Advanced Materials and Chemicals

Graphene Market

Graphene Market Size, Share, Growth & Industry Analysis, By Type (Graphene Nanoplatelets, Graphene Oxide, Bulk Graphene, Others), By End Use (Electronics, Aerospace, Automotive, Military, Others), By Application (Paint & Coatings, Electronic Components, Composites, Batteries, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : May 2024

Report ID: KR652

Graphene Market Size

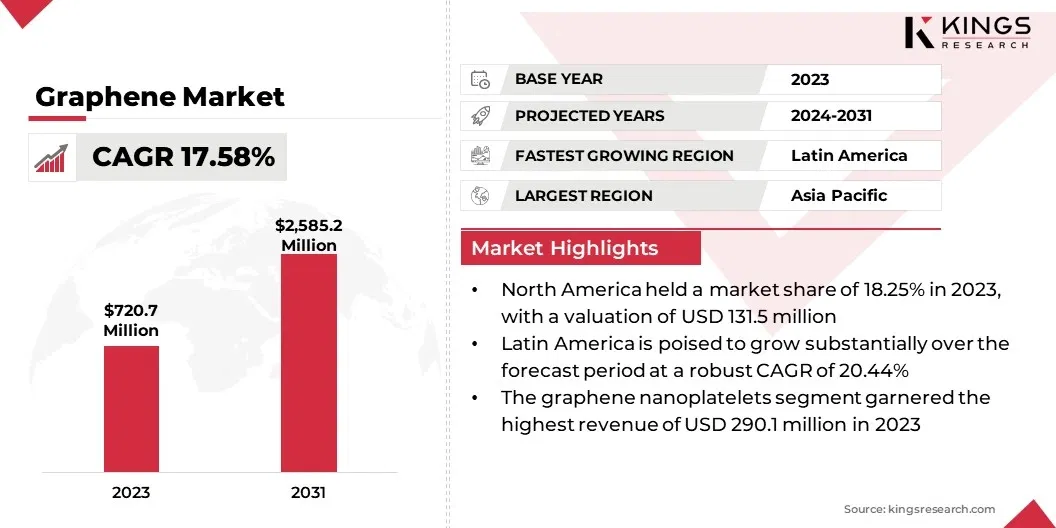

The Global Graphene Market size was recorded at USD 720.7 million in 2023 and is projected to reach USD 2,585.2 million by 2031, growing at a CAGR of 17.58% from 2024 to 2031.

The rising demand for lightweight, strong materials is boosting market growth and facilitating the adoption of graphene. In the scope of work, the report includes products offered by companies such as Graphenea, Haydale Graphene Industries, NanoXplore, Versarien, Directa Plus, Applied Graphene Materials, XG Sciences, ACS Material, Angstron Materials, Applied Nanotech Inc. (ANI), and others.

Graphene's exceptional mechanical properties, including high strength and low weight, are driving its adoption across industries such as aerospace, automotive, and construction. Its integration into materials enhances performance, fuel efficiency, and durability, making it a preferred choice for advanced applications.

Furthermore, the growing emphasis on environmental sustainability is increasing the demand for graphene-based solutions, as its unique properties address key ecological challenges. Industries are increasingly leveraging graphene to create eco-friendly and innovative materials, contributing to market growth and supporting environmental preservation.

- For instance, in June 2023, Directa Plus collaborated with Candiani Denim, an Italian leader in textile innovation and sustainability, to introduce GRAPHITO, an eco-denim textile. This innovative product combines Directa Plus' patented graphene technology, which offers antimicrobial and thermal properties, with Candiani Denim's bio-based polymer, replacing liquid plastics in textile production. This partnership highlights graphene's role in advancing sustainable manufacturing practices.

Additionally, graphene's high surface area and chemical reactivity enable the development of effective pollutant adsorbents for air and water treatment applications. Moreover, graphene-based energy storage devices, including batteries and super capacitors, hold the potential to enhance renewable energy systems and support the transition toward a more sustainable energy landscape.

The growing global awareness of environmental issues, coupled with strict regulations, is fueling demand for innovative solutions such as graphene. This is leading to widespread adoption in sectors that prioritize environmental sustainability and remediation.

Graphene, a two-dimensional carbon allotrope composed of a single layer of carbon atoms arranged in a hexagonal lattice, exhibits remarkable characteristics such as outstanding strength, electrical conductivity, thermal conductivity, and flexibility. In electronics, graphene is utilized in transistors, touchscreens, and conductive inks.

In aerospace, its lightweight and robust nature makes it ideal for composite materials, thereby enhancing structural integrity while simultaneously reducing overall weight. Automotive applications focus on lightweighting, improving mechanical strength, and enhancing component conductivity. In healthcare, graphene-based biosensors and drug delivery systems exhibit promising potential. Furthermore, graphene finds applications in coatings, sensors, and environmental remediation.

Key manufacturers in the graphene market are adopting strategic approaches to maintain their position and competitiveness. These strategies include innovation, diversification, and collaboration. Manufacturers are investing heavily in research and development to enhance graphene production methods, improve product quality, and explore new applications.

- For instance, in December 2023, CAP-XX announced a joint venture with Ionic Industries, marking a significant milestone as Ionic became the first Australian company to commercialize graphene technologies. This partnership aims to incorporate Ionic's reduced graphene oxide (rGO) technology into CAP-XX’s supercapacitors and other energy storage solutions.

Such collaborations are driving market growth by fostering the development of advanced materials with superior properties, expanding graphene’s application in sectors like energy storage, electronics, and automotive. Moreover, these initiatives accelerate commercialization, reduce production costs, and increase accessibility, making graphene a viable option for a broader range of industries, which is expected to drive the market demand in coming years.

Graphene Market Growth Factors

The increasing adoption in electronics and semiconductors is contributing substantially to the growth of the grapheme market. Graphene's superior electrical conductivity and high electron mobility make it a sought-after material for advanced electronic applications.

Its exceptional flexibility and conductivity have transformed flexible electronics, enabling the development of bendable and stretchable devices used in wearable electronics, flexible displays, and sensors. These advancements address the growing demand for innovative and high-performance electronic solutions, positioning graphene as a key material in next-generation electronics.

- For instance, in April 2024, Schaffhausen 2HS AG introduced the one-graphene platform, marking a significant breakthrough in graphene nanoelectronics. The platform features synthetic single-crystalline CVD graphene films, showcasing grapheme’s potential in advancing applications in the electronics industry.

Moreover, graphene-based conductive inks are utilized in printed electronics, RFID tags, and electronic packaging. The integration of graphene into these electronic components enhances their performance and creates new possibilities for advanced electronic devices, thereby increasing demand in the electronics sector.

However, the scalability and production costs significantly impact the growth of the graphene industry. While graphene production techniques are rapidly advancing, achieving large-scale production of high-quality graphene at a competitive cost remains a significant hurdle. The complex and energy-intensive nature of production methods limits scalability, thus affecting the commercial viability of graphene in certain applications.

High production costs hinder widespread adoption across various industries, particularly in sectors where cost-effectiveness is paramount. Addressing these challenges requires continued research and development efforts to optimize production processes, reduce costs, and enhance scalability.

Companies are actively addressing these challenges through strategic initiatives and technological innovations. They are investing heavily in research and development to streamline production processes, optimize efficiency, and reduce costs, which is expected to enhance the market demand.

Graphene Market Trends

The diversification of graphene applications and the notable shift toward graphene composites are significant trends shaping market dynamics. The exploration of new applications beyond traditional sectors such as electronics and aerospace is expanding market reach.

Graphene's unique properties, including strength, conductivity, and flexibility, are enhancing durability and conductivity in textiles, improving barrier properties in coatings, and reducing weight while boosting performance in sports equipment. Moreover, the trend toward incorporating graphene into composites is fostering innovation in materials science.

- For instance, in January 2023, Haydale, launched its graphene-enhanced prepreg after successful extended field trials, which demonstrated more than a twofold increase in the manufacture of composite parts.

Graphene-reinforced composites offer superior mechanical, electrical, and thermal properties, leading to the development of high-performance products across industries such as automotive, construction, healthcare, and consumer goods. These trends reflect the increasing recognition of graphene's versatility and its potential to drive disruptive advancements in diverse sectors.

Segmentation Analysis

The global graphene market has been segmented based on type, end use, application, and geography.

By Type

Based on type, the market has been segmented into graphene nanoplatelets, graphene oxide, bulk graphene, and others. The graphene nanoplatelets segment garnered the highest revenue of USD 290.1 million in 2023.

Graphene nanoplatelets offer a high surface area-to-volume ratio, making them suitable for a wide range of applications such as composites, coatings, and energy storage devices. Additionally, their unique properties, including exceptional mechanical strength, thermal conductivity, and electrical conductivity, enhance the performance of products across various industries.

Moreover, advancements in production techniques have led to improved scalability and cost-effectiveness, thereby fostering the adoption of graphene nanoplatelets in both established and emerging markets.

By End Use

Based on end use, the market has been classified into electronics, aerospace, automotive, military, and others. The electronics segment secured the largest revenue share of 36.25% in 2023. Continuous advancements in electronic devices and technologies are boosting the demand for high-performance materials such as graphene, renowned for its exceptional electrical conductivity and other key properties.

- For instance, the Graphene Center India Innovation Centre for Graphene (IICG), launched by the Ministry of Electronics and Information Technology (MeitY) in January 2024, is fueling the expansion of graphene applications in the electronics industry. Established in collaboration with Tata Steel Ltd, IICG aims to promote research, product innovation, and capacity building in graphene and electronics systems, thus supporting the growth of the electronics segment.

By Application

Based on application, the market has been categorized into paint & coatings, electronic components, composites, batteries, and others. The paint & coatings segment is poised to record a staggering CAGR of 19.61% through the forecast period due to the diverse applications and benefits of graphene coatings.

Graphene coatings exhibit hydrophobic, conductive, and chemically resistant properties, making them highly versatile and appealing across various industries. For instance, hydrophobic graphene coatings are used in ship hulls, pot/pan liners, glass surfaces, and textiles, while conductive coatings are applied in electronics such as cellphones, tablets, and television screens.

Additionally, graphene coatings offer superior protection against moisture, corrosion, UV radiation, and fire, which makes them ideal for medical devices and numerous industrial sectors, including aerospace. The immense potential of graphene coatings supports the expansion of the segment.

Graphene Market Regional Analysis

Based on region, the global graphene market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The region's commitment to innovation and advanced manufacturing further fuels the adoption of graphene technologies, supporting the development of high-performance materials that cater to diverse applications. These industries leverage graphene's unique properties to enhance product performance, sustainability, and durability, reinforcing North America's leading position in the global graphene market.

- For instance, in January 2024, NanoXplore Inc., a leading graphene company, expanded production capacity at its St-Clotilde, QC plant to meet the rising demand for graphene-enhanced sheet molding compound (SMC) parts from an existing customer. This development highlights the growing integration of graphene in advanced manufacturing processes in the region.

Latin America is poised to grow substantially over the forecast period at a robust CAGR of 20.44%. The region’s abundant natural resources, notably graphite, a key precursor for graphene production, aiding the development of the graphene industry.

Moreover, increasing investments in research and development, coupled with growing government initiatives to promote innovation and technology, are advancing graphene-related technologies and applications. Additionally, rising demand for high-performance materials across various industries such as electronics, automotive, and healthcare is fueling the adoption of graphene in Latin America.

Competitive Landscape

The global graphene market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are undertaking effective strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to gain a competitive edge in the market.

List of Key Companies in Graphene Market

- Graphenea

- Haydale Graphene Industries

- NanoXplore

- Versarien

- Directa Plus

- Applied Graphene Materials

- XG Sciences

- ACS Material

- Angstron Materials

- Applied Nanotech Inc. (ANI)

Key Industry Development

- October 2023 (Partnership): Industry leaders LayerOne, Graphmatech, and RDC collaborated on the DECOrGO project to innovate conductive rubber technology through the incorporation of graphene. They developed graphene-infused rubber compounds with superior electrical conductivity, offering a high-performance alternative to traditional carbon black materials. LayerOne produced cost-effective rGO (reduced graphene oxide) to overcome historical limitations associated with the adoption of graphene in various applications.

- June 2024 (Collaboration): Avanzare partnered with Tecnalia on the European Sunshine project to develop innovative Safe and Sustainable by Design (SSbD) strategies for graphene production.

The Global Graphene Market is Segmented as:

By Type

- Graphene Nanoplatelets

- Graphene Oxide

- Bulk Graphene

- Others

By End Use

- Electronics

- Aerospace

- Automotive

- Military

- Others

By Application

- Paint & Coatings

- Electronic Components

- Composites

- Batteries

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years

.webp)