ICT-IOT

High Throughput Satellite Market

High Throughput Satellite Market Size, Share, Growth & Industry Analysis, By Capacity (0-49 Gbps, 50-100 Gbps, Above Gbps), By Application (Broadband, Aeronautical & Maritime, Military & Defence, Government & Enterprise & others), and Regional Analysis 2024-2031

Pages : 120

Base Year : 2023

Release : November 2024

Report ID: KR1127

High Throughput Satellite Market Size

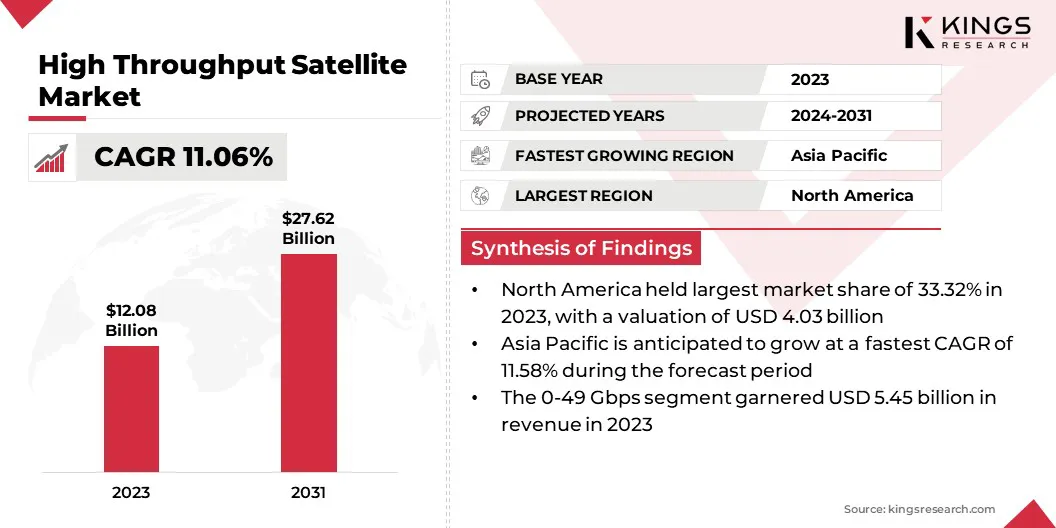

The global High Throughput Satellite (HTS) Market size was valued at USD 12.08 billion in 2023 and is projected to grow from USD 13.25 billion in 2024 to USD 27.62 billion by 2031, exhibiting a CAGR of 11.06% during the forecast period. Increasing investments in satellite constellations and rising demand for high-speed internet services are augmenting the market growth.

In the scope of work, the report includes services offered by companies such as Hughes Network Systems, LLC, Boeing, Thales, Airbus SE, EUTELSAT COMMUNICATIONS SA, Antesky Science Technology Inc., Fraunhofer IIS, Intelsat, SES S.A., Satellogic, and others.

The rising demand for IoT applications in remote areas represents a significant opportunity for HTS technology. IoT devices are essential for various applications in agriculture, environmental monitoring, mining, and energy segments, where remote operations in remote regions are common.

These devices collect critical data from areas with limited or no traditional communication infrastructure, providing insights for everything from crop health and water levels to equipment maintenance and wildlife tracking. HTS technology supports these IoT applications by delivering the high-speed and reliable connectivity necessary for seamless data transmission over longer distances.

Satellite-enabled IoT systems help organizations optimize operations, improve resource management, and ensure environmental compliance, which offers cost reductions and enhances efficiency.

- In June 2024, ORBCOMM launched OGx, an advanced satellite IoT service with enhanced network capabilities and cost-effective pricing. With patented technology that reduces power consumption, OGx allows IoT solutions to maintain or exceed traditional performance at a lower cost, supporting industries like agriculture, mining, and transportation. This innovation empowers IoT providers to tap into new, high-value markets.

The high throughput satellite market is particularly well-positioned to meet the needs of IoT solutions in remote regions due to its high capacity and capability to provide low-latency services. As the demand for IoT solutions grows globally, particularly in underserved areas, HTS providers have a promising opportunity to drive IoT adoption and bridge connectivity gaps in critical sectors.

High throughput satellites (HTSs) are advanced communication satellites designed to deliver substantially higher data capacity compared to traditional satellites. Unlike conventional satellite technologies that typically use a broad single beam for transmission, HTS divides its capacity into multiple tightly focused spot beams, significantly increasing data throughput by reusing frequencies across these beams.

This architecture enables HTS to provide cost-effective, high-bandwidth internet services, ideal for applications with robust connectivity requirements. Due to their increased efficiency, HTS are widely used in various industries, including telecommunications, military and defense, maritime, and aviation.

In aviation, HTS supports in-flight connectivity, allowing passengers to enjoy seamless internet access even at high altitudes. In maritime applications, HTS helps maintain real-time communication between vessels and the shore, which is crucial for navigation, safety, and crew welfare.

With capacities reaching hundreds of gigabits per second (Gbps), HTS provides scalable and affordable solutions, which helps bridge the digital divide in remote and underserved areas and support the rise of global IoT and 5G.

Analyst’s Review

In the highly competitive high throughput satellite market, key players are advancing their strategic efforts to establish a foothold by prioritizing high-capacity, cost-effective connectivity solutions that cater to diverse sectors. These companies invest in satellite constellations, particularly in low and medium Earth orbits, to expand the coverage area, reduce latency, and enhance service reliability in underserved regions.

Many players are also partnering with telecommunication providers and technology firms to integrate HTS with emerging 5G networks to deliver comprehensive, high-speed internet solutions to rural, remote, and maritime areas.

- In September 2024, Eutelsat Group and Mitsubishi Heavy Industries (MHI) formalized a multi-launch agreement, marking their first collaboration. From 2027, MHI will deploy Eutelsat’s satellites via H3 launch vehicles, adding diversity and new launch options to Eutelsat’s strategic fleet expansion. This agreement strengthens Eutelsat’s partnerships with top-tier launch providers, further securing its orbital deployment capabilities.

As the market faces intense competition from fiber optics and 5G technologies, HTS providers must differentiate their offerings by focusing on IoT connectivity, in-flight communication, and remote area broadband. Imperatives such as cost efficiency, reliability, and expanding service portfolios of IoT and emergency response solutions have become critical to maintaining their relevance and sustaining growth.

The emphasis on improving network flexibility and scalability to address dynamic market needs underpins the growth strategies of major HTS companies as they navigate an increasingly connected world.

High Throughput Satellite Market Growth Factors

Increasing investment in satellite constellations is a key driver for the high throughput satellite market, reshaping global connectivity landscapes. Companies and government agencies are ramping up investments in both the low Earth orbit (LEO) and medium Earth orbit (MEO) satellite constellations to enhance network coverage, minimize latency, and offer high-speed connectivity in regions lacking communications infrastructure.

These constellations, composed of hundreds or thousands of interconnected satellites, enable continuous, reliable coverage on a global scale, including over oceans and isolated areas.

- In September 2024, Eutelsat’s OneWeb LEO network was integrated into Inmarsat Maritime’s NexusWave connectivity solution, through a partnership with Viasat. This enhancement leverages OneWeb’s LEO network alongside Inmarsat’s maritime expertise to ensure reliable, high-speed connectivity for vessels in remote locations, reflecting a shared commitment to meeting the maritime industry’s complex connectivity requirements.

As internet demand surges and IoT applications multiply, satellite constellations serve as a vital link, connecting even the most remote locations to high-speed networks. This investment trend also aligns with governments' digital inclusion goals and supports military, aviation, and maritime industries.

While the initial cost for these constellations is substantial, the economic benefits, such as opening new markets and reducing the digital divide, continues to drive investment. Satellite providers are also forming partnerships to combine their expertise, reduce operational expenses, and ensure sustainable, wide-reaching connectivity.

High initial investment and ongoing maintenance costs are the major challenges in the HTS market. Launching and deploying HTS constellations involve substantial capital, often in billions, due to the cost of satellite production, launch services, regulatory compliance, and ground infrastructure.

Maintenance also requires specialized equipment and skilled personnel, which further elevates operational costs. For many companies, these expenses pose financial barriers, potentially deterring entry and stalling expansion efforts in this market. The financial risks are further heightened by the return on investment (ROI) timeline, as revenues often take years to materialize following the initial launch.

To mitigate this challenge, companies are exploring joint ventures, public-private partnerships, and innovative financing models like leasing or shared infrastructure agreements. Furthermore, technological advancements in miniaturization and propulsion efficiency can help reduce production and maintenance expenses, making HTS deployments more feasible.

Streamlining operations and enhancing satellite lifespan remain central to controlling long-term costs and sustaining competitiveness in a high-stakes market.

High Throughput Satellite Industry Trends

The demand for in-flight and maritime connectivity solutions is steadily rising, driving substantial growth within the high throughput satellite market. Global travelers and remote workers demand seamless internet access during flights and maritime voyages, which leads airlines and shipping operators to provide high-speed, uninterrupted connectivity.

HTS offers a viable solution for the same, supplying the bandwidth and coverage needed to meet consumer expectations.

- Intelsat FlexExec provides secure, enterprise-grade high-throughput satellite (HTS) connectivity for private, business, and government jets, ensuring reliable global coverage. Utilizing the same network trusted by leading airlines for passenger entertainment, FlexExec enhances in-flight connectivity, offering robust service for business jet owners and passengers demanding continuous, high-quality connections.

- Euroconsult’s October 2023 report on In-Flight Connectivity (IFC) highlights substantial growth, with over 36,000 aircraft now equipped with onboard internet. The annual report, Prospects for In-Flight Entertainment & Connectivity, forecasts that connected aircraft could nearly double by 2032, potentially reaching USD 3.4 billion in service revenue as the aviation demand rises.

Additionally, real-time connectivity enables maritime vessels to optimize navigation, monitor cargo, and ensure crew welfare, while in-flight connectivity supports passenger services and allows airlines to enhance operational efficiency.

The aviation and maritime vessels often traverse regions lacking terrestrial infrastructure, and depend on HTS to bridge connectivity gaps, ensuring reliable communication across oceans and in remote airspaces.

As these fleets are expanding, HTS providers are ramping up their technology offerings by partnering with airlines and maritime firms to deliver cost-effective, scalable connectivity solutions that meet high data demands, reinforce safety, and improve passenger experience.

Segmentation Analysis

The global market has been segmented on the basis of capacity, application, and geography.

By Capacity

Based on capacity, the market has been segmented into 0-49 Gbps, 50-100 Gbps, above 100 Gbps The 50-100 Gbps segment of the high throughput satellite market is expected to grow at a significant CAGR of 11.69% over the forecast period, driven by a surging demand for high-capacity data services across industries.

This bandwidth range caters to applications requiring large volumes of data transmission, such as in-flight and maritime connectivity, broadband internet services in remote locations, and critical government and defense communications. With more enterprises adopting cloud-based applications and the rise in IoT devices that require continuous data transfer, the need for robust, high-bandwidth solutions is intensifying.

The 50-100 Gbps segment strikes an ideal balance between speed and cost-effectiveness, making it attractive for sectors needing high-speed internet without investing in the largest, most expensive capacities. As more industries and regions adopt HTS to support their growing data requirements, this bandwidth range is expected to benefit from the increasing demand.

Additionally, advancements in satellite technology are expected to lower costs, further accelerating the adoption and market share of the 50-100 Gbps segment.

By Application

Based on application, the market has been classified into broadband, aeronautical & maritime, military & defence, government & enterprise, cellular backhaul, and broadcast services. The broadband segment held the largest share of the high throughput satellite market in 2023, capturing 22.56% of the total market.

This significant share is primarily attributed to the expanding demand for reliable, high-speed internet access within urban and rural areas. With the global digital transformation accelerating, broadband services have become essential for businesses, governments, and individuals who rely on consistent connectivity for remote work, E-learning, telemedicine, and other data-intensive applications.

- In September 2024, Vodafone and Intelsat extended their partnership to enhance satellite connectivity for organizations in remote, underserved, or disaster-prone areas. By complementing Vodafone’s terrestrial networks, the agreement supports broadband access for enterprises, governments, and nonprofits, enabling site connectivity, cargo tracking, and emergency response. This move highlights Vodafone’s commitment to comprehensive, resilient connectivity solutions.

- In October 2024, Intelsat introduced a new satellite backhaul platform in Nigeria, advancing its connectivity infrastructure across Africa. While Sub-Saharan Africa remains significantly underserved with 59% usage and 15% coverage gaps, this initiative aims to reduce disparity, providing essential broadband access to a region where nearly lack coverage.

HTS is uniquely suited to provide broadband access in remote and underserved regions where traditional ground-based infrastructure is either limited or unavailable. Government initiatives to close the digital divide further amplify the need for satellite broadband, particularly in developing regions where access to high-speed internet is still limited.

The segment also benefits from strong demand in mobile applications, such as in-flight and maritime broadband, where HTS enables robust connectivity even in the most isolated airspaces and maritime zones. As a result, HTS providers focus on developing cost-effective broadband solutions, solidifying the broadband segment's dominance.

High Throughput Satellite Market Regional Analysis

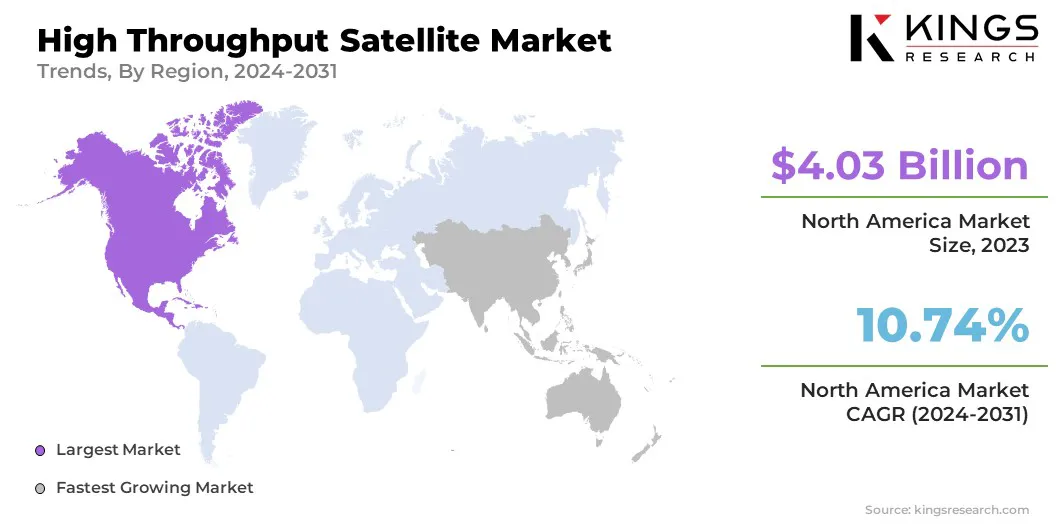

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America high throughput satellite market share accounted for 33.32% and was valued at USD 4.03 billion in 2023, positioning the region as a dominant player in the global market. This leadership can be attributed to North America’s robust infrastructure, high demand for data-intensive applications, and government investments in satellite technologies, particularly for defense and aerospace applications.

The United States, as the region's largest HTS market, has consistently supported innovation in satellite technology through extensive research funding, space exploration programs, and partnerships with private companies. Additionally, the region’s increasing need for advanced connectivity solutions to serve rural and remote areas has accelerated the deployment of HTS for broadband services.

- In February 2023, The Amazonas Nexus satellite, owned by Spanish telecom operator HISPASAT, was launched from Kennedy Space Center via SpaceX’s Falcon 9. Positioned at 61º West, this geostationary high-throughput satellite replaced Amazonas 2, enhancing capacity for HISPASAT’s high-demand mobility services in aviation and maritime sectors. .

In the commercial sector, HTS supports the oil and gas, agriculture, and transportation segments, where reliable connectivity is crucial for operating efficiently and safely. With constant advancements and increased demand for bandwidth-intensive applications, North America’s HTS market is poised to retain its lead, benefiting from a combination of public and private growth initiatives.

Asia-Pacific is anticipated to grow at the highest CAGR of 11.58% in the market over the coming years, driven by rapid digital transformation and expanding demand for high-speed connectivity.

Developing economies in Asia-Pacific, including India, China, and Southeast Asia, are seeing a surge in satellite-based internet services to bridge connectivity gaps in underserved rural and remote areas. Governments and private sectors across the region are investing heavily in satellite infrastructure for economic growth, disaster management, and smart-city projects.

- For instance, in October 2024, Thaicom’s subsidiary, Space Tech Innovation Limited, signed an agreement with SpaceX to launch THAICOM-10, a software-defined, high-throughput satellite (SD-HTS) with over 120 Gbps capacity. This next-generation satellite, set to launch on SpaceX’s reusable Falcon 9, offers adaptable configuration, ensuring dynamic, extended connectivity across Asia-Pacific for Thaicom’s clients.

Additionally, the increasing adoption of IoT applications in agriculture, transportation, and manufacturing segments create a robust demand for HTS to support data transfer over wide, hard-to-reach areas. Asia-Pacific’s growing aviation and maritime industries also rely on HTS for in-flight and on-sea connectivity, further boosting the market's growth.

This region’s expansive population, government incentives, and private investments in satellite technology have made Asia-Pacific as a rapidly expanding market in the HTS landscape.

Competitive Landscape

The global high throughput satellite market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in High Throughput Satellite Market

- Hughes Network Systems, LLC

- Boeing

- Thales

- Airbus SE

- EUTELSAT COMMUNICATIONS SA

- Antesky Science Technology Inc.

- Fraunhofer IIS

- Intelsat

- SES S.A.

- Satellogic

Key Industry Developments

- June 2024 (Product Launch): NewSpace India Limited (NSIL), under the Department of Space, launched GSAT-N2 (GSAT-20), a Ka-band high-throughput satellite. The satellite would improve broadband and in-flight connectivity across India. Equipped with multi-beam architecture and Ka x Ka transponders, GSAT-N2 would enhance frequency reuse, supporting a large subscriber base with small user terminals for high-capacity connectivity.

- September 2023 (Expansion): Thaicom Public Company Limited selected Airbus to build a new software-defined high-throughput satellite at 119.5° East. Thaicom’s subsidiary, Space Tech Innovation Limited, contracted Airbus for the satellite and ground control systems. Airbus’s OneSat will provide flexible Ku-band coverage over the Asia-Pacific with real-time adjustment to coverage and capacity.

- April 2023 (Product Launch): Intelsat launched Intelsat 40e (IS-40e), a geosynchronous high-throughput satellite with spot-beam technology to enhance the capacity of its North American aviation, mobility, and network services. This launch reinforces Intelsat’s commitment to high-performance connectivity for North American commercial and mobility sectors through optimized, expansive network coverage.

The global high throughput satellite market has been segmented:

By Capacity

- 0-49 Gbps

- 50-100 Gbps

- Above 100 Gbps

By Application

- Broadband

- Aeronautical & Maritime

- Military & Defense

- Government & Enterprise

- Cellular Backhaul

- Broadcast Services

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)