Food and Beverages

Feed Acidulants Market

Feed Acidulants Market Size, Share, Growth & Industry Analysis, By Animal Type (Poultry Feed, Swine Feed, Cattle Feed, Aquaculture Feed, Others), By Type (Organic Acidulants, Inorganic Acidulants), By Form (Powder, Liquid), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : March 2025

Report ID: KR1571

Market Definition

The feed acidulants market encompasses the production and formulation of organic and inorganic acids used as additives in animal nutrition to enhance feed preservation, digestion, and nutrient absorption.

These acidulants, including fumaric, propionic, and formic acids, regulate pH levels, inhibit microbial growth, and improve gut health. They are incorporated into compound feed, silage, and premixes through direct addition or encapsulation technologies to ensure controlled release and stability.

Widely applied in poultry, swine, and aquaculture sectors, feed acidulants support efficient feed utilization, mitigate pathogenic risks, and optimize livestock performance, making them essential components in modern animal husbandry practices.

Feed Acidulants Market Overview

The global feed acidulants market size was valued at USD 3,092.3 million in 2023 and is projected to grow from USD 3,262.2 million in 2024 to USD 4,996.3 million by 2031, exhibiting a CAGR of 6.28% during the forecast period.

The market is driven by the rising demand for high-quality animal nutrition to improve feed efficiency and livestock health. Increasing concerns over antimicrobial resistance have accelerated the shift toward acid-based alternatives, supporting their widespread adoption.

Additionally, stringent regulations on antibiotic growth promoters in animal feed have fueled the demand for acidulants, reinforcing their role in enhancing feed safety and performance.

Major companies operating in the global feed acidulants industry are BASF, Yara International, Kemin Industries, Inc., Eastman Chemical Company, Koninklijke DSM N.V., Corbion N.V., Cargill, Incorporated, ADM, Huangshi Xinghua Biochemical Co., Ltd., Novus International, Inc., Tate & Lyle PLC, Biomin Holding GmbH, Jungbunzlauer Suisse AG, PeterLabs Holdings Berhad, and Nutrex NV.

The rising prevalence of livestock diseases has intensified the need for effective feed additives, fueling the market.

- In July 2024, Brazil reported an outbreak of Newcastle Disease (ND) at a chicken farm in Rio Grande do Sul, the country’s third-largest poultry-exporting state, following the death of 7,000 birds. This marks the first significant ND outbreak since 2006. As the world's leading chicken exporter, Brazil ships approximately 430,000 tons of poultry products monthly.

The detection of ND in Rio Grande do Sul prompted authorities to implement an immediate and temporary suspension of chicken exports to contain the spread and assess the situation. Acidulants help mitigate these risks by creating an unfavorable environment for microbial growth, reducing disease outbreaks in poultry, swine, and ruminants.

The growing awareness among livestock farmers regarding the role of acidulants in disease prevention is driving their widespread adoption. The demand for safer and more effective feed preservation methods is further reinforcing market growth.

Key Highlights:

- The global feed acidulants market size was valued at USD 3,092.3 million in 2023.

- The market is projected to grow at a CAGR of 6.28% from 2024 to 2031.

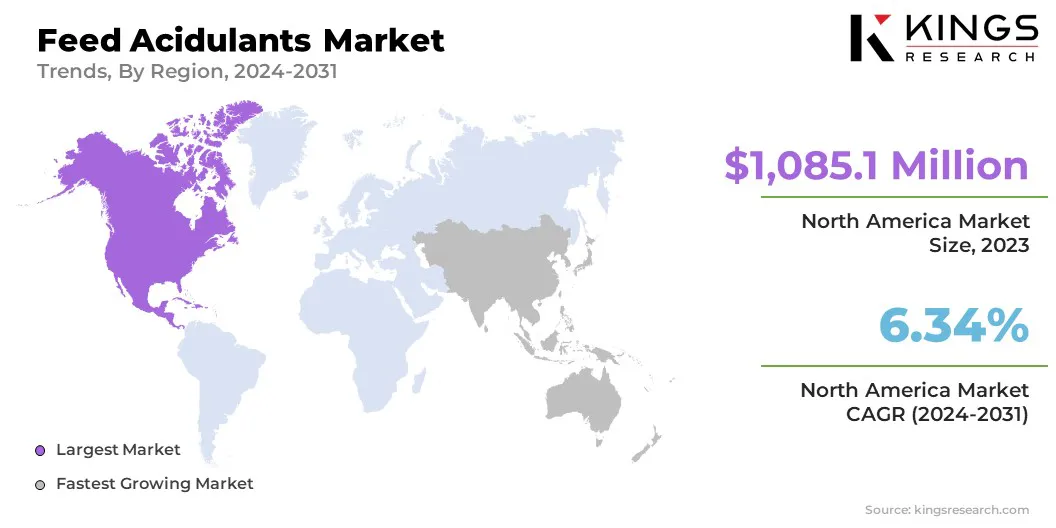

- North America held a market share of 35.09% in 2023, with a valuation of USD 1,085.1 million.

- The poultry feed segment garnered USD 1,054.2 million in revenue in 2023.

- The organic acidulants segment is expected to reach USD 3,115.8 million by 2031.

- The liquid segment is poised for a robust CAGR of 7.31% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.84% during the forecast period.

Market Driver

"Expansion of Livestock Production"

The increasing demand for meat and dairy products has propelled investments in livestock farming, supporting the growth of the feed acidulants market. Rising population levels, urbanization, and higher disposable incomes have contributed to a surge in animal protein consumption, requiring efficient feed formulations to sustain production.

Acidulants play a critical role in improving feed utilization, reducing pathogen risks, and ensuring high-performance livestock. Countries with large-scale meat and dairy industries, including China, Brazil, and the U.S., are registering significant adoption of acidulant-based feed additives to enhance productivity and meet rising consumer demand.

- The United States Department of Agriculture's October 2024 report projects global chicken meat production to rise by nearly 2% in 2025, reaching a record 104.9 million tons. Most of the major meat producing countries are expected to register growth, with the largest increases anticipated in China, the U.S., Turkey, the EU, Brazil, and Mexico. This expansion is driven by a slight improvement in feed prices and stronger consumer demand supported by economic growth. Global exports are forecasted to increase by 2% in 2025, reaching a record 13.8 million tons, following relatively stagnant trade in 2023 and 2024.

Market Challenge

"Regulatory Compliance and Complexity to Product Formulation"

The feed acidulants market faces significant challenges, due to regulatory requirements across various regions. Compliance with safety standards, residue limits, and environmental regulations adds complexity to product formulation and market entry.

Regulatory variations between countries further complicate approval processes, increasing costs and time-to-market for new products. Investment in advanced Research and Development (R&D) is focused on creating innovative acidulant formulations that meet regulatory standards while maintaining efficacy.

Strategic collaborations with regulatory bodies and continuous monitoring of evolving policies enable smoother compliance. Additionally, the adoption of sustainable production methods aligns with environmental regulations, ensuring long-term market growth.

Market Trend

"Advancements in Encapsulation Technologies"

Technological innovations in encapsulation have enhanced the stability and efficacy of acidulants, strengthening the feed acidulants market. Advanced microencapsulation and coating technologies enable the controlled release of acidulants, ensuring their effectiveness throughout digestion.

This enhances their bioavailability and reduces degradation during storage and feed processing. Encapsulated acidulants maintain optimal pH levels in animal intestines, improving feed conversion efficiency and disease resistance.

- In June 2024, Kemin Industries introduced FORMYL, an advanced feed additive aimed at improving swine health and productivity in the U.S. Developed by Kemin Animal Nutrition and Health – North America, this innovative solution features a proprietary blend of encapsulated calcium formate and citric acid, ensuring targeted delivery and maximum effectiveness. Research indicates that calcium formate serves as a potent feed acidifier and antimicrobial agent, disrupting pathogen cell membranes to enhance biosecurity and overall livestock performance.

Feed manufacturers are investing in R&D to develop acidulants with improved solubility and prolonged action, allowing precise delivery of active compounds. These advancements are driving greater adoption across poultry, swine, and aquaculture feed formulations.

Feed Acidulants Market Report Snapshot

|

Segmentation |

Details |

|

By Animal Type |

Poultry Feed, Swine Feed, Cattle Feed, Aquaculture Feed, Others |

|

By Type |

Organic Acidulants (Formic Acid, Citric Acid, Lactic Acid, Acetic Acid, Propionic Acid, Butyric Acid, Fumaric Acid, Malic Acid, Other Organic Acids), Inorganic Acidulants (Phosphoric Acid, Sulfuric Acid, Hydrochloric Acid, Other Inorganic Acids) |

|

By Form |

Powder, Liquid |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Animal Type (Poultry Feed, Swine Feed, Cattle Feed, Aquaculture Feed, and Others): The poultry feed segment earned USD 1,054.2 million in 2023, due to the increasing demand for high-quality poultry products, rising poultry farming activities, and the essential role of acidulants in improving feed efficiency, nutrient absorption, and disease prevention in poultry production.

- By Type (Organic Acidulants and Inorganic Acidulants): The organic acidulants segment held 64.09% share of the market in 2023, due to its superior efficacy in improving gut health, enhancing nutrient absorption, and ensuring pathogen control, while meeting regulatory standards and the growing demand for natural feed additives.

- By Form (Powder and Liquid): The liquid segment is poised for significant growth at a CAGR of 7.31% through the forecast period, due to its superior mixability, higher efficacy in pathogen control, and ease of uniform dispersion in feed formulations, enhancing overall feed quality and animal performance.

Feed Acidulants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a market share of around 35.09% in 2023, with a valuation of USD 1,085.1 million. The large-scale commercialization of livestock farming in North America is increasing the need for efficient feed additives, accelerating the demand for acidulants.

The presence of well-established poultry, swine, and dairy industries, particularly in the U.S., led to higher adoption of performance-enhancing feed solutions. The expansion of large integrated farming systems and animal husbandry enterprises is further driving the feed acidulants market in North America.

- The 2024 United States Department of Agriculture report projects a 2% increase in U.S. pork production in 2025, reaching 12.9 million tons. Higher profitability in 2024 and lower feed costs are expected to support increased hog weights. U.S. pork exports are forecasted to grow by 3% to 3.4 million tons in 2025, driven by strong price competitiveness and ample domestic supply. Mexico will remain a key export destination while facing rising competition from Brazil.

Additionally, regulatory bodies in North America, including the U.S. Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA), have imposed strict limitations on the use of antibiotic growth promoters in livestock feed due to concerns over antimicrobial resistance.

These regulations have accelerated the demand for natural alternatives such as feed acidulants, which enhance animal health and performance without contributing to antibiotic resistance. The growing emphasis on regulatory compliance has prompted feed manufacturers to integrate acidulants into livestock nutrition programs, supporting the expansion of the market in North America.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.84% over the forecast period. The frequent outbreaks of livestock diseases in Asia Pacific have heightened the demand for effective biosecurity measures, fueling the feed acidulants market.

The region has faced challenges from diseases such as African Swine Fever (ASF) and Avian Influenza, prompting livestock producers to adopt acidulants for their antimicrobial properties.

Acidulants help regulate gut pH, inhibit pathogenic bacteria, and enhance immunity in animals, reducing disease risks. The growing emphasis on preventive animal healthcare and minimizing economic losses, due to disease outbreaks, is driving the widespread use of acidulants in animal feed.

Furthermore, the rising middle-class population and shifting dietary patterns in Asia Pacific are driving higher consumption of protein-rich foods, including poultry, pork, and seafood. Countries like China, India, Japan, and Indonesia are registering increased demand for high-quality meat and dairy products, pushing livestock producers to optimize feed efficiency.

Acidulants improve digestion, enhance feed conversion ratios, and support weight gain in animals, aligning with the growing consumer preference for nutritious and safe animal protein.

- According to the Agriculture and Horticulture Development Board, per capita beef consumption is expected to rise by 4% in South Korea, 12% in Vietnam, and 11% in Malaysia between 2022 and 2029. During the same period, per capita pork consumption is projected to grow by 2% in South Korea, while China and Vietnam are anticipated to register a significant increase of 22%.

Regulatory Frameworks

- The EU regulates feed additives, including acidulants, under Regulation (EC) No 1831/2003, which establishes a comprehensive procedure for authorizing feed additives and sets rules for their marketing, labeling, and use. All feed additives must undergo a rigorous assessment for safety, quality, and efficacy before approval and are listed in the EU Register of Feed Additives.

- In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) oversees the regulation of feed additives through the Act on Safety Assurance and Quality Improvement of Feeds. Importers and manufacturers must comply with stringent standards to ensure the safety and quality of feed additives.

- In South Korea, the Ministry of Food and Drug Safety (MFDS) recently announced revisions to food additive standards, including updates to usage standards and testing methods for various additives. Public comments were invited until August 26, 2024, indicating ongoing efforts to enhance regulatory frameworks for feed additives.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) released an updated "Approved Feed Additives" catalog in 2021. Companies interested in exporting feed additives to China must ensure that their products are listed in this catalog and comply with facility registration requirements established by the General Administration of China Customs (GACC).

Competitive Landscape:

The global feed acidulants market is characterized by several market players who are implementing strategies focused on developing advanced feed acids to assist raw material and animal feed producers in maintaining feed safety.

These innovations are designed to enhance biosecurity measures, mitigate risks associated with pathogens, and improve overall feed quality. Companies are introducing high-performance acidulants that optimize feed preservation and nutritional value by investing in R&D.

Such advancements are strengthening compliance with stringent regulatory standards and addressing the growing demand for safer animal nutrition solutions. These strategic initiatives are significantly contributing to the expansion of the market.

- In March 2025, Kemin Industries introduced PROSIDIUM, an advanced feed pathogen control solution, at VIV Asia in Bangkok, the largest feed and animal production tradeshow in Asia. Developed after years of research and innovation, PROSIDIUM utilizes a powerful blend of novel peroxy acids to support raw material and animal feed producers in ensuring feed safety. The solution is specifically formulated to help the industry address risks associated with Salmonella and viruses, enhancing biosecurity measures and elevating standards for producing clean and safe feed & food.

List of Key Companies in Feed Acidulants Market:

- BASF

- Yara International

- Kemin Industries, Inc.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Corbion N.V.

- Cargill, Incorporated

- ADM

- Huangshi Xinghua Biochemical Co., Ltd.

- Novus International, Inc.

- Tate & Lyle PLC

- Biomin Holding GmbH

- Jungbunzlauer Suisse AG

- PeterLabs Holdings Berhad

- Nutrex NV

Recent Developments (Expansion/Product Launch)

- In May 2024, Nutrex NV announced that the European Commission (EC) approved the commercialization of Nutrase P, a highly efficient 6-phytase enzyme, in the European market. This approval marks a significant milestone in advancing the poultry industry across Europe by enhancing nutritional efficiency and supporting sustainable production practices.

- In December 2023, Corbion, the Amsterdam-listed sustainable ingredients company, announced the mechanical completion of its new circular lactic acid manufacturing plant in Rayong, Thailand. This state-of-the-art facility is designed to produce lactic acid with the lowest carbon footprint compared to existing manufacturing technologies. With key mechanical systems successfully installed, the commissioning phase involving functional testing of equipment and systems commenced.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years