Energy and Power

Floating Offshore Wind Power Market

Floating Offshore Wind Power Market Size, Share, Growth & Industry Analysis, By Water Depth (Shallow Water, Transitional Water, Deep Water), By Turbine Capacity (Up to 3 MW, 3 MW - 5 MW, Above 5 MW), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR450

Market Definition

The market involves the development and deployment of floating wind turbines in deep water areas where traditional fixed-bottom turbines are not feasible. Market growth is driven by advancements in technology, increased renewable energy demand, and the potential to leverage wind energy in previously inaccessible areas, contributing to global sustainable energy solutions.

Floating Offshore Wind Power Market Overview

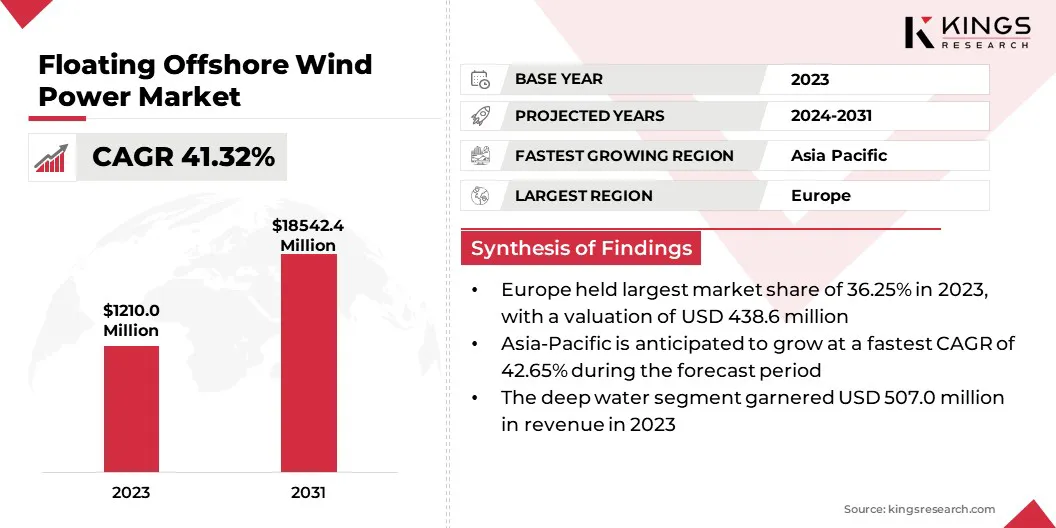

Global floating offshore wind power market size was USD 1,210.0 million in 2023, which is estimated to be valued at USD 1,647.4 million in 2024 and reach USD 18,542.4 million by 2031, growing at a CAGR of 41.32% from 2024 to 2031.

Technological advancements in floating turbine designs and installation methods are major factors fueling this growth. These innovations improve efficiency, reduce costs, and make offshore wind projects more feasible, enabling broader deployment in deep-water areas previously inaccessible to traditional turbines.

Major companies operating in the floating offshore wind power industry are TotalEnergies, Shell International B.V, Doosan Enerbility, Hitachi Energy Ltd, Vestas , Iberdrola, S.A., Equinor ASA, Siemens Gamesa Renewable Energy, S.A.U., General Electric Company, BW Ideol, Global Energy (Group) Limited, Hexicon, Ørsted A/S, Prysmian S.p.A, RWE, and others.

The market is a rapidly evolving segment of the renewable energy industry, utilizing floating turbines to leverage wind energy in deeper waters. This market is gaining significant interest due to the potential to generate large-scale, clean energy in areas where traditional offshore wind solutions are not viable.

The market is expanding significantly, propelled by technological advancements and rising investments, with ongoing projects exploring its potential for large-scale, sustainable energy generation.

- In March 2023, Salamander, a joint venture of Ørsted, Simply Blue Group, and Subsea7, secured an exclusivity agreement for a 100 MW floating wind project off Peterhead, Scotland. This initiative aims to advance floating offshore wind technology while supporting Scotland's broader energy goals and local supply chain development.

Click to learn, How data-driven insights can impact your market positionKey Highlights:

Click to learn, How data-driven insights can impact your market positionKey Highlights:

- The floating offshore wind power industry size was USD 1,210.0 million in 2023.

- The market is projected to grow at a CAGR of 41.32% from 2024 to 2031.

- Europe held a share of 36.25% in 2023, valued at USD 438.6 million.

- The deep water segment garnered USD 507.0 million in revenue in 2023.

- The above 5 MW segment is expected to reach USD 7,709.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 42.65% over the forecast period.

Market Driver

"Rising Renewable Energy Demand"

The growing global demand for sustainable and clean energy sources is significantly boosting investments in the floating offshore wind power market.

- According to the IEA, global renewable electricity generation is projected to exceed 17,000 terawatt-hours (TWh) by 2030, marking an increase of nearly 90% from 2023. This growth is expected to meet the combined power demand of China and the United States.

As the transition from fossil fuels accelerates, the demand for renewable energy solutions, particularly offshore wind power, is growing. Floating offshore wind offers a promising alternative, providing large-scale energy production while contributing to decarbonization efforts. This rising demand boosts technological advancements and market expansion, creating growth opportunities.

- In May 2024, Prysmian successfully completed the Gruissan/EOLMED floating offshore wind farm export cable project in France. This achievement, part of a contract with RTE, involved designing, supplying, and installing a 66 kV submarine cable, reinforcing Prysmian's leadership in dynamic cable systems for offshore wind farms.

Market Challenge

"Public Acceptance and Regulatory Challenges"

Public acceptance is a major challenge impeding the expansion of the floating offshore wind power market, as concerns over potential impacts on marine ecosystems and local communities often lead to opposition and regulatory delays.

To overcome this challenge, developers can engage in transparent public consultations, conduct thorough environmental assessments, and clearly communicate the long-term benefits of clean energy. Collaborating with local communities and providing clear information on environmental protection measures can foster support and streamline regulatory approvals.

- In July 2024, the DemoSATH Lab initiative was launched by Saitec Offshore Technologies and RWE to further study the environmental impacts of floating wind turbines. The research, running through 2025, focuses on bird interactions, underwater noise, and marine ecosystem biodiversity.

Market Trend

"Emergence of Floating Wind Farm Clusters"

A notable trend in the floating offshore wind power market is the development of large-scale floating wind farm clusters. By co-locating multiple floating turbines, these clusters optimize energy production, streamline installation and maintenance, and enhance grid integration.

By increasing the scale of projects, developers can reduce overall costs, improve efficiency, and enhance grid integration, strengthening the competitiveness of floating wind farms in the global renewable energy market.

- In May 2024, RWE announced the Nordseecluster project, to be developed in two phases. Nordseecluster A, with 660 MW capacity, will start construction in 2025 and be complete by 2027. Phase B, with 900 MW, is expected to begin in 2027 and operate by 2029. The project will generate 6.5 terawatt hours (TWh) annually, supporting industrial decarbonization.

Floating Offshore Wind Power Market Report Snapshot

|

Segmentation |

Details |

|

By Water Depth |

Shallow Water, Transitional Water, Deep Water |

|

By Turbine Capacity |

Up to 3 MW, 3 MW - 5 MW, Above 5 MW |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Water Depth (Shallow Water, Transitional Water, and Deep Water): The deep water segment earned USD 507.0 million in 2023 due to advancements in floating wind turbine technology that enables energy installations in previously inaccessible deep waters.

- By Turbine Capacity (Up to 3 MW, 3 MW - 5 MW, and Above 5 MW): The above 5 MW segment held a share of 41.61% in 2023, mainly fueled by the increasing demand for higher capacity turbines for large-scale offshore wind farms.

Floating Offshore Wind Power Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp)

Countries such as the UK, Germany, Spain and Denmark have heavily invested in offshore wind projects, establishing themselves as pioneers in this sector. Europe’s advanced technology, robust supply chain, and mature regulatory framework further enhance its appeal to developers and investors. This dominance is expected to persist as offshore wind capacity continues to expand across the region.

- In September 2023, RWE, Saitec Offshore Technologies and KEPCO connected Spain's first floating wind turbine, DemoSATH, to the grid. The project begins a two-year operational period to gather data on its environmental impact and performance.

Asia Pacific floating offshore wind power industry is set to grow at a robust CAGR of 42.65% over the forecast period. This growth is propelled by the region’s growing energy demand and commitment to sustainability.

China, Japan, and South Korea are heavily investing in floating offshore wind projects, spurred by government incentives and ambitious renewable energy targets.

Asia Pacific's increasing focus on offshore wind is further supported by favorable geographical conditions, such as vast coastlines and strong winds. With a robust manufacturing base and technological advancements, the regional market is expected to witness notable growth in the foreseeable future.

- In October 2023, Doosan Enerbility signed an MOU with Siemens Gamesa and Equinor for the 750MW Bandibuli Floating Offshore Wind Farm project in Ulsan, South Korea. Siemens Gamesa’s 14MW turbines will be assembled at Doosan’s Changwon plant for the development.

Regulatory Frameworks

- In the U.S., the Bureau of Ocean Energy Management manages the development of U.S. Outer Continental Shelf (OCS) energy, mineral, and geological resources in an environmentally and economically responsible way.

- The Ministry of New and Renewable Energy (MNRE) is India's central authority for new and renewable energy initiatives. Its primary objective is to develop and deploy new and renewable energy to meet the nation’s growing energy requirements.

Competitive Landscape

The global floating offshore wind power market is characterized by a large number of participants, including both established corporations and emerging players. Partnerships and collaborations between competitors are becoming increasingly common in the market.

Companies collaborate to pool resources, share technological expertise, and leverage diverse strengths. These strategic alliances help accelerate project development, reduce costs, and tackle challenges such as supply chain limitations, enabling faster scaling of floating offshore wind farms while promoting innovation and sustainability across the industry.

- In November 2024, TechnipFMC and Prysmian entered a collaboration to advance floating offshore wind development. By integrating TechnipFMC's system design expertise with Prysmian's cable technology, the partnership aims to provide an integrated solution, improving project economics and reducing execution risks.

List of Key Companies in Floating Offshore Wind Power Market:

- TotalEnergies

- Shell International B.V

- Doosan Enerbility

- Hitachi Energy Ltd

- Vestas

- Iberdrola, S.A.

- Equinor ASA

- Siemens Gamesa Renewable Energy, S.A.U.

- General Electric Company

- BW Ideol

- Global Energy (Group) Limited

- Hexicon

- Ørsted A/S

- Prysmian S.p.A

- RWE

Recent Developments (Launch/Expansion/Approval/Partnership/

- In August 2024, TotalEnergies launched a pilot project featuring a 3 MW floating wind turbine near the UK’s Culzean offshore platform. Aimed at reducing emissions, the turbine is expected to supply around 20% of the platform’s power by late 2025. This innovative project combines renewable electricity with existing gas turbine power generation.

- In October 2024, Iberdrola, through its U.S. subsidiary Avangrid, secured two lease sites for floating offshore wind development in the Gulf of Maine. With a potential capacity of 3,000 MW, the project will support New England's energy needs and contribute to the U.S. goal of 30,000 MW offshore wind capacity by 2030.

- In August 2023, the Hywind Tampen floating offshore wind farm was inaugurated in Norway, becoming a landmark project in offshore wind energy. Supplying power to the Gullfaks and Snorre oil fields, it reduces CO2 emissions by 200,000 tonnes annually, showcasing the viability of integrating floating wind power into the energy mix.

- In August 2024, Hexicon AB announced that its MunmuBaram floating offshore wind project in South Korea received approval for its Environmental Impact Assessment (EIA). This approval enables the participation in South Korea's wind power auction system, advancing the project’s role in supporting the country’s renewable energy targets.

- In September 2024, RWE signed a Letter of Support with the Port Authority of Setúbal to enhance port infrastructure for floating offshore wind projects. This collaboration aims to establish the port as a key logistics hub, supporting Portugal's industrialization goals and advancing the floating wind sector.

- In February 2025, RWE announced its plan to offer a 60 MW secondary reserve for the German power grid via its Amrumbank West offshore wind farm. This initiative supports grid stability by maintaining a 50 Hertz frequency while contributing to the integration of renewable energy into the grid.

- In February 2023, Ferrovial and RWE announced their partnership to develop, construct, and operate floating offshore wind farms off Spain’s coast. By combining Ferrovial’s local expertise and RWE’s 20+ years in offshore wind, the collaboration aims to support Spain’s 2030 renewable energy targets.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years