Healthcare Medical Devices Biotechnology

Healthcare Analytics Market

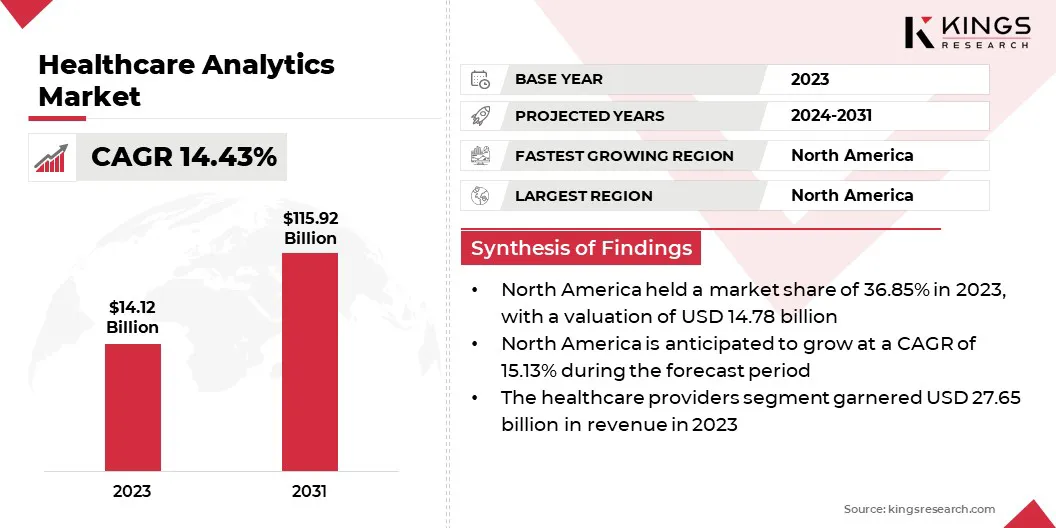

Healthcare Analytics Market Size, Share, Growth & Industry Analysis, By Type (Descriptive, Predictive, Prescriptive), By Deployment Model (On-premise Model, Cloud-based Model), By Application (Clinical Analytics, Financial Analytics, Operational and Administrative Analytics, Population Health Analytics), By End User, and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : March 2025

Report ID: KR185

Market Definition

The healthcare analytics market focuses on using data analysis techniques and technologies to improve healthcare outcomes. It involves collecting, processing, and analyzing health data to enhance decision-making, optimize operations, and improve patient care. The healthcare analytics market includes tools for predictive analytics, clinical data analysis, and business intelligence to drive innovation and ensure efficiency in healthcare systems.

Healthcare Analytics Market Overview

The global healthcare analytics market size was valued at USD 40.12 billion in 2023, which is estimated to be valued at USD 45.12 billion in 2024 and reach USD 115.92 billion by 2031, growing at a CAGR of 14.43% over the forecast period from 2024 to 2031. Rising healthcare costs drive the demand for analytics as organizations seek to optimize resource allocation and identify cost-saving opportunities.

Healthcare providers can streamline operations, reduce waste, and enhance efficiency by analyzing data, ultimately lowering overall healthcare expenditures. Major companies operating in the global healthcare analytics market are CitiusTech Inc, Health Catalyst, Inovalon, MedeAnalytics, Inc., Optum, Inc, Oracle, Veradigm LLC, COTIVITI, INC., IBM Corporation, Merative, SAS Institute Inc., Wipro, Apixio, Enlitic, and IQVIA.

The healthcare analytics industry is evolving rapidly, driven by advancements in data processing technologies and a growing focus on improving patient care. This market includes a range of solutions, from descriptive and diagnostic analytics to sophisticated predictive and prescriptive tools.

With the increasing volume of healthcare data, organizations are leveraging analytics to optimize operations, reduce costs, and enhance decision-making. The rise of Artificial Intelligence (AI) and Machine Learning (ML) further accelerates the capabilities of healthcare analytics, making it an essential component of modern healthcare systems.

- In May 2024, BrightInsight, Inc. announced its deployment of Google Cloud’s Gemini and MedLM generative AI models on Google Vertex AI platform. This integration aims to optimize research, enhance its disease management solution, and improve clinical engagements with advanced AI-driven tools for data access and analysis.

Key Highlights:

- The global healthcare analytics market size was valued at USD 40.12 billion in 2023.

- The market is projected to grow at a CAGR of 14.43% from 2024 to 2031.

- North America held a market share of 36.85% in 2023, with a valuation of USD 14.78 billion.

- The descriptive segment garnered USD 16.88 billion in revenue in 2023.

- The on-premise model segment is expected to reach USD 62.53 billion by 2031.

- The financial analytics segment held a market share of 42.36% in 2023.

- The healthcare payers segment is anticipated to register a CAGR of 18.12% in 2031.

- The market in Europe is anticipated to grow at a CAGR of 14.80% during the forecast period.

Market Driver

"Rising Availability of Healthcare Data"

The rising availability of healthcare data is a primary driver of the healthcare analytics market. With the widespread adoption of electronic health records (EHRs), wearable devices, and other health data sources, there is a growing volume of information that can be analyzed for insights. This vast amount of data enables healthcare providers to make more informed decisions, improve patient care, and streamline operations.

- In Oct 2024, Monash University in Australia collaborated with Apollo Hospitals to advance digital health research and solutions across India. Under this collaboration, Monash will gain access to insights from health data of over 200 million patients across Apollo Hospitals, driving innovation in digital health.

Market Challenge

"Lack of Standardization"

Lack of standardization in data formats and analytics tools presents a significant challenge in the healthcare analytics industry, as it hinders interoperability across different healthcare systems. Without universal standards, integrating data from diverse sources becomes complex, limiting the effectiveness of analytics solutions.

To address this, industry stakeholders must collaborate to develop and adopt common data standards and frameworks, enabling seamless data sharing and integration. Implementing standardized protocols, along with collaboration between healthcare providers and technology vendors can improve data flow while enhancing data analytics.

Market Trend

"Increased Adoption of AI and ML"

A prominent trend in the healthcare analytics market is the increased adoption of AI and ML technologies. These technologies are integrated into analytics tools to enhance predictive capabilities, enabling healthcare providers to anticipate patient outcomes or risks more accurately. AI and ML are also improving clinical decision-making by identifying patterns in large datasets, allowing for more personalized treatment plans and timely interventions.

- In Jan 2025, NVIDIA announced partnerships with Illumina, IQVIA, Arc Institute and Mayo Clinic to transmute to USD 10 trillion healthcare industry through AI, focusing on accelerating drug discovery, enhancing genomic research, and pioneering advanced healthcare services. This collaboration highlights the growing trend of AI adoption in healthcare analytics, improving clinical decision-making, research, and patient outcomes.

Healthcare Analytics Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Descriptive, Predictive, Prescriptive |

|

By Deployment Model |

On-premise Model, Cloud-based Model |

|

By Application |

Clinical Analytics, Financial Analytics, Operational and Administrative Analytics, Population Health Analytics |

|

By End User |

Healthcare Providers, Healthcare Payers |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Descriptive, Predictive, Prescriptive): The descriptive segment earned USD 16.88 billion in 2023, due to its ability to analyze historical data, identify patterns, assist healthcare providers make informed decisions, and improve operational efficiency.

- By Deployment Model (On-premise Model, Cloud-based Model): The on-premise model segment held 56.14% share of the market in 2023, due to the preference of healthcare organizations for maintaining control over sensitive data and ensuring compliance with privacy regulations.

- By Application (Clinical Analytics, Financial Analytics, Operational and Administrative Analytics, Population Health Analytics): The financial analytics segment is projected to reach USD 40.31 billion by 2031, owing to the increasing need for cost management, budgeting, and financial performance optimization within healthcare organizations.

- By End User (Healthcare Providers, Healthcare Payers): The healthcare payers segment is anticipated to register a CAGR of 18.12% during the forecast period, driven by the increasing adoption of analytics to streamline claims processing, fraud detection, and improve decision-making in insurance policies.

Healthcare Analytics Market Regional Analysis

Based on region, the global healthcare analytics market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp)

North America accounted for a market share of around 36.85% in 2023, with a valuation of USD 14.78 billion. North America remains the dominant region in the healthcare analytics market, capturing the largest market share due to advanced healthcare infrastructure, high adoption of digital health technologies, and substantial investments in AI and data analytics.

The U.S. leads in healthcare analytics innovation, driven by robust healthcare providers, payers, and government initiatives aimed at improving patient care and operational efficiency. Additionally, the region’s well-established healthcare policies, regulations, and large-scale data repositories significantly contribute to its dominance in the market.

- In July 2024, Microsoft announced collaborations with Mass General Brigham and the University of Wisconsin to accelerate AI advancements in radiology. This partnership enhances healthcare analytics, focusing on improving clinician efficiency, patient outcomes, and workflow automation through advanced AI models and imaging technologies.

The market in Europe is poised for significant growth at a robust CAGR of 14.80% over the forecast period. Europe is emerging as the fast-growing region in the healthcare analytics market, driven by increasing investments in digital health technologies and government initiatives promoting data-driven healthcare solutions.

The growing focus on personalized medicine, healthcare cost reduction, and improving patient outcomes is fueling the demand for analytics tools. Countries like Germany and the UK are at the forefront of adopting healthcare analytics, with a rising number of healthcare providers and payers embracing AI-driven technologies to enhance care delivery and operational efficiencies.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) of 1996 establishes federal standards protecting sensitive health information from disclosure without patient's consent.

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, nation's food supply, cosmetics, and products that emit radiation.

- In the European Union (EU), the GDPR (General Data Protection Regulation) sets strict guidelines on data protection and privacy for individuals within the EU, influencing data analytics practices.

Competitive Landscape

The global healthcare analytics market is characterized by a large number of participants, including established corporations and rising organizations. In recent years, companies in the healthcare analytics have secured significant funding to advance their technologies and expand their offerings. This investment is primarily focused on enhancing AI capabilities, improving data integration, and developing advanced analytics solutions.

The funding is driving innovation, enabling organizations to improve patient care, streamline operations, and leverage data for better decision-making and predictive insights.

- In January 2025, Innovaccer Inc. raised USD 275 million in Series F funding, with contributions from B Capital Group, Banner Health, Danaher Ventures, Generation Investment Management, Kaiser Permanente, and M12. This funding will enhance Innovaccer’s AI capabilities, cloud offerings, and developer ecosystem, driving growth and innovation across healthcare solutions.

List of Key Companies in Healthcare Analytics Market:

- CitiusTech Inc

- Health Catalyst

- Inovalon

- MedeAnalytics, Inc.

- Optum, Inc

- Oracle

- Veradigm LLC

- COTIVITI, INC.

- IBM Corporation

- Merative

- SAS Institute Inc.

- Wipro

- Apixio

- Enlitic

- IQVIA

Recent Developments (Collaboration/Acquisition)

- In August 2024, EXL acquired ITI Data to enhance its data management capabilities, expanding its presence in banking and healthcare sectors. This acquisition will strengthen EXL's data-driven insights, boosting AI offerings and accelerating growth for Global 1000 clients across regions.

- In May 2024, the World Health Assembly emphasized the critical role of digital health in shaping the future of global healthcare. Capgemini collaborated with the World Economic Forum, to launch the Digital Healthcare Transformation Community, enhancing health data collaboration and driving innovation in digital healthcare solutions.

- In March 2024, Sagility LLC acquired BirchAI, a Seattle-based healthcare tech company, enhancing its AI-powered customer support solutions. This acquisition expands Sagility’s analytics and automation capabilities, improving healthcare engagement services and driving impactful ROI for clients in the healthcare sector.

- In March 2024, Cardinal Health completed its acquisition of Specialty Networks, enhancing its specialty offerings with the PPS Analytics platform. This acquisition expands Cardinal Health’s reach to 11,500 providers, using AI and data analytics to deliver actionable insights for independent specialty practices.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership