Buy Now

Human Capital Management Market Size, Share, Growth & Industry Analysis, By Component (Software, Services), By Deployment Mode (Cloud-based, On-premise), By Enterprise Size (Small & Medium-sized Enterprises (SMEs), Large Enterprises), By Industry Vertical and Regional Analysis, 2025-2032

Pages: 190 | Base Year: 2024 | Release: July 2025 | Author: Versha V.

Human capital management (HCM) refers to the strategic process organizations use to manage and develop their workforce to improve performance and meet business goals. The HCM market includes software and services that support key HR functions such as recruitment, workforce planning, performance management, payroll, and employee training.

It spans both cloud-based and on-premise deployment models. Enterprises across industries adopt these solutions to streamline HR tasks, comply with labor laws, and align workforce capabilities with organizational needs.

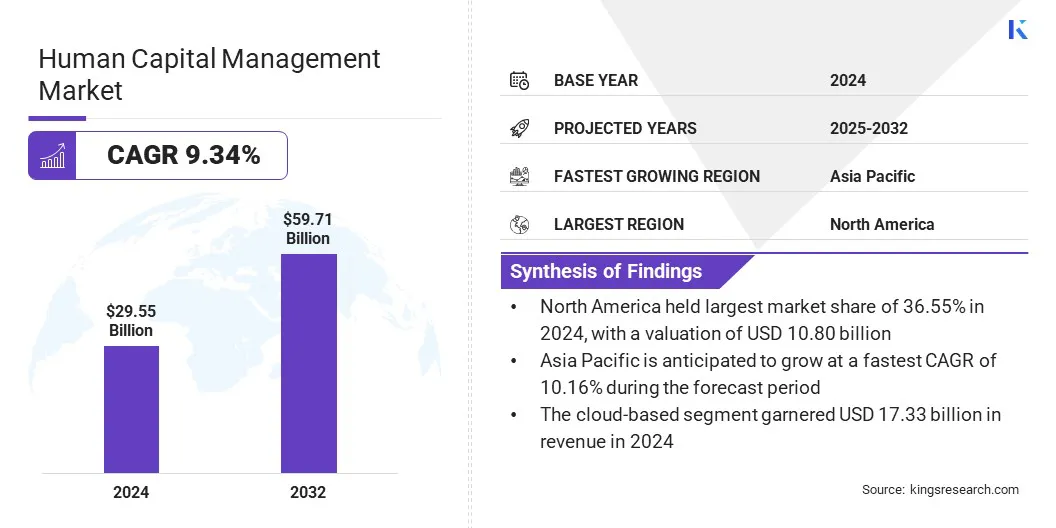

The global human capital management market size was valued at USD 29.55 billion in 2024 and is projected to grow from USD 31.96 billion in 2025 to USD 59.71 billion by 2032, exhibiting a CAGR of 9.34% during the forecast period.

Market growth is driven by increasing organizational focus on workforce optimization and digital transformation. Moreover, rising demand for centralized HR platforms and increased adoption of cloud-based solutions are further driving market expansion.

Major companies operating in the human capital management market are SAP SE, Oracle, Workday, Inc., ADP, Dayforce, UKG Inc., Paycom Payroll LLC, Cornerstone, Bamboo HR LLC, TriNet Group, Inc., Gusto, Zoho Corporation Pvt. Ltd., Namely, Inc., Sage Group plc, and Rippling People Center Inc.

Investments in advanced HCM platforms are driving market growth as companies focus on modernizing workforce management. Organizations are increasingly allocating resources to build scalable, cloud-based systems that improve HR operations and employee experience. These investments support faster innovation, expand international reach, and support the development of integrated solutions, thereby accelerating the global adoption of HCM technologies.

Demand for Scalable and Integrated Workforce Management Tools

The human capital management market is expanding due to the increasing demand for integrated and scalable workforce management tools. Companies are transitioning from fragmented systems toward unified platforms that manage payroll, time tracking, performance monitoring, and workforce planning. This transition improves process efficiency and enhances data accuracy.

Scalable tools enable organizations to support workforce growth and respond to evolving compliance needs. With workforce models growing more complex, businesses are increasingly adopting centralized systems to manage distributed teams consistently. These operational needs continue to drive the adoption of advanced HCM solutions.

Regulatory Complexity in Global Workforce Operations

The human capital management market faces a key challenge in managing regulatory compliance across different countries and regions. Companies operating globally must comply with a wide range of labor regulations, tax requirements, data privacy laws, and employment standards that differ across jurisdictions. These differences increase the complexity for HR teams and raise the risk of non-compliance.

Relying on manual processes to track and apply region-specific rules often leads to errors and delays. Companies are incorporating automated compliance features into their HCM systems to manage regulatory requirements more effectively.

These tools track legal changes, adjust workflows based on updated regulations, and maintain accurate records. This reduces the risk of non-compliance, enhances audit preparedness, and supports consistent adherence to legal obligations across international operations.

Increased Use of AI in Workforce Management

The human capital management market is experiencing a significant trend in the rising use of artificial intelligence to streamline HR operations. Organizations are using AI to automate high-volume tasks such as candidate screening, interview scheduling, and employee queries. This improves speed and accuracy while reducing manual workload.

AI is also enabling predictive insights that support workforce planning, attrition analysis, and skills mapping. These capabilities help businesses make faster, data-backed decisions. HR departments are increasingly focused on improving responsiveness and aligning workforce strategies with business goals. This is driving demand for AI-enabled solutions and influencing the development and deployment of HCM platforms across industries.

|

Segmentation |

Details |

|

By Component |

Software (Core HR, Talent Management, Workforce Management, Payroll & Compensation Management, Others), Services (Professional Services, Managed Services) |

|

By Deployment Mode |

Cloud-based, On-premise |

|

By Enterprise Size |

Small & Medium-sized Enterprises (SMEs), Large Enterprises |

|

By Industry Vertical |

BFSI, Healthcare & life sciences, Retail & E-commerce, IT & telecommunications, Manufacturing, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America human capital management market share stood at around 36.55% in 2024 in the global market, with a valuation of USD 10.80 billion. The region’s dominance is driven by an increasing adoption of AI-enabled HCM platforms to streamline HR operations, improve workforce planning, and manage complex organizational structures.

Companies in the United States and Canada use these systems to enhance employee experience, ensure compliance, and support remote and hybrid work models. The presence of advanced digital infrastructure and a high level of HR tech maturity contribute to steady adoption.

Strong digital infrastructure and widespread use of analytics help organizations make faster and more informed HR decisions. These factors continue to support consistent adoption and strengthen the region’s position in the global market.

The human capital management industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 10.16% over the forecast period. This strong growth is mainly attributed to companies in the region focusing on strategic partnerships to strengthen their HR technology capabilities.

Enterprises across India, China, and Southeast Asia are collaborating with HCM providers to access scalable platforms that address regional workforce needs and regulatory requirements. These partnerships allow businesses to adopt modern solutions without extensive in-house development, accelerating implementation. Continued business expansion and the digitization of HR functions are further supporting rapid market growth across emerging economies in the region.

The human capital management industry is characterized by the growing demand for unified platforms that combine Human Resources Information Systems (HRIS), payroll, performance management, and compliance tools. Companies are developing end-to-end solutions that support global teams while improving accuracy, operational efficiency, and visibility across HR functions.

Companies are integrating automation and AI-driven workflows to streamline core processes and enable faster decision-making. They are enhancing platform usability, ensuring smooth integration with external applications, and strengthening data security. In response to regulatory complexity, companies are automating compliance and adding localized features to manage international workforces more effectively.

Frequently Asked Questions