ICT-IOT

Managed Print Services Market

Managed Print Services Market Size, Share, Growth & Industry Analysis, By Component (Printers/Copiers Manufacturers, System Integrators, Independent Software Vendors), By Deployment (On-Premise and Cloud-Based), By Organization Size (SMEs and Large Enterprises), By End Use Industry and Regional Analysis 2024-2031

Pages : 120

Base Year : 2023

Release : December 2024

Report ID: KR1134

Managed Print Services Market Size

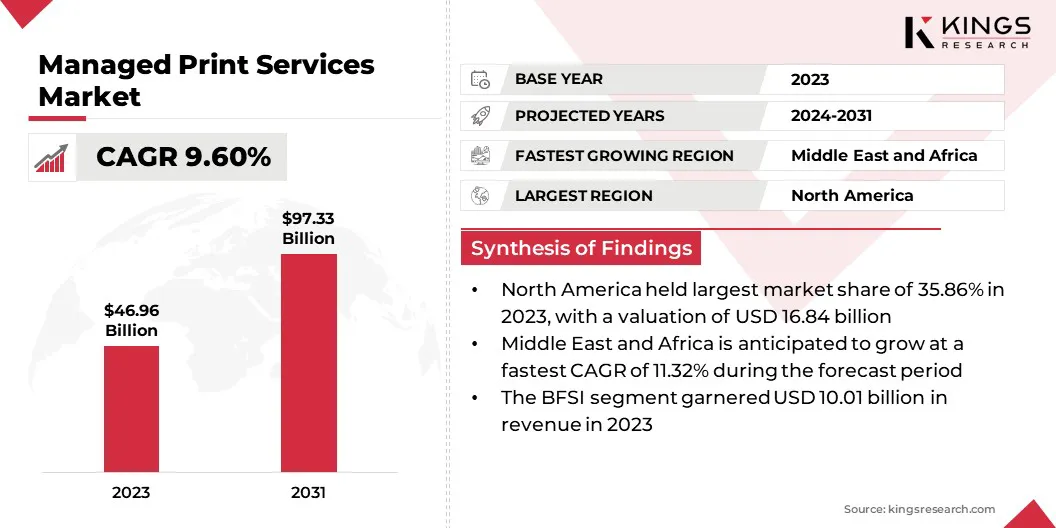

The global Managed Print Services Market size was valued at USD 46.96 billion in 2023 and is projected to grow from USD 51.24 billion in 2024 to USD 97.33 billion by 2031, exhibiting a CAGR of 9.60% during the forecast period.

The global shift toward digital transformation is significantly driving the growth of the managed print services market. Companies are transitioning from traditional paper-based workflows to digital document management systems to enhance operational efficiency.

The increasing emphasis on process automation and digital archiving has established MPS as an essential tool for organizations aiming to remain competitive in today’s technology-driven business landscape.

In the scope of work, the report includes services offered by companies such as HP Development Company, L.P, Lexmark International, Inc., Sharp Electronics Corporation., Konica Minolta, Inc., Canon Inc., Toshiba Corporation, HCL Technologies Limited, Wipro, Xerox Corporation, Seiko Epson Corporation, and others.

Moreover, the need to reduce operational expenses is increasing the global adoption of managed print services. Businesses are increasingly looking to streamline their printing processes, eliminate inefficiencies, and consolidate hardware to optimize costs. MPS solutions provide organizations with tools to track and manage print expenses, identify areas of waste, and implement usage policies to ensure cost-effective printing.

Managed print services (MPS) involve outsourcing the complete management of an organization’s print environment to an external provider. It encompasses optimizing, monitoring, and maintaining printing devices such as printers, copiers, and multifunction devices, along with managing print-related workflows and documents.

MPS aims to reduce operational costs, improve efficiency, and ensure secure document handling by analyzing and optimizing print usage, consumables, and device performance. Providers offer a range of solutions, including remote monitoring, automated supply replenishment, and proactive maintenance, to help organizations streamline printing processes while minimizing downtime and environmental impact.

Analyst’s Review

The ongoing expansion of global retail sales, driven by rising consumer demand and increasing revenues, is bolstering the adoption of managed print services. Retailers are facing growing complexities in managing vast amounts of documentation across areas such as inventory management, sales transactions, compliance records, and marketing collateral.

MPS provides tailored solutions to optimize these processes, reducing costs, improving efficiency, and enhancing security in retail operations.

- As reported by the U.S. Census Bureau in November 2024, retail trade sales increased by 0.4% from September 2024 and 2.6% from the same period in 2023.

With global retail revenues continuing to grow, the sector’s reliance on MPS as a strategic enabler of efficiency and cost-effectiveness is set to rise, highlighting the crucial role of these services in supporting modern retail operations.

Managed Print Services Market Growth Factors

The growing presence of micro, small, and medium enterprises (MSMEs) is propelling the expansion of the managed print services market. SMEs often face budget constraints and resource limitations, making MPS an ideal solution to manage their printing needs efficiently.

These services offer cost-effective alternatives by eliminating the need for large capital investments in hardware and maintenance. Additionally, MPS provides scalable solutions that adapt to the dynamic needs of SMEs, enabling them to benefit from advanced print management capabilities.

- The United Nations highlights the critical role of micro, small, and medium enterprises (MSMEs) and the circular economy in global progress. In 2024, MSMEs represent 90% of all businesses, provide over 70% of employment, and contribute 50% of the global GDP, underscoring their major role in economic stability.

Additionally, the rising importance of corporate sustainability initiatives is prompting organizations to adopt environmentally friendly printing practices. MPS solutions help businesses reduce paper consumption, energy usage, and waste through optimized printing strategies and advanced device configurations.

Features such as double-sided printing and digital sharing further support sustainability efforts. Companies are increasingly leveraging MPS to align with environmental goals, improve brand reputation, and meet consumer and regulatory expectations for sustainable operations.

By addressing these objectives, MPS providers are becoming key partners for businesses seeking to enhance operational efficiency and reduce environmental impact.

Managed Print Services Market Trends

The shift toward hybrid work models has increased the demand for centralized and flexible printing solutions. For instance, Wipro, a leading IT company, has implemented a new hybrid work policy mandating employees to work in the office three days per week.

MPS supports this trend by offering cloud-based print management, enabling remote workers to securely access and print documents from any location. These solutions further support mobile and on-demand printing, ensuring consistent productivity across distributed teams.

The ability to provide a unified print experience for both office-based and remote employees has made MPS essential for modern business operations.

Moreover, advancements in technology, particularly artificial intelligence (AI) and analytics, are boosting the adoption of MPS. Providers are incorporating predictive maintenance tools, automated supply management, and real-time usage monitoring to ensure optimal device performance and minimize downtime.

These innovations allow businesses to gain insights into printing patterns and implement data-driven strategies to enhance efficiency. The integration of cloud platforms and IoT-enabled devices further enhances the scalability and functionality of MPS solutions.

The ongoing advancement of technology is positioning MPS as a critical enabler of productivity and operational excellence in modern enterprises.

Segmentation Analysis

The global market has been segmented based on Component, deployment, organization size, end use industry, and geography.

By Component

Based on component, the market has been segmented into printers/copiers manufacturers, system integrators, and independent software vendors. The printers/copiers manufacturers segment led the managed print services market in 2023, reaching a valuation of USD 21.49 billion.

This growth is mainly due to the increasing reliance on hardware devices for print management. These devices are integral to document workflows, supporting scanning, printing, and copying needs across various industries.

Additionally, advancements in printer technology, including multifunctional capabilities, wireless connectivity, and energy-efficient features, further bolster the expansion of the segment. Moreover, the strong demand for reliable and efficient hardware solutions is fueling the growth of the printers/copiers manufacturers segment.

By Deployment

Based on deployment, the market has been classified into on-premise and cloud-based. The on-premise segment secured the largest revenue share of 61.76% in 2023. On-premise solutions allow businesses to maintain direct oversight of their devices, ensure immediate troubleshooting, and customize workflows to meet specific operational needs.

Furthermore, industries such as healthcare and finance, which require strict confidentiality, are more inclined to adopt on-premise MPS deployments. This preference for greater control and security reinforces the dominance of the on-premise segment.

By Organization Size

Based on organization size, the managed print services market is divided into SMEs and large enterprises. The large enterprises segment is poised to witness significant growth, recording a robust CAGR of 9.94% through the forecast period.

Large enterprises typically operate across multiple locations, making it crucial to streamline and centralize their print infrastructure. MPS solutions help large enterprises optimize their print workflows, reduce costs, and improve operational efficiency by consolidating devices and automating processes.

Additionally, large enterprises are better equipped to invest in advanced MPS technologies, including data analytics and security features, which enhance their print management capabilities.

Managed Print Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America managed print services market held a substantial share of around 35.86% in 2023, with a valuation of USD 16.84 billion. North American organizations are at the forefront of digital transformation, with many aopting IoT and cloud-based solutions, fueling regional market growth.

MPS providers are leveraging cutting-edge technologies such as AI, cloud integration, and IoT-enabled devices to enhance print management. These solutions offer greater flexibility, real-time monitoring, predictive maintenance, and seamless integration with existing enterprise software, thus improving operational efficiency.

- In February 2023, Lexmark, a U.S.-based imaging and printing solutions provider, introduced MPS Express, a cloud-based program designed to streamline document management for small and medium-sized businesses (SMBs) and eliminate daily printer management.

Moreover, data security and compliance with regulations such as HIPAA, GDPR, and other industry-specific standards are major concerns for businesses. MPS solutions help businesses safeguard sensitive information, meet regulatory requirements, and mitigate the risks of data breaches. MPS's robust security features make MPS a critical tool for organizations in sectors such as healthcare, finance, and legal services.

Middle East and Africa is set to experience significant growth, registering a staggering CAGR of 11.32% over the forecast period. The growing regulatory landscape in the MEA region is fueling the demand for secure document management solutions.

For instance, the UAE’s National Data Privacy Law and the introduction of the Personal Data Protection Law in South Africa have increased the need for secure print solutions that comply with stringent data protection standards.

Industries such as healthcare and finance in the region, which are heavily regulated, are increasingly adopting MPS to ensure compliance with data privacy regulations. MPS providers help organizations securely manage and store sensitive documents, reducing the risks of data breaches and ensuring adherence to regional regulatory requirements.

Competitive Landscape

The global managed print services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Managed Print Services Market

- HP Development Company, L.P

- Lexmark International, Inc.

- Sharp Electronics Corporation.

- Konica Minolta, Inc.

- Canon Inc.

- Toshiba Corporation

- HCL Technologies Limited

- Wipro

- Xerox Corporation

- Seiko Epson Corporation

Key Industry Developments

- March 2024 (Product Launch): HP Inc. unveiled the HP Workforce Experience Platform, its first AI-driven digital experience platform, along with a managed PC service and a new print subscription service. These innovations aimed at extending device lifespans and support the circular economy.

- February 2024 (Product Launch): Xerox Holdings Corporation introduced a suite of new solutions and services, including Xerox VersaLink, Xerox Intelligent Filer, and Xerox Workflow Central. These offerings are designed to drive digital transformation, enhance productivity, improve security in hybrid work environments, and streamline operations while reducing IT complexities.

The global managed print services market has been segmented as:

By Component

- Printers/Copiers Manufacturers

- System Integrators

- Independent Software Vendors

By Deployment

- On-Premise

- Cloud-Based

By Organization Size

- SMEs

- Large Enterprises

By End Use Industry

- BFSI

- Education

- Government

- Healthcare

- Industrial Manufacturing

- Retail & Consumer Goods

- Telecom & IT

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership