Buy Now

Decentralized Identity Market Size, Share, Growth & Industry Analysis, By Identity Verification Method (Biometrics, Non-Biometrics), By Component (Platform / Software, Services), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Deployment Mode, By End User, and Regional Analysis, 2025-2032

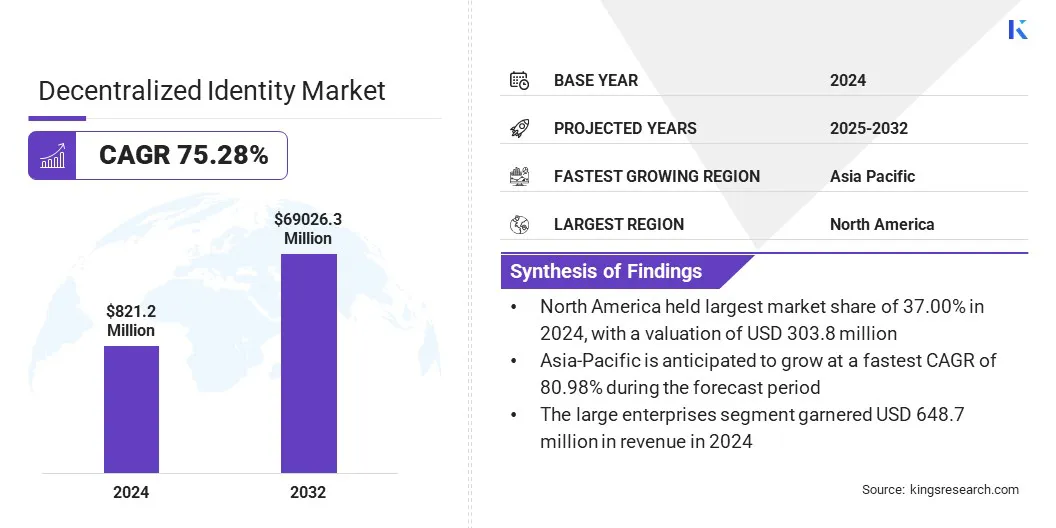

Pages: 250 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

Decentralized identity is a digital identity framework that enables individuals and organizations to control and manage their identity data independently, without relying on a central authority. Built on blockchain or distributed ledger technology, it provides secure and verifiable credentials that can be shared across platforms while preserving user privacy and consent.

These solutions are widely used in financial services, healthcare, education, and public sector applications for authentication, access control, and compliance. The market comprises platforms and services that support identity issuance, verification, and management across decentralized digital ecosystems.

The global decentralized identity market size was valued at USD 821.2 million in 2024 and is projected to grow from USD 1,357.7 million in 2025 to USD 69,026.3 million by 2032, exhibiting a CAGR of 75.28% during the forecast period. This growth is attributed to the rising adoption of decentralized identity solutions across finance, healthcare, government, and education.

Increasing demand for secure and user-controlled digital identities, along with growing concerns over data privacy and identity theft, drives the integration of decentralized frameworks into authentication and access management systems.

Major companies operating in the decentralized identity market are Microsoft, IBM, Accenture, Wipro, Persistent Systems, Nuggets, Validated ID, SL, Civic, 1Kosmos Inc., Ping Identity, Antiersolutions, Fractal ID, Hu-manity.co, Dragonchain, and Finema Co., Ltd.

|

Segmentation |

Details |

|

By Identity Verification Method |

Biometrics (Facial Recognition, Fingerprint Scanning, Iris/Retina Recognition), and Non-biometrics (Public Key Infrastructure (PKI), Knowledge-based Authentication , Smartcards & Tokens) |

|

By Component |

Platform / Software, and Services (Consulting & Integration, Support & Maintenance) |

|

By Organization Size |

Large Enterprises, and Small & Medium Enterprises (SMEs) |

|

By Deployment Mode |

On-premise, and Cloud-based |

|

By End User |

BFSI (Banking, Financial Services & Insurance), Government & Public Sector, Healthcare, Telecom & IT, Retail & E-commerce, Travel & Hospitality, Education, Energy & Utilities, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America decentralized identity market share stood at around 37.00% in 2024, valued at USD 303.8 million. This market dominance is reinforced by the region’s advanced digital infrastructure, early implementation of blockchain-based identity solutions, and the presence of key technology providers specializing in decentralized identity platforms.

Furthermore, rising regulatory focus on data privacy, widespread adoption of digital financial services, and strategic collaborations between public agencies and private firms are accelerating the deployment of decentralized identity solutions across various sectors.

The region’s commitment to enhancing digital trust and securing online interactions continues to drive the market. Growing demand for secure remote access, cross-border identity verification, and scalable authentication solutions, along with ongoing innovation in privacy-preserving technologies, strengthens North America’s position in the market.

The decentralized identity industry in Asia Pacific is set to grow at a CAGR of 80.98% over the forecast period. This growth is attributed to rapid digitalization, expanding mobile connectivity, and the rising demand for secure identity solutions across developing economies in the region.

The market in Asia Pacific is benefiting from government-led digital identity programs, blockchain research initiatives, and public-private partnerships aimed at improving data privacy and access to digital services. The growing adoption of decentralized identity in sectors such as fintech, healthcare, and education is supporting the regional growth.

The emphasis on digital inclusion, particularly for rural and unbanked populations, is accelerating the development of user-centric identity frameworks. The region’s thriving startup ecosystem, increasing venture capital activity, and favorable regulatory environments are further driving the innovation and deployment of decentralized identity technologies throughout Asia Pacific.

The growing emphasis on regulatory compliance, cross-border digital identity verification, and seamless user onboarding is fueling market expansion. Additionally, advancements in blockchain technology, interoperability standards, and digital wallets, along with increasing investments in Web3 and self-sovereign identity ecosystems, are accelerating market development.

Growing Adoption of Blockchain Technology

The decentralized identity market is propelled by the increasing integration of blockchain technology to enhance digital trust, data security, and user control. Traditional identity systems face mounting challenges like data breaches, identity theft, and centralized vulnerabilities, prompting organizations to adopt blockchain-based frameworks that provide tamper-proof and verifiable credentials. These solutions enable individuals to securely manage and share their identity information while minimizing dependence on third-party intermediaries.

This transition is further supported by the rising demand for privacy-focused authentication, cross-platform interoperability, and efficient user verification processes. The adoption of blockchain across finance, healthcare, and government continues to strengthen the shift toward decentralized identity systems, accelerating the overall market growth.

Lack of Standardization and Interoperability

Lack of standardization and interoperability remains a significant challenge in the decentralized identity market, restricting seamless integration across platforms, applications, and jurisdictions. The absence of universally accepted protocols and frameworks leads to implementations that hinder the consistent exchange and verification of digital credentials.

This inconsistency limits scalability, complicates cross-border identity use cases, and delays enterprise adoption, particularly in sectors that require high levels of compliance and system compatibility.

Industry leaders and regulatory bodies are advancing global standards like Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs) through initiatives such as those which is led by the World Wide Web Consortium (W3C). Collaborations among identity providers, developers, and enterprises, along with investments in interoperability testing and open-source frameworks are key to building a unified and scalable decentralized identity ecosystem.

Widespread Adoption of Self-Sovereign Identity (SSI) Frameworks

The adoption of SSI frameworks is reshaping the decentralized identity market by enabling users to own, manage, and share their identity data without relying on centralized authorities. This approach enhances privacy, ensures user consent, and provides greater control over personal information across digital platforms. SSI solutions are increasingly being used for secure authentication, credential verification, and regulatory compliance in finance, healthcare, and public services.

The integration of blockchain technology and cryptographic protocols supports tamper-proof and verifiable credentials, while decentralized identifiers (DIDs) and verifiable credentials (VCs) ensure interoperability and trust. Additionally, digital wallets and mobile-first applications are simplifying user access and management, making decentralized identity more accessible.

Companies operating in the decentralized identity industry are actively working to expand their presence through technological innovation, platform diversification, and strategic alliances. Key players are investing significantly in blockchain infrastructure, privacy-preserving cryptographic techniques, and interoperability standards to develop secure, user-centric, and scalable identity solutions suited for a wide range of digital applications.

They are also focusing on the development of decentralized identity wallets, verifiable credential systems, and zero-knowledge proof integrations to meet the evolving demands of data security, compliance, and seamless authentication.

Additionally, firms are partnering with governments, regulatory bodies, and industry consortiums to support national identity programs, influence global standards, and accelerate adoption across financial services, healthcare, education, and public sectors in developed and emerging markets.

Frequently Asked Questions