Food and Beverages

Infant Nutrition Market

Infant Nutrition Market Size, Share, Growth & Industry Analysis, By Type (Infant Formula, Baby Food), By Sales Channel (Hypermarket/Supermarket, Specialty Store, Online Retails, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : April 2024

Report ID: KR665

Infant Nutrition Market Size

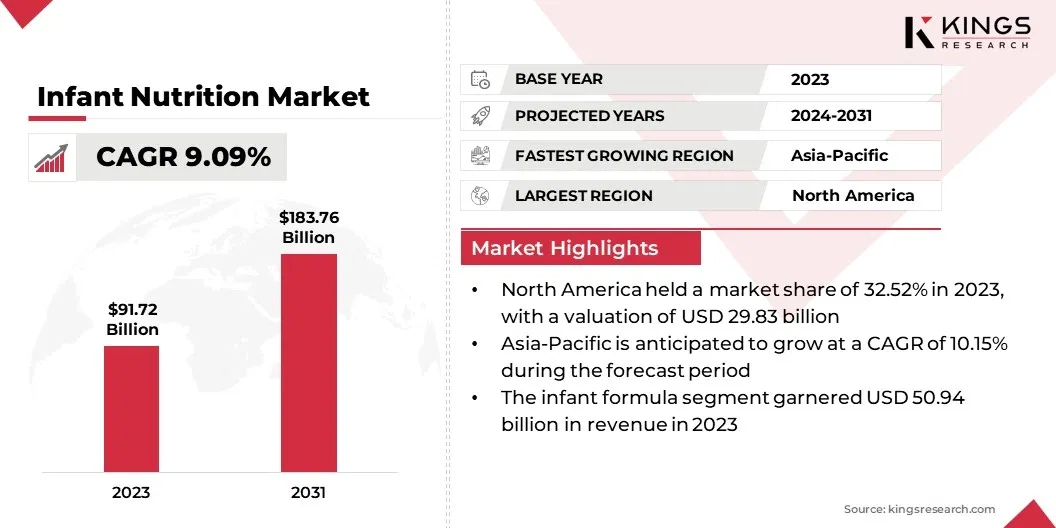

The global Infant Nutrition Market size was valued at USD 91.72 billion in 2023 and is projected to attain a valuation of USD 183.76 billion by 2031, growing at a CAGR of 9.09% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Danone S.A., Nestlé S.A., Abbott Laboratories, FrieslandCampina, Mead Johnson & Company, LLC., Reckitt Benckiser Group PLC, AUSNUTRIA B.V., Perrigo Company plc, Arla Foods, HiPP GmbH & Co. Vertrieb KG and Others.

Good nutrition plays an important role in the healthy development of an infant. Appropriate types and amounts of food fed to infants in their early years can have a drastic impact on their brain development, cognitive abilities, and overall immunity.

As per ZERO TO THREE, an organization formed under the National Center for Clinical Infant Programs, malnourished children have smaller brain development due to reduced dendritic growth, reduced myelination, and decreased glia production.

This is responsible for lasting behavioral and cognitive impairments such as lower IQ, slower language and fine motor development, and subpar school performance. Nutrition plays a critical role in the overall development of infants. Infant nutrition products, which provide essential macro and micronutrients to infants, are driving the infant nutrition market growth.

The growing awareness regarding the impact of baby food on infant health has necessitated the implementation of standards and regulations to ensure optimum quality.

- In December 2023, the Codex Alimentarius, a document published jointly by the Food and Agriculture Organization of the United States (US FAO) and the World Health Organization (WHO) detailing guidelines and codes of practice for follow-up formula and other related products intended for children aged between one and three years, was released.

These standards were adopted following over ten years of diligent effort and provide in-depth information on the nutritional composition, safety, quality, hygiene, labeling, and other aspects related to infant nutrition. The main aim behind the publication of the document was to ensure proper nutrition consumption by young children and address the nutrition gap in their diets.

Infant nutrition emerges as an extremely important aspect of the global food and nutrition sector. The increasing public sector scrutiny of products, coupled with guidelines mandating adherence for manufacturers, serves as a major factor driving market growth. Other factors, including easy access to suitable nutritional products, coupled with hectic modern lifestyles, are influencing the growth of the market.

Analyst’s Review

Changing regulations regarding infant nutrition products are likely to prompt manufacturers to innovate in order to maintain their footprint in the global market. Major manufacturers are complying with government regulations to implement changes and innovate their product offerings in order to maintain their position in this highly competitive industry.

Furthermore, manufacturers are incorporating clean label and organic ingredients in their product offerings with clear labels on the packaging to increase transparency, thus building consumer trust and augmenting revenue.

Infant Nutrition Market Growth Factors

The primary factor contributing to the rising popularity of infant nutrition products among parents is the readily available nutritional content they offer for consumption. Furthermore, the infant nutritional industry is highly regulated, ensuring that products available on the market meet high standards of quality and safety for consumption.

These factors, coupled with the convenience provided by ready-to-eat options to busy parents, result in an increased adoption of such products and drive consumption. Moreover, oversight from regulatory bodies such as the US FDA (United States Food & Drug Administration) ensures compliance with standards by the manufacturers.

- In 2022, safety concerns regarding powdered infant formula came to light, leading to the voluntary recall of specific batches manufactured at an Abbott Nutrition facility in Michigan.

This prompted the FDA to intervene, aiming to enhance the safety of powdered infant formula by developing a Cronobacter prevention strategy. This strategy involved intensified inspection activities, engagement with infant formula manufacturers, and the implementation of stringent regulatory measures.

Additionally, the FDA issued a letter emphasizing the importance of disclosing current safety information to stakeholders within the powdered infant formula industry. This initiative aimed to drive improvements in processes and programs to ensure the protection of infants.

The regulatory agency issued warning letters to three infant formula manufacturers, mandating the implementation and maintenance of appropriate corrective actions in cases where pathogens are detected. This action aimed to ensure compliance with FDA regulations and standards. Strict adherence to recommended guidelines and standards is necessary for manufacturers to maintain their position in the infant nutrition market.

Infant Nutrition Market Trends

Increasing awareness regarding various allergies and sensitivities, coupled with the rapid advancement in the healthcare sector, is emerging as a notable trend that influences the market outlook. The availability of products in the market, especially designed to be free from allergens, along with options for sensitive infants, is significantly impacting the market for infant nutrition products.

The growing preference for products with organic ingredients is gaining popularity among health-conscious parents. This trend is evident in the rising demand for products formulated using minimal processing and organic ingredients.

Consumer demand for transparent labeling and detailed information on infant food products has increased in recent years. Parents are increasingly seeking clearer insights into ingredients, nutritional content, and sourcing practices to make well-informed decisions regarding their infants' dietary needs.

Due to this burgeoning demand, brands that prioritize transparency are gaining favor. Innovative products comprising unique flavors, formats, or nutritional enhancements are attracting consumer interest and consequently boosting sales.

This trend underscores a growing emphasis on both transparency and innovation in the infant food market, reflecting consumers' desire for trustworthy and appealing options for their children's dietary needs.

Segmentation Analysis

The global market is segmented based on type, sales channel, and geography.

By Type

Based on type, the market is segmented into infant formula and baby food. The infant formula segment led the infant nutrition market in 2023, reaching a valuation of USD 50.94 billion. e infant formula segment is leading the market as its nutritional profile is the same as that of breast milk, thus offering convenience for parents unable to breastfeed.

Easy availability in the market, along with diverse options and rigorous regulations, are further bolstering its dominance in the market. Moreover, the adoption of lucrative marketing and endorsement strategies by manufacturers is aiding segment growth.

By Sales Channel

Based on sales channel, the market is segmented into hypermarket/supermarket, specialty store, online retails, and others. The hypermarket/supermarket segment secured the largest revenue share of 54.3% in 2023.

Hypermarkets and supermarkets outperform specialty stores and online channels in infant nutrition product sales due to their convenience, wide selection, competitive pricing, immediate availability, established trust, and in-store promotions. Parents value the one-stop shopping experience, extensive product choices, and affordable pricing offered by these large retailers.

Moreover, the assurance of finding products quickly and the trust built over time with familiar brands and outlets are contributing to their rising preference. In-store promotions further incentivize purchases. While specialty stores and online platforms offer unique advantages, hypermarkets and supermarkets provide unmatched convenience, variety, and affordability in the market.

Infant Nutrition Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America Infant Nutrition Market share stood around 32.52% in 2023 in the global market, with a valuation of USD 29.83 billion. This dominance can be attributed to robust investments in research and development, a well-established regulatory infrastructure, and extensive adoption of advanced technologies across various industries.

- For instance, FrieslandCampina Ingredients in March 2024 announced its partnership with the US biotech company Triplebar in order to produce lab-made lactoferrin by expanding its precision fermentation capabilities. Lactoferrin is an essential component of premium infant food.

Asia-Pacific is poised to witness significant growth over the forecast period at a CAGR of 10.15%. This growth is mainly driven by the rising population, increasing disposable incomes, rapid urbanization, and changing lifestyles. Additionally, growing awareness regarding the importance of nutrition for infants and expanding healthcare infrastructure contribute to the regional market.

- For instance, in September 2023, Asahi Group Foods declared its intent to sell its baby food in Vietnam on a trial basis from April and August online, and at other Japanese-owned grocery stores located in Ho Chi Minh City, Hanoi, and other locations.

Competitive Landscape

The infant nutrition market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Infant Nutrition Market

- Danone S.A.

- Nestlé S.A.

- Abbott Laboratories

- FrieslandCampina

- Mead Johnson & Company, LLC.

- Reckitt Benckiser Group PLC

- AUSNUTRIA B.V.

- Perrigo Company plc

- Arla Foods

- HiPP GmbH & Co. Vertrieb KG

Key Industry Developments

- November 2023 (Partnership): ELSE NUTRITION HOLDINGS INC. announced its multi-stage partnership with Danone S.A., wherein the first stage of their partnership involves providing Danone access to Else Nutrition's plant-based baby food portfolio. The signing of the definitive agreement was scheduled for the end of the first quarter of 2024, allowing Danone to negotiate opportunities beyond product commercialization.

- October 2023 (Launch): Nestlé S.A. launched its new infant nutrition product, 'Sinergity', a proprietary blend comprising a specific probiotic combined with six different human milk oligosaccharides (HMOs). Probiotics play a key role in the development of the gut microbiome and infant immunity. Meanwhile, HMO's, a crucial component of breast milk, support the development of intestinal microbiota and the fortification of the immune system during early childhood.

The global Infant Nutrition Market is segmented as:

By Type

- Infant Formula

- Baby Food

By Sales Channel

- Hypermarket/Supermarket

- Specialty Store

- Online Retails

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years