Semiconductor and Electronics

HVAC Insulation Market

HVAC Insulation Market Size, Share, Growth & Industry Analysis, By Type (Pipes, Ducts), By Material (Mineral Wool, Plastic Foam, Phenolic foam, Others), By End-Use (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR239

HVAC Insulation Market Size

The global HVAC Insulation Market size was valued at USD 5.98 million in 2023 and is projected to grow from USD 6.28 million in 2024 to USD 9.30 million by 2031, exhibiting a CAGR of 5.76% during the forecast period. Growing demand for energy-efficient buildings and development of smart insulation systems are augmenting the growth of the market.

In the scope of work, the report includes services offered by companies such as Saint - Gobain, Armacell, Owens Corning, Knauf Insulation, Johns Manville. A Berkshire Hathaway Company, Kingspan Group, Fletcher Insulation, GlassRock.com, IKO Industries Ltd., ROCKWOOL A/S, and others.

Advancements in insulation materials are revolutionizing the HVAC insulation market, offering improved energy efficiency, sustainability, and performance. Innovations in materials such as aerogels, vacuum-insulated panels (VIPs), and phase change materials (PCMs) are influencing the market. These materials offer superior thermal resistance, reduced thickness, and enhanced durability, making them ideal for modern HVAC systems.

- For instance, in November 2023, Kingspan Group launched HemKor, a product designed to further advance their strategy of decarbonizing the built environment. HemKor combines advanced material science with bio-based products to reduce embodied carbon emissions in buildings, thereby reinforcing Kingspan’s position as a leader in sustainable building solutions.

Aerogels, for instance, provide high insulation with minimal space requirements, which is particularly beneficial in retrofitting projects. VIPs offer exceptional thermal performance by minimizing heat transfer, which renders them particularly suitable for applications where space is limited.

Additionally, the development of eco-friendly insulation materials using recycled or natural fibers addresses the growing demand for sustainable building solutions. This trend presents a significant opportunity for companies to differentiate themselves by offering advanced insulation products that meet evolving environmental standards. As green building practices continue to gain traction, the adoption of these innovative materials is likely to increase, thereby stimulating the growth of the HVAC insulation market and creating new opportunities for expansion and market penetration.

HVAC insulation refers to the materials and methods used to prevent heat loss or gain in heating, ventilation, and air conditioning (HVAC) systems. Its primary function is to enhance energy efficiency by reducing the amount of energy required to maintain a building's temperature. HVAC insulation is available in various types, including duct insulation, pipe insulation, and equipment insulation, each engineered to serve a specific purpose within the system.

The materials used for HVAC insulation vary depending on the application and required performance characteristics. Common materials include fiberglass, foam, mineral wool, and reflective insulation. Fiberglass is widely used due to its excellent thermal resistance and fire-retardant properties, while foam insulation is highly favored for its lightweight and moisture-resistant qualities.

Mineral wool is known for its high density and soundproofing capabilities, making it ideal for commercial applications. Reflective insulation is specifically designed to reflect radiant heat, making it well-suited for environments characterized by high-temperature fluctuations. Applications of HVAC insulation span across residential, commercial, and industrial sectors. They contribute to reduced energy consumption, improved indoor air quality, and enhanced comfort levels.

Analyst’s Review

The HVAC insulation market is witnessing robust growth, largely attributed to the increasing demand for energy-efficient solutions and the implementation of stringent regulatory standards. Leading companies in the market are focusing on several strategic initiatives such as product innovation, mergers and acquisitions, and regional expansions to strengthen their market position. These companies are investing heavily in research and development to introduce advanced insulation materials that offer superior thermal performance and environmental sustainability. The current growth trajectory of the market is fueled by rising construction activities, particularly in emerging economies, where urbanization and industrialization are rapidly advancing.

- For instance, in June 2023, Armacell and AIS established a joint venture named Armacell AIS, LLC, with the aim of producing insulation jackets in the U.S. leveraging Armacell's Oklahoma facility. This collaboration, which combines their complementary expertise, is intended to enhance their presence in the U.S. markets for HVAC, acoustic, and fire protection insulation markets.

Additionally, key industry players are emphasizing the importance of sustainability by developing eco-friendly insulation products that align with global green building standards. However, to maintain competitive advantage, companies must address challenges such as fluctuating raw material prices and the pressing need for cost-effective solutions. Strategic collaborations and partnerships with construction firms and government bodies are imperative for expanding market reach and meeting the growing demand for innovative HVAC insulation solutions. The ability to adapt to evolving market dynamics and regulatory requirements is likely to be crucial for sustaining long-term growth in this competitive landscape.

HVAC Insulation Market Growth Factors

Rising construction activities are augmenting the growth of the HVAC insulation market. As urbanization and industrialization progress globally, there is a corresponding increase in the demand for new residential, commercial, and industrial buildings. This surge in construction activity highlights the need for energy-efficient solutions, including HVAC insulation, to meet modern building standards and regulatory requirements. In several regions, governments are mandating stringent energy efficiency codes, prompting builders to incorporate effective insulation materials to reduce energy consumption and minimize environmental impact.

- For instance, in July 2024, IKO launched a newly designed website for IKO Commercial, reflecting its dedication to innovation and customer satisfaction. The new site represents a strategic move to enhance user experience and underscores IKO’s leadership in the roofing and insulation industries.

Additionally, the construction of green buildings, which require advanced insulation solutions to obtain sustainability certifications such as LEED, is on the rise. This trend is particularly evident in urban centers, where the emphasis on sustainable infrastructure is growing. The increasing awareness of the benefits of energy efficiency among builders and property owners is further fueling the demand for HVAC insulation products. As construction activities continue to expand, especially in rapidly developing regions, the HVAC insulation market is poised to witness sustained growth. This trend presents ample opportunities for manufacturers and suppliers.

The fluctuating prices of raw materials pose a significant challenge to the development of the market, impacting both the cost structures and profitability of manufacturers. Key raw materials, such as fiberglass, foam, and mineral wool, are subject to price volatility due to various factors such as changes in global demand, supply chain disruptions, and fluctuations in the costs of oil and natural gas, which are crucial inputs for insulation materials. This volatility could lead to increased production costs, which may be transferred to consumers, potentially result in a decrease in demand.

Additionally, price fluctuations create uncertainty in the market, which may hinder manufacturers’ ability to plan and budget effectively. To mitigate this challenge, companies are adopting strategic procurement practices, such as long-term contracts with suppliers, diversification of raw material sources, and hedging strategies to manage price risks. Additionally, investing in research and development to explore alternative, cost-effective materials provides a buffer against raw material price volatility. By implementing these mitigation strategies, companies are effectively navigating the uncertainties of raw material pricing and maintaining their competitive edge in the market.

HVAC Insulation Market Trends

The rise in retrofitting projects is a notable trend reshaping the landscape of the HVAC insulation market. As existing buildings age, there is an increasing need to upgrade and modernize their HVAC systems to improve energy efficiency and comply with updated regulatory standards. Retrofitting involves replacing or enhancing outdated insulation materials with more advanced and effective solutions, resulting in substantial reductions in energy consumption and operational costs. This trend is particularly evident in developed regions, where a large portion of the building stock is aging and in need of refurbishment.

- For instance, in January 2023, Owens Corning showcased its extensive insulation products at the International Builders’ Show, with a particular emphasis on its newly acquired Ultra-Pure low VOC spray foam insulation. This product, designed to enhance energy efficiency and indoor air quality, highlights Owens Corning’s commitment to innovation and sustainability.

Additionally, governments and regulatory bodies are offering incentives and subsidies for energy-efficient retrofits, thereby prompting both property owners and managers to invest in HVAC insulation upgrades. The trend is gaining significant traction in developing regions, where retrofitting offers a cost-effective alternative to constructing new buildings. This is leading to the rising demand for HVAC insulation products specifically designed for retrofitting applications, providing manufacturers with new opportunities for market expansion. This growing focus on retrofitting is driving the sales of insulation materials, thereby contributing to the broader goal of reducing carbon emissions and enhancing building sustainability.

Segmentation Analysis

The global market is segmented based on type, material, end-use, and geography.

By Type

Based on type, the market is categorized into pipes and ducts. The ducts segment dominated the HVAC insulation market in 2023, capturing a substantial share of 59.95%, primarily due to the critical role ducts play in heating, ventilation, and air conditioning systems. Ducts are essential components of HVAC systems, tasked with distributing conditioned air throughout buildings, making effective insulation crucial to minimize energy loss and maintain system efficiency.

The demand for duct insulation is particularly pronounced in commercial and industrial buildings, where extensive ductwork is required to accommodate large spaces. Proper insulation of ducts is essential for preventing heat loss in heating systems and heat gain in cooling systems, thereby reducing the overall energy consumption of HVAC systems.

Furthermore, the growing emphasis on energy efficiency and the implementation of stringent energy codes have boosted the adoption of advanced duct insulation materials, as these materials offer superior thermal resistance and help lower operational costs. The rise in construction activities, particularly in emerging markets, coupled with an increasing focus on sustainable building practices, has further propelled the demand for duct insulation, thereby supporting segmental expansion.

By Material

Based on material, the market is classified into mineral wool, plastic foam, phenolic foam, and others. The plastic foam segment is set to experience robust growth, with a CAGR of 6.12% through the forecast period. Plastic foam insulation materials, such as expanded polystyrene (EPS), extruded polystyrene (XPS), and polyurethane foam, are increasingly favored in HVAC applications due to their exceptional thermal insulation properties, lightweight nature, and versatility. These materials offer high R-values, making them highly effective in reducing heat transfer and improving energy efficiency in HVAC systems.

Additionally, plastic foams are easy to install and can be molded into various shapes, rendering them suitable for insulating complex components such as ducts, pipes, and equipment. The growing demand for energy-efficient buildings, coupled with rising construction activities globally, is further fueling the adoption of plastic foam insulation.

Moreover, advancements in foam technologies, such as the development of eco-friendly and low-emission foams, are addressing environmental concerns and meeting stringent regulatory standards, thereby boosting segmental growth. As the focus on sustainability and energy efficiency increases, the plastic foam segment is poised to capitalize on these trends in the coming years.

By End-Use

Based on end-use, the market is divided into residential, commercial, and industrial. The commercial segment led the HVAC insulation market, generating USD 2.91 billion in 2023. The demand for HVAC insulation in commercial buildings, such as offices, shopping malls, hospitals, and educational institutions, remains notably higher due to the large-scale and complex nature of these structures. These buildings require extensive HVAC systems to maintain comfortable indoor environments for occupants, making effective insulation crucial to optimize energy use and reduce operational costs. The implementation of stringent energy efficiency regulations and green building standards, particularly in developed regions, has led to increased adoption of advanced insulation materials in commercial buildings to meet these requirements.

Additionally, the rise in new commercial construction projects, coupled with the growing trend of retrofitting older buildings with energy-efficient solutions, has propelled the demand for HVAC insulation. The rising focus on sustainability, occupant comfort, and reducing carbon footprints has made HVAC insulation a critical component in the design and operation of commercial buildings, thereby fostering the expansion of the segment.

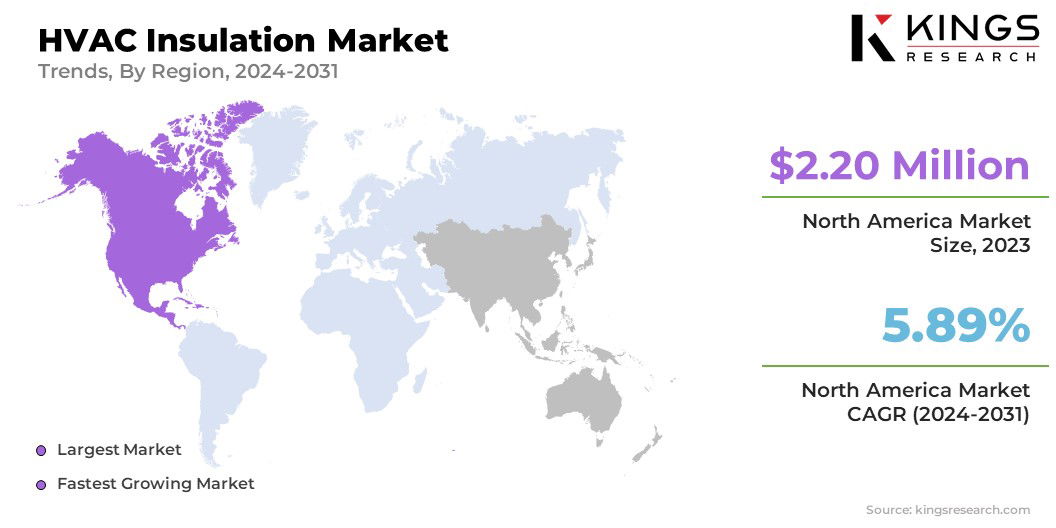

HVAC Insulation Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America dominated the global HVAC insulation market, holding the largest market share of 36.85%, with a valuation of USD 2.20 billion in 2023. This dominance is primarily attributed to the region's stringent energy efficiency regulations, high adoption of advanced HVAC technologies, and robust construction activities, particularly in the commercial and industrial sectors.

The U.S., as the largest contributor to the North American market, has enacted strict building codes and energy standards that mandate the use of effective insulation in HVAC systems to reduce energy consumption and carbon emissions. The growing trend of green buildings, supported by government incentives and certifications such as LEED, has further fueled the demand for HVAC insulation.

Additionally, the aging infrastructure in the region has led to an increase in retrofitting projects, where old HVAC systems are being upgraded with modern insulation solutions to enhance energy efficiency. The region's growing focus on sustainability, coupled with the increasing awareness of the benefits of energy-efficient insulation, has solidified North America's position in the market.

Asia-Pacific is poised to grow at a significant CAGR of 6.17% in the forthcoming years. This rapid growth is mainly propelled by several key factors, including the region's booming construction industry, rapid urbanization, and increasing demand for energy-efficient building solutions. Countries such as China, India, and Southeast Asian nations are witnessing a surge in construction activities, fueled by population growth, rising disposable incomes, and government initiatives aimed at infrastructure development.

The expansion of the middle-class population and the growing trend of smart cities in these countries are further contributing to the increased demand for advanced HVAC systems and, consequently, insulation materials that enhance energy efficiency and indoor comfort.

Additionally, the increasing awareness of environmental sustainability and the implementation of energy conservation policies are promoting the adoption of high-performance insulation products. The region's industrial sector is expanding, leading to a strong demand for HVAC insulation in manufacturing facilities and commercial buildings. As the region continues to modernize and urbanize, the Asia-Pacific market is expected to grow significantly, offering lucrative opportunities for industry players.

Competitive Landscape

The global HVAC insulation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in HVAC Insulation Market

- Saint - Gobain

- Armacell

- Owens Corning

- Knauf Insulation

- Johns Manville. A Berkshire Hathaway Company

- Kingspan Group

- Fletcher Insulation

- GlassRock.com

- IKO Industries Ltd.

- ROCKWOOL A/S

Key Industry Developments

- June 2024 (Acquisition): Armacell acquired E&M Industries' engineering business in Western Australia, leading to the formation of Armacell Australia Engineering Pty Ltd. This acquisition strengthens Armacell's energy and solution-selling capabilities in the region, while also expanding its range of insulation fabrication.

- December 2023 (Acquisition): ROCKWOOL Group acquired Boerner Insulation in Poland to accelerate its growth in this strategic region. The facility's location proximity to the German-Czech border optimizes logistics and supply-chain operations, thereby enhancing ROCKWOOL’s reach across multiple European markets.

The global HVAC insulation market is segmented as:

By Type

- Pipes

- Ducts

By Material

- Mineral Wool

- Plastic Foam

- Phenolic foam

- Others

By End-Use

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership