Healthcare Medical Devices Biotechnology

Immunoassay Market

Immunoassay Market Size, Share, Growth & Industry Analysis, By Product (Reagents & Kits, Analyzers), By Technology (Enzyme Immunoassays, Rapid Tests, Radioimmunoassay, Others), By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, Others), By End User, and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR1348

Market Definition

The immunoassay market involves the development, production, and sale of diagnostic tests that use antibodies to detect and measure specific substances in bodily fluids like blood or urine. These tests are commonly used for disease diagnosis, monitoring health conditions, and detecting substances such as hormones, drugs, or pathogens, with applications in healthcare, research, and clinical settings.

Immunoassay Market Overview

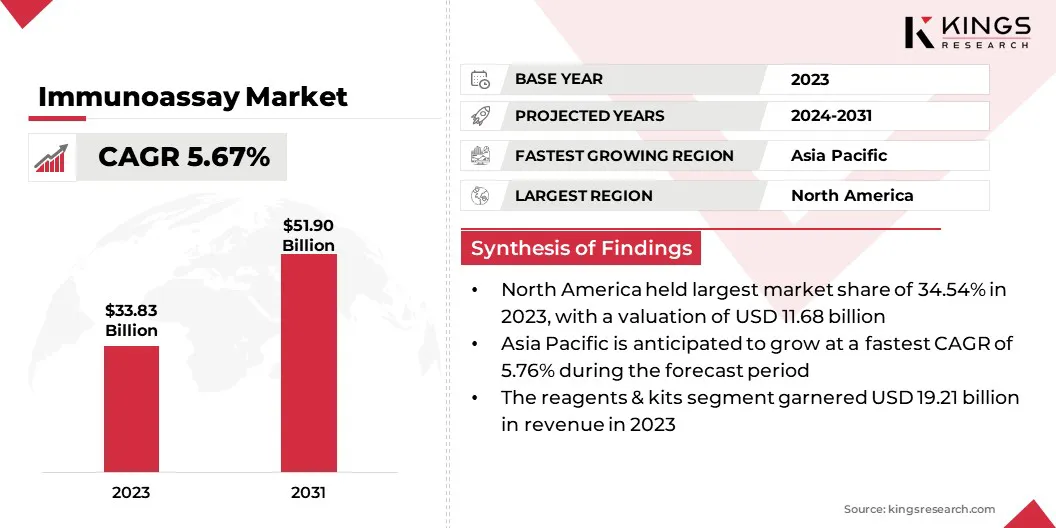

The global immunoassay market size was valued at USD 33.83 billion in 2023, which is estimated to be valued at USD 35.28 billion in 2024 and reach USD 51.90 billion by 2031, growing at a CAGR of 5.67% from 2024 to 2031.

The rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular conditions drives the demand for diagnostic tests. Immunoassays play a crucial role in early detection, monitoring, and managing these diseases, significantly contributing to the growth of the market.

Major companies operating in the global immunoassay Industry are Abbott, Siemens Healthcare Private Limited, Beckman Coulter, Inc, BIOMÉRIEUX, QuidelOrtho Corporation, SYSMEX CORPORATION, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, BD, Thermo Fisher Scientific Inc, Merck KGaA, Revvity, Nanōmix, Inc., SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD., and MESO SCALE DIAGNOSTICS, LLC.

The market is evolving rapidly with advancements in diagnostic technologies, such as enhanced sensitivity, automation, and point-of-care testing. It plays a crucial role in healthcare by enabling precise detection of biomarkers for disease diagnosis and monitoring.

- In September 2023, QuidelOrtho Corporation announced that its Sofia 2 SARS Antigen+ FIA received CLIA Waiver from the FDA. This makes it the first rapid antigen test for COVID-19 to be granted both FDA De Novo clearance and a CLIA waiver, enabling broader use in point-of-care settings.

As a vital component in personalized medicine, immunoassays are transforming clinical diagnostics, helping in the early detection of a range of conditions. The market continues to grow, driven by ongoing technological innovation and increasing demand for more accurate, efficient, and accessible diagnostic solutions globally.

- In May 2024, Siemens Healthineers launched four new blood biomarkers for a fully automated inflammation testing panel. Performed on the IMMULITE 2000/2000 XPi system, it offers seven immunoassays with a 35-65 minutes turnaround, providing fast, cost-effective testing for inflammatory diseases across 18 conditions.

Key Highlights:

- The global immunoassay market size was valued at USD 33.83 billion in 2023.

- The market is projected to grow at a CAGR of 5.67% from 2024 to 2031.

- North America held a market share of 34.54% in 2023, with a valuation of USD 11.68 billion.

- The reagents & kits segment garnered USD 19.21 billion in revenue in 2023.

- The enzyme immunoassays segment is expected to reach USD 20.30 billion by 2031.

- The infectious disease testing segment held a market share of 24.02% in 2023.

- The clinical laboratories segment is anticipated to register a CAGR of 5.76% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.76% during the forecast period.

Market Driver

"Growing Elderly Population"

The aging population is a significant growth driver for the immunoassay market, as older individuals often experience a higher prevalence of chronic diseases and health complications that require regular monitoring.

- According to a WHO article published in October 2024, by 2030, one in six people globally will be aged 60 years or older, representing approximately 1.4 billion individuals. By 2050, this number is expected to rise to 2.1 billion.

With age, the need for frequent health screenings, such as tests for cardiovascular diseases, diabetes, neurodegenerative diseases, and cancer, increases. Immunoassays offer efficient and accurate diagnostic solutions, contributing to early disease detection and better management. The demand for immunoassay-based diagnostic tests is expected to grow as the global population ages, fueling the market.

- In January 2025, Beckman Coulter Diagnostics announced the launch of new Research Use Only (RUO) blood-based biomarker immunoassays designed for neurodegenerative disease research. These assays target key biomarkers like p-Tau217, GFAP, NfL, and APOE ε4, offering advanced tools for Alzheimer's and other neurodegenerative conditions.

Market Challenge

"Regulatory Hurdles"

Regulatory hurdles pose a significant challenge in the immunoassay market, as obtaining approval for new tests can be a lengthy and complex process, delaying product launches. Manufacturers can invest in robust clinical trials and regulatory expertise, ensuring that their products meet all necessary standards.

Additionally, early engagement with regulatory bodies and streamlined approval processes can expedite approvals. Automation and advanced technologies can also help simplify the development process, reducing delays and costs.

- In May 2024, Beckman Coulter announced FDA clearance for its Access NT-proBNP assay, enabling heart failure assessment in under 11 minutes on the DxI 9000 Immunoassay Analyzer. This assay aids in diagnosing and stratifying heart failure severity, improving emergency department efficiency.

Market Trend

"Technological Advancements"

Technological advancements and innovations are significantly shaping the immunoassay market, as the development of more sensitive, accurate, and rapid immunoassay technologies enhances diagnostic precision. These innovations enable earlier detection of diseases, reduce the risk of false positives/negatives, and improve overall patient care.

With faster turnaround times and improved sensitivity, these advancements help clinicians make more informed decisions, resulting in better treatment outcomes. As technology continues to evolve, the market is poised to offer even more efficient and reliable diagnostic solutions.

- In May 2023, Beckman Coulter unveiled the DxI 9000 Access Immunoassay Analyzer, offering unmatched productivity with up to 215 tests per hour per square meter. It combines speed, reliability, and sensitivity, with innovations like ZeroDaily Maintenance, PrecisionVision Technology, and IntelliServe to optimize laboratory efficiency and system uptime. The DxI 9000 provides faster, more accurate results, improving patient care.

Immunoassay Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Reagents & Kits (ELISA Reagents & Kits, CLIA Reagents & Kits, IFA Reagents & Kits, Rapid Test Reagent & Kits, ELISpot Reagent & Kits, Western Blot Reagent & Kits, Others), Analyzers (Open-ended Systems, Closed-ended Systems) |

|

By Technology |

Enzyme Immunoassays, Rapid Tests, Radioimmunoassay, Others |

|

By Application |

Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, Autoimmune Diseases, Others |

|

By End User |

Hospitals & Clinics, Clinical Laboratories, Pharmaceutical & Biotechnology Companies, Blood Banks, Research & Academic Laboratories, Home Care Settings |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Reagents & Kits, Analyzers): The reagents & kits segment earned USD 19.21 billion in 2023, due to the growing demand for diagnostic testing, increased prevalence of diseases, and the need for rapid, reliable results in healthcare settings.

- By Technology (Enzyme Immunoassays, Rapid Tests, Radioimmunoassay, Others): The enzyme immunoassays segment held 39.33% share of the market in 2023, due to their high sensitivity, widespread usage in clinical diagnostics, and ability to detect a wide range of diseases accurately.

- By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, Autoimmune Diseases, Others): The infectious disease testing segment is projected to reach USD 12.42 billion by 2031, owing to the global rise in infectious diseases, advancements in immunoassay technologies, and increasing awareness for early detection and treatment.

- By End User (Hospitals & Clinics, Clinical Laboratories, Pharmaceutical & Biotechnology Companies, Blood Banks, Research & Academic Laboratories, Home Care Settings): The clinical laboratories segment is anticipated to register a CAGR of 5.76% during the forecast period, due to the increasing demand for diagnostic services, technological advancements, and a growing number of lab-based testing procedures.

Immunoassay Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a market share of around 34.54% in 2023, with a valuation of USD 11.68 billion. North America holds the largest share of the global immunoassay market, due to advanced healthcare infrastructure, high healthcare expenditure, and robust research & development activities.

The dominance of the market in the region is fueled by the increased demand for early disease detection, especially for chronic conditions like cancer and cardiovascular diseases.

Moreover, the presence of key market players, along with stringent regulatory standards ensuring high-quality testing solutions, supports the market growth. Additionally, the region's high adoption rate of innovative diagnostic technologies continues to drive its market leadership.

- In July 2023, Beckman Coulter introduced the DxI 9000 Access Immunoassay Analyzer in North America, designed to meet clinical laboratory demands for speed, reliability, and quality. The analyzer improves assay sensitivity and supports the advancement of diagnostic capabilities for complex diseases.

The immunoassay Industry in Asia Pacific is poised for significant growth at a robust CAGR of 5.76% over the forecast period. Asia Pacific is registering rapid growth in the market, due to improving healthcare infrastructure, rising disposable income, and increased awareness of preventive healthcare.

The region's expanding elderly population and growing prevalence of chronic diseases are contributing to the surge in demand for immunoassay-based diagnostics. Moreover, emerging markets such as China & India and developed markets such as Japan & South Korea are investing heavily in modern diagnostic technologies, which is further fueling the market in Asia Pacific.

- In March 2024, Sysmex Corporation launched six new gynecological and gonadal hormone immunoassay kits in Japan, expanding the HISCL-Series testing parameters. These kits support rapid hormone level measurement, aiding in the diagnosis and treatment of gynecological disorders and infertility.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting the public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical device. It is also responsible for advancing public health by speeding up innovations that make medical products more effective, safer, and affordable and by helping the public get the accurate, science-based information they need to use medical products and foods to maintain and improve their health.

- The Centers for Medicare & Medicaid Services (CMS) regulates all laboratory testing (except research) performed on humans in the U.S. through the Clinical Laboratory Improvement Amendments (CLIA). The CLIA program aims to ensure quality laboratory testing.

- The letters ‘CE’ appear on products traded on the extended Single Market in the European Economic Area (EEA). They signify that products sold in the EEA have been assessed to meet high safety, health, and environmental protection requirements.

- In India, the Central Drugs Standard Control Organisation (CDSCO) is responsible for the approval of drugs, conduct of clinical trials, laying down the standards for drugs, control over the quality of imported drugs in the country, and coordination of the activities carried out by different states in India.

Competitive Landscape:

The global immunoassay market is characterized by a large number of participants, including both established corporations and rising organizations. In the market, competitors frequently form strategic partnerships to enhance their product offerings and expand their market reach.

These collaborations often focus on integrating advanced technologies, expanding assay portfolios, improving automation, and enhancing diagnostic capabilities. By pooling resources and expertise, companies aim to drive innovation, improve testing efficiency, and meet the growing demand for accurate and reliable diagnostics across healthcare sectors.

- In February 2023, Siemens Healthineers and Unilabs announced a USD 208.05 million partnership. Unilabs will invest in Siemens Healthineers' technology, acquiring 400+ laboratory analyzers. This collaboration aims to enhance laboratory infrastructure, improve patient care, and modernize healthcare services across Unilabs' network with advanced solutions.

List of Key Companies in Immunoassay Market:

- Abbott

- Siemens Healthcare Private Limited

- Beckman Coulter, Inc

- BIOMÉRIEUX

- QuidelOrtho Corporation

- SYSMEX CORPORATION

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd

- BD

- Thermo Fisher Scientific Inc

- Merck KGaA

- Revvity

- Nanōmix, Inc.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- MESO SCALE DIAGNOSTICS, LLC

Recent Developments (Launch/Partnership/Acquisation/Approval)

- In July 2023, Siemens Healthineers introduced the Atellica CI Analyzer to address clinical lab challenges, including labor shortages and increased testing demands. This FDA-cleared system enhances workflow efficiency, offers improved turnaround times, and provides labs with advanced functionality, ensuring reliable, cost-effective testing for low to medium-volume settings.

- In May 2024, Beckman Coulter became an authorized distributor for the MeMed BV assay and MeMed Key analyzer, expanding their partnership. This collaboration aims to enhance infection management by offering rapid, accurate differentiation between bacterial and viral infections using advanced host-response diagnostics.

- In January 2025, bioMérieux announced its acquisition of SpinChip Diagnostics, a Norwegian company with a cutting-edge immunoassay platform. This acquisition enhances bioMérieux's point-of-care diagnostics, enabling rapid, high-sensitivity testing for acute conditions like Myocardial Infarction, improving patient outcomes and reducing healthcare costs.

- In October 2024, bioMérieux announced the CE-marking of VIDAS® VITAMIN B12 TOTAL, an automated test for measuring total Vitamin B12 levels in human serum or plasma. This addition enhances the VIDAS immunoassay portfolio, aiding in the diagnosis of vitamin B12 deficiency.

- In November 2023, Medical & Biological Laboratories Co., Ltd. launched the iStar 500, an automated chemiluminescence immunoassay (CLIA) analyzer designed for small to medium labs. It offers accurate, timely testing for cardiac markers, liver health, reproductive health, and more, with a focus on whole blood diagnostics.

- In May 2023, Thermo Fisher Scientific announced FDA clearance for its B·R·A·H·M·S PlGF plus KRYPTOR and sFlt-1 KRYPTOR immunoassays. These breakthrough biomarkers aid in preeclampsia risk assessment, offering timely results to improve outcomes for pregnant women at risk of severe complications.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years