Enquire Now

Hosted PBX Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-Use Industry (BFSI (Banking, Financial Services & Insurance), Healthcare, Retail & E-Commerce, Others), and Regional Analysis, 2024-2031

Pages: 170 | Base Year: 2023 | Release: April 2025 | Author: Versha V.

The market involves cloud-based phone systems that enable businesses enabling to manage and streamline their communication needs without the need for traditional on-site PBX hardware.

This market encompasses service providers offering hosted PBX solutions to organizations to small and medium-sized businesses (SMBs), large enterprises, and contact centers. It is driven by factors such as cost savings, scalability, flexibility, and the increasing demand for modern communication technologies that support remote work and mobile integration.

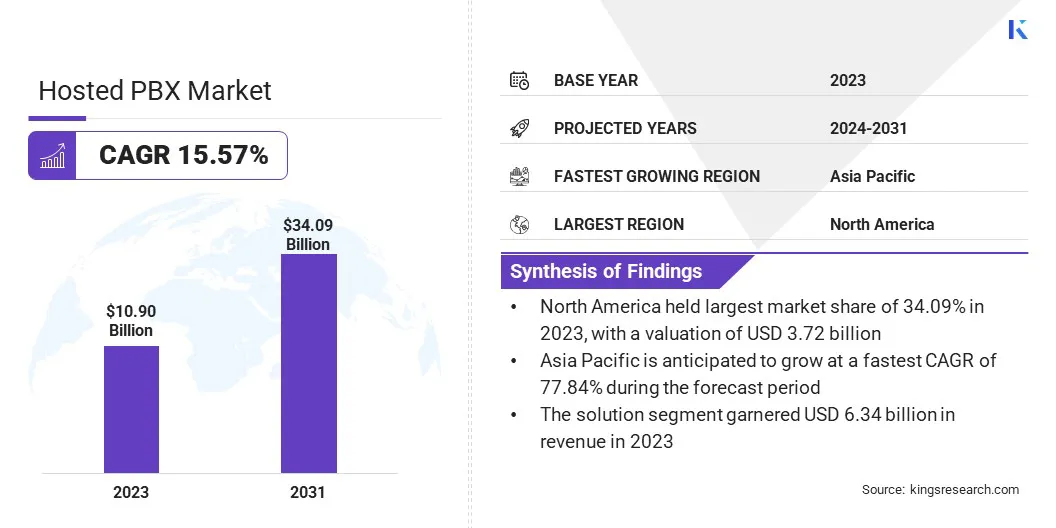

The global hosted PBX market size was valued at USD 10.90 billion in 2023 and is projected to grow from USD 12.38 billion in 2024 to USD 34.09 billion by 2031, exhibiting a CAGR of 15.57% during the forecast period.

Market expansion is fueled by the increasing demand for cost-effective, scalable, and flexible communication solutions. The adoption of cloud-based technologies is leading to a shift from traditional on-site phone systems to hosted PBX solutions.

The rise of Voice over Internet Protocol (VoIP) technology has significantly reduced costs while enabling high-quality voice communication. The need for enhanced collaboration tools and integration with business software, such as customer relationship management (CRM) systems, is further contributing to market expansion.

Major companies operating in the hosted PBX industry are RingCentral, Inc., 8x8, Inc., Vonage Holdings Corp., Nextiva, Inc., Mitel Networks Corp., Cisco Systems, Inc., DIALPAD, INC., Ooma, Inc., GoTo, Phone.com, TPx Communications, TelNet Worldwide, Inc., Freshworks Inc., 3CX, and Atlantech Online, Inc.

Moreover, businesses are increasingly adopting hosted PBX systems due to advanced features such as call forwarding, voicemail-to-email, call analytics, and mobile device integration.

The growing trend of small and medium-sized businesses leveraging cloud-based solutions for cost efficiency and operational improvements is propelling market growth. As organizations seek to improve their communication infrastructure with minimal upfront investment, the market is set to witness sustained expansion.

Market Driver

"AI Integration and Remote Work Expansion"

The hosted PBX market is witnessing substantial growth, propelled by advancements in AI and automation, along with the rising adoption of remote and hybrid work models. Hosted PBX providers are increasingly integrating AI-driven features such as virtual assistants, predictive call analytics, and automated customer support tools.

These capabilities enhance call management by offering intelligent call routing, real-time transcription services, and proactive customer engagement solutions, improving both operational efficiency and user experience.

AI-powered features also help businesses streamline repetitive tasks, reduce response times, and improve customer satisfaction, making hosted PBX systems more valuable for modern enterprises.

Moreover, the shift toward remote and hybrid work models has significantly increased the demand for flexible and scalable communication solutions.

Hosted PBX platforms provide cloud-based connectivity, allowing employees to make and receive calls, access voicemail, and join virtual meetings from any location and device. This ensures uninterrupted communication and collaboration, making hosted PBX essential for businesses adapting to decentralized work environments.

Market Challenge

"Security and Data Privacy Concerns"

A major challenge hindering the expansion of the hosted PBX market is the security and data privacy concerns associated with cloud-based communication systems. As more businesses transition to hosted PBX platforms, they face growing cybersecurity risks, including hacking, data breaches, and unauthorized access.

These platforms store sensitive communication data, including business calls, messages, and customer information, posing significant financial losses and reputational risk if compromised.

Additionally, reliance on internet connections exposes them to network threats such as Distributed Denial of Service (DDoS) attacks, potentially disrupting critical business communications.

To mitigate these risks, hosted PBX providers are implementing stringent security measures,such as end-to-end encryption, multi-factor authentication (MFA), and continuous monitoring of networks for unusual activity. They are also adopting secure data storage solutions with encryption at rest, ensuring that even if data is intercepted, it remains unreadable.

Market Trend

"Growing Preference for Cloud-Based Communication and Unified Communications as a Service"

The hosted PBX market is witnessing significant trends driven by evolving business communication needs and technological advancements. A key trend is the growing preference for cloud-based communication solutions.

Businesses are increasingly transitioning from traditional on-premise systems to cloud-hosted PBX platforms for their cost-efficiency, scalability, and enhanced disaster recovery capabilities.

Cloud solutions eliminate the need for extensive hardware investments, allowing companies to manage communications remotely with minimal maintenance. This shift is particularly beneficial for organizations with distributed teams or hybrid work models, as it ensures seamless connectivity and centralized management.

Another significant trend is the rising demand for Unified Communications as a Service (UCaaS). This model consolidates voice, video, messaging, and collaboration tools into a single cloud-based platform, allowing seamless communication across various channels.

UCaaS is particularly beneficial for hybrid and remote workforces, offering scalability, mobility, and simplified management. By consolidating communication tools, it reduces reliance on on-premises hardware while enabling seamless collaboration. This trend aligns with businesses’ growing focus on digital transformation and enhancing team productivity.

|

Segmentation |

Details |

|

By Component |

Solution, Services |

|

By Organization Size |

Small and Medium Enterprises (SMEs), Large Enterprises |

|

By End-Use Industry |

BFSI (Banking, Financial Services & Insurance), Healthcare, Retail & E-Commerce, IT & Telecom, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America hosted PBX market accounted for a substantial share of 34.09% in 2023, valued at USD 3.72 billion. This expansion is primarily reinforced by its robust technological infrastructure, which supports the widespread adoption of cloud-based solutions across industries.

The region's well-established communication frameworks have enabled businesses, particularly SMEs and large enterprises, to seamlessly transition to scalable, cost-efficient communication systems. The U.S., a hub for technological innovation, is experinecing growing demand for hosted PBX solutions.

Enterprises are increasingly adopting cloud communications to improve operational efficiency, enhance scalability, and reduce upfront capital expenditures associated with traditional on-premise PBX systems.

Furthermore, the rise of Unified Communications as a Service (UCaaS) is aiding this growth, as businesses seek integrated tools for seamless collaboration, productivity, and continuity. This demand, coupled with advanced infrastructure and the shift toward digital and remote operations, reinforces North America's market leadership.

Asia-Pacific hosted PBX industry is expected to register the fastest CAGR of 17.84% over the forecast period. This growth is fostered by a burgeoning SME sector, rapid urbanization, and the increasing adoption of cloud technologies in key markets such as China, India, and Japan.

Cost-conscious businesses, particularly small and medium-sized enterprises, in the region are increasingly adopting cloud-based communication solutions to improve operational efficiency while minimizing capital expenditures associated with traditional on-premise systems.

The flexibility, scalability, and lower upfront costs offered by hosted PBX solutions make them an attractive option for businesses looking to stay competitive in an evolving market.

Additionally, ongoing digital transformation initiatives and the rise of remote and hybrid work models are fueling demand for more robust and integrated communication systems. As companies across Asia Pacific prioritize customer experience, improve collaboration, and ensure business continuity, the regional market is likely to foster expansion.

Key players operating in the hosted PBX industry focus on differentiating themselves through features such as advanced VoIP technology, seamless integration with other business software such as CRM and collaboration tools, mobile device support, and strong customer support services. Providers prioritize scalable solutions tailored to organizations of all sizes.

With the rise of remote and hybrid work models, hosted PBX solutions stand out for their mobile compatibility and integration with various collaboration platforms. Service providers are also improving the security and reliability to meet the increasing demand for secure communications and uninterrupted service.

Recent Developments (Acquisitions/New Product Launch)

Frequently Asked Questions