Electric Construction Equipment Market

Electric Construction Equipment Market Size, Share, Growth & Industry Analysis, By Vehicle (Forklift, Excavator, Loader, Crane, Roller, Others), By Battery (Lithium-Ion, Lead Acid, Others), By End-Use (Residential, Commercial, Industrial) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR480

Electric Construction Equipment Market Size

The global Electric Construction Equipment Market size was valued at USD 13.44 billion in 2023 and is projected to reach USD 81.58 billion by 2031, growing at a CAGR of 25.72% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as AB Volvo, Caterpillar, BYD Group, Hitachi Construction Machinery Co. Ltd, Komatsu Ltd., Wacker Neuson Group, Deere & Company, J C Bamford Excavators Ltd., Doosan Corporation, KUBOTA Corporation, CNH Industrial N.V. and Others.

The perspective of the market is promising, with a current scenario marked by a growing shift toward sustainability and eco-friendly solutions in the construction industry. The market is experiencing steady growth driven by factors such as increasing awareness of environmental concerns, stringent emission regulations, and advancements in electric vehicle technology. The outlook for the market is optimistic, with continued growth expected in the forecast years as more construction companies embrace electric equipment to reduce carbon footprint, lower operating costs, and enhance operational efficiency. Market players are focusing on innovation and product development to meet the evolving consumer needs, which is positively impacting the market's growth trajectory.

Analyst’s Review

Key growth influencing trends in the electric construction equipment market include technological advancements, the increasing adoption of electric vehicles in construction activities, and government initiatives promoting sustainable infrastructure development. In the forecast years, the market is poised to witness significant growth driven by factors such as the rising demand for zero-emission construction equipment, favorable government policies incentivizing electric vehicle adoption, and growing investment in renewable energy infrastructure projects. Additionally, advancements in battery technology, improved charging infrastructure, and the introduction of smart electric construction equipment are expected to further propel market growth.

Market Definition

Electric construction equipment refers to machinery and vehicles used in construction activities that are powered by electric sources, such as batteries or electric motors. This equipment offers various advantages over traditional diesel-powered counterparts, including lower emissions, reduced operating costs, quieter operation, and improved efficiency. Key applications of electric construction equipment include excavation, material handling, earthmoving, road construction, and demolition. From the regulatory perspective, there is a growing emphasis on reducing carbon emissions and promoting sustainable practices in the construction industry, leading to the increased adoption of electric equipment through incentives, subsidies, and stricter emission standards.

Electric Construction Equipment Market Dynamics

The rapid advancement in battery technology is a significant driver fostering the growth of the electric construction equipment market. As battery technology continues to evolve, electric construction equipment manufacturers can offer products with improved battery capacity, faster charging times, longer operational hours, and enhanced performance. This technological advancement enables electric equipment to match or even surpass the capabilities of traditional diesel-powered counterparts, making them more attractive to construction companies seeking sustainable and efficient solutions.

Additionally, advancements in battery technology contribute toward reducing the total cost of ownership for electric construction equipment, further incentivizing their adoption in the construction industry.

High initial cost associated with electric-powered equipment poses a significant restraint to the growth of market. While electric equipment offers long-term cost savings through lower operating expenses and maintenance costs compared to diesel-powered counterparts, the upfront investment required for purchasing electric construction equipment is typically higher. This high initial cost can deter some construction companies from transitioning to electric equipment, especially for small and medium-sized enterprises with budget constraints.

Additionally, the need for investing in charging infrastructure and training personnel for operating electric equipment adds to the initial expenses, further hampering the adoption of electric construction equipment.

Segmentation Analysis

The global market is segmented based on vehicle, battery, end-use, and geography.

By Vehicle

Based on vehicle, the market is segmented into forklift, excavator, loader, crane, roller, and others. The excavator segment dominated the market with a share of 27.54% in 2023 can be attributed to several factors, including the widespread use of excavators across various construction projects such as building construction, infrastructure development, and mining activities. Additionally, the increasing availability and advancements in electric excavator models, coupled with their ability to offer comparable performance to diesel-powered counterparts while being more environmentally friendly, are aiding segmental expansion.

Moreover, government regulations promoting the use of electric equipment in construction activities, along with incentives for adopting sustainable practices, have further boosted the demand for electric excavators, solidifying their position as the leading segment in the electric construction equipment market.

By Battery

Based on battery, the market is classified into lithium-ion, lead acid, and others. The lithium-ion segment is expected to exhibit the fastest-growth acquiring a CAGR of 26.61% over the forecast period. This growth can be attributed to several factors, including the superior performance characteristics of lithium-ion batteries compared to other battery technologies, such as higher energy density, longer cycle life, and faster charging capabilities. Additionally, ongoing advancements and innovations in lithium-ion battery technology, coupled with declining costs and increasing production capacity, are driving their adoption in electric construction equipment.

Furthermore, the growing demand for electric vehicles and renewable energy storage solutions across various industries is expected to further fuel segment growth, making them the preferred choice for powering electric construction equipment.

By End-Use

Based on end-use, the market is classified into residential, commercial, and industrial. The commercial segment garnered the highest valuation of USD 5.20 billion in 2023. This valuation can be attributed to several factors, including the increasing adoption of electric construction equipment by commercial construction companies, real estate developers, and infrastructure development projects. Rising number of construction activities, including residential and commercial building construction, infrastructure development, and urban development projects is driving product uptake in the commercial sector.

Additionally, government initiatives promoting sustainable construction practices and incentives for adopting electric equipment in commercial projects have further facililated segment growth .

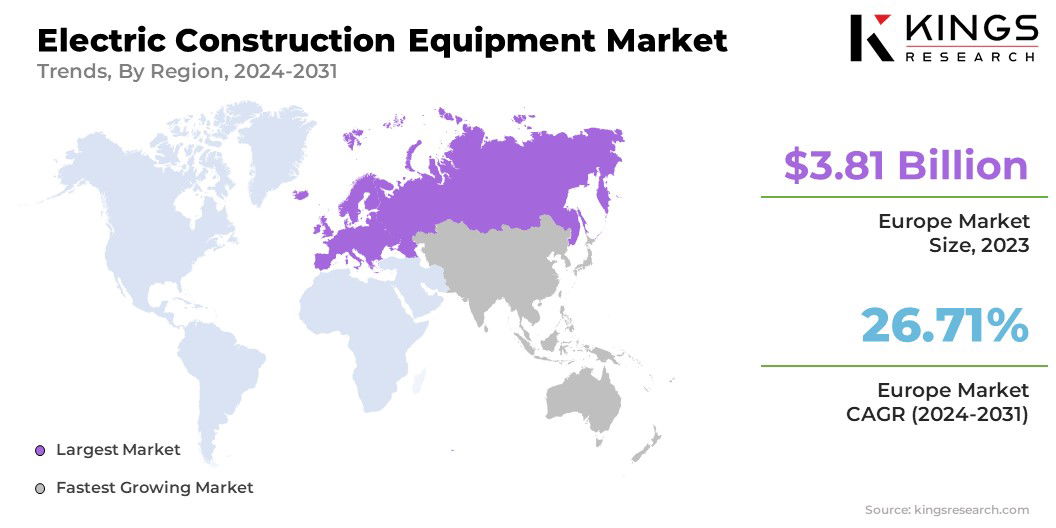

Electric Construction Equipment Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Electric Construction Equipment Market share stood around 28.35% in 2023 in the global market, with a valuation of USD 3.81 billion. The stringent environmental regulations and emission standards imposed by European Union directives have pushed construction companies in the region to transition towards electric construction equipment to comply with sustainability requirements. Additionally, government initiatives and subsidies supporting the adoption of electric vehicles and renewable energy technologies have further boosted the regional electric construction equipment market growth.

Moreover, the presence of key manufacturers of electric construction equipment in Europe, along with advanced infrastructure for electric vehicle charging and battery manufacturing, has contributed to the region's leadership position in the market. Overall, Europe's dominance in the market is expected to continue in the foreseeable future, driven by a combination of regulatory support, technological advancements, and increasing environmental awareness.

Competitive Landscape

The electric construction equipment market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Electric Construction Equipment Market

- AB Volvo

- Caterpillar

- BYD Group

- Hitachi Construction Machinery Co. Ltd

- Komatsu Ltd.

- Wacker Neuson Group

- Deere & Company

- J C Bamford Excavators Ltd.

- Doosan Corporation

- KUBOTA Corporation

- CNH Industrial N.V.

- Kobelco Construction Machinery Co., Ltd.

Key Industry Developments

- November 2023 (Partnership): Volvo Group and CRH inked a Memorandum of Understanding (MoU) aimed at investigating decarbonization prospects in transport, operations, and materials. This strategic collaboration was purposed to concentrate on electrification, charging infrastructure, low carbon fuels, and renewable energy, with the collective aim of minimizing emissions.

- August 2023: Deere & Company announced plans to setup North Carolina as the site for constructing its 115,000-square-foot manufacturing plant. This facility was intended to enhance production capabilities for Kreisel Electric products, thus supporting Deere's strategic expansion initiatives.

- February 2023 (Launch): Volvo Group constructed a new production facility and equipment at Changwon plant in South Korea, the largest excavator production site in Volvo CE, generating approximately 55% of its total excavator volumes. The new facility was built to manufacture various common electric storage solutions (battery packs) for Volvo Group.

The global Electric Construction Equipment Market is segmented as:

By Vehicle

- Forklift

- Excavator

- Loader

- Crane

- Roller

- Others

By Battery

- Lithium-Ion

- Lead Acid

- Others

By End-Use

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)