Energy and Power

Hydrogen Generation Market

Hydrogen Generation Market Size, Share, Growth & Industry Analysis, By Process (Steam Methane Reforming, Electrolysis, Others), By End User (Chemical Industry, Oil and Gas, Transportation, Utilities), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : October 2024

Report ID: KR333

Hydrogen Generation Market Size

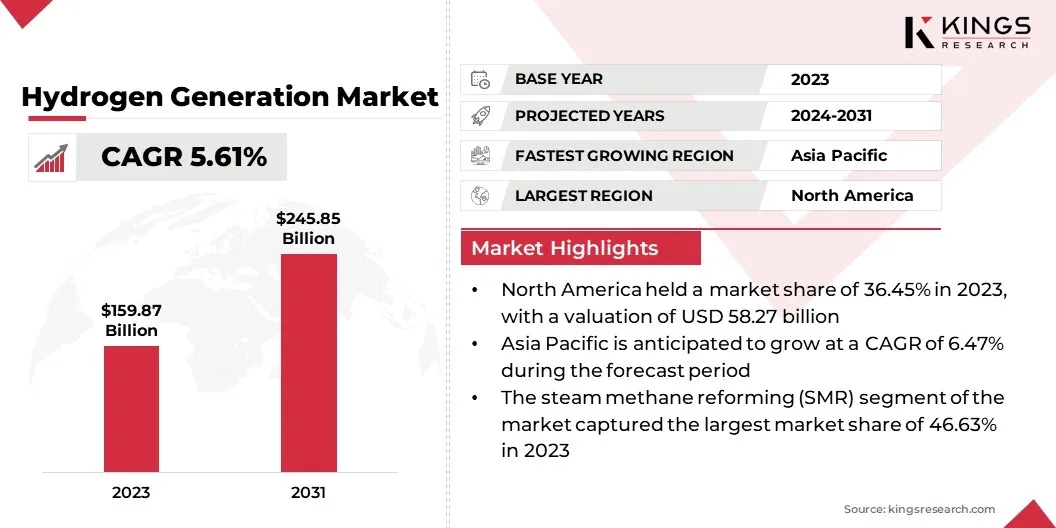

The global Hydrogen Generation Market size was valued at USD 159.87 billion in 2023 and is projected to grow from USD 167.78 billion in 2024 to USD 245.85 billion by 2031, exhibiting a CAGR of 5.61% during the forecast period. Rising demand for clean energy and policies and subsidies encouraging hydrogen production are augmenting the market.

In the scope of work, the report includes services offered by Air Products and Chemicals, Inc., Linde PLC, Air Liquide, Cummins Inc., Plug Power Inc., Ballard Power Systems, ITM Power PLC, Nel ASA, McPhy Energy S.A., FuelCell Energy, Inc., ENGIE SA, and others.

The expansion of hydrogen in heavy-duty transportation can significantly accelerate the decarbonization of aviation, shipping, and long-haul trucking industries which face challenges with electrification due to energy density and refueling limitations. Hydrogen fuel cells can provide a longer range and faster refueling times compared to battery-electric options, which makes them more suitable for vehicles that require continuous operation over long distances.

Many companies in the transportation industry are exploring the use of hydrogen to reduce their carbon footprint, and governments are supporting this shift through subsidies and infrastructure investments.

- In May 2024, Symbio unveiled a hydrogen-powered Class 8 regional-haul truck, integrated with Michelin’s next-gen EV tires for improved fuel efficiency. This initiative, supported by the CEC, showcases the viability of zero-emission fuel cell technology for heavy-duty transport applications.

Heavy-duty transportation fleets can benefit from hydrogen’s potential to improve energy efficiency and reduce greenhouse gas emissions. Additionally, as more hydrogen refueling stations are built, the cost of using hydrogen as a fuel source is expected to decrease, encouraging the growth of hydrogen generation market. With hydrogen's versatility in industrial applications, its integration into heavy-duty transportation can be a key step in addressing global climate change while driving innovation in the energy and automotive industries.

Hydrogen generation refers to the process of producing hydrogen gas for use as a fuel or in various industrial applications. Hydrogen can be produced by various methods, such as steam methane reforming (SMR), electrolysis of water, and gasification of biomass.

SMR uses natural gas to produce hydrogen and is currently the most common method, though it emits significant carbon dioxide. Electrolysis, which uses electricity to split water into hydrogen and oxygen, is a cleaner process, especially when powered by renewable energy sources like wind or solar, producing what is called “green hydrogen.”

Hydrogen has versatile applications across industries. In energy, it can be used as a clean fuel for transportation, power generation, and storage. In industrial applications, hydrogen is used as a feedstock in chemical production, refining, and metallurgy. As the focus on sustainable energy solutions intensifies, the market will likely see growth within industries aiming to lower their fossil fuel dependence and reduce carbon emissions.

Analyst’s Review

The market is poised for rapid growth, driven by increased demand for clean energy and substantial investments from both public and private sectors. Leading companies operating in the market are focusing on scaling up their production capabilities, particularly in green hydrogen, to meet clean energy demand while addressing environmental concerns.

Strategic partnerships between manufacturers, energy firms, and governments are expected to bring about developments hydrogen technologies and establish robust supply chains in the market.

- For instance, in April 2023, Linde signed a long-term agreement to supply Evonik with green hydrogen. This contract was signed to support the expansion of Evonik's infrastructure and help reduce its carbon emissions, enhancing sustainability efforts at its operations in Singapore.

The major companies in the hydrogen generation market are also making substantial investments in R&D to improve the efficiency and cost-effectiveness of hydrogen production methods, such as electrolysis and carbon capture.

Many firms are expanding their global footprint by entering new markets through joint ventures and strategic acquisitions, to take advantage of growing regional demand for hydrogen in transportation, industrial applications, and energy storage. To stay competitive, key players in the market must continue to innovate, scale operations, and navigate regulatory challenges while meeting the demand for sustainable energy solutions to fight climate change.

Hydrogen Generation Market Growth Factors

The rising demand for clean energy is transforming global energy markets. Industries, governments, and consumers are prioritizing sustainability and carbon reduction. Clean energy sources such as wind, solar, and hydrogen are playing an essential role in meeting global climate goals, with hydrogen emerging as a key solution due to its versatility.

Hydrogen is particularly appealing because it is a zero-emission energy carrier that can be used in transportation, power generation, and heavy industries.

- In August 2024, DRIFT Energy, a UK-based startup specializing in green energy via high-tech sailing vessels, completed a USD 6.2 billion seed funding round led by Octopus Ventures. This funding will enable the company to scale production and initiate vessel manufacturing in 2025.

With increasing renewable energy production, green hydrogen, produced through electrolysis powered by renewable sources, is also gaining momentum. Governments are implementing policies and incentives to accelerate the adoption of clean energy technologies, with hydrogen at the forefront.

Industries are also recognizing the potential of hydrogen to decarbonize their operations, especially in hard-to-electrify sectors like steel manufacturing and aviation. These factors are expected to drive the growth of hydrogen generation market. The rising demand for clean energy is a critical driver that will support the expansion of hydrogen infrastructure, creating a more sustainable and resilient global energy system.

High costs remain a significant challenge for the hydrogen generation industry, particularly for green hydrogen produced through electrolysis. Currently, large-scale production of hydrogen is expensive due to the high energy requirements of electrolysis process, which often relies on electricity from renewable sources. While technological advancements have improved the efficiency of hydrogen production, the overall cost remains high compared to traditional fossil fuel-based energy sources.

The infrastructure required to store, transport, and distribute hydrogen also increases the cost, limiting widespread growth of the hydrogen generation market. Addressing this challenge is crucial to scaling hydrogen as a sustainable energy solution. Therefore, companies and governments are investing in R&D to make hydrogen production more energy-efficient and cost-effective.

The use of innovation to streamline production and scale manufacturing capabilities can help cut costs. Collaboration with renewable energy providers and the deployment of carbon capture and storage technologies will help lower overall production expenses and enhance hydrogen's competitiveness in the energy market.

Hydrogen Generation Industry Trends

The growing adoption of green hydrogen technology is a significant trend shaping the future of hydrogen generation market. Green hydrogen, produced using renewable energy sources like wind and solar, offers a clean alternative to traditional hydrogen production methods that rely on fossil fuels. This technology produces zero carbon emissions and is a vital component in efforts to reduce greenhouse gas emissions and combat climate change.

Many countries are implementing policies to promote the adoption of green hydrogen, including subsidies, tax incentives, and funding for research and development.

- For instance, in May 2024, the Government of India planned to achieve a green hydrogen production capacity of 5 MMTPA, significantly reducing dependence on imported fossil fuels and saving USD 12.03 billion in fossil fuel imports by 2030.

As a result, the transportation, power generation, and manufacturing industries are integrating green hydrogen into their operations to reduce their carbon footprint.

The growing interest in green hydrogen is also driving innovation in electrolysis technology, which is making the production process more efficient and scalable. With the global push toward cleaner energy sources, the adoption of green hydrogen technology is poised to accelerate, supporting the transition to a low-carbon economy.

Segmentation Analysis

The global market has been segmented based on process, end user, and geography.

By Process

Based on process, the market has been segmented into steam methane reforming, electrolysis, and others. The steam methane reforming (SMR) segment of the hydrogen generation market captured the largest market share of 46.63% in 2023 due to several key factors.

SMR is a well-established, mature technology that uses natural gas, which is abundant and relatively cost-effective, as a feedstock to produce hydrogen. The process involves reacting methane with steam at high temperatures to produce hydrogen and carbon dioxide. One of the primary reasons for SMR’s dominance is its cost-effectiveness compared to other methods like electrolysis, which is currently more expensive due to the involvement of renewable energy sources.

Oil refining, chemical production, and ammonia manufacturing industries rely heavily on SMR for their hydrogen needs, further driving its widespread adoption despite carbon emissions. SMR remains the preferred choice because it offers high efficiency and scalability. With advancements in carbon capture and storage technologies, SMR will continue to remain a dominant production method, as the market transitions to greener solutions.

By End User

Based on end user, the market has been classified into chemical industry, oil and gas, transportation, and utilities. The chemical segment is poised to reach a valuation of USD 95.17 billion by 2031, driven by its critical role in the hydrogen economy and increasing demand for hydrogen in industrial applications.

Hydrogen is used as a feedstock for generating methanol, ammonia, and other chemicals used in fertilizers, plastics, and synthetic materials. With the growing global population and decreasing agricultural productivity, the demand for ammonia-based fertilizers is rising, significantly boosting the consumption of hydrogen. Moreover, methanol, which relies heavily on hydrogen in its production process, is seeing a high demand across automotive, construction, and pharmaceuticals.

The transition toward cleaner production processes is further driving investments in hydrogen-based chemical manufacturing, where hydrogen is replacing more carbon-intensive feedstock. Additionally, regulatory pressure to reduce emissions and adopt sustainable practices in chemical production is prompting companies to explore low-carbon hydrogen solutions.

Hydrogen Generation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

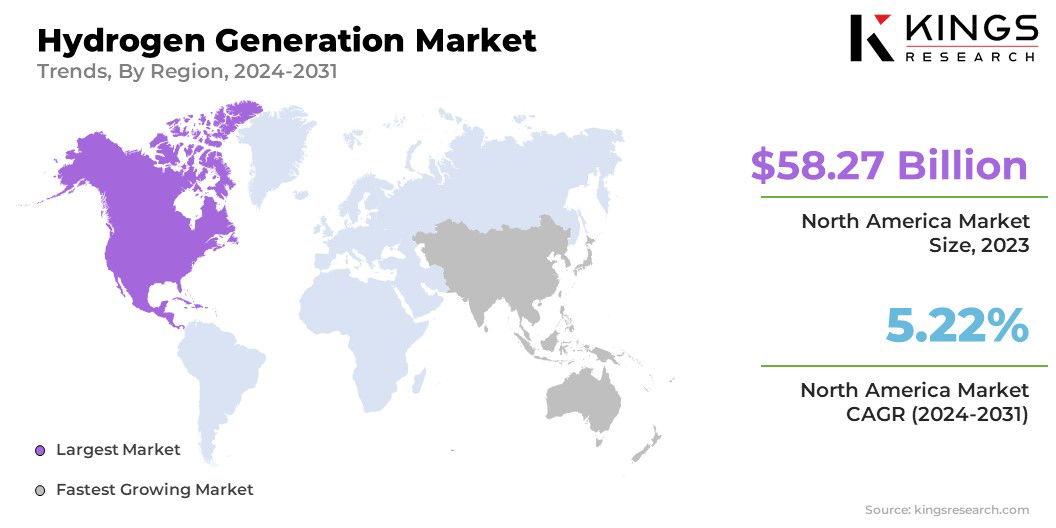

North America's hydrogen generation market share accounted for 36.45%, which was valued at USD 58.27 billion in 2023, making it the largest region in the global market. This dominance is driven by strong government support, well-developed infrastructure, and substantial clean energy investments in the region.

The U.S. is leading the market in North America due to its robust industrial sector and growing demand for hydrogen in sectors such as refining, ammonia production, and energy storage. The region's focus on reducing carbon emissions through policies like the U.S. Inflation Reduction Act, which offers incentives for green hydrogen production, is further driving growth of the market.

Additionally, investments in hydrogen refueling stations and the push for hydrogen-powered vehicles are fueling demand for hydrogen in the transportation sector.

- In November 2023, Air Products announced plans to build, own, and operate a state-of-the-art carbon capture and CO2 treatment facility at its hydrogen production plant in Rotterdam, to be operational by 2026. The facility will supply blue hydrogen to ExxonMobil’s refinery and other customers via Air Products' hydrogen pipeline, becoming Europe's largest blue hydrogen plant.

North America’s advanced research capabilities and innovation in electrolysis and carbon capture technologies are positioning it as a leader in the transition to a hydrogen-based economy, enabling continued growth and expansion of the hydrogen generation market.

Asia-Pacific is projected to grow at the fastest-growing CAGR of 6.47% over the forecast period, driven by rising demand for hydrogen across key industries and the region's focus on transitioning to cleaner energy sources. China, Japan, and South Korea are leading this growth with stringent government policies aimed at reducing greenhouse gas emissions and fostering the adoption of hydrogen technologies.

China, the world’s largest producer of carbon dioxide, is ramping up investments in green hydrogen projects, while Japan is pushing forward its “Hydrogen Society” vision, promoting hydrogen-powered transportation and energy storage.

- In April 2024, Panasonic Corporation announced that its Electric Works Company will introduce a pure hydrogen fuel cell generator in October 2024. This generator produces electricity through a chemical reaction between high-purity hydrogen and atmospheric oxygen, and will be launched in Europe, Australia, and China to advance clean energy solutions.

South Korea has also made significant strides with its Hydrogen Economy Roadmap by boosting hydrogen production and expanding the use of hydrogen fuel cells in vehicles and power generation. Rapid industrialization and increasing demand for energy are propelling the need for hydrogen in refining, chemicals, and heavy industry applications. Asia-Pacific’s commitment to sustainability and innovation will further accelerate its growth, positioning it as a key player in the global market.

Competitive Landscape

The global hydrogen generation market report provides valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Hydrogen Generation Market

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide

- Cummins Inc.

- Plug Power Inc.

- Ballard Power Systems Inc.

- ITM Power plc

- Nel ASA

- McPhy Energy S.A.

- FuelCell Energy, Inc.

- ENGIE SA

Key Industry Developments

- June 2024 (Agreement): ExxonMobil and Air Liquide partnered to produce low-carbon hydrogen and ammonia at ExxonMobil’s Baytown, Texas facility. Air Liquide will also construct and operate four Large Modular Air separation units, supplying oxygen and nitrogen, while utilizing low-carbon electricity to reduce the project’s carbon footprint.

- June 2024 (Partnership): TotalEnergies and Air Products have entered a 15-year agreement to supply 70,000 tons of green hydrogen annually in Europe, starting 2030. This deal follows TotalEnergies’ tender for 500,000 tons per year of green hydrogen to decarbonize its European refineries, reducing CO₂ emissions by approximately 700,000 tons annually.

- May 2024 (Launch): GAIL (India) Limited inaugurated its first Green Hydrogen Plant in Vijaipur, Madhya Pradesh, with a production capacity of 4.3 TPD. The plant utilizes a 10MW PEM Electrolyzer, powered by renewable energy, to generate 99.999% pure hydrogen at 30 Kg/cm² pressure.

- March 2024 (Launch): Larsen & Toubro (L&T) commissioned its first domestically manufactured electrolyser at its Green Hydrogen Plant in Hazira, Gujarat. This 1-MW-capacity electrolyser can produce 200 Nm³/hr. of hydrogen, marking a significant step in L&T’s commitment to advancing sustainable energy solutions.

The global hydrogen generation market has been segmented:

By Process

- Steam Methane Reforming

- Electrolysis

- Others

By End User

- Chemical Industry

- Oil and Gas

- Transportation

- Utilities

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)