buyNow

Nutraceutical Excipients Market

Nutraceutical Excipients Market Size, Share, Growth & Industry Analysis, By Form (Dry, Liquid), By Product (Prebiotics, Probiotics, Proteins & Amino Acids, Vitamins), By Source (Organic, Inorganic), By Function, and Regional Analysis, 2025-2032

pages: 200 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Nutraceutical excipients are inactive substances used in the production of nutraceuticals to facilitate manufacturing, stabilize active ingredients, enhance absorption, and ensure consistent formulation. They enable effective delivery of functional ingredients in tablets, capsules, powders, and liquids, while aiding in taste masking, shelf-life extension, and product aesthetics, without offering therapeutic effects.

Nutraceutical Excipients Market Overview

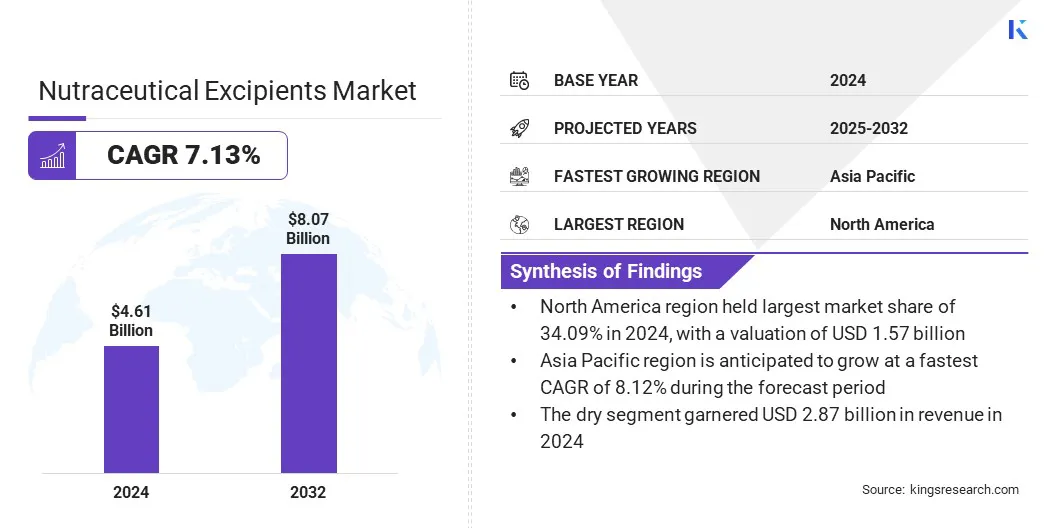

The global nutraceutical excipients market size was valued at USD 4.61 billion in 2024 and is projected to grow from USD 4.91 billion in 2025 to USD 8.07 billion by 2032, exhibiting a CAGR of 7.13% during the forecast period.

This growth is fueled by the rising demand for tablets with stable sustained release, which require specialized excipients to control the release rate and improve efficacy. A key market trend is the shift toward moisture-resistant excipients that protect active ingredients and enhance shelf stability.

Key Highlights:

- The nutraceutical excipients industry size was recorded at USD 4.61 billion in 2024.

- The market is projected to grow at a CAGR of 7.13% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 1.57 billion.

- The dry segment garnered USD 2.87 billion in revenue in 2024.

- The prebiotics segment is expected to reach USD 2.42 billion by 2032.

- The organic segment is projected to generate a revenue of USD 4.60 billion by 2032.

- The binder segment is expected to reach USD 1.80 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 8.12% over the forecast period.

Major companies operating in the nutraceutical excipients market are Rubexco, Roquette Frères, GATTEFOSSE SAS, Biogrund, International Flavors & Fragrances Inc., The Lubrizol Corporation, ABF Ingredients, Lipoid GmbH, DFE Pharma, Ingredion, Nordmann, Rassmann GmbH, Innophos, Sensient Technologies Corporation, Actylis, and JRS PHARMA.

Market expansion is propelled by the growing use of excipients in softgel capsule formulations. These capsules require excipients that support uniform fill, prevent ingredient migration, and enhance the bioavailability of lipid-based actives.

The increasing demand for softgels, boosted by consumer preference for easy-to-swallow formats and rapid absorption, has prompted manufacturers to develop excipients that ensure stability, clarity, and controlled release. This has strengthened the role of excipients in supporting the quality and functionality of softgel-based nutraceutical products.

- In May 2024, Roquette launched its new LYCAGEL Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical softgel capsules. The excipient, introduced at Vitafoods Europe 2024, allows manufacturers to choose custom plasticizer combinations, addressing formulation and production challenges while meeting growing demand for plant-based softgel alternatives.

Market Driver

Growing Demand for Tablets with Stable Sustained Release

The growth of the nutraceutical excipients market is fueled by the growing demand for tablets with stable sustained release. Manufacturers are developing excipients that support controlled delivery of active ingredients over time.

This improves therapeutic effectiveness, enhances consumer convenience, and reduces the need for frequent dosing. Healthcare providers and consumers prefer formulations that offer consistent absorption and extended effects. This growing demand is accelerating investments in advanced excipient technologies focused on sustained-release applications.

- In October 2023, The Lubrizol Corporation launched Carbopol Polymers for nutraceutical applications, following new EU food-grade approval. The approval allows their use in both liquid and solid supplements, supporting sustained release, reduced tablet size, and enhanced product differentiation for manufacturers.

Market Challenge

Compatibility Issues Between Excipients and Active Ingredients

A major challenge restraining the progress of the nutraceutical excipients market is the potential incompatibility between excipients and active ingredients, which can compromise stability, alter release profiles, and affect absorption. This leads to formulation delays and increased risk of product failure.

To overcome this challenge, manufacturers are conducting compatibility testing during early development. They are using predictive modeling tools and pre-screened excipient systems to ensure functional and chemical alignment. These solutions help maintain product quality, reduce reformulation costs, and support faster time-to-market.

Market Trend

Shift Toward Moisture-resistant Excipients

The nutraceutical excipients market is witnessing a rising trend toward the adoption of moisture protection across formulations. Manufacturers are increasingly using moisture-resistant excipients to prevent degradation of sensitive active ingredients during storage and transport. High humidity can compromise the stability, texture, and shelf life of nutraceutical products, particularly in regions with tropical or variable climates.

Formulators are adopting excipients with desiccant properties or moisture-barrier coatings that ensure product integrity over time. This trend supports the development of reliable and long-lasting tablets, capsules, and powders.

- In October 2023, Roquette introduced three new excipient grades: LYCATAB CT-LM, MICROCEL 103 SD, and MICROCEL 113 SD at CPHI Barcelona to strengthen its moisture protection portfolio. These excipients offer low water activity and enhanced stability for moisture-sensitive pharmaceutical and nutraceutical formulations, supporting various production methods and improving product performance.

Nutraceutical Excipients Market Report Snapshot

|

Segmentation |

Details |

|

By Form |

Dry, Liquid |

|

By Product |

Prebiotics, Probiotics, Proteins & Amino Acids, Vitamins, Minerals, Others |

|

By Source |

Organic, Inorganic |

|

By Function |

Binder, Disintegrants, Fillers & Diluents, Coating Agent, Flavoring Agents & Sweeteners, Lubricants, Colorants, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Form (Dry and Liquid): The dry segment earned USD 2.87 billion in 2024, mainly due to its wide use in tablets and capsules for better stability and shelf life.

- By Product (Prebiotics, Probiotics, Proteins & Amino Acids, Vitamins, Minerals, and Others): The prebiotics segment held a share of 29.90% in 2024, primarily fueled by rising demand for gut health supplements and functional foods.

- By Source (Organic and Inorganic): The organic segment is projected to reach USD 4.60 billion by 2032, owing to increased consumer preference for clean-label and plant-based formulations.

- By Function (Binder, Disintegrants, Fillers & Diluents, Coating Agent, Flavoring Agents & Sweeteners, Lubricants, Colorants, and Others): The binder segment is projected to reach USD 1.80 billion by 2032, propelled by its essential role in maintaining structural integrity in solid nutraceutical dosage forms.

Nutraceutical Excipients Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America nutraceutical excipients market share stood at 34.09% in 2024, valued at USD 1.57 billion. This dominance is reinforced by strong demand for sustained-release nutraceutical tablets and well-established manufacturing infrastructure.

Consumers in the region are preferring advanced dosage forms that support consistent nutrient delivery. This has increased the use of specialized excipients in tablets and capsules. Additionally, the presence of key nutraceutical brands and contract manufacturers has accelerated innovation in excipient formulations, supporting regional market growth.

The Asia-Pacific nutraceutical excipients industry is poised to grow at a CAGR of 8.12% over the forecast period. This growth is propelled by increasing health awareness and rising consumption of functional foods and dietary supplements. Rapid urbanization, expanding middle-class population, and supportive government initiatives for nutrition and wellness are contributing to higher demand for advanced excipient-based formulations.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates nutraceutical excipients under the Dietary Supplement Health and Education Act (DSHEA), requiring them to be classified as Generally Recognized as Safe (GRAS) or approved food additives.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates excipients under the Food Sanitation Act, which governs the use of food additives and ensures they meet safety standards for functional foods.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates nutraceutical excipients under the Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, Food for Special Medical Purpose, Functional Food, and Novel Food) Regulations, 2016.

Competitive Landscape

Key players in the nutraceutical excipients industry are focusing on strategic partnerships and geographic expansion to strengthen their market position. Companies are forming alliances with contract manufacturers and ingredient suppliers to improve supply chain efficiency and ensure consistent quality. Several players are entering joint development agreements with nutraceutical brands to co-create advanced formulations tailored to specific health applications.

Geographical expansion remains a key strategy, with companies investing in new production facilities across Asia Pacific, North America, and Europe to meet rising regional demand.

Market participants are also increasing their presence in emerging markets through distribution agreements and localized production to reduce costs and comply with regional regulations. These strategies aim to enhance global reach, improve responsiveness to market needs, and support long-term growth.

- In May 2025, Colorcon and ASHA Cellulose entered an exclusive partnership focused on the distribution of ethyl cellulose-based excipients across Europe, the Middle East, Africa, and Asia. The agreement enables Colorcon to represent ASHACEL and ASHAKOTE products, supporting sustained release, taste-masking, and moisture control in pharmaceutical and nutraceutical formulations.

Key Companies in Nutraceutical Excipients Market:

- Rubexco

- Roquette Frères

- GATTEFOSSE SAS

- Biogrund

- International Flavors & Fragrances Inc.

- The Lubrizol Corporation

- ABF Ingredients

- Lipoid GmbH

- DFE Pharma

- Ingredion

- Nordmann, Rassmann GmbH

- Innophos

- Sensient Technologies Corporation

- Actylis

- JRS PHARMA

Recent Developments (Partnerships)

- In October 2024, Hovione and Zerion Pharma established a joint venture to advance the Dispersome technology platform. The partnership aims to enhance the solubility and bioavailability of small drug molecules for use in nutraceutical and medicinal foods.

freqAskQues