Energy and Power

Ignition Transformer Market

Ignition Transformer Market Size, Share, Growth & Industry Analysis, By Type (Silicon Steel Sheet Transformer, Electronic Transformer), By End Use Industry (Power Generation, Oil & Gas, Automotive, Manufacturing & Processing), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2025

Report ID: KR1410

Market Definition

The ignition transformer market involves the production, sale, and distribution of ignition transformers. These specialized transformers are primarily used in ignition systems, such as in internal combustion engines, gas burners, and other applications requiring high-voltage electrical pulses for sparking and ignition.

An ignition transformer steps up the voltage from a lower voltage to a higher one, creating a spark that ignites fuel in engines or burners. These transformers are crucial for proper ignition, and their reliability and efficiency are essential for the overall performance of the systems they power.

Ignition Transformer Market Overview

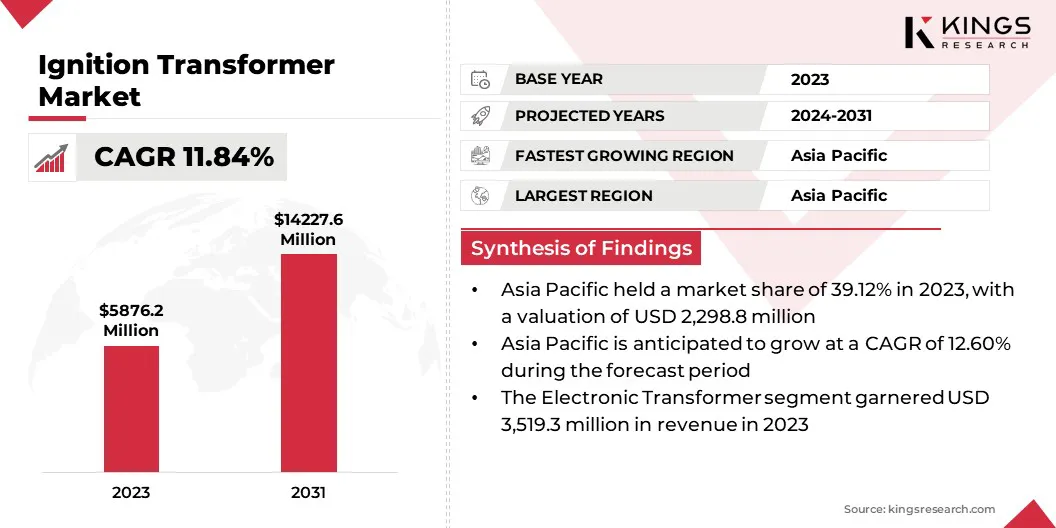

The global ignition transformer market size was valued at USD 5,876.2 million in 2023, which is estimated to be valued at USD 6,502.1 million in 2024 and reach USD 14,227.6 million by 2031, growing at a CAGR of 11.84% from 2024 to 2031.

The growing demand for gas-powered heating systems and boilers in residential and commercial sectors drives the need for reliable ignition systems. As a result, ignition transformers are essential for efficient spark generation, supporting the HVAC industry expansion and increasing market demand.

Major companies operating in the global ignition transformer industry are Honeywell International Inc., IBHS, BRAHMA s.p.a, Cofi Ignitions, Guangzhou Liancheng Energy Technology Development Co. Ltd., Enerdoor, JS Combustion Equipments., VASANT TRANSFORMERS, F.I.D.A. Srl, and Bürkle + Schöck KG.

The market is characterized by a steady demand across multiple industries, particularly in automotive, heating, and industrial applications. Ignition transformers play a crucial role in ensuring optimal ignition performance by providing high-efficiency, reliable solutions for spark generation.

Manufacturers are emphasizing software, quality and durability to meet the needs of both traditional combustion systems and newer, more energy-efficient applications. As industries continue to prioritize system reliability, ignition transformers will continue to be in demand in sectors reliant on high-voltage ignition systems.

- In July 2024, Ambarella and Plus announced the launch of their high-performance transformer-based PlusVision software, enhancing the CV3-AD AI domain controller. This collaboration provides automotive OEMs with efficient, power-saving solutions for L2+/L3 autonomous vehicle development.

Key Highlights:

- The global ignition transformer market size was valued at USD 5,876.2 million in 2023.

- The market is projected to grow at a CAGR of 11.84% from 2024 to 2031.

- Asia Pacific held a market share of 39.12% in 2023, with a valuation of USD 2,298.8 million.

- The electronic transformer segment garnered USD 3,519.3 million in revenue in 2023.

- The manufacturing & processing segment is expected to reach USD 4,758.2 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 11.39% during the forecast period.

Market Driver

"Demand for Electric Vehicles (EVs)"

The increasing demand for EVs, including hybrid models, is driving the ignition transformer market.

- According to the International Energy Agency (IEA), the EV market registered significant growth in 2023, with sales approaching 14 million units. The share of electric cars in total global car sales was nearly nearly 18% in 2023.

Fully EVs are reducing their reliance on traditional ignition systems; however, hybrid vehicles still depend on internal combustion engines, which require efficient ignition solutions.

The automotive industry is gradually embracing hybrid technology for cleaner emissions and longer driving ranges. Thus, ignition transformers remain crucial for these systems, ensuring reliable spark generation. Continuous demand for hybrid vehicles directly impacts the market.

- In February 2024, CorePower Magnetics, as part of the Wells Fargo Innovation Incubator (IN2), advanced its solid-state transformer technology. Primarily focused on EVs and power grids, such innovations indirectly influence the market through evolving energy needs.

Market Challenge

"Cost Pressure"

A significant challenge facing the ignition transformer market is the high production and development costs associated with creating high-performance systems. These costs often lead to increased pricing, making ignition transformers less affordable for end users.

Manufacturers can focus on improving manufacturing efficiency through automation and the use of cost-effective materials without compromising quality. Additionally, research into innovative designs and collaboration with suppliers can help reduce raw material costs, ultimately driving down production expenses and making these transformers more affordable.

Market Trend

"Shift Toward Energy Efficiency"

A notable trend in the ignition transformer market is the shift toward energy efficiency. The demand for energy-efficient ignition transformers is growing as environmental regulations become stricter and the focus on sustainability increases.

These transformers are designed to consume less power, reduce emissions, and align with global efforts to decrease energy consumption in various industries, especially transportation.

Manufacturers are creating transformers that are not only more efficient but also cost-effective and environmentally friendly by integrating advanced technologies and innovative materials.

- In September 2024, Hitachi Energy’s transformers continue to enhance Chennai’s Metro infrastructure, fostering efficiency amidst urban challenges. Its high-performance transformers, including 8x31.5/40 MVA, 110/33 kV, and various other units, support Chennai Metro Rail’s sustainability and smooth transportation.

Ignition Transformer Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Silicon Steel Sheet Transformer, Electronic Transformer |

|

By End Use Industry |

Power Generation, Oil & Gas, Automotive, Manufacturing & Processing |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Silicon Steel Sheet Transformer, Electronic Transformer): The electronic transformer segment earned USD 3,519.3 million in 2023, due to its higher efficiency, compact design, and ability to handle varying voltage levels in ignition systems.

- By End Use Industry (Power Generation, Oil & Gas, Automotive, Manufacturing & Processing): The power generation segment held 34.09% share of the market in 2023, due to the increasing demand for reliable ignition systems in power plants and efficient energy distribution.

Ignition Transformer Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a ignition transformermarket share of around 39.12% in 2023, with a valuation of USD 2,298.8 million. Asia Pacific has emerged as the dominant region in the market, holding a significant market share.

This dominance is primarily driven by the high demand for ignition transformers in the automotive, power generation, and manufacturing sectors across countries like China, Japan, and India.

The rapid urbanization, expanding automotive industry, and growing industrial activities in these nations contribute to the continued growth of the market. Moreover, favorable government initiatives for infrastructure development further strengthen the region's market position.

- In Oct 2024, Hitachi Energy celebrates 75 years of contributing to India’s energy transition. The company will invest USD 250 million USD to expand operations, including power transformer capacities and digitalization efforts, supporting the nation’s growing energy demands and Net-Zero goals.

The ignition transformer industry in Europe is poised for significant growth at a robust CAGR of 11.39% over the forecast period. Europe is registering rapid growth in the market, with the increasing adoption of advanced technologies and rising demand from the automotive and power sectors.

Countries such as Germany, France, and the UK are investing heavily in EVs and renewable energy, driving the need for efficient ignition systems. Europe’s focus on energy efficiency, sustainability, and innovative automotive technologies is fueling this growth. The region’s commitment to reducing carbon emissions and promoting clean energy solutions further accelerates the demand for ignition transformers.

Regulatory Frameworks

- In the U.S., the Federal Energy Regulatory Commission (FERC) assists consumers in obtaining reliable, safe, secure, and economically efficient energy services at a reasonable cost through appropriate regulatory & market means and collaborative efforts.

- In the EU, the low voltage directive (LVD) (2014/35/EU) ensures that electrical equipment within certain voltage limits provides a high level of protection for European citizens, and benefits fully from the single market

- The International Electrotechnical Commission (IEC) is a global, not-for-profit membership organization, whose work underpins quality infrastructure and international trade in electrical and electronic goods.

Competitive Landscape:

The global ignition transformer market is characterized by a large number of participants, including established corporations and rising organizations. Companies in the market are significantly increasing their investments and expanding operations to meet growing demand.

These efforts focus on enhancing manufacturing capabilities, advancing product technology, and expanding service networks globally. Additionally, companies are supporting the rise of EVs and sustainable energy systems while ensuring high-performance solutions, improving efficiency, and catering to diverse industry needs.

- In April 2024, Hitachi Energy announced over USD 1.5 billion in global transformer manufacturing investments, expanding capacity by 2027. This includes a new $180 million facility in Finland and enhancements in the U.S., Germany, and Asia to support growing electrification and sustainability efforts.

List of Key Companies in Ignition Transformer Market:

- Honeywell International Inc.

- IBHS

- BRAHMA s.p.a

- Cofi Ignitions

- Guangzhou Liancheng Energy Technology Development Co. Ltd.

- Enerdoor

- JS Combustion Equipments.

- VASANT TRANSFORMERS

- I.D.A. Srl

- Bürkle + Schöck KG

Recent Developments (Launch/Expansion)

- In September 2024, Hitachi Energy continues to address challenges in the clean energy transition, vital for the market. Its innovations, like WindSTAR Transformers, enhance renewable energy integration, supporting grid efficiency, reliability, and flexibility while contributing to sustainable energy solutions for the future.

- In June 2024, Toshiba Energy Systems and Solutions Corporation's installation of seven gas-insulated transformers (GIT) in Makkah highlighted the growing demand for safe and reliable transformer solutions. This trend emphasizes the market's need for high-performance, explosion-proof, and safety-enhancing products for urban and industrial applications.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years