Drug, and Cosmetic Act (FD&C Act) by overseeing product safety and addressing adulterated or misbranded cosmetics.

- In Europe, the European Commission (EC) monitors cosmetic preservatives by establishing guidelines on their safe utilization of preservatives in cosmetic products. It oversees the approval process, specifying permissible preservatives and their concentrations to ensure consumer safety.

- In India, the market is regulated by the Central Drugs Standard Control Organization (CDSCO), which is responsible for ensuring the safety, quality, and efficacy of cosmetic products, including preservatives used in their formulations. The CDSCO oversees product approvals, ingredient compliance, and manufacturing standards, ensuring that preservatives used in cosmetics meet the necessary safety requirements before they reach consumers.

Competitive Landscape

The global cosmetic preservatives market is characterized by a number of participants, including both established corporations and emerging players. Leading companies focus on product innovation, sustainable preservative solutions, and strategic partnerships to gain a competitive edge.

Key industry players invest in research and development (R&D) to create multifunctional, natural, and biodegradable preservatives that cater to evolving consumer preferences.

Market participants compete on safety, product efficacy, cost-effectiveness, and formulation compatibility. The increasing demand for clean-label and plant-based preservatives boosts innovation in green chemistry and bioengineering techniques.

Additionally, mergers, acquisitions, and collaborations with cosmetic brands and raw material suppliers strengthen market positioning. With the rising emphasis on sustainability and consumer safety, companies that offer innovative, regulatory-compliant, and high-performance preservatives are expected to maintain a strong foothold in the global market.

- For instance, in April 2024, LANXESS showcased its extensive range of preservatives, multifunctionals, and fragrances for cosmetics and personal care at in-cosmetics Global in Paris. Its preservatives, designed for leave-on and rinse-off products, support both traditional and natural formulations, meeting global green certification standards such as EU Ecolabel, Ecocert, NATRUE, COSMOS, and Nordic Swan.

List of Key Companies in Cosmetic Preservatives Market:

- Ashland

- CHEMIPOL, S.A.

- Sharon group

- Salicylates & Chemicals Pvt. Ltd.

- Symrise

- NIPPON SHOKUBAI CO., LTD.

- BASF SE

- Brenntag Austria GmbH

- Lonza

- Thor

- The Lubrizol Corporation

- Clariant

- Dow

- AE Chemie, Inc.

- Akema S.r.l.

Recent Developments (New Product Launch)

- In September 2024, DermEgen launched Dermacare NP, a fermentation-derived alternative to phenoxyethanol, reflecting the growing demand for natural and sustainable preservatives. This innovation highlights the industry's shift toward bio-based solutions, catering to consumer preferences for clean-label formulations while ensuring effective product preservation and stability.

- In August 2023, LANXESS announced Neolone BioG Preservative, a COSMOS-approved, naturally derived solution under its Scopeblue sustainability brand. Compliant with ISO 16128 standards, this innovation addresses the rising demand for eco-friendly, high-performance preservatives, reinforcing LANXESS's position in the market.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)