Buy Now

Iron and Steel Market Size, Share, Growth & Industry Analysis, By Product Type (Iron Products, Steel Products), By Process [Blast Furnace - Basic Oxygen Furnace (BF-BOF), Electric Arc Furnace (EAF), Open Hearth Furnace (OHF), Others], By Application, and Regional Analysis, 2024-2031

Pages: 180 | Base Year: 2023 | Release: January 2025 | Author: Siddhi J.

Key strategic points

The market refers involves the production, distribution, and consumption of iron and steel products. It encompasses the extraction of raw materials, manufacturing of various steel forms, and their use in industries such as construction, transportation, and manufacturing. This market is influenced by factors like supply-demand dynamics, raw material costs, and global economic trends.

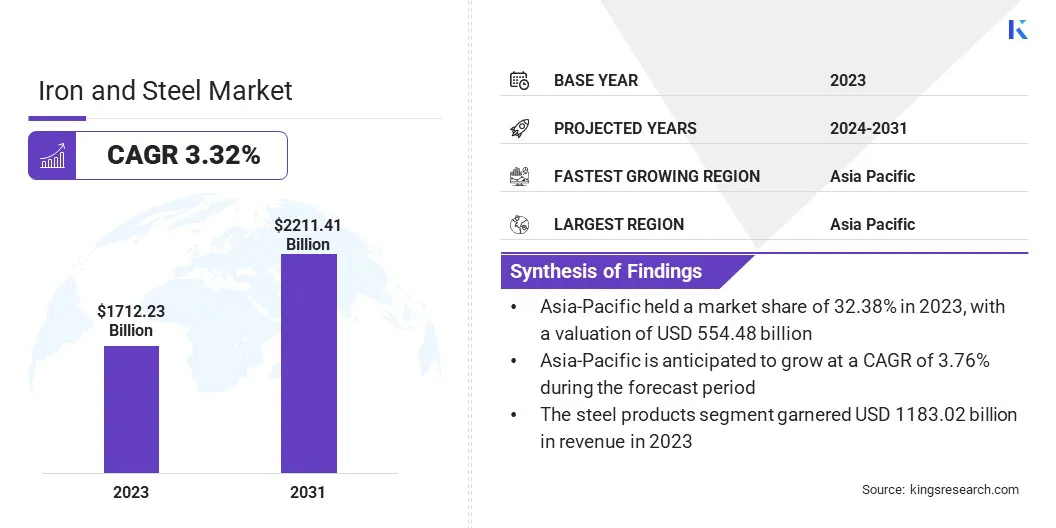

Global iron and steel market size was valued at USD 1712.23 billion in 2023, which is estimated to be valued at USD 1759.09 billion in 2024 and reach USD 2211.41 billion by 2031, growing at a CAGR of 3.32% from 2024 to 2031.

Infrastructure development is a key growth driver for the market, as rising investments in construction and infrastructure projects, particularly in emerging economies, create strong demand for steel in the building of roads, bridges, and urban infrastructure.

Major companies operating in the market are ArcelorMittal S.A, BaoWu Steel Group Corporation Limited, NIPPON STEEL CORPORATION, HBIS GROUP, SHAGANG GROUP Inc, POSCO HOLDINGS., Tata Steel, JFE Steel Corporation, Nucor Corporation, Ansteel Group Corporation Limited, JSW, SAIL, NLMK, Rio Tinto, Vale, and others.

The iron and steel market is a vital component of the global economy, marked by its continuous demand driven by industrial applications. It is highly sensitive to global economic shifts, production efficiency, and environmental regulations.

The market is influenced by factors such as technological innovations, cost fluctuations, and sustainability efforts. As an integral part of global supply chains, it plays a central role in shaping industrial growth, infrastructure development, and the overall economic landscape across regions.

Market Driver

"Urbanization as a Growth Driver in the Iron and Steel Market"

Urbanization significantly drives the demand for iron and steel, as growing urban populations necessitate more infrastructure development. The need for steel in the construction of buildings, roads, bridges, and transportation systems increases in rapidly developing cities.

As more people move to urban areas, there is also a surge in industrial activities that require steel for machinery and production. This trend leads to a continuous rise in steel demand, propelling growth in the iron and steel industry.

Market Challenge

"Environmental Regulations"

Environmental regulations present a significant challenge for the iron and steel market, as rising pressure to reduce carbon emissions and adopt sustainable practices can lead to higher production costs and require substantial technological investments. The market can adopt cleaner production technologies, which reduce emissions.

Additionally, increasing the use of recycled steel, government support, and transitioning to renewable energy sources can help lower environmental impact while maintaining cost-efficiency, ensuring long-term sustainability in the industry.

Market Trend

"Sustainability Initiatives in the Iron and Steel Industry"

A significant trend in the iron and steel market is the growing focus on sustainability initiatives, with increasing emphasis on environmentally friendly production methods. Companies are adopting recycled steel production techniques and exploring low-carbon technologies like green hydrogen and carbon capture.

This shift is driven by both regulatory pressures and consumer demand for more sustainable products. As a result, the market is registering greater investments in green technologies, promoting environmentally conscious practices while spurring market growth in the long term.

| Segmentation | Details |

| By Product Type | Iron Products (Pig Iron, Direct Reduced Iron (DRI), Cast Iron, Others) and Steel Products (Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel, Others) |

| By Process | Blast Furnace - Basic Oxygen Furnace (BF-BOF), Electric Arc Furnace (EAF), Open Hearth Furnace (OHF), Others |

| By Application | Construction and Infrastructure (Buildings, Bridges, Roads, Airports, Others), Automotive and Transportation (Passenger Vehicles, Commercial Vehicles, Railway Equipment, Aerospace, Others), Industrial Equipment (Machinery, Tools, Equipment Manufacturing, Others), Energy (Power Plants, Oil and Gas, Others), Consumer Goods (Appliances, Furniture, Electronics, Others) & Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 32.38% market share in 2023, with a valuation of USD 554.48 billion. Asia Pacific dominates the global iron and steel market, driven by major production hubs like China, Japan, and India.

China, as the world’s largest producer and consumer of steel, plays a pivotal role in shaping market dynamics. The region’s rapid industrialization, urbanization, and infrastructure development significantly contribute to high demand for steel in sectors such as construction, automotive, and manufacturing.

Additionally, favorable government policies, technological advancements, and investments in sustainable practices further solidify Asia Pacific's leadership in the market.

The market in Europe is poised for significant growth at a robust CAGR of 3.55% over the forecast period. Europe is emerging as a fast-growing region in the iron and steel market, driven by the increasing demand for sustainable steel production and green technologies.

The region is prioritizing eco-friendly manufacturing methods, such as hydrogen-based steelmaking and carbon capture technologies, to meet stringent environmental regulations.

Countries like Germany, Italy, and France are leading the charge in adopting innovative steel production processes, while investments in infrastructure, automotive, and energy sectors continue to fuel growth. Europe’s commitment to sustainability is positioning it as a key player in the evolving global market.

The global iron and steel market is characterized by a number of participants, including both established corporations and rising organizations. Government support plays a crucial role in the growth of the iron and steel industry by offering incentives for green technologies, implementing favorable policies, and funding infrastructure projects.

These initiatives foster innovation, reduce production costs, and promote sustainable practices, enabling the industry to expand and meet future demands efficiently.

Recent Developments:

Frequently Asked Questions