Energy and Power

Industrial Utility Communication Market

Industrial Utility Communication Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Technology (Wired, Wireless), By End-Use (Power Generation, Power Transmission and Distribution, Oil and Gas, Water and Wastewater, Others), and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : March 2025

Report ID: KR1536

Market Definition

The market refers to technologies and systems used for efficient communication and data exchange within energy, water, and gas sectors.

This market includes solutions that support real-time monitoring, automation, and secure data transmission which enhance operational efficiency, safety, and resource management. These capabilities also facilitate better decision-making and optimized utility operations.

Industrial Utility Communication Market Overview

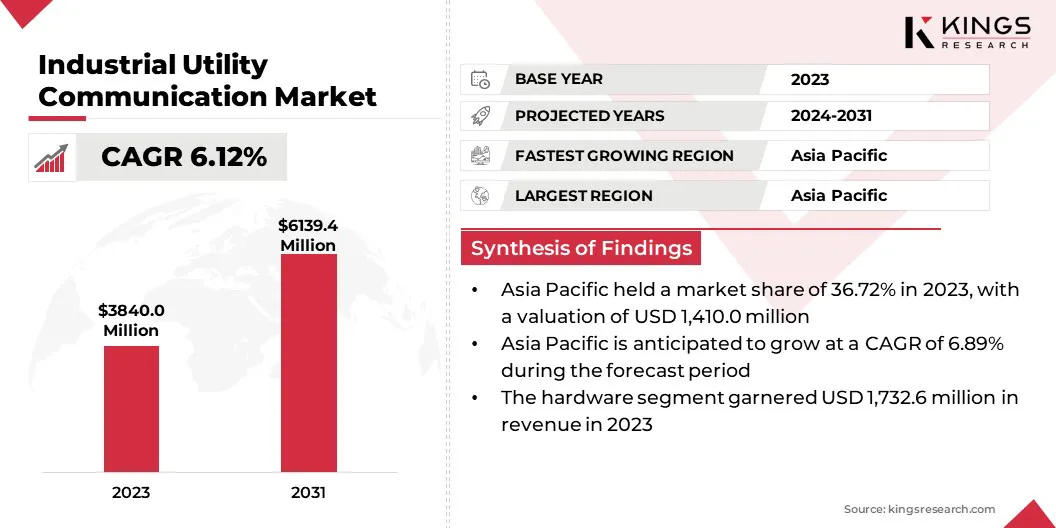

Global industrial utility communication market size was valued at USD 3,840.0 million in 2023, which is estimated to be valued at USD 4,051.0 million in 2024 and reach USD 6,139.4 million by 2031, growing at a CAGR of 6.12% from 2024 to 2031.

The digitalization of power grids and the integration of renewable energy into utility systems drive the need for advanced communication infrastructure. Smart grids require real-time data exchange, automation, and secure connectivity. These capabilities help optimize energy distribution, improve efficiency, and support a sustainable energy transition

Major companies operating in the industrial utility communication industry are General Electric Company, Siemens, Schneider Electric, Hitachi, Ltd., FUJITSU, Motorola Solutions, Inc., Telefonaktiebolaget LM Ericsson, Nokia, Itron Inc, Cisco Systems, Inc., Emerson Electric Co, ABB, RAD, OMICRON, and Hexagon AB.

The market is evolving rapidly due to growing demand for secure, high-speed, and resilient connectivity. As digitalization increases, sectors such as energy, transportation, and manufacturing depend on advanced communication networks to boost efficiency and operational reliability.

Technologies like 5G, hybrid wireless solutions, and Industrial IoT (IIoT) are enabling real-time data exchange, remote monitoring, and automation. This advancements support grid modernization and smart infrastructure while enabling reliable and scalable industrial communication solutions.

The market is evolving rapidly due to growing demand for secure, high-speed, and resilient connectivity. As digitalization increases, sectors such as energy, transportation, and manufacturing depend on advanced communication networks to boost efficiency and operational reliability.

Technologies like 5G, hybrid wireless systems, and Industrial IoT (IIoT) are enabling real-time data exchange, remote monitoring, and automation. These advancements support grid modernization and smart infrastructure while enabling reliable and scalable industrial communication solutions.

- In July 2024, Accenture completed its acquisition of FiberMind, a company specializing in fiber and mobile 5G network services. This acquisition enhances Accenture's capability to deliver cutting-edge solutions for fiber and 5G network infrastructure.

Key Highlights:

- The industrial utility communication industry size was recorded at USD 3,840.0 million in 2023.

- The market is projected to grow at a CAGR of 6.12% from 2024 to 2031.

- Asia Pacific held a market share of 36.72% in 2023, with a valuation of USD 1,410.0 million.

- The hardware segment garnered USD 1,732.6 million in revenue in 2023.

- The wireless segment is expected to reach USD 3,539.3 million by 2031.

- The power transmission and distribution segment is anticipated to witness fastest CAGR of 7.46% during the forecast period

- North America is anticipated to grow at a CAGR of 6.23% during the forecast period.

Market Driver

"Smart Grid and Energy Transition"

The increasing shift towards smart grids and renewable energy integration is driving the demand for advanced communication infrastructure. As utilities transition to decentralized energy systems, real-time data exchange becomes critical for balancing supply and demand.

Smart grids use automation, AI-driven analytics, and secure connectivity to optimize power distribution, reduce energy losses, and integrate distributed energy resources. This transformation improves grid resilience, ensures regulatory compliance and enables predictive maintenance.

The increasing reliance on high-speed communication networks to support these advancements is a key driver for the growth of the industrial utility communication market.

- In April 2024, ABB announced a strategic partnership with GridBeyond to enhance smart grid energy management. This collaboration aims to optimize energy usage and enhance grid flexibility, supporting the transition to a more sustainable energy future.

Market Challenge

"Skilled Workforce Shortage"

The industrial utility communication market is facing a shortage of skilled workforce, particularly in areas like advanced network management, cybersecurity, and digital grid technologies.

As smart grids and IIoT adoption expand, the utility sector struggles to find professionals proficient in real-time data management, AI-driven automation, and secure communication protocols.

To address this, companies can invest in workforce training programs, establish partnerships with academic institutions, and implement AI-driven automation to reduce reliance on manual operations. Additionally, remote monitoring and cloud-based solutions help bridge skill gaps while ensuring efficient and secure grid communication.

Market Trend

"Integration of Artificial Intelligence (AI) and Machine Learning (ML)"

The integration of AI and ML is transforming the industrial utility communication market by optimizing energy distribution, predictive maintenance, and network efficiency. AI-driven analytics enable real-time monitoring of grid performance, helping utilities detect faults, prevent failures, and enhance asset longevity.

Machine learning algorithms improve demand forecasting, ensuring efficient energy distribution and reducing operational costs. Additionally, AI-powered automation streamlines network management, enhancing reliability and responsiveness. This trend is accelerating digital transformation, making utility grids smarter, more resilient, and better equipped for the energy transition.

- In May 2024, Honeywell launched its Forge AI-enabled software solution designed to accelerate the digital transformation and modernization of utility grid assets. This solution leverages artificial intelligence to optimize grid management and enhance operational efficiency.

Industrial Utility Communication Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Hardware [Communication Devices, Sensors, Network Infrastructure, Remote Terminal Units (RTUs) and Programmable Logic Controllers (PLCs)], Software (Network Management Systems, SCADA Software, Data Analytics Platforms, Cybersecurity Software), Services (Installation and Integration, Maintenance and Support, Consulting and Engineering, Cybersecurity Services) |

|

By Technology |

Wired, Wireless |

|

By End-Use |

Power Generation, Power Transmission and Distribution, Oil and Gas, Water and Wastewater, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Hardware, Software, Services): The hardware segment earned USD 1,732.6 million in 2023 driven by increased adoption of advanced communication devices in utilities.

- By Technology (Wired, Wireless): The wireless segment held 56.27% of the market in 2023, fueled by growing demand for flexible, scalable, and cost-effective communication solutions.

- By End-Use (Power Generation, Power Transmission and Distribution, Oil and Gas, Water and Wastewater, Others): The power generation segment is projected to reach USD 2,057.5 million by 2031, supported by rising investments in smart grid technologies.

Industrial Utility Communication Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific industrial utility communication market share stood around 36.72% in 2023 in the global market, with a valuation of USD 1,410.0 million. Asia Pacific leads the market due to rapid urbanization, strong government support for smart grid deployment, and increasing investments in renewable energy.

Countries like China, India, and Japan are upgrading their utility infrastructure with advanced communication networks to enhance grid reliability and efficiency, in turn driving the growth of the market. The rising adoption of IoT, AI, and cloud-based solutions in utility operations further strengthens the region’s dominance. .

The industrial utility communication Industry in North America is expected to grow at a robust CAGR of 6.23% over the forecast period. The region is experiencing significant adoption of wireless communication technologies, AI-powered analytics, and smart metering systems.

Government regulations promoting sustainable energy integration, coupled with high investments in digitalization, are driving market expansion. Additionally, the presence of key industry players and advancements in industrial automation are contributing to the rapid growth of the market in the region.

- In November 2024, Message Broadcast acquired West Technology Group’s utilities business, strengthening its customer engagement software for utilities.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates interstate and international communications through cable, radio, television, satellite and wire.

- In the EU, Energy Efficiency Directive (EU/2023/1791) governs smart grid communication, interoperability, and data security for energy networks.

Competitive Landscape:

Companies in the industrial utility communication industry are increasingly integrating advanced technologies and enhancing telecom and utility networks. Strategic acquisitions allow firms to optimize operations, improve network resilience, and adopt innovative solutions, ensuring they remain leaders in the evolving digital landscape.

- In December 2024, Accenture acquired IQT Group, enhancing its capabilities in net-zero infrastructure projects. IQT Group specializes in engineering services for electricity, water, and telecom networks, supporting industrial utility communication and energy efficiency for both public and private sector clients.

List of Key Companies in Industrial Utility Communication Market:

- General Electric Company

- Siemens

- Schneider Electric

- Hitachi, Ltd.

- FUJITSU

- Motorola Solutions, Inc.

- Telefonaktiebolaget LM Ericsson

- Nokia

- Itron Inc

- Cisco Systems, Inc.

- Emerson Electric Co

- ABB

- RAD

- OMICRON

- Hexagon AB

Recent Developments (M&A/Launch)

- In October 2024, Accenture acquired BOSLAN to enhance its expertise in industrial utility communication and net-zero infrastructure projects. BOSLAN specializes in engineering services for smart grids, electricity transmission, and telecom networks, supporting efficient energy transition and digital transformation for public and private sector clients.

- In July 2024, Quanta Services acquired Cupertino Electric to expand its electrical infrastructure solutions, strengthening capabilities in utility communications, renewable energy, and data center.

- In June 2024, Hitachi ABB Power Grids advanced industrial utility communication by leveraging the 450 MHz spectrum for mission-critical applications. This initiative enhances connectivity for utilities and industries, ensuring reliable, secure, and cost-effective communications essential for digital grids and decentralized energy operations.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years