Automotive and Transportation

Future of Hydrogen in Automotive Market

Future of Hydrogen in Automotive Market Size, Share, Growth & Industry Analysis, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Range (0-250 Miles, 251-500 Miles, Above 500 Miles), By Propulsion (Fuel Cell Electric Vehicles (FCEV), Hybrid Vehicle, H2-ICEV), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : March 2025

Report ID: KR1429

Market Definition

The hydrogen in automotive market focuses on the development of hydrogen fuel cell electric vehicles (FCEVs), which use hydrogen to generate electricity, emitting only water vapor. This market is driven by the demand for zero-emission vehicles and sustainable transportation.

It includes the production, distribution, and infrastructure for hydrogen fuel, supported by government policies and the need to reduce carbon footprints. The market offers growth opportunities with benefits like fast refueling, long driving ranges, and eco-friendly alternatives to fossil fuel vehicles.

Future of Hydrogen in Automotive Market Overview

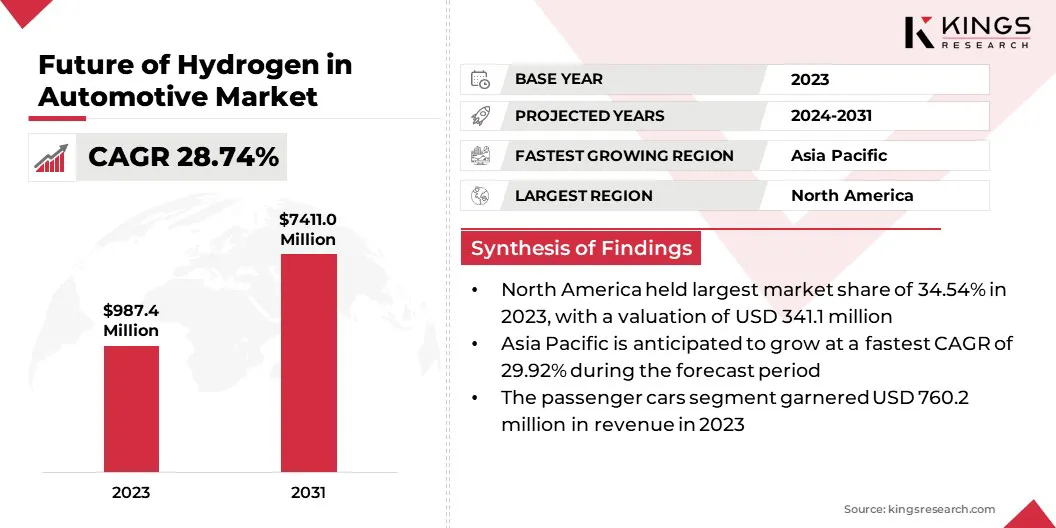

The global future of hydrogen in automotive market size was valued at USD 987.4 million in 2023 and is projected to grow from USD 1,264.7 million in 2024 to USD 7,411.0 million by 2031, exhibiting a CAGR of 28.74% during the forecast period. This growth is driven by increasing global efforts to reduce carbon emissions and transition to sustainable energy solutions.

Government policies and incentives supporting clean energy, along with investments in hydrogen infrastructure, are accelerating the adoption of hydrogen FCEVs. Advancements in hydrogen production, particularly through green hydrogen derived from renewable sources, are enhancing its viability and cost-effectiveness.

Major companies operating in the global future of hydrogen in automotive industry are Toyota Motor Corporation, Honda Motor Co., Ltd., BMW GROUP, AUDI AG, Mercedes-Benz Group AG, General Motors, Hyundai Motor Company, Volvo Group, Ballard Power Systems Inc., RIVERSIMPLE, Hyzon Motors Inc., Nikola Corporation, Plug Power Inc., Robert Bosch GmbH, and Cummins Inc.

Additionally, the automotive industry's focus on diversifying zero-emission vehicle options, coupled with the high energy density and fast refueling capabilities of hydrogen, is boosting its appeal for both passenger and commercial transport.

The growing demand for long-range, efficient, and eco-friendly mobility solutions, particularly in heavy-duty trucking, buses, and fleet operations, further bolsters market expansion.

- In February 2025, Toyota unveiled its third-generation fuel cell system to accelerate hydrogen adoption in the commercial sector. The new system enhances durability by 100%, improves fuel efficiency by 20%, and reduces costs. Toyota plans to expand its application beyond passenger cars to heavy-duty vehicles, rail, ships, and stationary generators, reinforcing its commitment to a hydrogen-based future.

Key Highlights:

- The global future of hydrogen in automotive market size was USD 987.4 million in 2023.

- The market is projected to grow at a CAGR of 28.74% from 2024 to 2031.

- North America held a market share of 34.54% in 2023, with a valuation of USD 341.1 million.

- The passenger cars segment garnered USD 760.2 million in revenue in 2023.

- The 0-250 miles segment is expected to reach USD 3,357.9 million by 2031.

- The hybrid vehicle segment is expected to reach USD 3,049.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 29.92% during the forecast period.

Market Driver

"Favorable Government Initiatives and Emphasis on Sustainability"

The future of hydrogen in automotive market is experinecing notable growth, attributed to strong government policies and incentives. Governments worldwide are implementing subsidies, tax benefits, and funding programs to accelerate the development of hydrogen fuel cell technology and expand refueling infrastructure.

Several countries have outlined ambitious hydrogen roadmaps, allocating substantial investments in research, production, and deployment of hydrogen-powered vehicles. Additionally, emission reduction mandates and the phase-out of fossil fuelvehicles are prompting automakers and energy providers to invest in hydrogen mobility solutions.

Rising demand for zero-emission transportation is further contributing to market growth, fueled by increasing environmental concerns, corporate sustainability goals, and stringent emissions regulations.

With major economies targeting carbon neutrality, hydrogen fuel cell vehicles (FCEVs) are emerging as a viable alternative to conventional internal combustion engines and, in specific cases, battery-electric vehicless.

Their long range, fast refueling times, and high energy efficiency make them ideal for commercial fleets, public transportation, and heavy-duty trucks. As consumer awareness and infrastructure improve, the adoption of hydrogen-powered vehicles is expected to accelerate, propelling market growth.

- In September 2024, Hyundai Motor Company unveiled the INITIUM hydrogen fuel cell electric vehicle concept at its ‘Clearly Committed’ event, highlighting its commitment to hydrogen mobility and sustainability. I The concept showcases Hyundai’s new ‘Art of Steel’ design language, emphasizing a customer-centric approach and commitment to hydrogen technology.

Market Challenge

"Storage, Transportation, and Production Barriers"

The future of hydrogen in automotive market faces several challenges that impact its large-scale adoption. A major challenge is the energy-intensive nature of hydrogen production, as current methods require significant amounts of electricity, which can affect sustainability and cost-effectiveness. The viability of hydrogen hinges on developing more efficient and economical production methods powered by renewable sources such as wind and solar.

Advancements in electrolysis and hydrogen production efficiency are addressing this issue, supported by government and private investments in research and development to enhance sustainability and reduce cost.

Another challenge is the complexity of hydrogen storage and transportation, as hydrogen requires high-pressure tanks or cryogenic storage, making distribution more challenging than conventional fuels. This poses logistical barriers, particularly for long-distance transportation and widespread adoption.

These storage requirements make hydrogen infrastructure more expensive and technically complex, requiring advanced materials and strict safety protocols. Additionally, investments in pipeline infrastructure and localized hydrogen production hubs near consumption points are expected to improve distribution efficiency and stimulate market growth.

Market Trend

"Infrastructure Expansion and Green Hydrogen Trends"

The future of hydrogen in automotive market is influenced by key trends such as the expansion of hydrogen refueling infrastructure and the integration of green hydrogen in automotive applications.

With the growing adoption of hydrogen-powered vehicles, significant investments are being directed toward dexpanding refueling infrastructure to support both passenger and commercial fleets.

Governments and private stakeholders are collaborating to establish hydrogen corridors, particularly in regions with strong clean energy policies. This expansion is crucial for improving consumer confidence and accelerating the large-scale adoption of FCEVs.

Another major trend is the increasing integration of green hydrogen, produced from renewable energy sources such as wind and solar power, into automotive applications. As industries focus on decarbonization, green hydrogen is emerging as a sustainable alternative to conventional hydrogen production methods that rely on fossil fuels.

Automakers and energy companies are investing in electrolysis technology to enhance the efficiency and scalability of green hydrogen production, reducing emissions across the hydrogen supply chain. The transition to green hydrogen is crucial for establishing hydrogen-powered vehicles as a sustainable, long-term solution for zero-emission mobility.

- In March 2024, Intelligent Energy unveiled the IE-DRIVE hydrogen fuel cell system, a compact, and commercially viable zero-emission solution for passenger vehicles. Featuring a 30% smaller heat exchanger for improved integration, the system is designed as a turnkey solution for automakers.

Future of Hydrogen in Automotive Market Report Snapshot

|

Segmentation |

Details |

|

By Vehicle Type |

Passenger Cars, Commercial Vehicles |

|

By Range |

0-250 Miles, 251-500 Miles, Above 500 Miles |

|

By Propulsion |

Fuel Cell Electric Vehicles (FCEV), Hybrid Vehicle, H2-ICEV |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Vehicle Type (Passenger Cars and Commercial Vehicles): The passenger cars segment earned USD 760.2 million in 2023 due to increasing consumer demand for zero-emission vehicles and government incentives promoting hydrogen mobility.

- By Range (0-250 Miles, 251-500 Miles, and Above 500 Miles): The 0-250 miles segment held a share of 46.12% in 2023, largely attributed to the growing adoption of hydrogen-powered urban and regional transport solutions.

- By Propulsion (Fuel Cell Electric Vehicles (FCEV), Hybrid Vehicle, and H2-ICEV): The hybrid vehicle segment is projected to reach USD 3,049.6 million by 2031, owing to advancements in hydrogen-electric hybrid technology and its ability to enhance fuel efficiency and driving range.

Future of Hydrogen in Automotive Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America future of hydrogen in automotive market accounted for a substantial share of 34.54% in 2023, valued at USD 341.1 million. This growth is propelled by favorable government initiatives, increasing investments in hydrogen infrastructure, and advancements in fuel cell technology.

The United States leads this growth due to its expanding network of hydrogen refueling stations and the growing adoption of FCEVs in commercial and public transport sectors. Additionally, favorable policies and funding for clean energy projects, along with collaborations between public and private sectors, are accelerating regional market expansion.

The rising demand for zero-emission vehicles, coupled with ongoing research and development efforts to improve hydrogen storage and distribution, is further contributing to this dominance.

- In June 2024, Honda commnced production of the 2025 CR-V e:FCEV fuel cell electric vehicle manufactured in the U.S. It features a domestically produced fuel cell system and plug-in EV charging capability.

Asia Pacific future of hydrogen in automotive industry is expected to register the fastest CAGR of 29.92% over the forecast period. Countries such as China, Japan, and South Korea lead in hydrogen adoption, fueled by strong government support, large-scale investments in hydrogen infrastructure, and ambitious plans to reduce carbon emissions.

Japan and South Korea have been early adopters of hydrogen fuel cell technology, actively expanding FCEV fleets and hydrogen refueling networks. Meanwhile, China is rapidly advancing its hydrogen economy, supported by government policies, industrial collaboration, and the development of fuel cell-powered commercial vehicles.

The increasing production of green hydrogen and the integration of hydrogen fuel in public and private transportation are key factors contributing to regional market growth.

Regulatory Framework

- In the U.S., the Department of Energy (DOE) drives advancements in hydrogen fuel technologies, including automotive applications, while the Environmental Protection Agency (EPA) regulates hydrogen vehicle emissions to ensure compliance with air quality standards.

- In China, the Ministry of Industry and Information Technology (MIIT) promotes the use of hydrogen in vehicles, the National Development and Reform Commission (NDRC) sets guidelines for the development of hydrogen technologies, and the Ministry of Ecology and Environment (MEE) oversees emissions regulations.

- In Japan, the Ministry of Economy, Trade and Industry (METI) supports the development of hydrogen fuel cell vehicles, the Japan Hydrogen & Fuel Cell Demonstration Project (JHFC) conducts vehicle testing, and the National Institute of Advanced Industrial Science and Technology (AIST) leads hydrogen research.

- In India, the Ministry of Heavy Industries and Public Enterprises (MHIPE) promotes hydrogen fuel technologies, the Bureau of Indian Standards (BIS) establishes safety standards for hydrogen-powered vehicles, the Ministry of New and Renewable Energy (MNRE) supports hydrogen production advancements.

Competitive Landscape

Key players operating in the future of hydrogen in automotive market are engaged in continuous research and development efforts to enhance fuel cell efficiency, optimize hydrogen storage solutions, and reduce overall vehicle production costs.

With growing governmental support and increasing consumer interest in sustainable transportation, companies are focusing on expanding their product portfolios and strengthening their market presence.

Significant investments are being made in fuel cell advancements, lightweight materials for vehicle efficiency, and alternative hydrogen propulsion systems such as hydrogen combustion engines and hybrid hydrogen-electric models.

To accelerate hydrogen adoption, companies are collaborating with governments, energy firms, and research institutions to scale up hydrogen production and refueling infrastructure.

- In September 2024, FORVIA partenered with HYVIA, a joint venture of Renault Group and Plug Power, to supply advanced hydrogen storage systems for the Renault Master H2-Tech. The system features up to five second-generation composite carbon fiber tanks, storing up to 9kg of hydrogen, enhancing affordability and sustainability through optimized manufacturing.

List of Key Companies in Future of Hydrogen in Automotive Market:

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- BMW GROUP

- AUDI AG

- Mercedes-Benz Group AG

- General Motors

- Hyundai Motor Company

- Volvo Group

- Ballard Power Systems Inc.

- RIVERSIMPLE

- Hyzon Motors Inc.

- Nikola Corporation

- Plug Power Inc.

- Robert Bosch GmbH

- Cummins Inc.

Recent Developments (Mergers /Agreements)

- In September 2024, BMW Group and Toyota Motor Corporation expanded their collaboration to advance Fuel Cell Electric Vehicle (FCEV) technology. The partnership focuses on developing next-generation fuel cell powertrain systems, with BMW set to launch its first series production FCEV in 2028.

- In September 2024, Hyundai Motor Company and Škoda Group signed a Memorandum of Understanding to collaborate on hydrogen mobility and energy-efficient solutions. The partnership aims to accelerate the adoption of hydrogen fuel cell systems, explore energy-efficient mobility solutions, and expand the hydrogen ecosystem beyond mobility applications.

- In September 2024, VivoPower announced a strategic merger with Future Automotive Solutions and Technologies (FAST) to integrate its renewable energy and electric vehicle expertise with FAST’s hydrogen conversion technology. This merger seeks to enhance both companies' advancements in sustainable energy and hydrogen sectors.

- In June 2024, Voith and Weifu High Technology Group entered a strategic cooperation agreement to establish two joint ventures focused on the research, development, production, and application of hydrogen storage systems.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)