Healthcare Medical Devices Biotechnology

Dental 3D Printing Market

Dental 3D Printing Market Size, Share, Growth & Industry Analysis, By Technology (Stereolithography (SLA), Fused Deposition Modeling (FDM), Selective Laser Melting (SLM)/Direct, Metal Laser Sintering (DMLS), Others), By Application (Dental Models, Aligners, Dentures, Others), By End User, and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1360

Market Definition

Dental 3D printing refers to the additive manufacturing process used to create dental prosthetics, orthodontic devices, crowns, bridges, aligners, and other dental appliances with high precision. This technology utilizes digital scans, computer-aided design (CAD) software, and specialized biocompatible materials to produce customized dental solutions.

Dental 3D printing enhances patient care and streamlines workflows for dental professionals by enabling faster production, improved accuracy, and cost efficiency.

Dental 3D Printing Market Overview

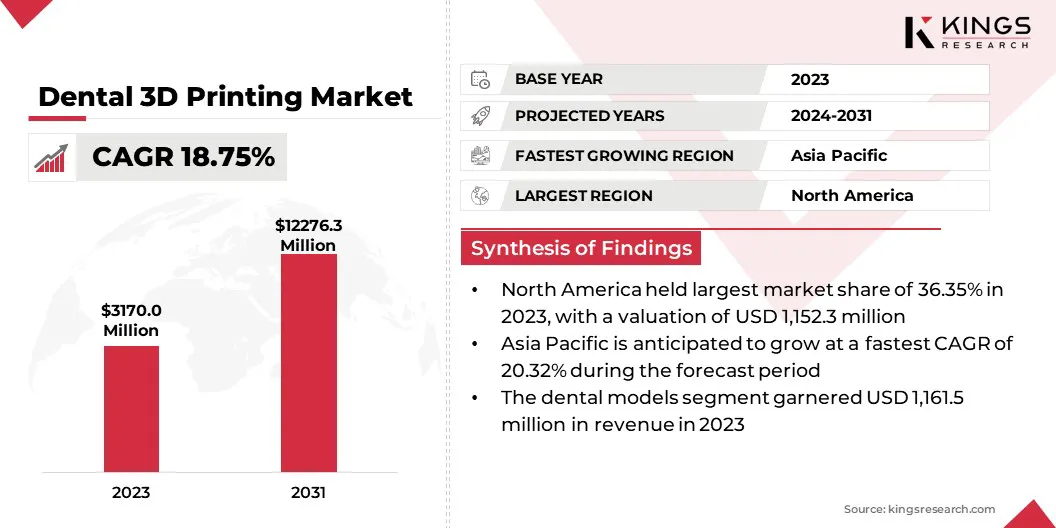

The global dental 3D printing market size was valued at USD 3,170.0 million in 2023, which is estimated to be valued at USD 3,687.2 million in 2024 and reach USD 12,276.3 million by 2031, growing at a CAGR of 18.75% from 2024 to 2031.

The market is driven by advancements in material science, enabling the production of biocompatible & durable restorations. The increasing adoption of digital workflows in dental practices is streamlining treatment processes, reducing costs, and improving patient outcomes.

Additionally, the rising demand for customized orthodontic solutions, including clear aligners and implants, is accelerating the adoption of 3D printing technology in dentistry.

Major companies operating in the dental 3D printing industry are Stratasys, Dentsply Sirona, 3D Systems, Inc., Formlabs, Renishaw plc., Desktop Metal, Inc., Nexa3D, ENVISIONTEC US LLC, Prodways, Zortrax, General Electric Company, Roland DGA Corporation, Align Technology, Inc., SLM Solutions Group AG, and Asiga.

The increasing incidence of dental conditions, including tooth decay, periodontal diseases, and edentulism, is amplifying the growth of the market. A growing number of patients require crowns, bridges, and implants, creating opportunities for additive manufacturing in dental care.

Traditional manufacturing techniques often involve lengthy turnaround times and higher costs, prompting a shift toward digital production. Dental 3D printing enables rapid prototyping and precise fabrication, improving treatment accessibility.

- In November 2024, the World Health Organization (WHO) reported that approximately 2 billion people globally experience caries in permanent teeth, while 514 million children are affected by caries in primary teeth. Oral diseases impact nearly 3.5 billion individuals globally, with three out of four cases occurring in middle-income countries.

Key Highlights:

- The dental 3D printing industry size was valued at USD 3,170.0 million in 2023.

- The market is projected to grow at a CAGR of 18.75% from 2024 to 2031.

- North America held a market share of 36.35% in 2023, with a valuation of USD 1,152.3 million.

- The stereolithography (SLA) segment garnered USD 1,227.7 million in revenue in 2023.

- The dental models segment is expected to reach USD 4,155.2 million by 2031.

- The dental laboratories segment secured the largest revenue share of 46.33% in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 20.32% during the forecast period.

Market Driver

"Expansion of Cloud-based Digital Dentistry Platforms"

Cloud-based dental design and 3D printing platforms are improving accessibility and collaboration across the dental industry. Digital workflows allow practitioners to share patient scans and treatment plans with laboratories in real time, enhancing efficiency.

The ability to store and retrieve digital models is reducing the need for physical impressions, optimizing record management. Cloud-integrated CAD/CAM solutions are streamlining production while ensuring consistency in prosthetic fabrication.

The shift toward remote design and automated production is reducing turnaround times for dental restorations. The increasing adoption of cloud-driven solutions is strengthening the growth of the dental 3D printing market.

- In September 2024, Dentsply Sirona introduced Primescan 2, an advanced intraoral scanner, marking a significant milestone in digital dentistry. This next-generation, cloud-native, and wireless device enables seamless scanning directly to the cloud from any internet-connected device. Building on the proven technology of Primescan, Primescan 2 enhances efficiency in daily workflows, expands treatment capabilities, and improves patient care & comfort for dental practices.

Market Challenge

"High Initial Investment and Cost Constraints"

The adoption of dental 3D printing faces challenges, due to the high initial investment required for advanced printers, software, and training. Smaller dental clinics and laboratories often struggle with the financial burden of integrating this technology.

Thus, companies are offering flexible financing options, subscription-based models, and leasing programs to make 3D printing more accessible. Additionally, advancements in cost-effective printing materials and open-platform software solutions are reducing operational expenses.

Strategic collaborations with dental service organizations (DSOs) and educational institutions are also helping practitioners adopt 3D printing by providing training programs and workflow optimization support.

Market Trend

"Increasing Adoption of Digital Dentistry"

The transition from conventional dental workflows to digital systems is accelerating the integration of 3D printing technologies. Intraoral scanning, CAD/CAM modeling, and automated milling processes are streamlining prosthetic design and fabrication. This shift is minimizing manual intervention, reducing the risk of errors, and enhancing overall efficiency.

- In November 2024, Align Technology, Inc. launched the iTero Design Suite, enabling doctors to efficiently design 3D-printed models, bite splints, and restorations within their practice. This solution integrates exocad CAD/CAM software, offering user-friendly design applications tailored for both doctors and staff. It strengthens the Align Digital Platform by expanding its portfolio of customer-centric technologies.

Digital workflows enable faster diagnosis and treatment planning, improving patient satisfaction. The ability to create accurate restorations within a short timeframe is strengthening market adoption.

The dental 3D printing market is gaining momentum, driven by enhanced precision & operational efficiency and increasing investments in digital transformation by dental clinics & laboratories.

Dental 3D Printing Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Stereolithography (SLA), Fused Deposition Modeling (FDM), Selective Laser Melting (SLM)/Direct, Metal Laser Sintering (DMLS), Others |

|

By Application |

Dental Models, Surgical Guides, Aligners, Dentures, Others |

|

By End User |

Dental Laboratories, Dental Clinics, Hospitals and Research Institutions |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Stereolithography (SLA), Fused Deposition Modeling (FDM), Selective Laser Melting (SLM)/Direct, Metal Laser Sintering (DMLS), and Others): The stereolithography (SLA) segment earned USD 1,227.7 million in 2023, due to its ability to deliver high precision and excellent surface finish, making it ideal for producing intricate dental models, crowns, and bridges with exceptional accuracy and detail.

- By Application (Dental Models, Surgical Guides, Aligners, and Dentures): The dental models segment held 36.64% share of the market in 2023, due to the growing demand for customized and precise dental models for orthodontic and restorative treatments, driving the need for efficient, high-quality 3D printing solutions.

- By End User (Dental Laboratories, Dental Clinics, Hospitals and Research Institutions): The dental laboratories segment is projected to reach USD 5,562.2 million by 2031, owing to its ability to efficiently produce highly customized dental products, such as crowns, bridges, and dentures, using advanced 3D printing technologies.

Dental 3D Printing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 36.35% market share in 2023, with a valuation of USD 1,152.3 million. The dental 3D printing market in North America is fueled by rapid innovations in 3D printing technology, including the development of faster and more precise printers.

Enhanced materials such as biocompatible resins and high-performance ceramics are enabling the production of durable, patient-specific restorations. These technological advancements are improving both the efficiency and accuracy of dental treatments, driving adoption across clinics and laboratories.

- In September 2024, 3D Systems received FDA 510(k) clearance for its multi-material, monolithic jetted denture solution, marking its second 3D printed healthcare product to obtain this approval. The single-piece denture, created using 3D Systems' jetting technology along with NextDent Jet Denture Teeth and NextDent Jet Denture Base materials, is designed to offer enhanced durability, long-lasting wear, and realistic esthetics.

Furthermore, the increasing incidence of dental diseases, such as cavities and gum diseases, in North America is driving the demand for advanced dental treatments. The need for customized prosthetics and implants for patients with oral health issues boosts the use of 3D printing technologies, contributing to market growth.

The dental 3D printing market in Asia Pacific is poised for significant growth at a robust CAGR of 20.32% over the forecast period. Rising awareness of the importance of oral health, coupled with the growing prevalence of dental diseases in the region, is encouraging patients to seek advanced treatments.

The need for personalized dental solutions is driving the adoption of 3D printing technologies, enabling faster, more accurate, and cost-effective procedures. Governments and private entities are promoting innovations like dental 3D printing to address oral health challenges and improve healthcare standards.

Additionally, cosmetic dentistry is gaining popularity in Asia Pacific, driven by rising disposable incomes and changing esthetic preferences. The demand for custom-made dental implants, crowns, veneers, and clear aligners is expanding, contributing to the growth of the market.

The ability to provide tailored, esthetically superior solutions with faster turnaround times is fueling the adoption of 3D printing technologies in cosmetic dentistry, significantly contributing to market growth.

Regulatory Frameworks

- In the U.S., the FDA regulates dental 3D printing products as medical devices. Manufacturers must submit for pre-market approval or clearance (such as 510(k)) for dental products. The FDA's guidance documents, especially for additive manufacturing, do specify the requirements for demonstrating the safety and effectiveness of 3D printed devices.

- In Europe, the European Commission's MDR (EU) 2017/745 provides comprehensive rules governing medical devices, including dental 3D printed products. Manufacturers need to demonstrate product safety and effectiveness through conformity assessment.

- In China, the National Medical Products Administration (NMPA) regulates medical devices, including dental 3D printing products. The approval process involves demonstrating compliance with Chinese national standards and can require clinical trials.

- In Japan, the PMDA (Pharmaceuticals and Medical Devices Agency) regulates medical devices, with a risk-based classification system. Dental 3D printing devices fall under this framework and require approval.

- In India, the CDSCO (Central Drugs Standard Control Organization) oversees medical devices and ensures that dental 3D printed products meet the regulatory requirements set out in the Medical Device Rules.

Competitive Landscape:

The dental 3D printing industry is characterized by a large number of participants, including established corporations and rising organizations. Companies in the market are increasingly adopting strategies like partnerships & collaborations to foster innovation and expand their market presence.

These strategic alliances allow companies to combine resources, expertise, and technologies, accelerating product development and addressing diverse customer needs.

Moreover, partnerships between dental practices and 3D printing technology providers enable seamless integration of advanced 3D printing solutions into clinical workflows. These collaborations help practitioners adopt cutting-edge technologies and improve patient care by offering customized treatments and efficient production processes.

- In December 2024, Dentsply Sirona and HeyGears announced their collaboration to enhance accessibility to the Lucitone Digital Print Denture System. This system includes a complete range of materials and validated workflows featuring BAM! smart polymer technology. The newly validated workflow for HeyGears printers encompasses all Lucitone Digital Print materials for both premium and economy dentures. Labs utilizing HeyGears printers will be able to swiftly produce single-arch dentures and manage more complex cases, providing clinicians and patients with greater efficiency and a wider selection of options.

List of Key Companies in Dental 3D Printing Market:

- Stratasys

- Dentsply Sirona

- 3D Systems, Inc.

- Formlabs

- Renishaw plc.

- Desktop Metal, Inc.

- Nexa3D

- ENVISIONTEC US LLC

- Prodways

- Zortrax

- General Electric Company

- Roland DGA Corporation

- Align Technology, Inc.

- SLM Solutions Group AG

- Asiga

Recent Developments (M&A/ Product Launch)

- In October 2024, Prodways unveiled its new line of 3D printers tailored for the dental market. The DENTAL PRO model boasts a resolution of 600 DPI and 42 μm per pixel, with a maximum modular build volume of 300 x 445 mm. This advanced printer is capable of producing up to 72 denture bases or 55 aligner models in a single print cycle.

- In February 2023, Nexa3D introduced two new dental resins and an enhanced dental workflow: xDENT201 and xDENT341. xDENT201 is an ultrafast printing resin designed for the rapid production of orthodontic models, capable of producing up to 10 flat models in just 20 minutes. Meanwhile, xDENT341 is a high-resolution material specifically developed for 3D printing removable die models, offering exceptional accuracy and dimensional stability.

- In September 2023, Align Technology, Inc. entered into a definitive agreement to acquire Cubicure GmbH, a privately held company known for its leadership in direct 3D printing solutions for polymer additive manufacturing. Cubicure develops, produces, and distributes innovative materials, equipment, and processes for advanced 3D printing solutions.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership