Healthcare Medical Devices Biotechnology

Digital Radiography Market

Digital Radiography Market Size, Share, Growth & Industry Analysis, By Technology (Computed Radiography (CR), Direct Digital Radiography (DDR)), By Portability (Fixed Digital Radiography Systems, Portable Digital Radiography Systems), By Application (General Radiography, Dental Imaging), By End User, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : March 2025

Report ID: KR1490

Market Definition

The digital radiography market includes advanced imaging solutions that replace traditional film-based X-ray systems with digital sensors, improving image acquisition, processing, and storage. This market encompasses direct and computed radiography technologies used in healthcare, dentistry, veterinary, and industrial applications.

Digital Radiography Market Overview

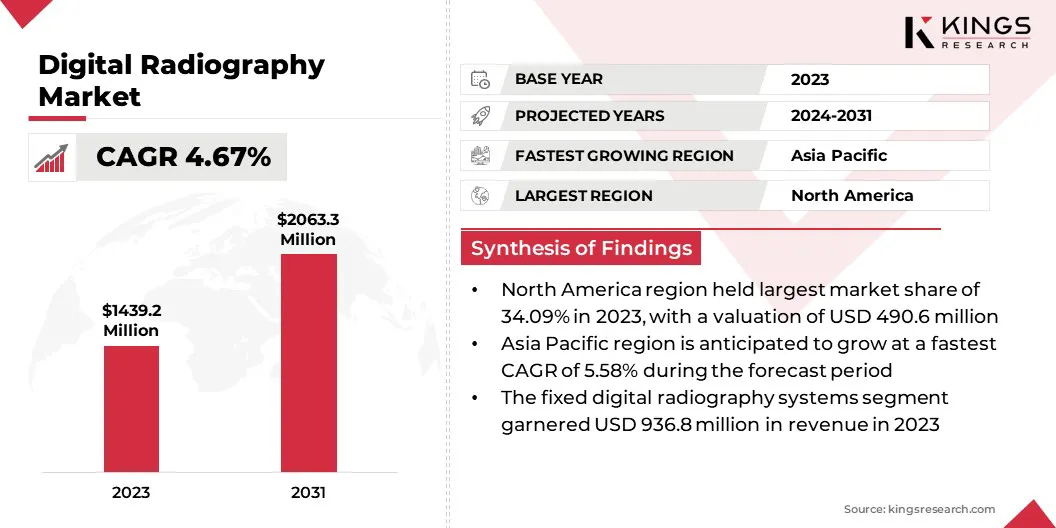

The global digital radiography market size was valued at USD 1,439.2 million in 2023 and is projected to grow from USD 1,498.7 million in 2024 to USD 2,063.3 million by 2031, exhibiting a CAGR of 4.67% during the forecast period.

This growth is driven by the increasing demand for advanced imaging technologies, theadoption of AI-powered diagnostic solutions and rising healthcare investments. The shift from traditional film-based X-rays to digital radiography enhances image quality, reduces radiation exposure, and improves workflow efficiency.

Major companies operating in the global digital radiography industry are Siemens Healthcare Private Limited, Samsung, Agfa-Gevaert Group, Planmed Oy, Shimadzu Corporation, Carestream Health, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Shanghai United Imaging Healthcare Co., LTD, Analogic Corporation, Canon Medical Components Europe B.V., Guerbet, Novarad Corporation, FUJIFILM, Koninklijke Philips N.V., General Electric Company, and others.

Technological advancements, such as wireless detectors, cloud-based image storage, and AI integration, are reshaping the competitive landscape. Key players focus on product innovation, regulatory compliance, and strategic partnerships to strengthen market presence.

The rising chronic disease cases, an aging population, and government initiatives to modernize healthcare infrastructure are fueling demand.

- In July 2023, Carestream launched the DRX-Rise Mobile X-ray System, highlighting the shift toward portable imaging solutions. This innovation enhances point-of-care diagnostics with high-quality imaging, wireless connectivity, and improved workflow efficiency, addressing the growing demand for mobile, AI-driven, and cloud-integrated systems in healthcare.

Key Highlights:

- The global digital radiography market size was recorded at USD 1,439.2 million in 2023.

- The market is projected to grow at a CAGR of 4.67% from 2024 to 2031.

- North America held a share of 34.09% in 2023, valued at USD 490.6 million.

- The direct digital radiography (DDR) segment garnered USD 819.0 million in revenue in 2023.

- The fixed digital radiography systems segment is expected to reach USD 1,319.5 million by 2031.

- The general radiography segment is likely to generate a revenue of USD 984.9 million by 2031.

- The hospitals & clinics segment is projected to hit USD 1,258.4 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.58% over the forecast period.

Market Driver

"Rising Demand for AI-Integrated Digital Radiography Solutions"

The digital radiography market is witnessing significant growth due to the increasing adoption of AI-powered imaging solutions. AI-driven digital radiography enhances diagnostic accuracy by enabling automated image analysis, anomaly detection, and predictive insights, reducing human errors and streamlining clinical workflows.

Additionally, AI integration optimizes image quality while minimizing radiation exposure, making it a preferred choice in modern healthcare. The increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, is further fueling the need for AI-driven radiography.

As automation advances, AI is expected to play a pivotal role in improving efficiency, reducing costs, and enhancing clinical decision-making.

- In November 2023, Philips launched AI-enabled innovations at RSNA 2023 to enhance workflow efficiency, diagnostic accuracy, and patient care. These advancements align with the growing industry focus on AI-driven radiology, faster image processing, and seamless healthcare IT integration.

Market Challenge

"High Cost of Digital Radiography Equipment"

A key challenge hampering the growth of the digital radiography market is the high initial cost associated with purchasing and installing digital radiography systems. Advanced DR equipment, such as flat-panel detectors (FPDs), wireless imaging solutions, and AI-driven diagnostic tools, require substantial capital investment.

This poses a significant barrier, particularly for small and mid-sized healthcare facilities, clinics, and emerging markets where budget constraints limit technology adoption. Additionally, the cost of maintenance, software upgrades, and staff training adds to the financial burden, slowing down market penetration.

To address this challenge, leasing models, pay-per-use agreements, and financing options are emerging as viable alternatives. Subscription-based or cloud-hosted digital radiography solutions enable healthcare providers to reduce upfront costs while ensuring access to the advanced technologies.

Moreover, governments and healthcare organizations are offering incentives, subsidies, and reimbursement policies to facilitate the transition to digital radiography, particularly in underserved regions.

Market Trend

"Growing Adoption of Portable & Mobile Digital Radiography Systems"

A key trend shaping the digital radiography (DR) market is the increasing adoption of portable and mobile DR systems, highlighting the need for enhanced flexibility and point-of-care diagnostics.

Unlike conventional fixed radiography units, portable DR systems offer greater mobility, faster imaging, and real-time data sharing, making them ideal for emergency rooms, intensive care units (ICUs), operating rooms, and remote healthcare settings. These systems are crucial in disaster response, home healthcare, and military applications, where immediate imaging is required.

Technological advancements, such as wireless detectors, AI-powered image processing, and cloud-based PACS (Picture Archiving and Communication System) integration, have further accelerated the adoption of mobile DR units.

Healthcare facilities are increasingly investing in lightweight, battery-operated, and user-friendly digital radiography devices to improve patient convenience and workflow efficiency.

- In August 2024, DocGo Inc., in partnership with MinXray, launched a mobile X-ray program to enhance on-site imaging capabilities. This initiative supports the growing demand for portable, high-quality diagnostic solutions, improving patient access, workflow efficiency, and real-time diagnostics in healthcare facilities, emergency care, and remote locations.

Digital Radiography Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Computed Radiography (CR), Direct Digital Radiography (DDR) |

|

By Portability |

Fixed Digital Radiography Systems, Portable Digital Radiography Systems |

|

By Application |

General Radiography, Dental Imaging, Mammography, Orthopedic Imaging, Veterinary Radiography |

|

By End User |

Hospitals & Clinics, Diagnostic Imaging Centers, Specialty Clinics, Mobile & Home Healthcare |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Technology (Computed Radiography (CR) and Direct Digital Radiography (DDR)): The direct digital radiography (DDR) segment earned USD 819.0 million in 2023 due to its superior image quality, faster processing times, and reduced radiation exposure, making it the preferred choice across healthcare facilities.

- By Portability (Fixed Digital Radiography Systems and Portable Digital Radiography Systems): The fixed digital radiography systems segment held a share of 65.09% in 2023, largely attributed to high hospital adoption, cost-effectiveness, and seamless integration with Picture Archiving and Communication Systems (PACS) for efficient data management.

- By Application (General Radiography, Dental Imaging, Mammography, and Orthopedic Imaging): The general radiography segment is projected to reach USD 984.9 million by 2031, owing to rising demand for routine diagnostic imaging, increasing chronic disease prevalence, and advancements in AI-powered radiographic analysis.

- By End User (Hospitals & Clinics, Diagnostic Imaging Centers, Specialty Clinics, and Mobile & Home Healthcare): The hospitals & clinics segment is projected to reach USD 1,258.4 million by 2031, fueled by the growing patient volumes, expanding healthcare infrastructure, and increasing investments in digital imaging technology for faster and accurate diagnoses.

Digital Radiography Market Regional Analysis

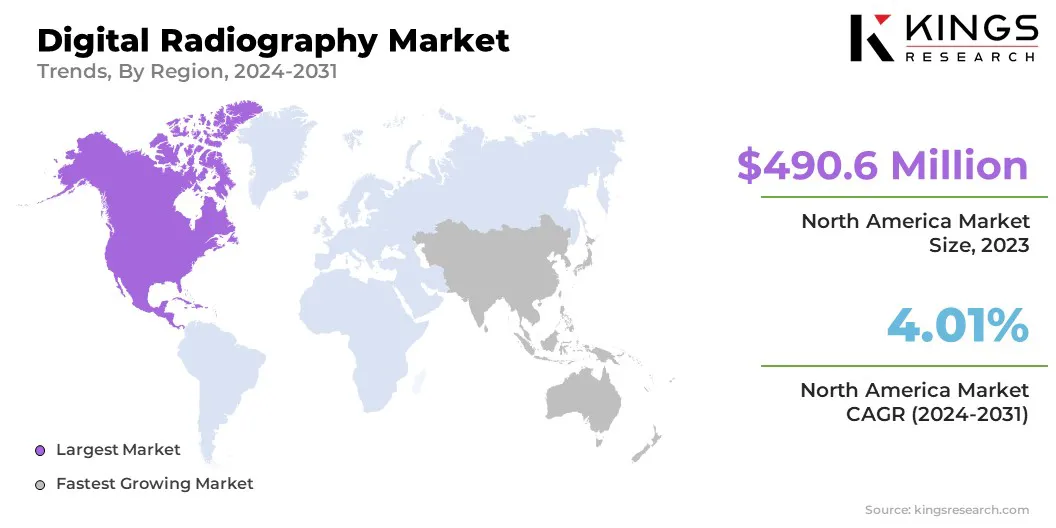

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America digital radiography market accounted for a substantial share of around 34.09% in 2023, valued at USD 490.6 million. This dominance is reinforced by high healthcare expenditure, rapid adoption of advanced imaging technologies, and a well-established regulatory framework.

The presence of leading players, increasing investments in AI-powered radiology solutions, and strong reimbursement policies further support regional market growth.

The U.S. dominates the marke due to its rising geriatric population, a growing prevalence of chronic diseases, and surging demand for efficient diagnostic imaging. Additionally, technological advancements such as portable DR systems, cloud-based PACS, and tele radiology are fostering market expansion.

- In July 2024, according to the U.S. Food and Drug Administration (FDA), chronic diseases (CCDs) account for 7 of the 10 leading causes of death in the U.S., propelling demand for digital radiography. The increasing need for early detection and accurate diagnostics is accelerating the adoption of advanced imaging technologies in healthcare facilities.

Asia Pacific digital radiography industry is poised to grow at a CAGR of 5.58% over the forecast period. Factors such as rising healthcare infrastructure investments, increasing adoption of digital healthcare solutions, and a growing patient population are propelling regional market expansion.

Countries such as China, India, and Japan are witnessing a surge in demand for cost-effective and efficient imaging solutions, supported by government initiatives to modernize radiology departments. The region’s focus on early disease detection, AI-driven imaging, and mobile radiography solutions is expected to further accelerate this growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the market by overseeing device approvals, radiation safety, and compliance standards. Through 510(k) clearance and premarket approvals, the FDA ensures that radiographic systems meet safety, performance, and data security requirements.

- In Europe, the European Commission (EC) regulates the market by enforcing strict approval processes to ensure safety, quality, and compliance. It madates that digital radiography devices meet rigorous regulatory requirements before market entry, balancing innovation with patient safety and performance efficiency.

Competitive Landscape

Leading companies operating in the digital radiography market focus on technological advancements, strategic partnerships, and product portfolio diversification to strengthen their market presence.

Key players invest in AI-integrated imaging solutions, portable digital radiography systems, and cloud-based diagnostic platforms to enhance efficiency and patient outcomes. Additionally, mergers, acquisitions, and collaborations with healthcare institutions and research organizations are aiding market growth.

Emerging companies leverage cost-effective solutions and regional market penetration strategies to compete with dominant firms, intensifying global competitiong.

- In July 2024, Siemens Healthineers inaugurated the Multix Impact E production facility in Bengaluru to strengthen its market presence. This initiative enhances local manufacturing capabilities, supports affordable digital X-ray solutions, and addresses the growing demand for cost-effective, AI-integrated imaging systems in emerging healthcare markets like India.

List of Key Companies in Digital Radiography Market:

- Siemens Healthcare Private Limited

- Samsung

- Agfa-Gevaert Group

- Planmed Oy

- Shimadzu Corporation

- Carestream Health

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shanghai United Imaging Healthcare Co., LTD

- Analogic Corporation

- Canon Medical Components Europe B.V.

- Guerbet

- Novarad Corporation

- FUJIFILM

- Koninklijke Philips N.V.

- General Electric Company

Recent Developments (Product Launch)

- In December 2024, Mindray expanded its Resona-Series radiology portfolio with the launch of the Resona I8 Ultrasound Machine, reinforcing innovation in the digital radiography market. Featuring ZST+ beamforming technology, the mobile platform enhances workflow efficiency, imaging precision, and affordability, aligning with the evolving needs of modern sonographers and healthcare providers.

- In September 2024, Harrison.ai launched a Harrison.rad.1, a world-leading AI model to transform healthcare imaging, aligning with the digital radiography market's growing adoption of AI-powered diagnostic solutions.

- In July 2023, Shimadzu Corporation launched the MobileDaRt Evolution MX8 Version V, a next-generation mobile digital radiography system, enhancing the digital radiography market with advanced AI-powered image processing, wireless connectivity, and improved dose management.

- In July 2023, Canon Medical Systems Corporation launched the Zexira i9, a highly versatile Digital X-ray RF system offering superior image quality and low radiation dose, designed to improve clinical efficiency and patient care.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)