Automotive and Transportation

In Wheel Motor Market

In Wheel Motor Market Size, Share, Growth & Industry Analysis, By Propulsion (BEV, HEV, PHEV), By Cooling (Air, Liquid), By Motor (Axial, Radial), By Power Output, By Vehicle, and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : March 2025

Report ID: KR1496

Market Definition

The market refers to the industry focused on electric motors integrated directly into a vehicle's wheels. These motors enable direct propulsion, improving vehicle efficiency, space utilization, and performance.

Primarily used in electric vehicles (EVs), the market is driven by advancements in electric mobility, demand for more efficient drivetrains, and the adoption of sustainable transportation solutions.

In Wheel Motor Market Overview

The global in wheel motor market size was valued at USD 232.5 million in 2023, which is estimated to be USD 323.3 million in 2024 and reach USD 4040.6 million by 2031, growing at a CAGR of 43.44% from 2024 to 2031.

In wheel motors enhance energy efficiency by directly powering each wheel, minimizing power losses through traditional drivetrain components like shafts and gearboxes. This streamlined design improves overall vehicle performance, contributing to longer driving ranges and lower energy consumption in EVs.

Major companies operating in the global in wheel motor market are Protean Electric Limited, Elaphe LTD, PMW Dynamics Limited, Schaeffler AG, MW Motors, REE, GEM Motors d.o.o., Consolidated Metco, Inc, DeepDrive GmbH, DOL Mobility Pvt. Ltd., Hyundai Mobis, Beetle Motor , MACCON , Hitachi, Ltd., and Nissan Motor Co., Ltd.

The market is focused on the development and integration of electric motors within vehicle wheels. This innovative technology eliminates the need for traditional drivetrains, offering a more compact and efficient solution for EVs.

By powering the wheels directly, in wheel motors enable improved handling, space utilization, and performance. With increasing adoption in EVs and other mobility solutions, the market is set to play a pivotal role in shaping the future of transportation technology and vehicle design.

- In January 2025, Donut Lab introduced its next-generation in wheel electric motor, producing 845bhp. Weighing just 40kg, it delivers a higher power-to-weight ratio compared to competitors like the Rimac Nevera. This innovative motor, designed for trucks and bikes, offers up to 50% lower manufacturing costs and promises efficient power delivery despite concerns over unsprung weight, a common challenge in in wheel motors.

Key Highlights:

- The in wheel motor industry size was valued at USD 232.5 million in 2023.

- The market is projected to grow at a CAGR of 43.44% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 2 million.

- The BEV segment garnered USD 89.4 million in revenue in 2023.

- The air segment is expected to reach USD 2332.2 million by 2031.

- The radial segment is anticipated to register a CAGR of 43.51% during the forecast period.

- The up to 60 KW segment held a market share of 39.43% in 2023.

- The passenger cars segment is anticipated to hold a market share of 58.11% in 2031.

- The market in Europe is anticipated to grow at a CAGR of 43.47% during the forecast period.

Market Driver

"Rising Demand for Electric Vehicles (EVs)"

The rising demand for EVs is a significant driver of the in wheel motor market.

- According to the International Energy Agency (IEA), (EV) sales reached nearly 14 million units in 2023. As a result, the share of electric cars in total vehicle sales has increased significantly, accounting for approximately 18.5% of global sales in 2023.

As EV adoption continues to accelerate globally, there is an increasing need for more efficient and compact propulsion technologies. In wheel motors, by directly powering each wheel, offer enhanced energy efficiency, reduced weight, and improved handling, which are crucial for modern EVs.

With automakers focusing on maximizing performance, range, and vehicle design flexibility, the demand for in wheel motor solutions is expected to grow steadily in the coming years.

- In January 2025, Elaphe unveiled the SONIC.1 at CES, a high-performance front in wheel motor. Offering 272 horsepower per wheel and compatibility with 400 mm high-performance brakes, it enhances vehicle dynamics with 20x faster wheel control, optimizing design and performance.

Market Challenge

"Durability Concerns"

Durability is a significant challenge for in wheel motors, as their exposure to harsh road conditions can lead to higher wear and tear. Constant exposure to vibrations, shocks, and environmental elements can impact motor performance and lifespan.

Thus, manufacturers are focusing on enhancing motor sealing, using robust materials that can withstand extreme conditions, and improving shock absorption systems within the wheel. Advanced coatings and protective measures are also being integrated to reduce corrosion and improve the overall durability of in wheel motors.

Market Trend

"Integration with Autonomous Vehicles"

Integration with autonomous vehicles is a key trend in the in wheel motor market. in wheel motors are becoming a preferred choice as autonomous and robotic vehicles demand more precise wheel control and space efficiency. These motors allow for independent wheel movement, enabling advanced steering, torque vectoring, and better vehicle handling.

The compact design of in wheel motors also optimizes vehicle architecture, freeing up space for other components, which is essential for the flexible, modular designs required for autonomous mobility solutions.

- In November 2023, Hyundai and Kia unveiled the Uni Wheel system, a revolutionary wheel drive technology that integrates drive components into the wheel hub, improving space efficiency and enabling modular, high-performance, and autonomous vehicle designs for future mobility solutions.

In Wheel Motor Market Report Snapshot

|

Segmentation |

Details |

|

By Propulsion |

BEV, HEV, PHEV |

|

By Cooling |

Air, Liquid |

|

By Motor |

Axial, Radial |

|

By Power Output |

Up to 60 KW, 60–90 KW, Above 90 KW |

|

By Vehicle |

Passenger Cars, Commercial Vehicles |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Propulsion (BEV, HEV, PHEV): The BEV segment earned USD 89.4 million in 2023, due to the increasing adoption of EVs and demand for efficient propulsion systems.

- By Cooling (Air, Liquid): The air segment held 57.86% share of the market in 2023, due to its simpler design, cost-effectiveness, and ease of maintenance.

- By Motor (Axial, Radial): The axial segment is projected to reach USD 2533.9 million by 2031, owing to its higher power density and efficiency in electric motors.

- By Power Output (Up to 60 KW, 60–90 KW, Above 90 KW): The 60–90 KW segment is anticipated to register a CAGR of 43.77% during the forecast period, due to the growing demand for mid-range power for commercial and passenger vehicles.

- By Vehicle (Passenger Cars, Commercial Vehicles): The passenger cars segment is anticipated to hold a market share of 58.11% in 2031, due to rising EV adoption and increased focus on lightweight, efficient propulsion systems.

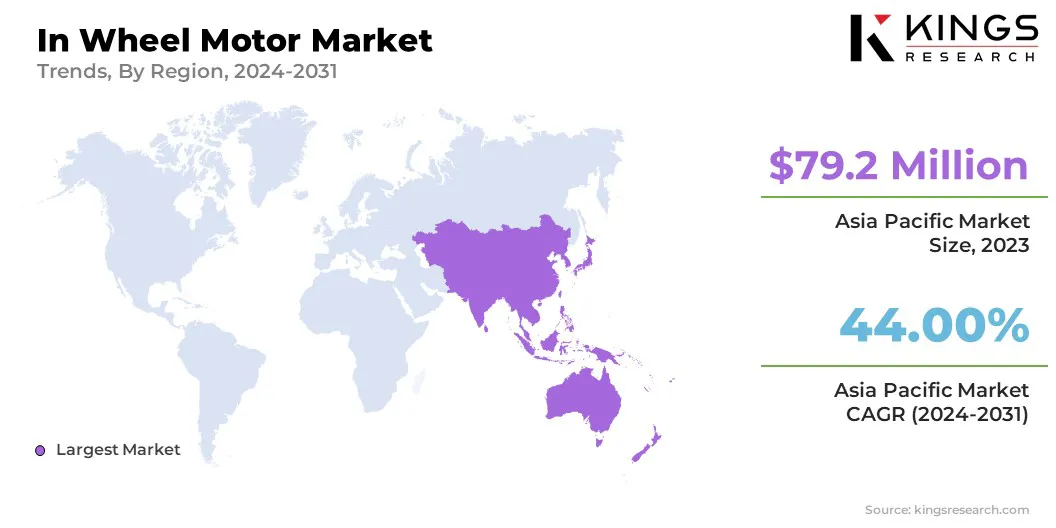

In Wheel Motor Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia Pacific accounted for around 34.04% share of the global in wheel motor market in 2023, with a valuation of USD 79.2 million. Asia Pacific is the dominant region in the market, due to the rapid adoption of EVs and strong manufacturing capabilities.

Countries like China, Japan, and South Korea lead the way in EV production, supported by government policies and incentives promoting clean energy.

Additionally, the presence of major automotive manufacturers in this region, along with advancements in EV technology, contributes to the market’s growth. The increasing demand for efficient propulsion systems further drives the adoption of in wheel motors in Asia Pacific.

The market in Europe is poised for significant growth over the forecast period at a CAGR of 43.47%. Europe is the fast growing region in the in wheel motor industry, driven by aggressive sustainability goals and a strong push for electrification.

Countries like Germany, France, and the Netherlands are embracing cleaner mobility solutions, with increasing government regulations promoting EV adoption.

The rise of eco-conscious consumers, advancements in automotive technologies, and the development of autonomous driving are fueling the demand for in wheel motors in Europe. As automakers continue innovating, Europe is quickly becoming a hub for in wheel motor growth.

- In Oct 2024, Elaphe, in collaboration with InnoEnergy, showcased its cutting-edge in wheel motor technology at the Barcelona-Catalunya F1 Circuit. The event highlighted Elaphe’s advancements in vehicle design freedom, dynamic control, and performance, demonstrating the potential of in wheel motors in next-gen EV architectures.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) investigates safety defects in motor vehicles, regulates safety standards for EVs and in wheel motors.

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- In the EU, the Vehicle General Safety Regulation introduced a range of mandatory advanced driver assistance systems (ADAS) to improve road safety and established the legal framework for the approval of automated and fully driverless vehicles in the region.

Competitive Landscape:

Companies in the in wheel motor industry are increasingly providing innovative solutions to municipalities and various sectors by offering high-efficiency, space-saving electric motors for a range of applications.

These motors are used in public transportation, delivery vehicles, and specialized municipal services, enabling enhanced vehicle performance, reduced maintenance, and improved energy efficiency while supporting sustainable, eco-friendly urban mobility solutions.

- In March 2023, Schaeffler Group launched its fully electric wheel hub motors for municipal utility vehicles, including street sweepers, snowplows, and vans. These motors enable zero-emission, low-noise operations, enhancing vehicle maneuverability and offering sustainable, space-saving solutions for urban environments.

List of Key Companies in In Wheel Motor Market:

- Protean Electric Limited

- Elaphe LTD

- PMW Dynamics Limited

- Schaeffler AG

- MW Motors

- REE

- GEM Motors d.o.o.

- Consolidated Metco, Inc

- DeepDrive GmbH

- DOL Mobility Pvt. Ltd.

- Hyundai Mobis

- Beetle Motor

- MACCON

- Hitachi, Ltd.

- Nissan Motor Co., Ltd.

Recent Developments (Funding/ Partnership/Launch)

- In September 2023, YASA secured USD 26.9 million in funding from the Advanced Propulsion Centre UK to develop a revolutionary in wheel motor design. This project aims to enhance EV performance, reduce weight, and improve driving dynamics, accelerating EV adoption with advanced propulsion technologies.

- In October 2023, Continental formed a strategic partnership with DeepDrive to develop a combined wheel hub drive and brake unit for EVs. This collaboration aims to enhance efficiency, reduce weight, and improve modularity, advancing the electrification of motor vehicles with compact, resource-efficient solutions.

- In October 2024, Freudenberg Sealing Technologies advanced in wheel motor development by introducing a patented seal design. The innovative seals reduce friction, enhance durability, and offer superior protection, optimizing the performance of EVs and commercial applications.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years